Stock market fear gives way to market optimism fuelled by the Fed

November was dominated by a sharp upturn in volatility in the stock markets, amid doubts about the potential exuberance of AI investments in the US and the high valuations of the big tech firms. Sentiment recovered towards the end of the month, with the expectation that the Fed could continue its rate cuts in December, but concern shifted to Japan in the sovereign debt markets.

Volatility makes another appearance

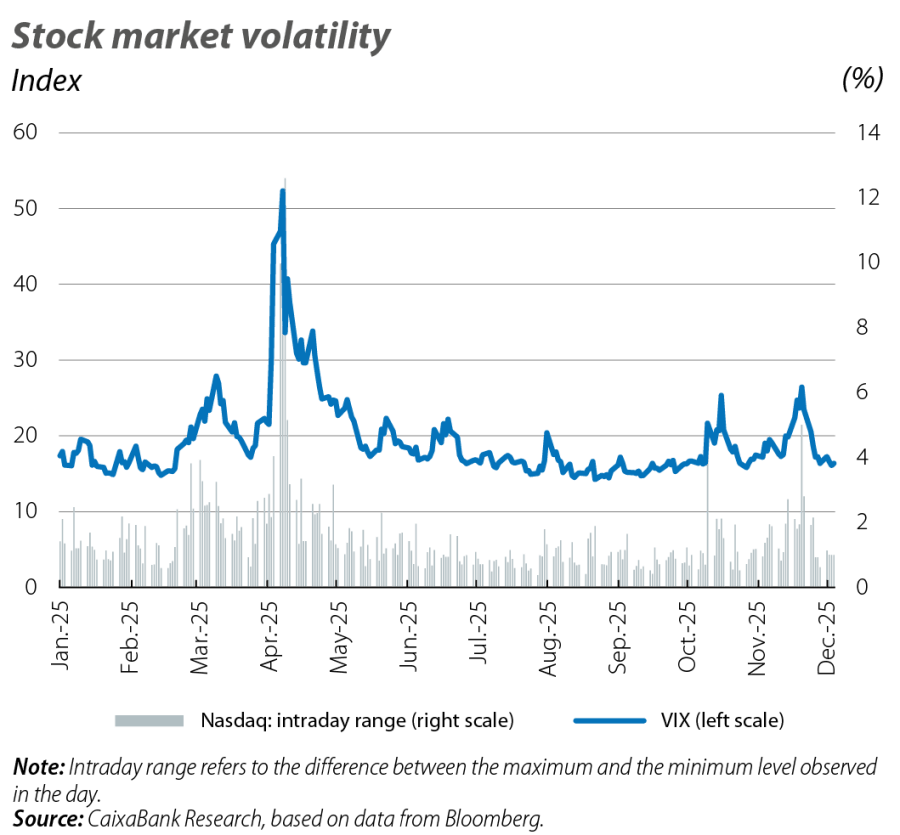

November was dominated by a sharp upturn in volatility in the stock markets, amid doubts about the potential exuberance surrounding AI investments in the US and the high valuations of the big tech firms. The US stock market volatility index (VIX) rebounded to levels not seen since April, and the Nasdaq experienced its most volatile day since then, with an intraday oscillation of as much as 5%. For much of the month, the dominant tone was risk aversion, with widespread setbacks in the main global equity indices. However, sentiment gradually recovered towards the end of November as the expectation that the US Fed could continue its rate cuts in December consolidated. With this expectation, sovereign yields in the US fell. However, the final focus shifted to Japan, where concerns over the fiscal outlook pushed long-term sovereign yields to record highs.

