The global economy: no respite in the uncertainty

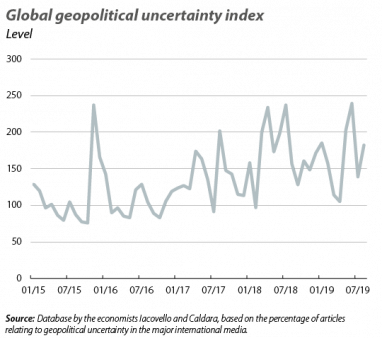

The uncertainty shock shows no sign of abating. Over the summer months, far from providing a respite, the main pockets of uncertainty of recent times have remained active: the trade tensions between the US and China have intensified, the EU’s political troubles (Italy, Brexit) have not been dispelled and the global geopolitical situation has been cause for alarm (notably the difficult circumstances in Hong Kong and Iran, among others). Furthermore, these dynamics have been compounded by volatility in financial markets and indicators which, generally speaking, have confirmed that the rate of economic activity is somewhat worse than a few months ago. This is a combination that has resulted in an intensification of doubts over the future path of global growth, and the risk of the latter being lower than expected has increased.

Escalation of trade tensions between the US and China. Among the open fronts mentioned above, the one with the biggest implications for the global economy is the increase in the trade skirmishes between the world’s two leading economies, which are trading tit for tat. On 1 August, just when negotiations appeared to be at a more constructive point, the US made a surprise announcement that it would apply a 10% tariff on 300 billion dollars of Chinese imports (which would partially come into force in September and fully in December). Shortly thereafter, China responded by applying various tariffs, ranging from 5% to 10% depending on the product, on 75 billion dollars of US imports. In addition, the Chinese giant allowed the renminbi to devaluate down to around 7 yuan per dollar. On 23 August, the US government announced a 5-pp increase (from 25% to 30%) on tariffs already in force on another 250 billion dollars of Chinese imports, making practically all US purchases from China now subject to tariffs that did not exist a year and a half ago. In short, although the two parties are expected to reach a basic agreement, probably in 2020, the uncertainty is already taking its toll and that hypothetical agreement is unlikely to recover the eroded confidence in full.

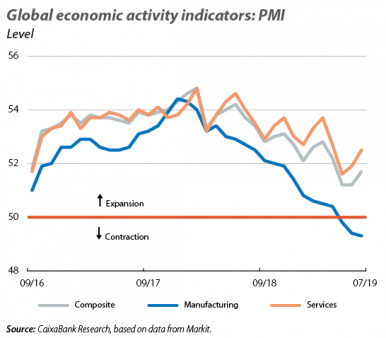

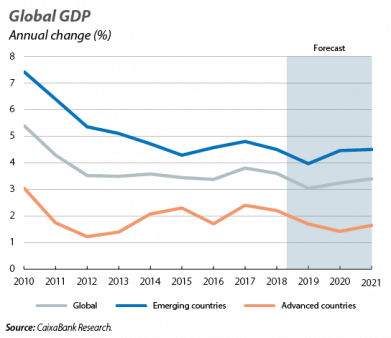

Expectations of lower future growth are beginning to spread. In this situation, most analysts and institutions have begun to revise their growth forecasts for 2019 and subsequent years downwards. A prime example of this is that, in July, the IMF once again reduced its global growth forecasts and reiterated the significant risks surrounding the global economy. Specifically, having grown by 3.6% in 2018, according to the Fund the global economy is expected to grow by 3.2% in 2019 and by 3.5% in 2020, both 1 decimal point lower than the figures included in its April forecasts. This downward revision was the result of growth in emerging economies being lower than predicted three months ago, the intensification of trade tensions, as well as the uncertainty surrounding Brexit and technological risks (with the various measures that the US could adopt in relation to Chinese companies and the multiple investigations underway on potential anti-competitive practices by some US technological giants). After the spike in uncertainty in August, these figures even appear somewhat optimistic. Accordingly, at CaixaBank Research we anticipate that growth will be 3.0% in 2019 and 3.2% in 2020, 2 decimal points lower than predicted in our previous Monthly Report.

US

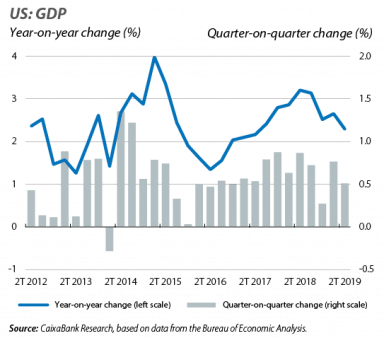

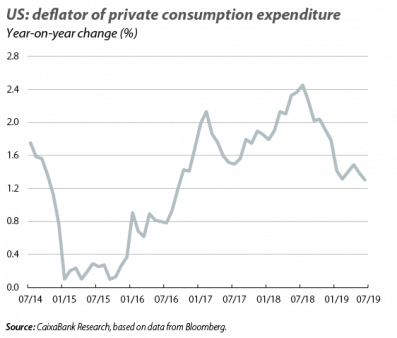

The economy keeps up the pace... for now. US GDP growth slowed in Q2, although it continues to expand at a considerable rate. In particular, US economic activity grew in Q2 2019 by 0.5% quarter-on-quarter (2.1% annualised quarter-on-quarter, and 2.3% year-on-year), clearly below the 0.8% quarter-on-quarter registered in the previous quarter. That said, it should be emphasised that the Q1 figure was exceptionally high, particularly considering the US economy’s stage of maturity in the cycle. As such, this figure is more consistent with the growth potential that we assign to the US (slightly below 2.0%). Also of note was the encouraging tone in private consumption, a key component with a high degree of inertia, which indicates a gradual deceleration in US growth. The indicators for Q3 suggest growth in that area of 2.0%, with the foundation of the labour market proving highly resistant and all this in a context with few price tensions.

