How is Brexit affecting tourism in Spain?

In June 2016, the United Kingdom’s vote in favour of leaving the European Union (EU) opened up a new scenario for the British economy that could have important repercussions for the Spanish economy and particularly for the tourism industry, which receives around 16 million British tourists a year1. In this article we examine the impact of Brexit on the number of British tourists visiting Spain and its potential impact in the future under different EU exit scenarios.

- 1This figure represents nearly 22% of Spain’s total inbound tourism (2018 data).

Three years after the referendum, it is still unclear when and under what terms the UK will leave the EU. It is also true that, after an initial adverse reaction in the financial markets, the British economy has performed better than expected2. However, this does not mean that the confusion caused by Brexit has no economic consequences.

In fact, some of the effects of Brexit can already be seen, such as a slowdown in the UK’s economic growth rate since the referendum (from 2.4% in 2015 to 1.4% in 2018). This loss of dynamism has been caused, in part, by the decline in real income due to the sharp depreciation of the pound sterling occurring after the Brexit referendum. This has directly reduced the purchasing power of the British, both in terms of their domestic purchases and also when they travel abroad. In this respect, as the first chart shows, it is not surprising that the tourism demand by UK residents has diminished since mid-2016.

- 2This was partly due to the actions carried out by the Bank of England, which lowered interest rates and took a number of measures to boost liquidity, helping to ease the initial tension and preventing financial conditions from getting any tighter.

A drop in tourism demand

The reduction in the purchasing power of the British as a result of the Brexit referendum has led to a drop in tourism demand from 2016 onwards

Overseas visits by UK residents (cumulative over 12 months)

Millions

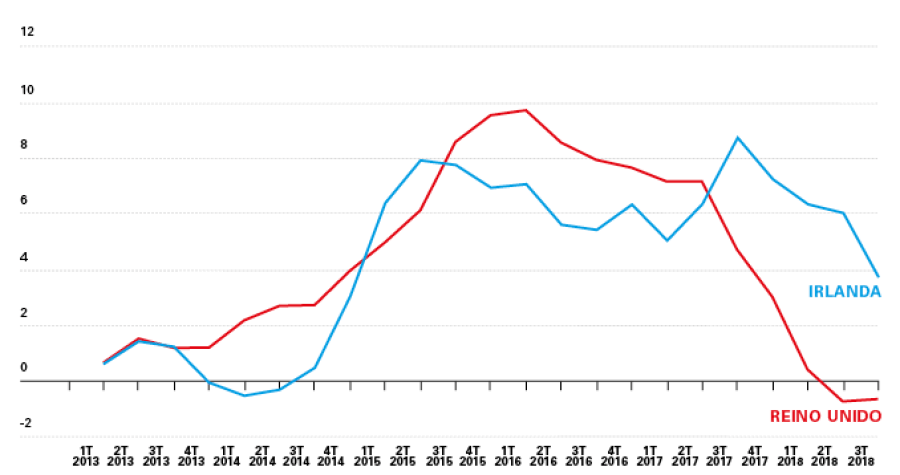

Given this situation, we might wonder how British tourism demand would have fared without the Brexit effect. To find out, we used the trend in tourist demand in Ireland, which behaved very similarly to the UK trend until mid-2016 (see the second chart). If UK tourist numbers had continued to perform in a similar way to those from Ireland after the Brexit referendum, up to 5 million more UK residents would have travelled abroad between Q3 2016 and Q3 2018. For Spain, the most popular destination among the British, this estimate means that, since mid-2016, approximately 1.1 million British tourists have been lost (around 500,000 a year)3. However, it should be noted that UK visitor numbers for Spain have posted a positive trend over the past two years. In fact, Spain has managed to increase its market share (from 20% in Q2 2016 to 22% in 2018) as well as the daily expenditure per visit among the British, a sign that it is still a competitive market.

For the next few quarters, the outlook for the British economy in general and British tourism demand in particular will continue to depend on the Brexit developments and outcome. Ratification of an agreement would avoid a hard Brexit and help to dispel some uncertainty in the short term, although it would not guarantee that the current links between the EU and the UK would remain in the medium and long term. Specifically, a long process will begin post-Brexit during which both parties must define the details of their future relationship. At present, the UK’s position is unclear, a fact that makes it difficult to determine what the future relationship will be like and the implications for economic activity, among other areas.

- 3For the calculation we used the average market share (21.5% of outbound tourism) between Q3 2016 and Q3 2018.