The expectation of interest rate cuts in the US grows

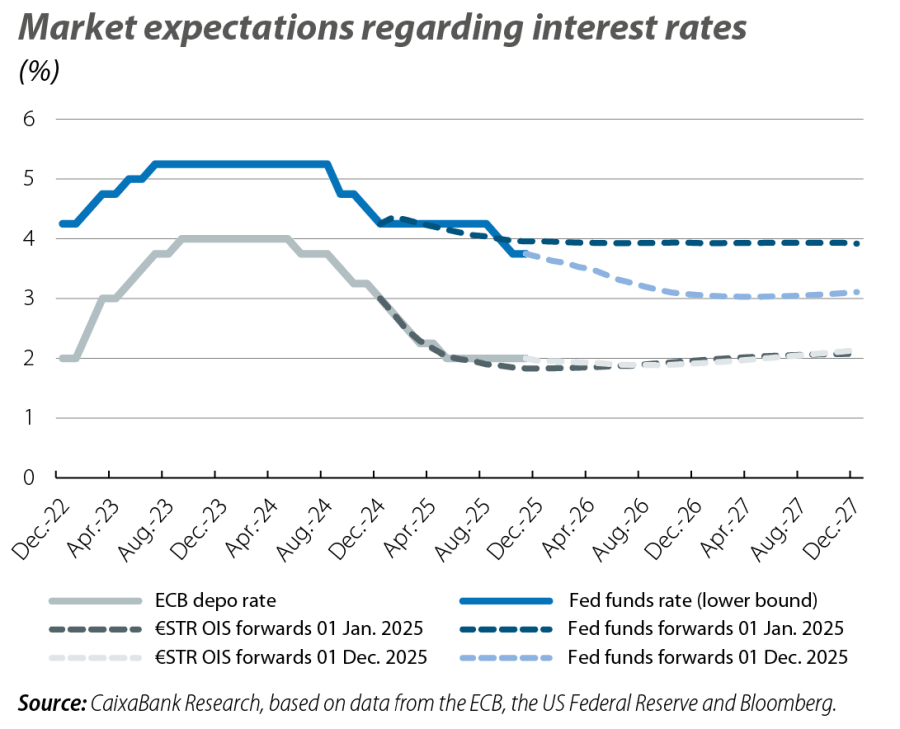

The decision that the Federal Reserve will take in December has been shrouded in a high degree of uncertainty due, firstly, to the lack of official data following the federal government shutdown and, secondly, to the growing internal division among Board members regarding the right path for interest rates (given the current context of a cooling labour market combined with upward inflationary pressures). However, towards the end of November, the release of consumer confidence surveys showing a slight deterioration, the fall in employment reflected in private payroll data and weak retail sales growth, coupled with the shift in sensitivity among some members of the Board towards more dovish positions, cemented the expectation of a rate cut in December (which would leave the benchmark rate in the 3.50%-3.75% range). In addition, it was reported that President Trump has already chosen his nominee for the future head of the Fed to replace Jerome Powell (whose term as chair ends next May, although his position on the Board does not end until 2028). Although Trump did not formally reveal the name of the successor, betting houses are naming Kevin Hasset, the current director of the US National Economic Council, as the clear favourite, fuelling expectations that rates will continue to decline to neutral levels next year. In contrast, expectations regarding the ECB remained anchored, with markets assigning a near 0% probability to a rate cut in December and keeping expectations for the depo rate at around 2% for the whole of 2026, with inflation virtually at the target rate and balanced inflationary risks in both directions.

