Geopolitics fails to dampen market risk appetite

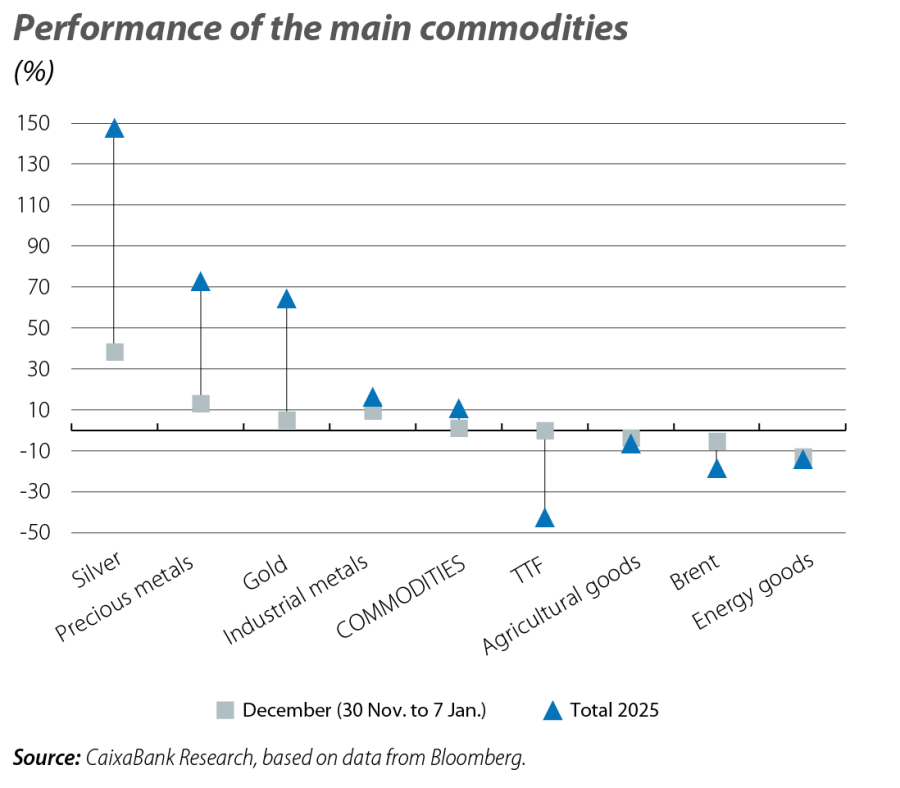

The volatility of the main asset classes continued to decline in December, while liquidity improved in the US and financial conditions were eased, although risks related to geopolitics and AI persist. The main stock indices extended the rally that had begun in November, while long-term sovereign yields rose. The euro consolidated its appreciation in the year, while oil closed down at a four-year low due to oversupply and investors' medium-term reading of the situation in Venezuela. Precious metals experienced a historic rally, albeit not without setbacks.

