A key sector for the economy and for society

The agrifood sector contributes a lot of value to Spain’s economy, accounting for 5.8% of its GDP, 11% when all the activities in the food chain are included. It is also notable for its great export potential and a resilience that has helped it to weather the ups and downs of the economy over the years. Consequently, although the main markets for Spanish agrifood exports have slowed as a result of increased trade tensions and uncertainty over Brexit, available activity indicators show that, for the time being, the industry is withstanding the situation reasonably well.

Contribution of the agrifood sector to the economy

The agrifood sector is of vital importance to the Spanish economy. Specifically, it contributes 5.8% of the gross value added (GVA) of the economy, compared to 5.3% in 2007, showing how the sector has grown in the past decade compared with the Spanish economy as a whole. It is made up of around 945,000 agricultural businesses1 which contribute 3.0% of the total GVA, and more than 31,000 companies dedicated to food processing2, contributing 2.9% of the GVA. The relative weight of the agrifood sector in the Spanish economy as a whole is significantly greater than its share in the EU (3.8%)3, a figure that reflects the greater preponderance of agrifood production in Spain. In fact, Spain’s agrifood sector occupies a key position among European countries: it is the third country in terms of its contribution to the EU’s agrifood sector with a 11.9% share of GVA,4 only behind France (15.6%) and Germany (13.9%).

- 1Survey by Spain’s National Statistics Institute on the structure of agricultural businesses (2016).

- 2Companies in the agrifood industry are classified under codes 10, 11 and 12, according to the National Classification of Economic Activities (CNAE), produced by the National Statistics Institute (2018). For more details, see the article «The agrifood industry: business structure and productivity» in this Report.

- 3Eurostat data (national accounts) corresponding to 2017, latest year available.

Above the European average

The agrifood sector’s contribution to the Spanish economy as a whole is 5.8%, above the average for the European Union (3.8%)

Relative weight of the agrifood sector in the economy as a whole

% of the GVA of the whole economy

If, in addition to the agrifood sector, we take into account all the activities carried out throughout the life cycle of food; i.e. the added value of each of the sectors that make up the Spanish agrifood system, its contribution to the Spanish economy is around 11% of GDP5. These sectors include those «upstream» of the food chain, supplying the primary sector with inputs and services such as fertilisers and seeds; and «downstream» sectors, which include services such as transport, distribution and sale to the final consumer (retail channel or out-of-home consumption). In a broader context, it is important to point out that the relevance of the sector goes beyond its own economic activity, since the rural milieu occupies 84.2% of the whole area of Spain and its activity has important implications for other areas such as environmental sustainability, territorial balance and rural development. In this respect, it is vital to have a resilient, competitive agrifood sector that can successfully tackle the challenges in all these areas.

- 5From 2011 to 2016, the contribution made by the agrifood system went from 9% of GDP to 10.6%. «Contribución del Sistema Agroalimentario a la Economía Española», Ministry of Agriculture, Fishing and Food, 2018.

Recent performance of Spain’s agrifood sector

We will now examine the state of the agrifood sector, made up of the primary sector and the agrifood industry, based on the main indicators for the industry from the point of view of supply (value added and production), demand (expenditure on food and beverages), labour market, credit flow and foreign sector.

The trend in the agrifood sector in the past few years has been very positive, although the latest data, corresponding to the first half of 2019, show a substantial slowdown compared with 2018, sharper in the primary sector than in the industrial branch. Regarding the primary sector, real GVA fell by 4.6% year-on-year in Q2 2019, a figure that should not alarm us given the high volatility of the historical series due to the very nature of the sector and its dependence on weather conditions. If we look at a longer timeframe, we can see average annual growth of 2.5% between 2015 and 2018, a similar increase to the 2.8% growth posted for the economy as a whole. Regarding the agrifood industry, GVA rose by a substantial 4.7% per year on average between 2015 and 2017, although the latest data are not available, so we must use other supply indicators published more frequently to analyse the state of the sector.

Resistance to the ups and downs of the economy

The food and beverages industry is withstanding the slowdown seen in Spain’s manufacturing sector as it is less closely linked to the economic cycle

Among these indicators, industrial agrifood production continues to post good growth rates, up by 2.4% and 6.5% in the food and in the beverages sectors, respectively, between January and July 2019. These figures are particularly positive when compared with manufacturing activity as a whole, which rose by 0.8% in the same period due to the slowdown that threatens the sector as a whole in the face of increased uncertainty regarding the future of international trade policy and a slowdown in world trade flows. A similar pattern can be seen in the industry’s order intake index and turnover index, as shown in the enclosed chart.

Agrifood sector indicators are withstanding the slowdown in manufacturing

Variation (%)

For its part, the primary sector’s labour market is also showing a poorer performance. Specifically, the number of people registered with Social Security rose by 0.1% year-on-year in September. On the other hand, worker registration in the agrifood industry is withstanding the slowdown: this rose by 2.1% yearon- year in September, just below the figure of 2.4% for the economy as a whole but higher than the manufacturing sector’s 1.3%.

