What can we expect in 2023?

As we leave 2022 behind us, we look back on a year which promised a return to normality but delivered an unprecedented series of episodes: the war in Ukraine and the consequent energy crisis, inflation at historic highs and the abrupt end of the ultra-low interest rate era. These factors will continue to shape the economy in 2023, with the euro area facing the most challenging outlook among the major advanced economies. Inflation will also be one of the major players this year, as its evolution, especially in the core component, will determine the agenda of the central banks. While we believe inflation will recede over the course of the year in developed economies, this correction will remain incomplete and inflation will persist well above the central banks’ targets. In any case, the uncertainty we face as we enter into 2023 is very high and the geopolitical situation will continue to play a key role in shaping developments in the financial markets and the economy, particularly the war in Ukraine. All in all, this is a year in which the outlook for growth is skewed to the downside, while upside surprises in inflation cannot yet be ruled out.

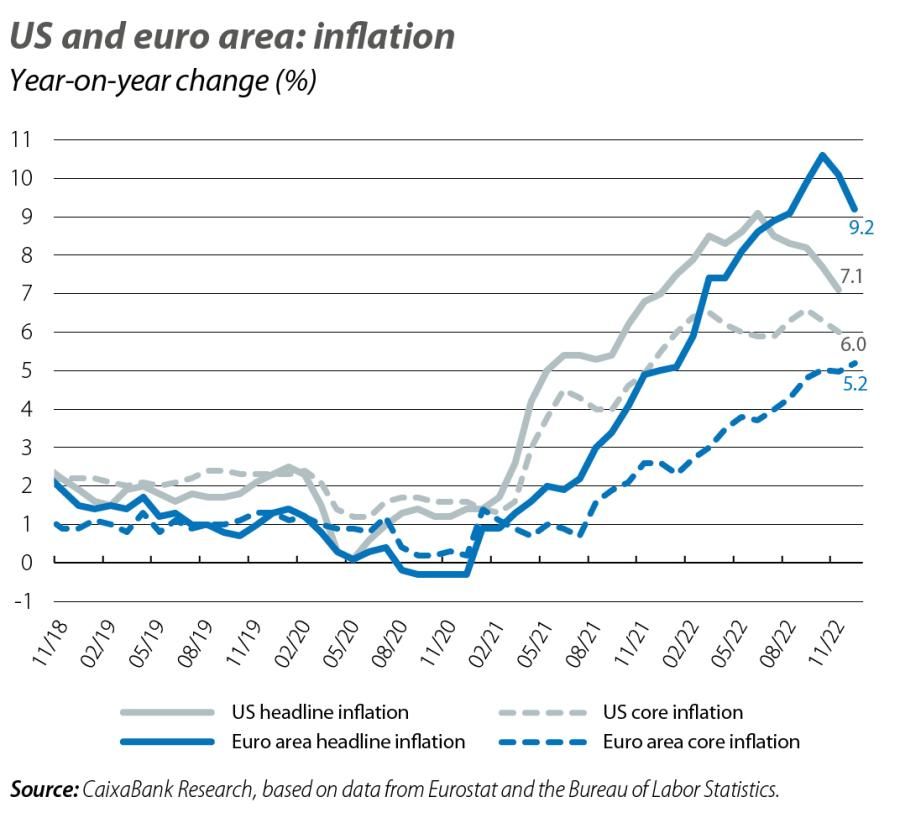

Weighed down by the tightening of financial conditions, the global environment of uncertainty and the erosion of purchasing power caused by inflation, for the US economy the year ahead looks set to bring a loss of buoyancy and modest growth, as the latest sentiment indicators have already been showing (e.g. in December the composite PMI fell once again and stood at around 45 points). Given the sensitivity of investment to the Fed’s rate hikes, the resilience of private consumption and the labour market will be key. Indeed, the labour market remains strong and the slowdown it is experiencing appears to be a gradual one. In particular, the latest available data (December) show that some 223,000 new jobs were created, compared to an average of around 400,000 in the rest of 2022, while the ratio of job vacancies per unemployed person stands at around 1.7 – a figure which, although high, marks a moderation from the recent historic high of 2.0. It will also be essential that the reduced stress in the labour market translates into a moderation in wage growth, which currently remains at uncomfortable levels for the Fed’s inflation targets, as the institution’s own officials acknowledged in December (for instance, hourly wages have continued to rise at a rate of around 5% in recent months). Overall, we anticipate a significant slowdown in the economy in 2023 to growth rates of around 1%. This reduced economic momentum will help to curb the high inflation rate: although it has eased since the summer peaks, as of late 2022 inflation was still showing persistence in the core components (headline inflation of 7.1% in November and core inflation of 6.0%).

Unlike the US, the bulk of the indicators suggest that the euro area will be unable to avoid entering a recession over the winter months, although they also signal it ought to be a mild one. As an example, in December the composite PMI indices for the euro area and its main economies remained in contractionary territory for the sixth consecutive month, but they also registered a widespread improvement (49.3 points for the euro area as a whole, compared to a low of 47.3 in October). However, there are various elements that point to a more challenging outlook beyond the immediate economic contraction. First of all, it must be borne in mind that, after the winter, gas inventories will have been significantly depleted and the task of replenishing them with little to no supply from Russia will pose a significant challenge. Therefore, it is foreseeable that the current efforts to cut gas usage, both among households and businesses, will be intensified in order to avoid a «critical» winter in 2023-2024 (consumption fell by around 20% up to November compared to the average for 2017-2021, according to Eurostat). On the other hand, inflation, although declining, will remain high and above the ECB’s target rate, so we can expect the monetary institution to continue tightening monetary policy in 2023 (with rates exceeding 3%, according to market expectations at the year end). Moreover, the fiscal momentum of recent years has reduced the margin for action in the public accounts, and in 2023 they look set to achieve a certain «normalisation». This will pave the way for the Stability and Growth Pact to be reactivated in 2024, pending its reform during the course of this year to adapt it to «the new times» (see the Focus «The EU, raider of the lost fiscal rules» in the MR12/2022). All in all, with the continued resilience of the labour market (unemployment rate at 6.5% in November), a savings rate still above its long-term average, and a better starting position thanks to a stronger-than-expected performance in 2022 (GDP will grow by more than 3.0%), we have reason to be moderately optimistic. Thus, for 2023 we anticipate average GDP growth of around 0.2%. However, the high uncertainty of the current context and the region’s significant exposure to an escalation in the war in Ukraine introduce clear downside risks for growth and upside risks for inflation.

The Chinese government ended the year by abandoning its zero-COVID policy and allowing the economy to open up. However, this decision by no means clears the outlook for the Asian giant. The country is experiencing an explosion in COVID cases and an increase in pressure on its health system, all in a context in which vaccination rates are too low. This raises doubts about how sustained the lifting of restrictions could be and, in any case, suggests that proper mobility will take a long time to normalise. On the other hand, the approval in the US of the CHIPS and Science Act in July 2022, through which the country aims to regain its leadership position in technology and chip production, will have a direct impact on the Chinese economy. Other measures include provisions to prevent China from directly accessing US science and technology, which could shave around 0.3 pps from China’s GDP growth in 2023 according to some analysts’ estimates. In addition, in 2023, the difficulties in China’s construction sector will still be present, while the country’s exports will face headwinds due to the slowdown in global economic activity.