December closed a year of economic resilience and high risk appetite

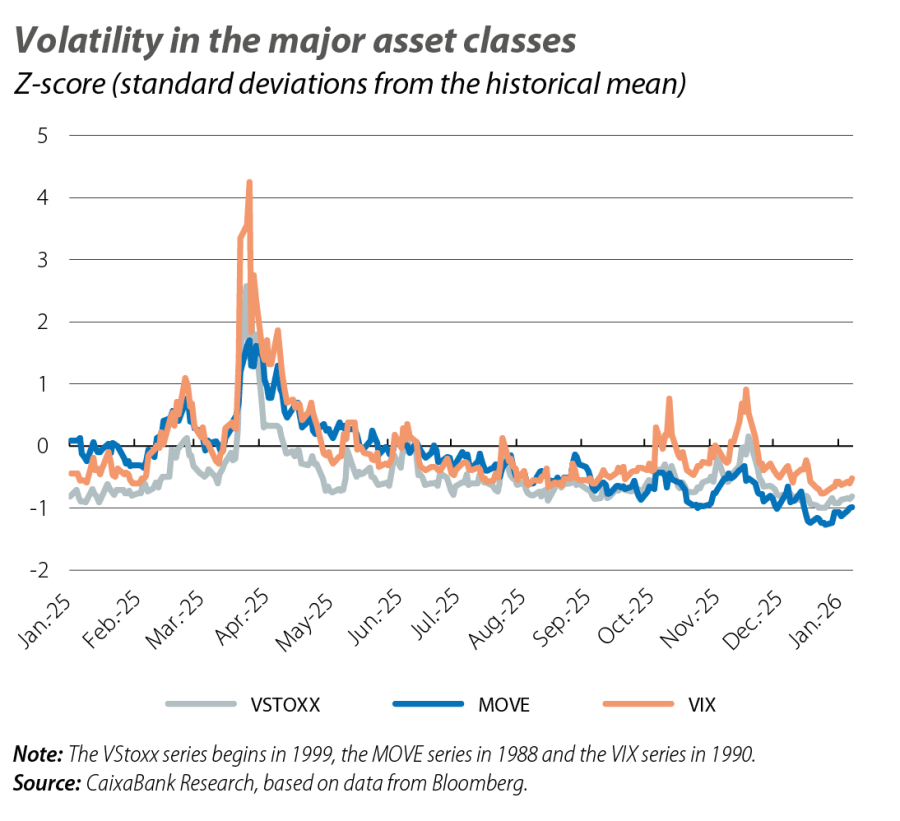

The gradual decline in volatility in the main asset classes since the tariff shock in April continued in December, alongside an improvement in liquidity in the US (supported by the end of the Fed's balance sheet reduction process) and an easing of financial conditions. Nevertheless, risks related to geopolitics and the concentration of investments in artificial intelligence (AI) persist, and they continue to influence the perception of risk in global markets. Investor appetite recovered in December following the positive US inflation data in November and, subsequently, after the Fed's rate cut and strong US GDP data in Q3 2025. The main stock indices extended the rally that had begun in November, despite sector rotation away from the US tech sector, while long-term sovereign yields rose. In currencies, the euro consolidated its appreciation in the year, while in commodities, oil closed down and reached a four-year low in a market dominated by oversupply, with investors taking a medium-term view of the situation in Venezuela (possible recovery of Venezuelan production). Additionally, precious metals experienced a historic rally, albeit not without setbacks.