Jobs source

The agrifood industry has generated 1 out of every 3 industrial jobs in the past year and totals 519,600 employees, accounting for 2.6% of all employment in Q2 2019

The agrifood sector, investment-intensive and with significant borrowing requirements, is being supported by highly favourable financing conditions. The latest data, corresponding to Q2 2019, show that the outstanding balance of credit has grown by 4.1% in the primary sector and by 4.0% in the agrifood industry, figures that contrast with the decline still being recorded for all production activities as a whole. It is also important to note that the NPL ratio has been falling since 2013, now at 5.9% for the primary sector and 4.2% for the industrial branch.

It is also revealing to analyse the sector’s performance based on demand indicators. On the one hand, consumers acquire products in commercial establishments to consume them at home and, on the other, go to catering establishments (commercial or collective, such as college, hospital or company canteens). In 2018, expenditure on food and beverages at home totalled over EUR 88 billion, 15.9% of all household spending. Expenditure away from home, on the other hand, which accounts for around 35% of all expenditure on food, totalled EUR 49 billion6. The latest demand indicators suggest a slight weakness in food consumption: the retail sale index for food establishments grew by a moderate 1.7% year-on-year in August 2019, lower than the general index at 3.3%. Over the coming quarters, in which we predict a macroeconomic slowdown, the rate of growth in the demand for food is likely to remain contained.

- 6Survey of household budgets by the National Statistics Institute.

A key industry that looks increasingly towards other countries

One crucial factor in evaluating the trends in the agrifood sector is international trade. In fact, the significant growth in agrifood exports over the past 20 years has placed Spain in a strong position internationally: it ranks eighth in the world among food product exporters and fourth in the European Union. With regard to 2019, agrifood exports still look quite strong, up by 3.8% year-on-year between January and June compared with 1.7% growth for all exports of goods. Agrifood imports, on the other hand, have fallen by 2.2% over the same period, widening the agrifood trade surplus even further, which now represents 1% of GDP.

Spain’s agrifood trade surplus is increasing

Billion euros

Its importance in GDP and exports

Agrifood exports total almost EUR 50 billion (4% of GDP) and account for 16.9% of all goods exported

The product groups7 that contributed most to the growth in agrifood exports in the first six months of 2019 were legumes and vegetables (10.1% year-on-year) and animal meat (12.9%), followed by products derived from cereals, bakers’ wares, pastry and biscuits (8.7%), and cereals (39.5%), in the latter case due to the strong growth in wheat. On the other hand, exports of citrus fruits, olive oil and wine have fallen compared with the same period the previous year, although they are all in the top 10 exported agrifood products8.

Which group of agrifood products does Spain export the most?

What is the trend for the first half of 2019?

Top 10 agrifood products exported

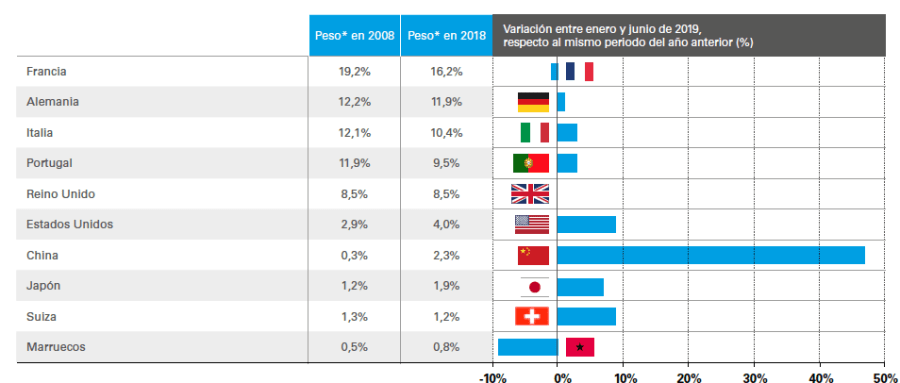

Spain’s main trading partner is the EU, the destination for 74% of its agrifood products in 20189. Across countries, the main member states are France (16.2%), Germany (11.9%), Italy (10.4%), Portugal (9.5%) and the United Kingdom (8.5%)10. Growth in agrifood exports to these markets was not very strong in the first six months of 2019, partly due to them being mature markets but also due to situational factors related to the slowdown in the European economies’ growth rate and the uncertainty caused by Brexit. These factors will continue to affect the trend in agrifood exports to European countries over the coming quarters. However, one factor which could help to cushion the European slowdown is the increasing importance of other destinations outside the EU, especially the US, Japan, Switzerland and Morocco and Asian countries in general, particularly China, whose share has gone from 0.3% in 2008 to 3.1% in 2018.

- 9countries over the coming quarters. However, one factor which could help to cushion the European slowdown is the increasing importance of other destinations outside the EU, especially the US, Japan, Switzerland and Morocco and Asian countries in general, particularly China, whose share has gone from 0.3% in 2008 to 3.1% in 2018.

- 10Fruit and vegetables account for approximately 28% of Spain’s agrifood exports to the United Kingdom, followed by wine and must (8%), olive oil (5%) and pork (3%). For more details, see the bilateral report on external agrifood trade with the United Kingdom published by the Ministry of Agriculture, (2017), available at: https://www. mapa.gob. es/es/ministerio/ servicios/ analisis-y-prospecti-va/ Comercio_Exterior_Union_ Europea.aspx