The emerging markets suffer while the US shifts up a gear

The economic indicators known in the summer months confirm that the growth rate of global economic activity is rebalancing: while there is growing evidence that the persistent economic uncertainty is taking its toll on the growth of some emerging economies, it is also clear that the advanced economies are on a different wavelength. The US is experiencing significant acceleration in its growth rate thanks to the fiscal impulse, while the euro area is seeing only a slight moderation in the growth of its economic activity. Overall, the scenario forecast by CaixaBank Research has been adjusted to account for this progressive weakening. Specifically, the growth figures for the emerging markets expected for the current year and the next have been revised down to 4.9% and 4.8%, respectively (1 decimal point lower than the previous forecast). As a result, the expected global growth will also be slightly lower in 2018 and 2019.

The downside risks remain considerable. Despite the moderation of the outlook set out above, the balance of risks continues to point towards a possible weakening of the economy in the future. The protectionist shift of the US and its possible global implications continue to play a prominent role in this balance. In the last few weeks, there has been a combination of negative and encouraging news in this area. The US has finished implementing the remainder of the package of tariff increases on Chinese products with a value of 50 billion dollars announced months earlier. In contrast, and somewhat unexpectedly, the US and Mexico have reached a bilateral trade agreement in principle which, once approved by the two countries’ legislative authorities, will replace the NAFTA (while Canada is yet to be included). The terms of this future agreement have made it possible to balance both the US’ demands (with a tightening of the rules of origin and an implicit rise in the minimum wage of the automotive sector) and the matters that Mexico considered important (with an extension of the adjustment periods, minimum terms and review periods, de facto protection against competition from Asia and without adversely affecting the primary sector). Besides the content of the agreement, the very fact that an agreement has been reached at all after months of complex negotiations and heated rhetoric provides some hope that, in the medium term, pragmatism will be able to lead to the resolution of trade tensions.

US

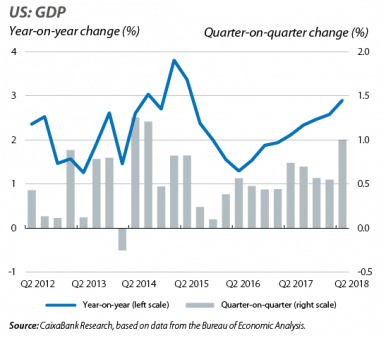

The US economy escapes the predicament of lower growth endured by other economies. The growth data for Q2 2018 (1.0% quarter-on-quarter, 2.9% year-on-year) confirm that the economy has accelerated thanks to the support of temporary and cyclical factors (such as the fiscal stimulus and a labour market that exceeds full employment). In particular, the breakdown of GDP by component of demand confirms that the bulk of the activity continues to come from domestic demand, leaving behind the bump experienced in Q1 thanks to the renewed strength of private consumption. Furthermore, it is worth noting that the contribution of external demand has also accompanied the acceleration of the economy, thanks to the robust performance of exports being combined with a reduction in imports. This reduction has been unexpected and, to some extent, surprising in light of the strength of domestic demand.

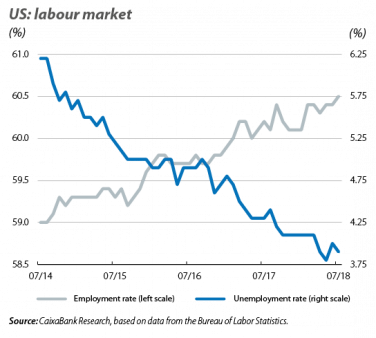

The labour market continues to be a source of stability. The strength of domestic demand is largely attributable to the labour market, which continues to show signs of growth. In July, nearly 160,000 jobs were created (slightly less than in previous months, but still a high figure if we consider that the previous figures have been revised upwards), while the unemployment rate stood as low as 3.9%. Wages, meanwhile, rose by 2.7% in year-on-year terms.

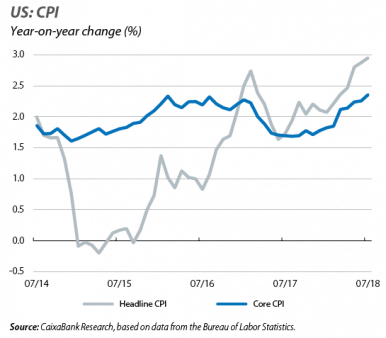

Inflation continues to rise and the Fed will take action soon. In the last few months, inflation has been gradually on the rise, in July reaching 2.9% (the headline index) and 2.4% (the core index, i.e. excluding the most volatile items of energy and food). This is another sign that the US economy is passing through the mature phases of the business cycle. In this context, we expect the Fed to continue its strategy of increasing the reference rate (with two further increases expected in what remains of the year, up to 2.5%). Beyond this, both the macroeconomic scenario and, therefore, that relating to monetary policy become more uncertain. That said, the strong inertia of the current rate of growth in economic activity should be more contained in 2019 when the effect of fiscal policy is reduced.