Dark clouds loom on the horizon. All in all, if we take a step back from the current data and we project the expected impact of the trade tensions in accordance with CaixaBank Research’s estimate (see the Focus «The threat of protectionism in the global economy» in the MR07/2019), the resulting forecasts point towards lower-than-expected growth in the US. Specifically, the theoretical impact of the tariff hike can be estimated as a 4-decimal point reduction in growth in 2019 and 2020, but this impact is unlikely to be fully passed on to the growth rate of economic activity. This is partly because 2020 is an election year (so it is plausible that fiscal stimulus measures could be used) and partly because decisions were taken over the summer relating to debt and budgetary limits which should reduce the likelihood of negative shocks in this area.

EUROPE

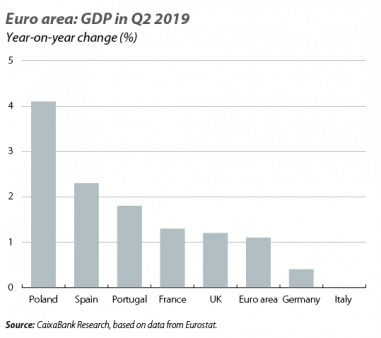

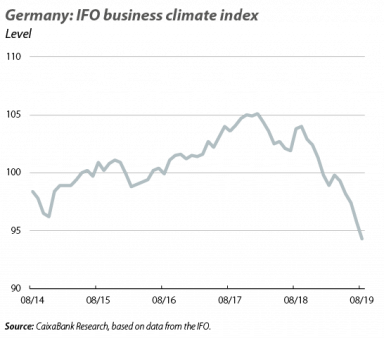

Europe, the main victim of the uncertainty shock. While the main trade conflict is between the US and China, for the time being it is the European countries that, paradoxically, seem to be more affected by the increase in uncertainty. In Q2 2019, GDP rose by 0.2% quarter-on-quarter (1.1% year-on-year), a 0.2-pp slowdown compared to Q1. In addition, Germany’s GDP fell by 0.1% in quarter-on-quarter terms (+0.4% year-on-year) and the Bundesbank predicts another decline in Q3. In the rest of Europe, the tone was one of lower growth, albeit not negative. The performance of the economic activity indicators at the beginning of Q3 suggested growth for the quarter in line with the previous one, although the downside risks have intensified.

What lies behind the worse tone in Europe? The most likely explanation as to why the EU is performing differently to, say, the US (which is directly affected by the trade tensions) is Europe’s high sensitivity to changes in global confidence, as the region is more internationally integrated than the US. This is reflected in the estimates of the aforementioned article, which stated that the intensity of the so-called uncertainty channel was practically the same in the euro area as it was in the US and China. An additional factor that intensifies Europe’s growth problems is the uncertainty of a strictly political nature, particularly that which is affecting Italy (despite expectations of the formation of a new coalition government, doubts over its duration will not be easily appeased) and the United Kingdom. Despite these dynamics being of an idiosyncratic nature, they are probably also hindering economic sentiment in the rest of Europe.

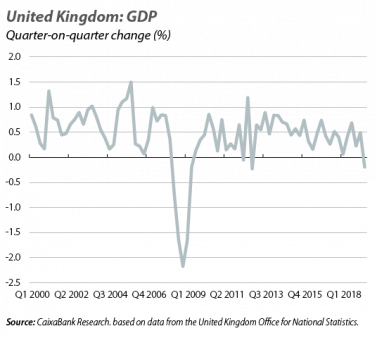

British recession on the verge of Brexit. In Q2 2019, GDP fell by 0.2% quarter-on-quarter, representing a significant reversal of the 0.5% growth registered in Q1. In year-on-year terms, growth slowed to 1.2% (1.8% in Q1). The first fall in GDP should be interpreted in the context of Brexit, as it was largely a result of the reduction of stocks (the one-off accumulation of Q1 was partially reversed, in anticipation of what was then believed to be the impending departure from the EU) and the contraction of investment, affected by the prevailing uncertainty. The immediate outlook does not appear promising, as the likelihood of a no-deal Brexit has increased following the election of the new prime minister Boris Johnson, with his hard negotiating line both with the EU and internally (even so, we still believe that Article 50 of the EU Treaty will end up being extended).

REST OF THE WORLD

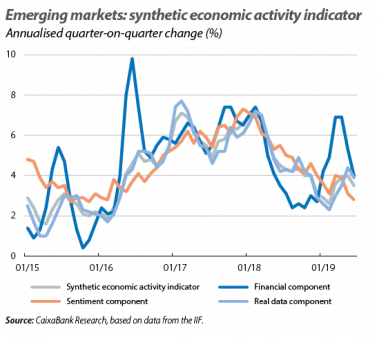

Uncertainty begins to weigh down on the emerging markets. The rate of economic activity growth in the emerging markets has lost momentum over the summer months. Following a highly turbulent 2018, the emerging bloc had recovered in the first few months of the year, as evidenced by the trend in the IIF’s economic activity indicator. However, in May this trend was cut short, especially from a financial standpoint, with a heightening of trade tensions. Although the data by country for Q2 and the beginning of Q3 suggest differing trends (growth consistent with expectations in China; better than expected in Turkey and mildly better in Brazil; worse than expected in India and Mexico; in the midst of a debt crisis in Argentina), the general tone is somewhat grey. Looking ahead to the future, the foreseeable impact of the trade war on Chinese growth looms as a threat for much of the emerging bloc.