Japan captures the attention of sovereign debt markets

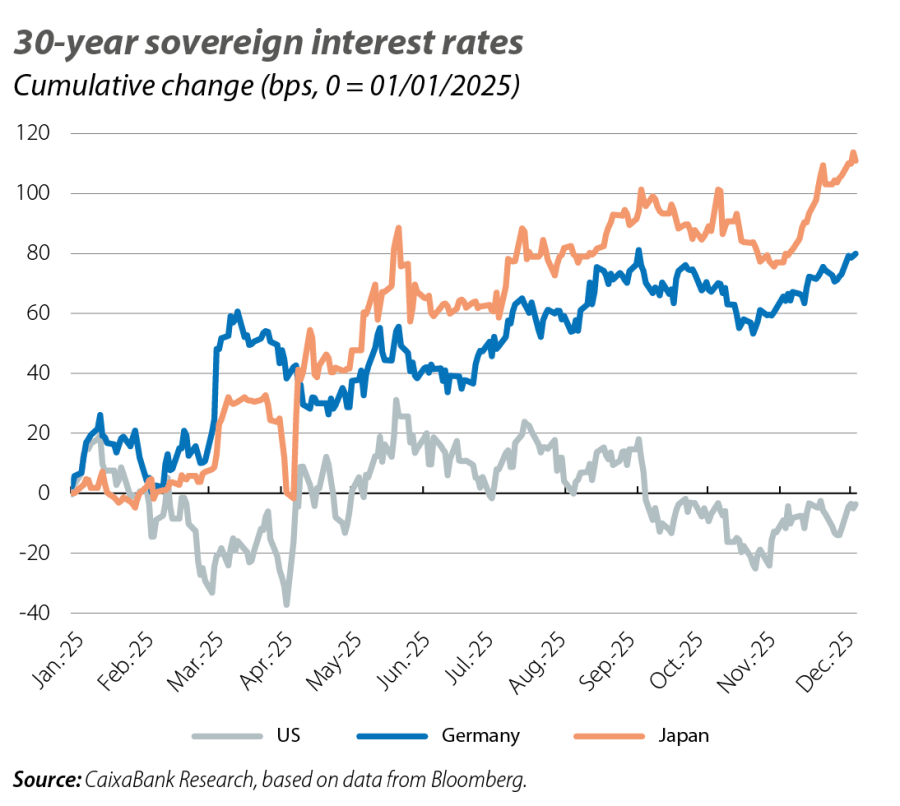

In Japan, the growing expectation of fiscal expansion by the new government, and the resulting concern over public debt, sparked a sell-off of sovereign bonds that pushed 30-year sovereign yields to an all-time high (of around 3.5%), amassing a cumulative increase of around 100 bps in the year. The rise in the 2-year benchmark, which exceeded 1.0%, the highest level since 2007, was later reinforced by the perception of a possible rate hike by the Bank of Japan (markets are anticipating one hike in December and another at the end of 2026 with a 100% probability). In other economies, sovereign debt showed less volatility. The German bund rebounded by around 10 bps up until early December, while euro area peripheral risk premiums narrowed slightly, supported by the upward revision of Italy’s credit rating (Moody’s upgraded its rating for the first time in 23 years, from Baa3 to Baa2, citing political stability and progress in the recovery plans). In the US, yields declined as the expectation of a rate cut by the Fed in December consolidated. The 2-year benchmark fell by around 5 bps.