No surprises from the central banks

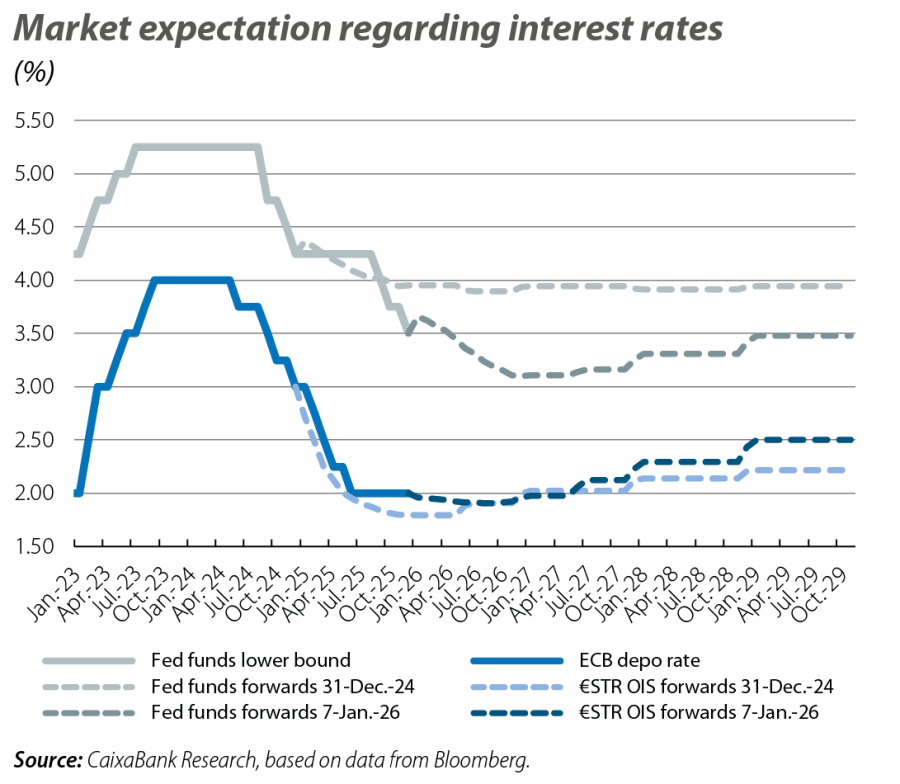

In December, the Fed implemented its third rate cut of the year, bringing rates down to the 3.50%-3.75% range. Its chair, Jerome Powell, suggested a pause going forward, indicating that monetary policy has entered the range of what could be considered neutral ground, leaving the Fed in a good position to «wait and see» how the economy evolves. Nevertheless, the market continues to anticipate two further cuts in 2026 (bringing the fed funds rate to 3.00%-3.25%), supported by upwardly revised growth forecasts and inflation converging on the medium-term target. In the euro area, the ECB maintained the depo rate at 2.00%, reiterating its «meeting-by-meeting» approach and presenting a more optimistic macroeconomic outlook, with higher GDP growth and inflation closer to the target. President Christine Lagarde emphasised the inertia of service prices and geopolitical risks, while Isabel Schnabel, a member of the Executive Board, sent messages with a somewhat hawkish bias that induced tensions. The market anticipates stability in the coming quarters. On the other hand, the Bank of England cut rates by 25 basis points to 3.75%, due to the gradual disinflation recorded, while the Bank of Japan (BoJ) raised rates to 0.75%, the highest level in 30 years, anticipating further hikes in 2026.

