Outlook for the Spanish economy and its sectors in 2025-2026

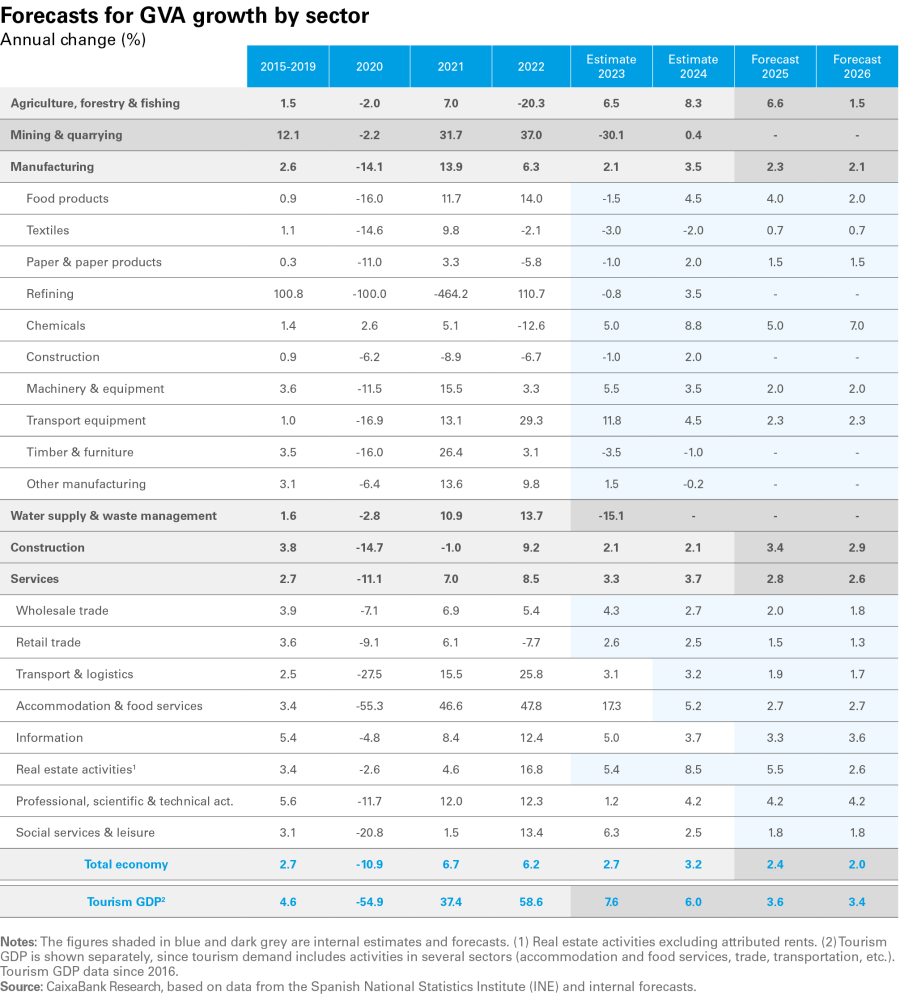

The outlook for the Spanish economy and its sectors in 2025 and 2026 is strong. Although there remains a high level of uncertainty surrounding the rules that govern global trade, we expect Spain’s GDP to grow by 2.4% in 2025 and by 2.0% in 2026, in a scenario in which the trade tensions remain contained.

Our forecasts envisage that the impact of the tariff hikes will be concentrated in the manufacturing sectors, although other indirect channels could affect other sectors more broadly, including services, depending on how the scenario pans out. Some of the key supporting factors include the lower price of energy inputs for Spain’s industry compared to that of other European countries, which will help Spain’s sector to grow at a similar rate to the economy as a whole despite the tariffs. We expect to see stronger-than-average performance in high-value-added sectors such as information and communication technologies, professional services and the pharmaceutical industry. In contrast, branches of industry with a high exposure to international competition and cost pressures – such as the textile and paper industries – are expected to record more modest growth.

