Public debt: the elephant in the room

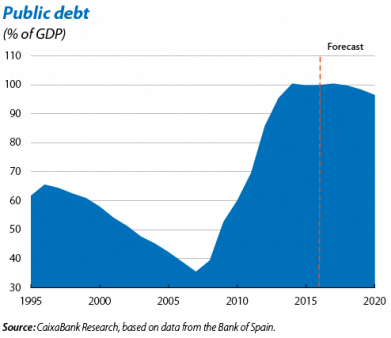

High levels of public debt and deficit have aggravated the funding needs by general government in the last few years, bringing these to historically high levels. Given this situation, it is vital to manage government bond issuances properly.

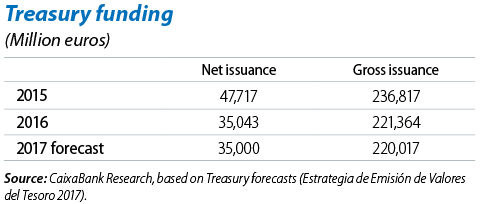

Debt maturities totalling 185,017 million euros will have to be covered in 2017. Moreover, the Treasury plans net issuances of an additional 35 billion euros, raising funding needs to more than 220 billion euros. As in the last few years, the Treasury is going to finance this new debt by issuing medium and long-term bonds, so the average maturity of public debt will continue to rise. In 2016 this reached 6.8 years, a similar figure to the one recorded at the start of the crisis. Lengthening the average maturity helps to reduce refinancing risk, particularly important when a large amount of debt needs to be renewed each year.

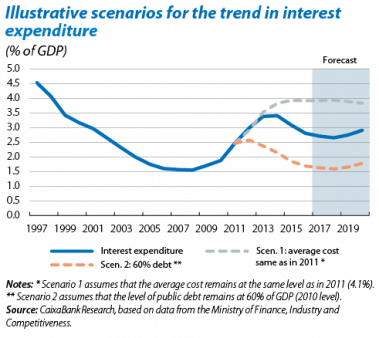

This extension of the average maturity has been compatible with a reduction in its average cost thanks largely to the ECB’s accommodative monetary policy.1 In 2016, the average cost of Spain’s debt stood at around 2.9%, far from the 4.1% recorded in 2011. This lower financing cost has led to considerable savings in interest payments, which have even fallen in nominal terms since 2014. Specifically, if the average cost had remained at the same value as in 2011, interest expenditure would represent 3.9% of GDP instead of the 2016 figure of 2.8%. Neither should we forget that the increase in debt has resulted in higher costs. If the ratio of government debt to GDP had remained at 2010 levels (60% of GDP), annual expenditure on interest payments would be 40% lower.2

Although the ECB will continue its quantitative easing programme in 2017, interest rates will no longer be so favourable as they are likely to rise gradually, especially in the longer-term tranche of the curve. Given this scenario, it is the right decision to concentrate issuances in the longer-term tranches of the curve as this helps to take advantage of today’s low interest rates at the same time as reducing refinancing risk.

Whatever the outcome, it is important for Spain to focus on continuing its process of fiscal consolidation and gradually reduce its levels of public debt to ensure that, once interest rates start to rise again, the elephant in the room will not become unruly.

1. In fact, in 2016 the ECB bought 93,514 million euros of Spanish government bonds, so the net issuance, including the effect of these purchases, was –58.5 billion euros.

2. This calculation merely illustrates the direct effect of the increase in debt on interest payments and assumes that the trend in the rest of the variables is the same as the observed trend.