New economic scenario for the international economy

In recent quarters, the global economy has shown remarkable resilience and we estimate that it could have grown by around 3.0% in 2023. With this starting point, we explain the latest revision to our global economic forecast scenario and the outlook for monetary policy.

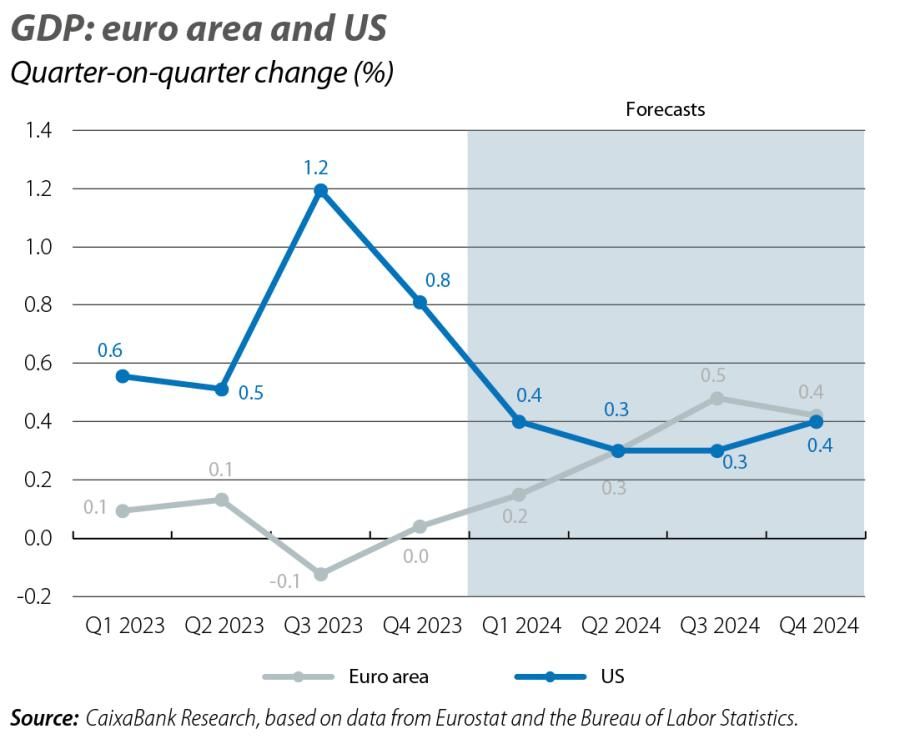

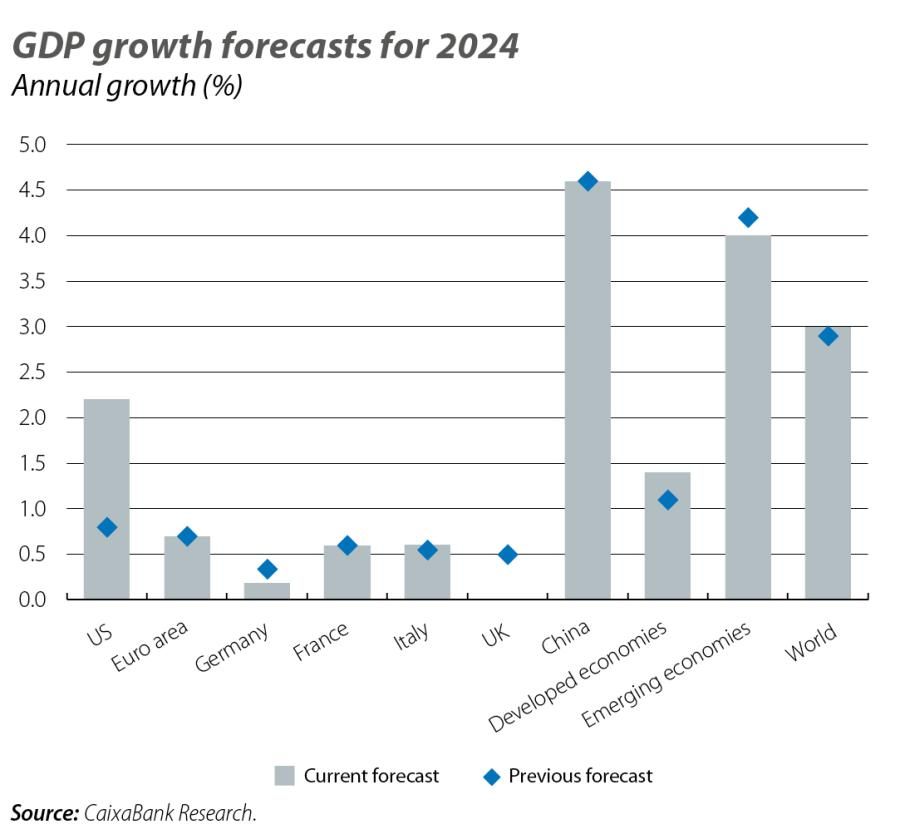

In recent quarters, the global economy has shown remarkable resilience and we estimate that it could have grown by around 3.0% in 2023. One of the main drivers of growth last year was the US, which showed remarkable dynamism that has led it to exceed all expectations. Gone are the scenarios anticipating that the monetary tightening in a context devoid of fiscal stimulus would drag the economy into recession – a possibility that was even raised by the Fed. The reality is that US GDP achieved an average quarter-on-quarter growth of 0.8% (above its long-term pre-COVID average), with an exceptional second half of the year, which placed GDP growth for 2023 as a whole at 2.5%, compared to the 0.5% expected at the beginning of last year. This buoyancy in the economy has led to a complete change in the discourse and there are those who even defend a no landing scenario for the American economy. Our stance is somewhat more conservative and we continue to anticipate a slowdown throughout the year, ending up at quarter-on-quarter rates of between 0.3%-0.4%, slightly below its potential. However, the knock-on effect of a particularly dynamic second half of 2023, coupled with a more expansive start to the year than initially estimated, leads us to revise our 2024 growth forecast up to 2.2%, almost 1.4 pps above the initial forecast.