Widespread rise in long-term sovereign rates and steepening of yield curves

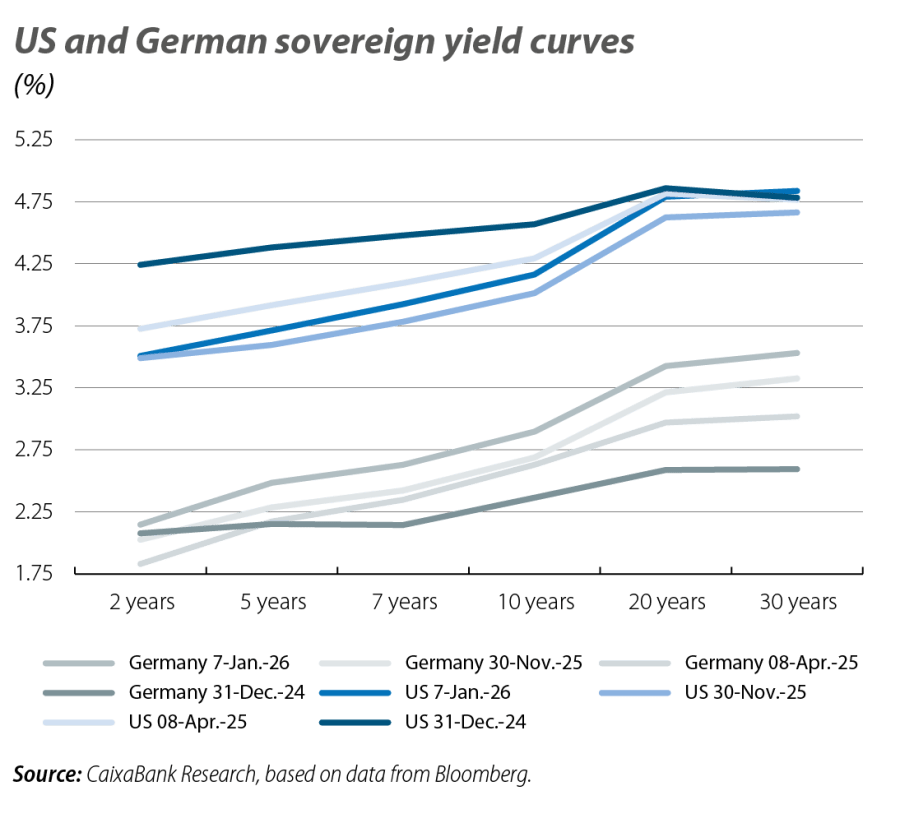

Medium and long-term sovereign yields in developed economies rose at the end of 2025, driven by the messages emanating from the central banks (signals of a pause from the Fed, some tension-inducing comments among ECB members) and positive economic activity data. In contrast, short-term interest rates remained more stable or edged slightly lower, resulting in a steepening of yield curves. On the other hand, sovereign spreads in the euro area periphery narrowed, also extending the trend observed during the year (Italy around −50 bps in 2025, Spain almost −30 bps). Finally, the BoJ's rate hike caused a sharp steepening of the Japanese yield curve (with an increase of around 30 basis points for the 10-year benchmark since the end of November).

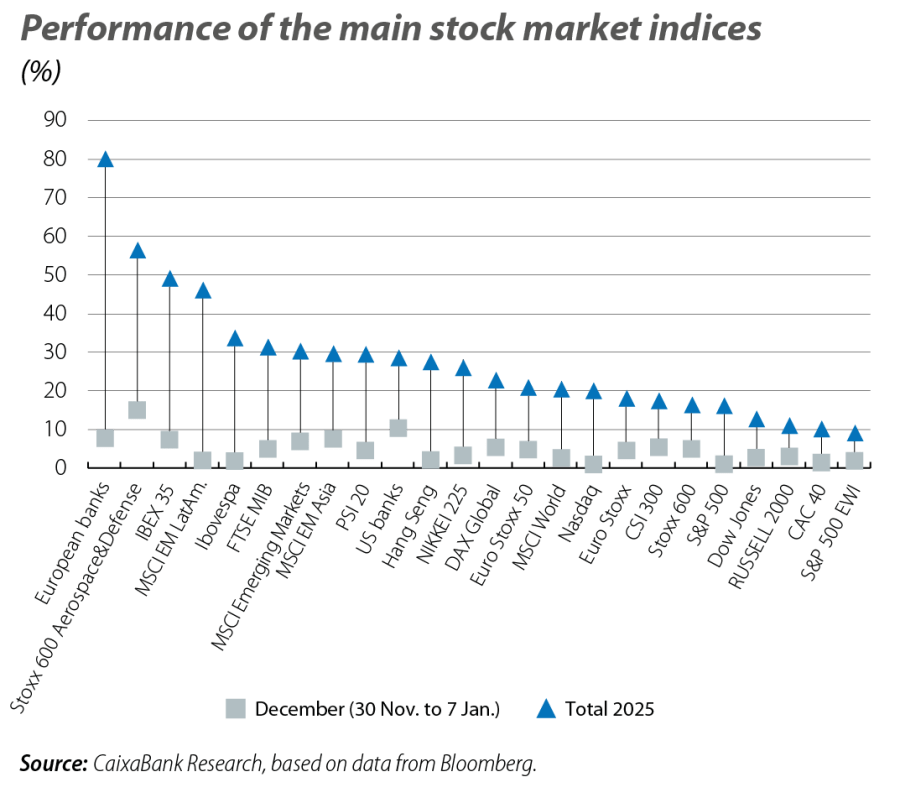

Stock market gains despite caution over AI investment

December closed with the third consecutive year of gains in the main global stock markets, following a rally in the month (MSCI ACWI Global up by more than 20% in 2025). In the US, caution over the high investments in AI weighed on the tech indices in December, although other sectors, such as finance, recorded gains supported by the strength of the economy. In Europe, there were also widespread gains during the month, albeit with some regional disparity: the French CAC advanced only slightly, and the biggest gains were seen in the Italian and Spanish indices − particularly the latter − due to the strong performance of the banking sector. The Japanese stock market also closed a month (and a year) of gains, thanks to the strong performance of the tech sector, the weakness of the yen and the government's stimulus plans. The positive tone also prevailed among the stock markets of emerging economies, with annual gains exceeding 30% across the bloc as a whole and notable increases in both emerging Asia and Latin America.