Comparison of outbound tourism between Ireland and the United Kingdom

Year-on-year change (%)

In this context, it may be useful to look at possible future scenarios and analyse their impact on Spain’s inbound tourism from the UK. To this end, we have used the range of scenarios developed by the Bank of England4, going from benign environments, where the links between the EU and the UK remain close, to more adverse ones such as a hard Brexit. With these scenarios, and based on our estimates of the elasticity of tourism demand in the United Kingdom (with respect to GDP and the exchange rate)5, we have passed the impact of Brexit onto the number of British tourists coming to Spain.

In the most favourable scenario, the United Kingdom would ratify the exit agreement negotiated with Brussels and a relatively long transition period would be implemented, during which both parties would negotiate as close a future relationship as possible (without any significant increase in trade barriers between the two). In this case, the Bank of England estimates that, thanks to the reduction in uncertainty, the impact on UK GDP could even be positive in the medium term (+1.75%)6 and that the pound sterling would appreciate by 5%. If this scenario occurs, we believe the impact on British tourism would be positive and that visits to Spain would increase by around 800,000 (4.9%), cumulative up to 2023.

- 4These scenarios are not forecasts because they do not cover all possible assumptions and effects of a future economic relationship other than the current one or a hard Brexit. See Bank of England (2018): EU withdrawal scenarios and monetary and financial stability. A response to the House of Commons Treasury Committee.

- 5Change in the number of tourists in response to changes in real GDP and the nominal pound-euro exchange rate.

- 6Up to 2023. Effect on GDP in relation to the base scenario valid in November 2018.

Four future scenarios

At CaixaBank Research we have analysed four possible scenarios to estimate the future impact of Brexit on the number of British tourists coming to Spain, from the most benign to the most adverse

A second scenario, less favourable than the previous one, envisages a future trade relationship that is less close with the EU. Specifically, after the transition period, border controls and more regulatory barriers would be introduced, leading to a slight fall in GDP in the medium term (–0.75%). However, the reduction in uncertainty would push up the pound slightly (by 2%). In this case, our estimates indicate that the impact on the number of British tourists coming to Spain would be negligible: British visits would decrease by approximately 150,000 (1.0%) up to 2023.

The other two scenarios contemplate the possibility that the UK and EU will not reach an agreement and that trade between them will be governed by WTO terms (with tariffs and non-tariff barriers to trade and customs checks). Neither do these two scenarios rule out the possibility of some of the production chains currently in operation breaking down, or certain episodes of financial instability. Depending on the degree of disruption, the Bank of England estimates the impact on the UK’s GDP could range from −4.75% (less disruptive scenario)7 to −7.75% (highly disruptive or disorderly scenario)8. Both scenarios also assume a sharp depreciation of the pound (between 15% and 25%, depending on the severity of the scenario). Should any of these scenarios occur, we estimate the impact on British tourism outflows to Spain would be significant and negative, ranging from 13.8% to 22.7%, cumulative up to 2023.

- 7The United Kingdom is able to replicate teh trade agreements with third countries that it had due to its EU membership. There are also certain disruptions at border controls.

- 8After leaving the EU, the United Kingdom loses all its trade agreements with third countries. The United Kingdom also faces severe disruption at its borders due to customs checks.

Impact of Brexit on British tourist visits to Spain

Million visits

The impact of Brexit on the tourism sector will therefore largely depend on the type of commercial relationship established between the UK and the EU. However, the sensitivity of British tourism in each of these scenarios may be amplified or reduced depending on the institutional arrangements agreed, since they could make Europe’s tourism industry less competitive. One such important provision is the United Kingdom’s access to the European Common Aviation Area9, as without this prices for flights between the UK and continent are likely to increase (due to less competition). Also, if a soft Brexit is not achieved, particularly costly measures could be introduced for British tourists, such as the loss of free health coverage in the EU and restrictions on their movements (including border controls and visa requirements for travelling to the EU).

- 9This single market for aviation services allows any airline from an EU country to operate on any route within the EU and set the fares it wants. If the United Kingdom loses access to the ECAA, British airlines would be treated as third-country operators and their licences, certificates and registration would no longer be valid in the EU.

Impact on tourism

The impact of Brexit on Spain’s tourism industry will largely depend on the trade relations established between the UK and EU. In the short term, British tourism is likely to be less dynamic than in the years prior to the referendum

In summary, the estimated impact of Brexit on British tourism demand varies considerably depending on the scenario and hypotheses considered, illustrating the high degree of uncertainty surrounding the UK’s exit from the EU and its possible economic implications. In this respect, an agreement between both parties that minimises uncertainty and guarantees an orderly transition towards a new model of commercial relations without unnecessary barriers would succeed in mitigating a large part of this impact. However, over the next few months, Brexit confusion is likely to keep the rate of economic activity in the UK contained and the British pound volatile. In such a situation, British tourism is likely to continue suffering from the effects of Brexit and be less dynamic than in the years prior to the referendum.