The Japanese yen in the spotlight

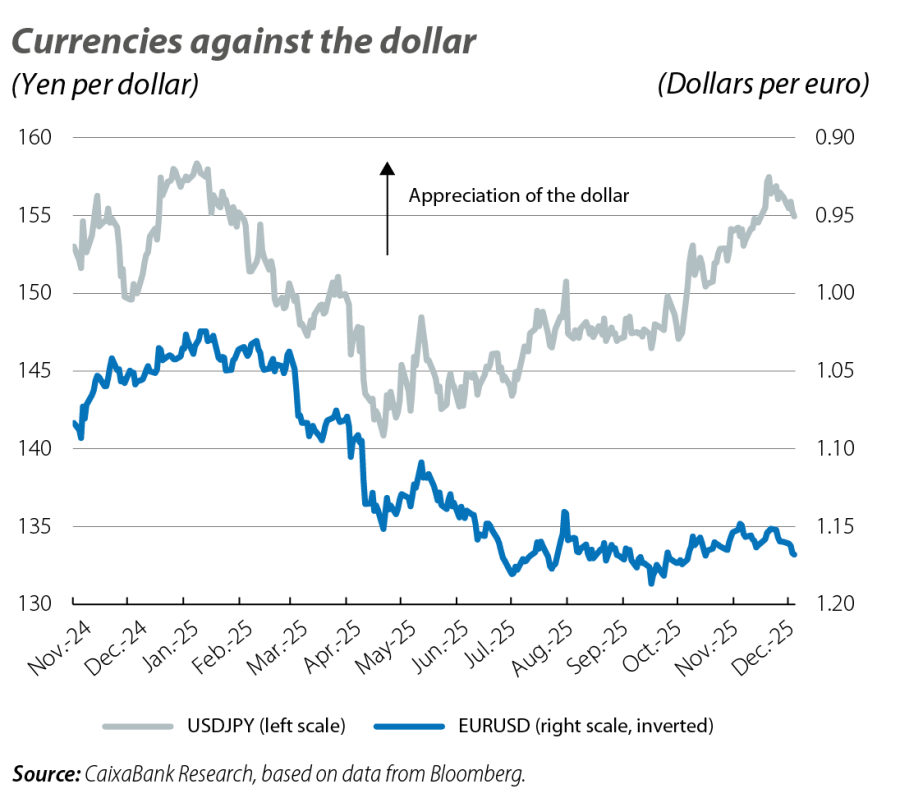

In this context, the yen weakened against the dollar as Japanese sovereign yields rose sharply. However, the movement subsequently reversed, as markets began to accommodate the possibility of the Bank of Japan raising rates before the end of the year, and the yen ended up depreciating by 1.5%. On the other hand, the euro-dollar exchange rate remained relatively stable, trading between 1.15 and 1.16 dollars per euro, before settling closer to 1.16 as the expectation of an imminent rate cut by the Fed was consolidated.

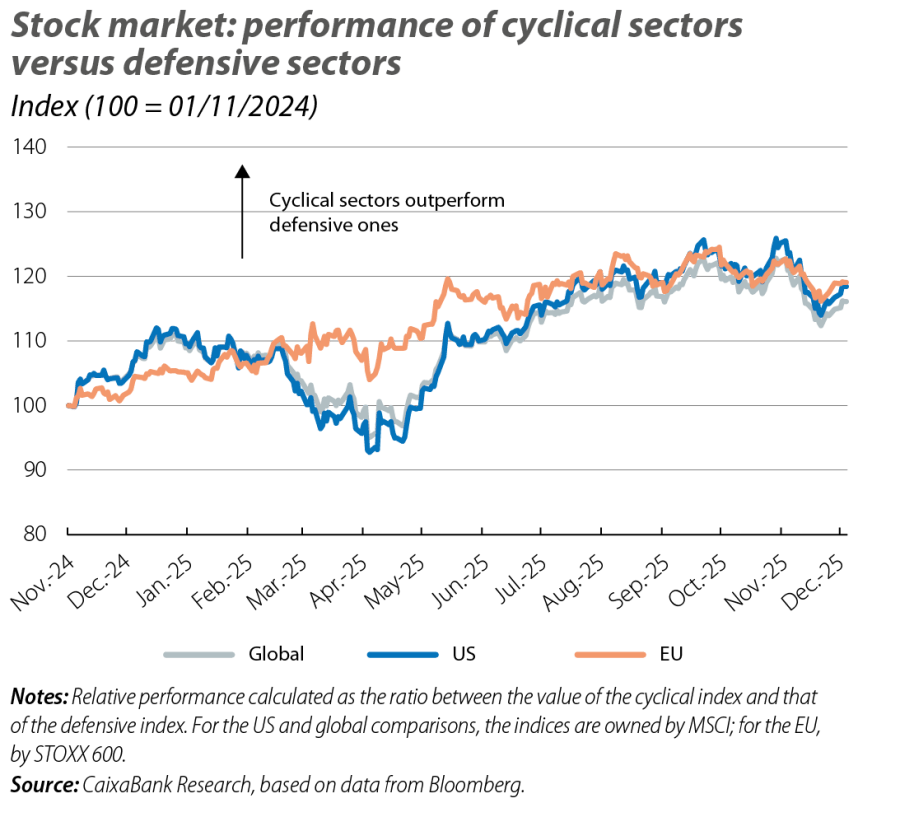

A month of volatility in stock markets amid nervousness surrounding technology and expectations regarding the Fed