The euro consolidates its annual appreciation in December

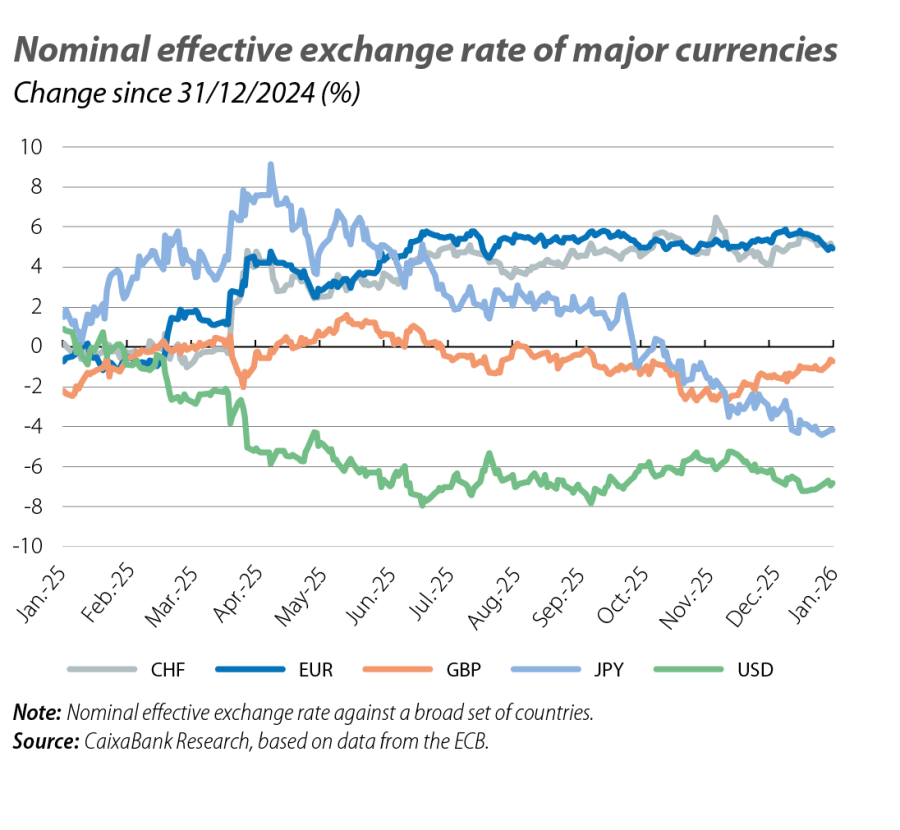

The nominal effective exchange rate (NEER) of the euro rose slightly during the month (0.1% according to the ECB's reference index against a broad group of countries), thus consolidating an appreciation of just over 5% in the year. Nevertheless, in December, the euro consolidated its appreciation against the US dollar (reaching around 1.17-1.18 dollars per euro), while it weakened slightly against the strength of currencies more exposed to mining commodities (Latin American currencies and the Australian dollar) and other European currencies (the British pound sterling and the Swedish krona). The yen, meanwhile, experienced another month of depreciation in its nominal effective exchange rate (although it remained practically flat against the dollar) despite expectations that the BoJ will continue to raise rates in 2026 (the money markets are pricing in one or two more rate hikes).

Energy prices fall in Europe, while metals extend their rally

Oil began the last month of the year with slight price increases due to geopolitical tensions, but corrected amid forecasts of oversupply and the possible return of Russia to the market. At the beginning of 2026, the prospect of a potential return of Venezuelan crude oil (without US sanctions, and once productive capacity is restored) also left Brent crude at around 60 dollars a barrel, its lowest level since 2021. The European natural gas benchmark also extended its downward trend, in a context of normalisation following the 2022 energy crisis (nearly –40% in the year), amid abundant supply and signs of weak Asian demand. Precious metals were once again in the spotlight, particularly silver, which experienced a price rally in December (almost +30%), albeit not without volatility. The exceptional performance of precious metals throughout the year is explained by the high degree of uncertainty in the geopolitical and economic environment during the year, in addition to increased purchases by central banks, structural imbalances in supply and demand, and the depreciation of the dollar. Among industrial metals, copper and nickel surged due to expectations of stimulus in China.