Strong growth which looks set to continue

The Spanish economy ends the first half of 2018 in a strong position. CaixaBank Research’s GDP forecasting model predicts a quarter-on-quarter growth of 0.66% in Q2 2018, practically the same as the actual figure for Q1 (0.7%). Looking forward to the second half of 2018, we expect GDP growth to slow down very gradually due to weakening tailwinds (for example, due to the rise in the price of oil) and the fact that little remains to close the output gap. In any case, the economy will continue to show healthy growth and will be backed by both external tailwinds and internal strengths. These tailwinds include the encouraging tone of global growth and accommodative financial conditions which are sustained by the ECB’s monetary policy. As for the internal strengths, the Spanish economy will benefit from heightened job creation in the current expansionary cycle (see the Focus «Strong recovery in employment: explanatory factors», in this same Monthly Report), as well as from greater international competitiveness and progress made in the correction of macroeconomic imbalances.

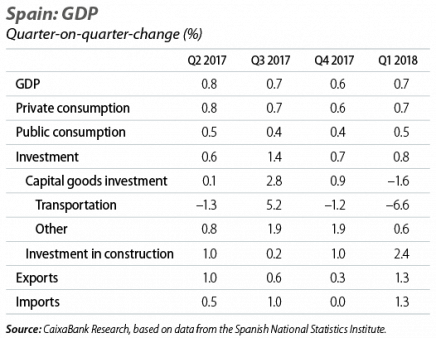

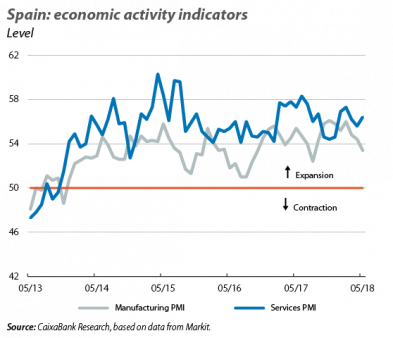

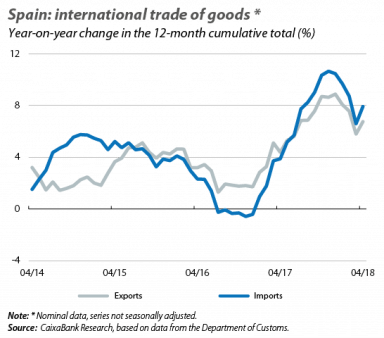

The breakdown of GDP for Q1 shows a strong contribution from domestic demand. Private consumption, which accounts for 58% of the total, continued to show an encouraging tone with quarter-on-quarter growth of 0.7% in Q1, in line with the figure suggested by the composite consumption indicator. It is the slowdown in investment, however, which has drawn the most attention following the publication of the components of GDP. Specifically, there was a decline in capital goods investment (–1.6% quarter-on-quarter) due to the reduction in investment in transportation equipment, which fell by 6.6% quarter-on-quarter. This reduction was slightly offset by investment in construction, which accelerated to a quarter-on-quarter growth of 2.4%. All in all, the moderation of investment in Q1 should be considered temporary. As such, while capital goods investment could still be suffering from the hangover of the abnormally strong upturn in Q3 of 2017, construction still has room for growth. More importantly, the latest indicators suggest that investment has once again gained traction in Q2, since the composite PMI index for May rose from 55.4 to 55.9 points, well within expansionary territory (above 50). The foreign sector, meanwhile, contributed less than expected. Although exports maintained a positive tone, imports grew more than expected, particularly in services.

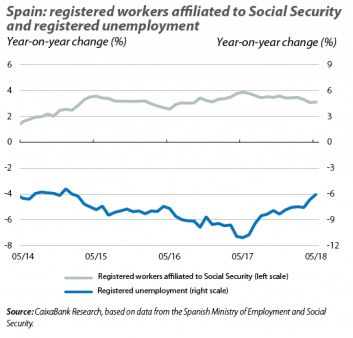

The labour market is showing healthy growth. In May, the number of registered workers affiliated to Social Security increased by 70,898 (seasonally-adjusted figure), the biggest increase in 2018 and well above the increase of 50,935 recorded in May 2017. With this, the year-on-year change stands at 3.1%. By sector, the recovery of employment in construction was particularly significant, gaining traction with 6.6% growth, as was the figure for the services sector, which is the biggest component overall and which accelerated by 1 decimal point to reach year-on-year growth of 3.2%. This growth in employment resulted in a drop in registered unemployment in May of 84,000 people. This is an encouraging figure, albeit slightly lower than that forecast by CaixaBank Research.

Private consumption appears buoyant thanks to the strength of the labour market. While retail sales slowed in April (0.5% year-on-year) because of Easter, other indicators suggest that private consumption will continue to show strength in Q2. These include consumer confidence, which in May recovered from the declines seen in March and April, and the composite consumption indicator (which includes sales in large firms, car registrations, adjusted retail sales, tourism and wage-earners’ pay).

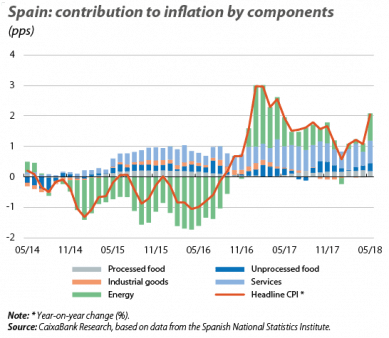

Inflation picks up due to energy prices. Headline inflation rose by 1 pp in May, up to 2.1%, and reached 2.3% in June. The indicators suggest that this increase was primarily due to the rise in energy prices, although the breakdown by components for June is not yet known. Underlying inflation, meanwhile, increased by 3 decimal points in May, up to 1.1%, due to the rise in the price of tourist packages. Over the coming months, the oil price will continue to push up prices, although we expect some moderation in the last third of 2018. It should also be noted that core inflation, which is what sets the medium to long-term trends, remains at moderate levels. CaixaBank Research’s inflation forecast for 2018 has been increased from 1.6% to 1.8%, mostly due to the greater impact of electricity, unprocessed food and tourist packages.

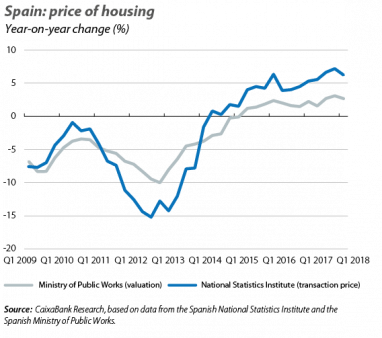

The real estate market continues to produce encouraging figures. Sales and purchases of homes for the four months to April grew by 16.0% year-on-year, confirming the upward trend in the sector. This momentum in sales is also having an impact on housing transaction prices, which rose by 6.2% year-on-year in Q1 2018 (1.4% quarter-on-quarter). This is a strong sign of growth, although it is 3 decimal points below our forecast. With regards to the outlook for the next few years, construction will continue to make a positive contribution to economic growth and job creation, since, despite the intensity of the latest spurts of growth, the starting point is low. For example, planning permission grants grew by 25.4% year-on-year in February (12-month cumulative total).