It is feasible that during this year private consumption, the great driver of growth in 2023, could lose some steam, given that the savings buffer accumulated during the pandemic has been practically exhausted: having reached more than 8.0% of GDP at the end of 2021, it currently amounts to only 0.7%. Moreover, the labour market is likely to begin to «normalise» in an orderly manner, resulting in lower job creation than today, more in line with an economy experiencing slower growth and very low unemployment. We can also expect to see a cooling of public spending, given the need to control rising fiscal deficits (in excess of –8.0% of GDP in 2023, according to IMF estimates), which in the coming years will remain heavily weighed down by the pressure of population ageing on public spending and the heavy interest burden generated by public debt at record highs (above 123% of GDP in 2023, according to the IMF). However, some of the loss of momentum which we anticipate for overall consumption will be offset by investment, especially residential, which would benefit from a lower rate environment.

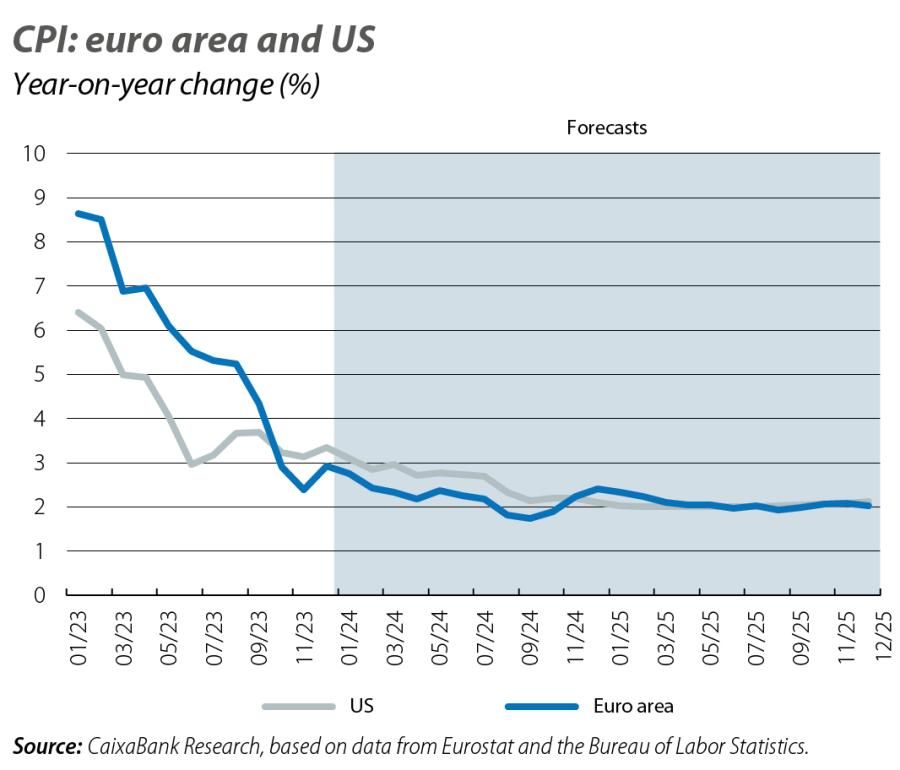

In this context of timid cooling in the US economy, inflation is converging on the 2.0% target somewhat slower than expected due to downward resistance shown by core inflation measures, especially the shelter component (see Brief Note), which accounts for over 40% of core inflation and responds with a time lag. However, we continue to predict declining inflation, despite the possibility of momentary rebounds (see the Focus «US inflation’s last mile» in this same Report).