The month was marked by episodes of high volatility and a general feeling of pessimism, especially amid high tech stock valuations. The sharp rally which had begun in April took a pause, and most global indices registered declines almost throughout November, led by the more cyclical sectors (technology, industry), while defensive sectors (health, basic resources and consumer staples) performed relatively better. However, the expectation of a rate cut by the Fed revived risk appetite and the indices began to rebound towards the end of the month, with gains led by these cyclical sectors. Overall, the S&P 500 closed the month practically flat, the Nasdaq ended slightly down and the euro area indices showed a mixed performance. The IBEX 35 closed with clear gains and stood out above the European average, driven by the good performance of stocks in the financial and materials sectors.

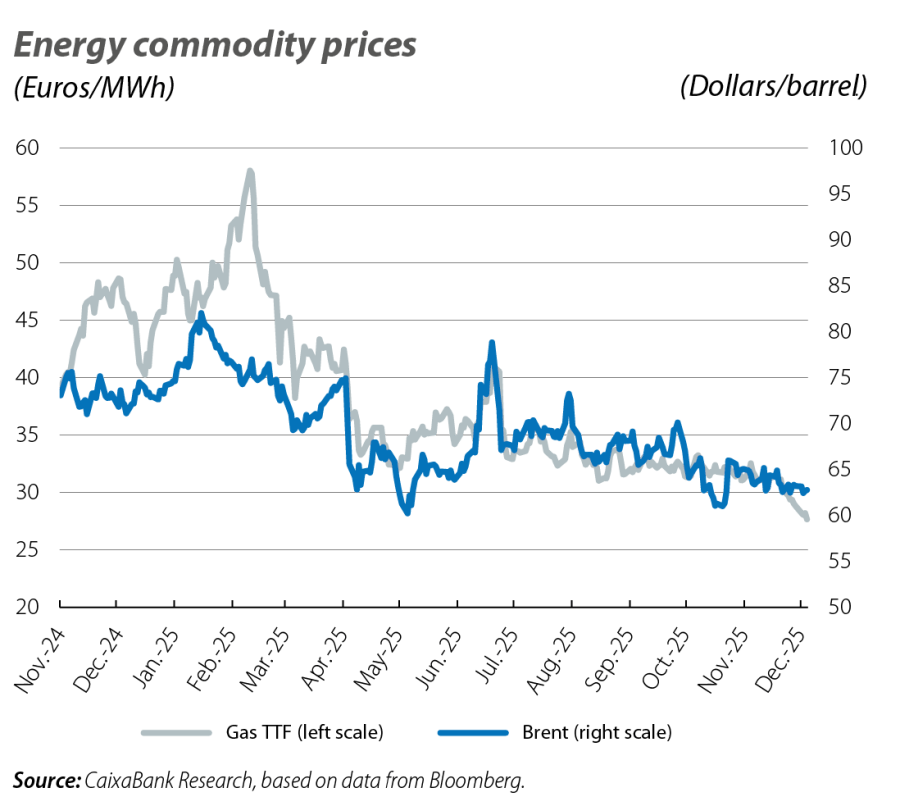

Discussions of a peace deal in Ukraine drag down energy prices

The price of energy commodities registered widespread declines during November. Despite US sanctions on Russia’s two largest oil companies and OPEC’s announcement that it will stop increasing production in Q1 2026, prices continued to decline amid news of the possible signing of a ceasefire or peace agreement between Russia and Ukraine. The TTF gas benchmark fell below 30 euros/MWh for the first time in more than a year and a half, and the price of the Brent barrel closed the month 2 dollars below October levels, at around 63 dollars. On the other hand, metals had a positive month amid the spike in volatility and the flight to safety. Gold recovered ground and in early December reached 4,200 dollars an ounce, approaching the October highs. Silver reached its all-time peak at 58.5 dollars an ounce and has accumulated gains of almost 95% so far this year.