EUROPE

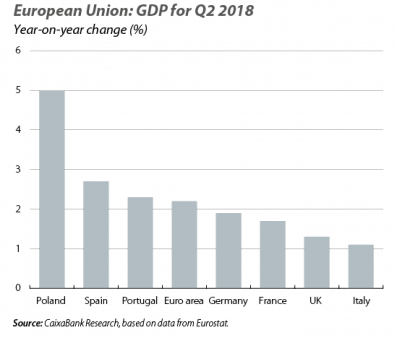

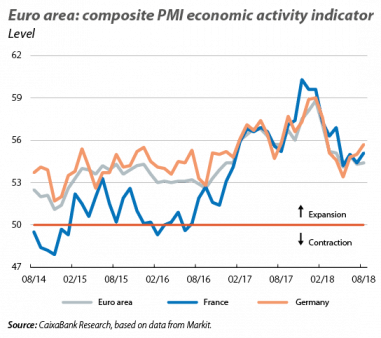

Slowdown in growth in the euro area. The GDP of the euro area grew in Q2 by 2.2% year-on-year (0.4% quarter-on-quarter), a figure similar to the 2.5% registered in the previous quarter, but lower than those observed at the end of 2017. By country, Germany maintained a similar growth rate to the previous quarter (0.5% in quarter-on-quarter terms, 1.9% year-on-year), well above that of countries such as France (which had surprisingly low growth of just 0.2% quarter-on-quarter) and Italy (which also grew by 0.2%, although in this case it was expected and in line with past figures). Outside the euro area, Poland continued to show very buoyant growth, while the United Kingdom recovered a little vibrancy following a somewhat shaky start to the year.

Growth in the euro area: a warning sign or just a bump in the road? The relative disappointment of Q2 was interpreted as a warning signs among analysts. However, in the opinion of CaixaBank Research it should not be treated as a warning, although it cannot be considered an isolated result either. The stability of the PMI indicator of the euro area for August (going from 54.3 points in July to 54.4), together with the gentle decline in other economic sentiment indicators, suggests that growth remains at levels similar to those of Q2. On the whole, although production capacity utilisation remains relatively low, it could be said that the strong cyclical upswing experienced by the euro area in 2017 moderated somewhat faster than expected. Therefore, it is foreseeable that the growth rate of economic activity in the first semester is representative of the growth to come in the next few quarters. Finally, inflation has continued to follow the same trend of recent months, with modest pressures on prices besides the fluctuations in energy prices. In August, inflation in the euro area stood at 2.0%, just 1 decimal point less than in July.

EMERGING MARKETS

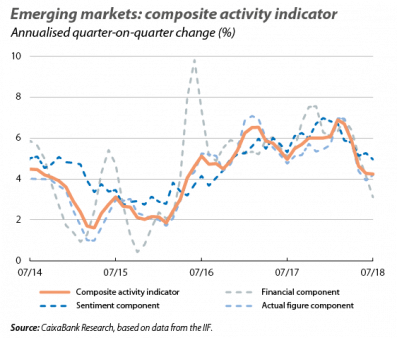

The emerging economies are beginning to acknowledge the adverse environment. In the last few weeks, there has been a notable increase in financial volatility in emerging market assets. This has resulted in significant depreciations of certain currencies, spikes in long-term interest rates and heavy declines in stock market prices. Besides the lead role of countries such as Turkey in this process, there are aspects not of an idiosyncratic nature which we believe are dragging down investor sentiment and which are already affecting the economic activity indicators. As is well known, the underlying context came about as a result of the progressive tightening of global financial conditions, a trend that is largely the result of the toughening of monetary policy in the US. This trend is affecting many emerging markets that previously made use of the lax financial conditions to accumulate debt in dollars and other strong currencies. Now, in addition to this, there is the added effect of the increased uncertainty caused by the escalation of protectionism by the US (although the preliminary agreement with Mexico is an encouraging development), as well as doubts surrounding the extent of the slowdown in China. As a result, indicators that attempt to capture the current rate of growth in the emerging markets, such as the composite activity indicator of the Institute of International Finance, are now showing notable declines that extend back to the end of Q1.

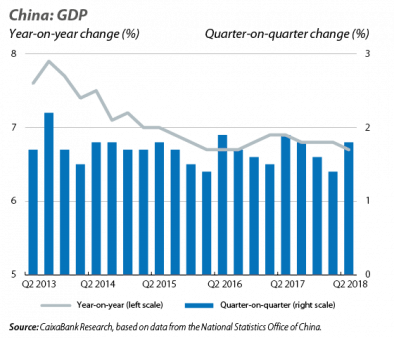

China’s GDP slows and the economic activity data suggest more deceleration is to come. The increase in GDP in Q2 was 6.7% year-on-year, after three quarters growing at 6.8%. In addition, the economic activity indicators (such as industrial production) and the sentiment indicators for Q3 point towards a slowdown in economic activity that is somewhat higher than that indicated by the official GDP data. We expect the country’s growth will continue to decelerate gradually in the second half of the year. That said, as mentioned previously, this process is not free of uncertainty and it has had an adverse effect on global investor sentiment.

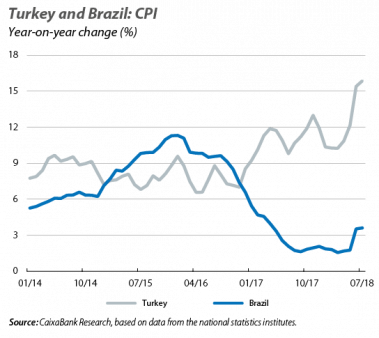

Turkey, at the heart of the financial hurricane. As a result of an accumulation of excessive imbalances over too long-a-period (the most obvious is inflation, which stood at 15.8% in July, although there is also an unsustainable current account deficit of more than 6% of GDP in Q2) and a somewhat questionable economic policy, the Turkish economy is experiencing a sudden halt of capital inflows in Q3. This situation will likely lead to an abrupt slowdown in economic activity when faced with the inevitable credit crunch. Unfortunately, this sudden macroeconomic adjustment may not be the end of Turkey’s problems if it is not accompanied by a shift in economic policy that tackles the latent imbalances.