As for the euro area, our expectations continue to suggest significant weakness: not only did the region avoid a technical «recession» at the end of 2023 by the skin of its teeth, but it has also remained weak at the start of the current year (see the International Economy - Economic Outlook section). This apathy is most pronounced in Germany and France, where in February their respective governments applied a significant downward revision to their growth forecasts for 2024: to 0.2% in Germany, down from 1.3%; and to 1.0% in France, down from the previous 1.4%. Our forecast scenario has always been rather cautious and we have been pointing out how the euro area economy is struggling to recover growth rates close to its potential, with 2024 beginning with practical stagnation.

That said, we continue to believe in the euro area economy’s ability to recover, especially from the summer onwards: consumption and investment will be favoured by the decline we anticipate in inflation and interest rates. In addition, we must take into account the positive impact that the execution of the remaining European funds will have on growth: the Commission estimates that a further 100 billion euros of NGEU funds will be granted this year, after some 290 billion (less than 35% of the total) has already been distributed since 2021. The Commission estimates that, thanks to these NGEU funds, the real GDP of the EU will be 1.4% higher in 2026 than in a scenario without them. All these factors will help to offset a smaller fiscal boost than that of previous years, since, after years of highly expansionary fiscal policies to combat the impact of COVID and the war in Ukraine, the Stability and Growth Pact was revived on 1 January and governments will therefore have to gradually begin to adjust their fiscal policies in order to converge towards the medium-term deficit and debt targets of 3.0% and 60% of GDP, respectively.

As a result, we keep our euro area growth forecast for 2024 virtually unchanged at 0.7%, with a minimal downward adjustment to the forecast for Germany (–0.1 pp, to 0.2%), which is offset by marginal upward revisions for Italy and France (to 0.6% in both cases) as well as by the substantial buoyancy we continue to see in Spain’s economy (+0.5 pps, to 1.9%) (see the article «New economic scenario: improved outlook for the Spanish economy in 2024» in this same Dossier). However, the risks for these forecasts are concentrated on the downside, with Germany being the main source of uncertainty. Its industrial sector continues to be weighed down by the loss of competitiveness and the increase in costs associated with gas prices, which despite moderating remain twice as high as pre-war levels, in a context of falling exports due to the global economic slowdown.

Against this backdrop of economic apathy, and following a sharp fall in inflation in 2023, both in the headline index (5.4%, after standing at 8.4% in 2022) and in the core components (4.9% vs. 3.9% in 2022), we continue to expect inflation to decline during the course of 2024. In fact, the good data at the end of 2023 and the decline in future energy prices anticipated by the markets lead us to lower our 2024 forecast for headline inflation to 2.2% (previously 3.1%) and that of core inflation to 2.6% (previously 3.0%).

Global outlook

The improvement in the US growth forecast explains why we have raised our estimated growth in 2024 for developed economies as a whole by 0.4 pps to 1.4%, after 1.6% in 2023. For emerging markets, meanwhile, we cut the estimated growth for 2024 by 0.2 pps to 4.0% (4.0% expected in 2023), and we keep the forecast for the BRIC countries, Turkey and Mexico practically unchanged; although, with presidential or parliamentary elections being held this year in India, Mexico and Russia, the data could be more volatile than usual. As a result, the world’s growth (aggregated in purchasing power parity terms) in 2024 is revised up by 0.1 pp, to 3.0%, thus equalling the growth expected to have been achieved in 2023. With regard to inflation in 2024, the revisions are much more modest: we maintain the projected inflation for the world economy virtually unchanged at 5.2%, since the 0.2-pp downward revision to 2.5% for the developed bloc is almost entirely offset by the upward revision of just over 0.1 pp, to 7.2%, of inflation for emerging economies. Many of these forecasts are based on a fairly contained energy price outlook, with no major tensions between supply and demand on the forecast horizon. In fact, for the crude oil price, we anticipate a modest reduction which would lead it to trade at around 78 dollars a barrel in December 2024 (with no significant changes from the previous scenario), while in the case of gas prices we consider it feasible that they could end the year trading at around 35 euros/MWh, almost 18 euros below what was previously estimated.

Monetary policy outlook

As already mentioned, the lowering of interest rates is one of the key determining factors for the economic outlook, especially in advanced economies. The sharp fall in inflation throughout 2023 and the expectation that prices will continue to slow down in 2024, albeit more gradually, opens the door for the Fed and the ECB to begin lowering rates in the coming quarters. Our forecast is that the first cuts will come in June and, given the communicative power of this first cut, they will continue in the following months. However, after more than two years with inflation significantly above the 2% target, and against a background with a strong labour market on both sides of the Atlantic, we believe that both the Fed and the ECB will maintain an anti-inflationary bias and opt to bring rates down gradually, in the absence of any changes to the scenario. Thus, our forecasts contemplate 100 bps of cuts from the Fed and the ECB during the year as a whole, ending 2024 with the fed funds rate at 4.50% and the depo rate at 3.00%, respectively.