Liquidity in the business sector: more does not always mean better

The economic activity carried out by companies is compensated in monetary terms by the generation of cash flows. As these are produced, the company’s managers (the «agent» in academic jargon) face a very significant challenge: deciding how such cash should be employed. Broadly speaking, and as a simplification, there are four possible options: boost investment to increase organic growth (in other words capex); reward the shareholders, either by paying out dividends or buying back shares; repay debts or, lastly, build up the company’s liquidity in its cash accounts. Over the past few years companies have notably, and increasingly, opted to hold onto cash with levels reaching an all-time high. This phenomenon, known as cash hoarding, has sparked fierce discussion, both in an attempt to understand the underlying factors and also to gauge its consequences.

Cash hoarding by companies has been widely and amply documented by empirical studies. One of the most prominent has been carried out by the economists Karabarbounis and Neiman, showing an increase in company saving relative to GDP at a global level over the past three decades.1 Another sign of this phenomenon is the increase observed over the past decade in the liquidity ratios of listed companies from the main countries in the developed bloc. The liquidity ratio consists of a company’s cash and other liquid assets easily converted into cash (mostly short-term fixed interest instruments) relative to its total assets. The trend in this ratio shows that cash hoarding appears to be a global phenomenon but is particularly strong in the US and Japan. At year-end 2016, almost 12% of the total assets of US firms were liquid compared with an average of 6.4% in the period 1996-2006. But the liquidity ratio appears to be rising even more sharply in Japan: from an average of 7.8% in the period 1996-2006 to close to 17% in 2016. The cash hoarding by companies in the euro area has been less remarkable, however, going from an average of 9.2% over the period in question to 10.5% in 2016 (see the graph).

Whereas there is widespread consensus concerning the empirical evidence for cash hoarding, the same cannot be said for the theory. Academic discussion has focused on why corporate cash surpluses have increased, as well as the possible consequences for the real economy. Corporate finance literature has traditionally identified several factors behind cash surpluses in firms. There are four key causes: the volatility of cash flow, perceived uncertainty on the part of managers, corporate governance issues and fiscal aspects. However, economists disagree when it comes to a unified theory that explains the increase in corporate liquidity over the past decade. Cash flow volatility is often put forward as a major cause and forms the basis of a large number of the factors classically proposed to explain corporate cash surpluses. In an influential study, Almeida, Campello and Weisbach find a positive and statistically significant correlation between the variability of cash flows and levels of cash in a large sample of companies.2 In particular, the authors demonstrate that the relationship between these two variables is even stronger among firms that share certain attributes, such as being smaller in size and more constrained in terms of their access to external financing. Other factors proposed by cash hoarding literature are the imperfections of capital markets as well as, more recently, the role played by regulation in the international financial system.

Other studies related to cash flow volatility have highlighted uncertainty as the underlying reason for cash hoarding, particularly after the outbreak of the financial crisis in 2008-2009.3 Companies hoard cash for preventative or precautionary reasons in order to hedge, to a greater or lesser degree, against the risk of a future scarcity of liquidity because of, for instance, possible negative shocks of a macroeconomic or idiosyncratic nature (i.e. related particularly to the company). Hoarding helps to ensure that, if faced with such situations, companies still have enough resources to take advantage of opportunities or invest in profitable projects, as well as to avoid bankruptcy. Historically, uncertainty regarding business cycle trends or sales has had a positive correlation with liquidity provision. However, the association between these two variables alters over time and has actually been weak during the period in question.

Also relevant are the cash management implications of possible conflicts or diverging interests that may appear between a company’s directors and owners (known as the «agency problem»). This issue has led to increasing mistrust in business and financial circles. Prominent Wall Street investors have even brought formal complaints against the boards of directors of some companies, claiming that their holding onto cash is clearly not in the shareholders’ interest. There is evidence in the literature that the agency problem tends to increase cash hoarding through many different channels. In particular, companies tend to have higher levels of liquidity in countries where shareholders’ rights and corporate governance are more deficient. According to various studies, Japan suffers from this problem. The fiscal factor has also come under scrutiny by researchers.4 In the case of the US, high levels of corporate tax discourage the repatriation of profits made beyond the country’s borders, so they tend to be kept abroad.

Probably one vital piece in the puzzle is the change in the sector composition of business and especially among listed companies. Sectors related to information and communication technology (ICT) have seen incredible growth over the past ten years. In 1996 only one ICT company was among the ten biggest in the S&P 500 index in terms of stock market capitalisation and this number was still the same in 2006; however, it had grown to six in 2016. Moreover, the five S&P 500 firms with the largest cash surpluses make up 25% of the total and all of them are involved with new technologies. The emphasis placed by such businesses on research and development (R&D) and the type of investment required (primarily in intangible capital, making external financing more difficult to obtain) may explain their propensity to accumulate savings. This has also been suggested by a recent Federal Reserve study, whose authors suggest that innovation is a first-order driver of cash hoarding.5

To recap, there is ample evidence of companies holding onto cash. However, the main causes of such hoarding and the relative weights of its potential underlying forces have yet to be satisfactorily defined. Nevertheless, the most recent evidence suggests that, for greater insight into this phenomenon, factors such as innovation and technological change should also be studied. Given the structural nature of such changes, corporate cash surpluses are likely to remain relatively high and certainly above the average levels seen in 1996-2006.

Carlos Martínez Sarnago

Financial Markets Unit, Strategic Planning and Research Department, CaixaBank

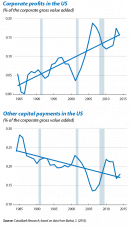

1. See Karabarbounis, L. & Neiman, B. (2012), «Declining Labor Shares and the Global Rise of Corporate Saving», NBER, Working paper No. 18154. The authors base their analysis on the trend in profit (variable flow). Readers should not confuse this with the concept of surplus corporate liquidity or cash surplus (variable stock).

2. See Almeida, H., Campello, M. & Weisbach, M. (2004), «The Cash Flow Sensitivity of Cash», Journal of Finance 59(4): 1777-1804.

3. Readers will find an interesting reference in Sánchez, J. & Yurdagül, E. (2013), «Why Are U.S. Firms Holding So Much Cash? An Exploration of Cross-Sectional Variation», Federal Reserve Bank of St. Louis Review.

4. For example, see Foley, F., Hartzell, F., Titman, S. & Twite, G. (2007), «Why Do Firms Hold So Much Cash? A Tax-based Explanation», Journal of Financial Economics, 86, 579-607.

5. See Falato, A. & Sim, J. (2014), «Why Do Innovative Firms Hold so Much Cash? Evidence from Changes in State R&D Tax Credits», Finance and Economics Discussion Series 2014-72, Board of Governors of the Federal Reserve System (US).