In 2024, the Spanish economy grew by 3.2%, accelerating significantly compared to the 2.5% recorded in 2023. In addition, this improvement was widespread across all sectors: the services sector, manufacturing and the primary sector all showed greater buoyancy.

- Services: although the tourism sector registered a slight slowdown in 2024 (it grew by 6.0% compared to 7.6% in 2023), the strength of high-value-added services – such as professional and scientific activities, which grew by 4.2% – and the solid performance of real estate activities (8.5%) boosted the services sector as a whole, which registered growth of 3.7% in 2024, up from the 3.3% recorded in 2023.

- Manufacturing: the gross value added (GVA) of the manufacturing industry grew by a solid 3.5% in 2024, driven in part by lower energy costs compared to its European competitors, as analysed in the article «Spain and its new energy advantage« in this same Sectoral Observatory. Some of the sectors with the best performance are the chemicals and pharmaceutical industries, with an estimated growth of 8.8%, and the agrifood industry, at 4.0%. In contrast, some branches with negative structural trends, such as the textile and footwear industry or the wood and furniture industry, registered falls. These sectors continue to be affected by significant international competition and strong price pressure.

- Primary sector: the primary sector (agriculture, forestry and fishing) continued to recover in 2024, with GVA growth of 8.3%, after recording an advance of 6.5% in 2023 and a sharp 20.3% contraction in 2022. This improvement was driven by better weather conditions and the reduction of agricultural production costs. Thanks to this recovery, the sector is approaching the activity levels reached in 2021.

Our forecasts envisage that the impact of the tariff hikes will be concentrated in the manufacturing sectors

Although the pace of GDP growth is expected to moderate from 3.2% in 2024 to 2.4% in 2025 and to 2.0% in 2026, the Spanish economy is expected to continue to grow above its long-term potential, albeit gradually converging towards this benchmark. This scenario is dependent on two key factors, with conflicting effects. On the one hand, the global trade tensions and the associated uncertainty are exerting downward pressure and will particularly affect sectors more exposed to the US market, or those that are more export-oriented – due to the global slowdown – and those that are investment-intensive. We analyse these direct and indirect channels in the article «Tariff tensions and reconfiguration of trade flows: impact on Spain» in this same Sectoral Observatory. On the other hand, Spain’s competitive advantage when it comes to electricity costs compared to its European competitors acts as a driving factor for growth, especially for those most energy-intensity branches of manufacturing. The growth rates of the various sectors will also be determined by medium- and long-term structural trends. Thus, sectors with persistent challenges, such as the textile industry, will continue to show more moderate growth.

Based on the projected growth for 2025-2026, we can group the different sectors into three broad categories: 1. Sectors with high growth, 2. Sectors with growth around the average and 3. Sectors with weak growth.

1. High-growth sectors

These sectors show a high potential for expansion, either because of the boost provided by favourable structural trends or due to a particularly favourable economic context in the case of construction, the primary sector and the agrifood sector.

High-value-added services: both the information and communication technologies (ICT) sector and professional and administrative activities will continue to grow above the Spanish economy’s average, thus increasing its relative weight in the productive fabric of the economy. The ICT sector is benefiting from a sustained structural boost, favoured by digitalisation and the adoption of new technologies. It is expected to grow by 3.3% in 2025, accelerating to 3.7% in 2026. Professional and administrative activities also show a positive structural trend, as reflected in our projections for growth in excess of 4.0% in 2025-2026.

Pharmaceutical industry: the pharmaceutical industry has gained significant prominence in the last 25 years, acting as a high-value-added growth driver for the Spanish economy. In 2024, the chemicals and pharmaceutical industry as a whole grew by 8.8% according to CaixaBank Research estimates. While this sector is particularly vulnerable to potential tariffs that the Trump administration could impose, due its high exposure to the US economy, we expect it to slow to what is still a strong growth rate of +5% in 2025 and to grow by +7% in 2026.

Tourism Sector: the tourism sector continues to benefit from a high degree of specialisation and competitiveness, which allows it to maintain higher growth than the Spanish economy as a whole. After expanding by 6.0% in 2024 and far exceeding its 2019 level of activity, growth in the sec Pharmaceutical industry tor is expected to moderate towards more contained rates of around 3.5%, although this is still well above the economy’s average. Some of the main economic factors supporting this strength are the high level of savings in the main source countries and the increase in gross disposable income, in a context marked by the normalisation of inflation towards the 2% target in the euro area. It should be stressed that the sector’s competitiveness is reflected in its performance relative to that of other large European economies. The aggregate of trade, transportation and accommodation and food services – which includes most tourism-related activities in the national accounting records – has grown more in Spain since 2019 than in the EU as a whole or in any of the continent’s major economies, despite having suffered a deeper fall during the pandemic, as reflected in the following chart.

Agrifood sector: in 2025 the primary sector (agriculture, forestry and fishing) is expected to grow by 6.6%, while the agrifood industry (food products) will grow by around 4.0%. This upturn will allow the primary sector in 2025 to recover a level of activity similar to that of 2021. For this reason, more moderate growth is expected in 2026, in line with its potential.

Construction sector: the sector grew a modest 2.1% in 2024, in a context in which the supply of housing began to reactivate, although it remains far below the demand derived from net household formation. For the period 2025–2026, lower interest rates, the housing deficit accumulated in recent years and the execution of Next Generation EU (NGEU) funds are expected to boost both residential construction and urban regeneration projects, thus favouring further growth in the construction sector.

2. Sectors with average growth

Manufacturing industry: the industry enjoyed a solid performance in 2024, with growth of 3.5%, outperforming the economy as a whole. This growth was favoured by the lower cost of energy inputs compared to other European countries, which has boosted the competitiveness of Spanish manufacturing. As a result, the sector grew substantially above the EU average. As shown in the chart above, the GVA of Spanish manufacturing has grown by 9.9% since 2019. This compares with growth of 4.3% in the EU as a whole, a decline of 1.6% Germany and one of 0.5% in the case of France. Nevertheless, manufacturing is the sector of the Spanish economy most exposed to the tariffs imposed by the US, both through the direct channel – due to its high export-intensity – and through indirect channels. The uncertainty stemming from the swings in US trade policy could adversely affect investment, posing a risk to what is a capital-intensive sector. Although the competitive advantage derived from energy prices is expected to persist, the headwinds associated with international trade policy suggest that we will see a slowdown in the sector's growth rate, placing it slightly above 2.0% in 2025 and 2026.

Wholesale trade: we expect it to benefit from the high level of savings and the growth of Spanish households’ gross disposable income. These factors, coupled with the decline in inflation and robust job creation, point to a strong performance from private consumption during this year and next. The strength of private consumption leads us to anticipate that wholesale trade will grow in line with the economy as a whole in 2025 and 2026.

Some sectors will show growth below the economy’s average

3. Sectors with weak growth

Our baseline scenario does not contemplate any downturn in activity in any sector during the period 2025-2026. However, some sectors will show growth clearly below the economy’s average. These include:

Textile industry: for which we anticipate annual growth below 1% in both years, after three consecutive years of contraction. This industry is facing negative structural trends, marked by intense international competitive pressure, and it is not expected to recover its 2019 activity levels within the forecast horizon.

Paper industry: it shares some of these challenges and will also remain below its 2019 production level, although slightly higher growth rates are expected, at around 1.5% per year.

Finally, and despite the good outlook for consumption, we expect that retail trade will have the most modest performance. Retail is facing significant headwinds, including competition from digital platforms that act as intermediaries (and which are not included in retail), and changes in consumer habits, especially among younger generations. We expect it to grow by 1.5% in 2025 and by 1.3% in 2026.