Spanish agrifood exports in 2025: strength and diversification

Spain’s agrifood sector continues to show significant strength and has consolidated its role as the country’s leading driver of exports, thanks to an environment with contained price increases and a recovery in demand. Spain has become the EU’s fourth biggest exporting power and the eighth in the world, with a 3.4% share of the global market. In addition, it has recorded almost three decades of trade surpluses, equivalent to 1.2% of GDP in 2024. Despite the complex international environment, marked by geopolitical tensions and protectionism, the growth of agrifood exports in the first half of 2025, both in volume and in value, hints at a good year for the sector.

The strategic role of the agrifood sector in Spain’s exports

The agrifood sector continues to be one of the main drivers of Spanish exports.5 In 2024, Spain exported more than 36.2 million tonnes of agrifood products, valued at 74.2 billion euros, which represents 20.5% of the volume and 19.3% of the value of the country’s total exports of goods. These statistics consolidate Spain’s position as a global power in agrifood exports.

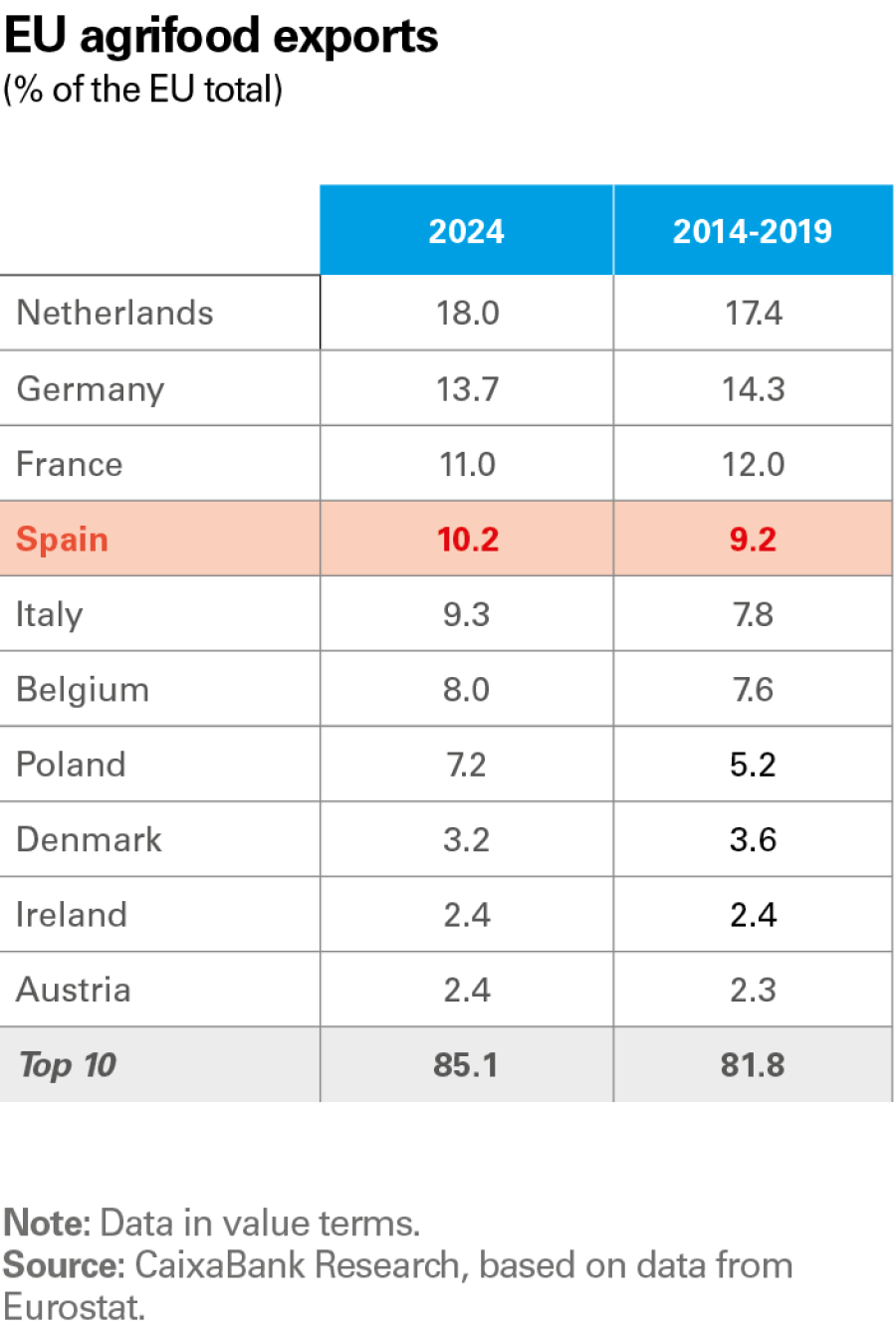

In the European context, Spain occupies fourth position in both volume and value terms, with 7.7% and 10.2% of the total, respectively, behind the Netherlands, Germany and France, but ahead of Italy.

Globally, according to data from the World Trade Organization (WTO) for 2023 (latest available year), Spain is ranked eighth in terms of value, with a 3.4% share of the global total. This is much higher than its position in other categories such as the trade in goods, where it holds a share of just 1.8%. In addition, its share has increased slightly by 0.1 pp relative to the average of the period 2014-2019. Only three countries have managed to increase their share in this time interval, and among European nations only Italy has registered a bigger improvement, in contrast to the loss of share observed in major powers such as Germany, France and the Netherlands.

- 5

Includes tariff chapters 1-24 of the TARIC system.

Spain is a major player in the global agrifood trade

In terms of the balance of trade, Spain’s agrifood sector has been registering surpluses for almost three decades now (since 1996), demonstrating its clear focus on exports. In 2024 the surplus reached over 18.4 billion euros, equivalent to 1.2% of GDP; this is higher than prior to the pandemic (0.9% of GDP on average in 2014-2019), but slightly lower than the exceptional figures reached in 2020-2021 (1.5% of GDP).

Recent developments in agrifood exports

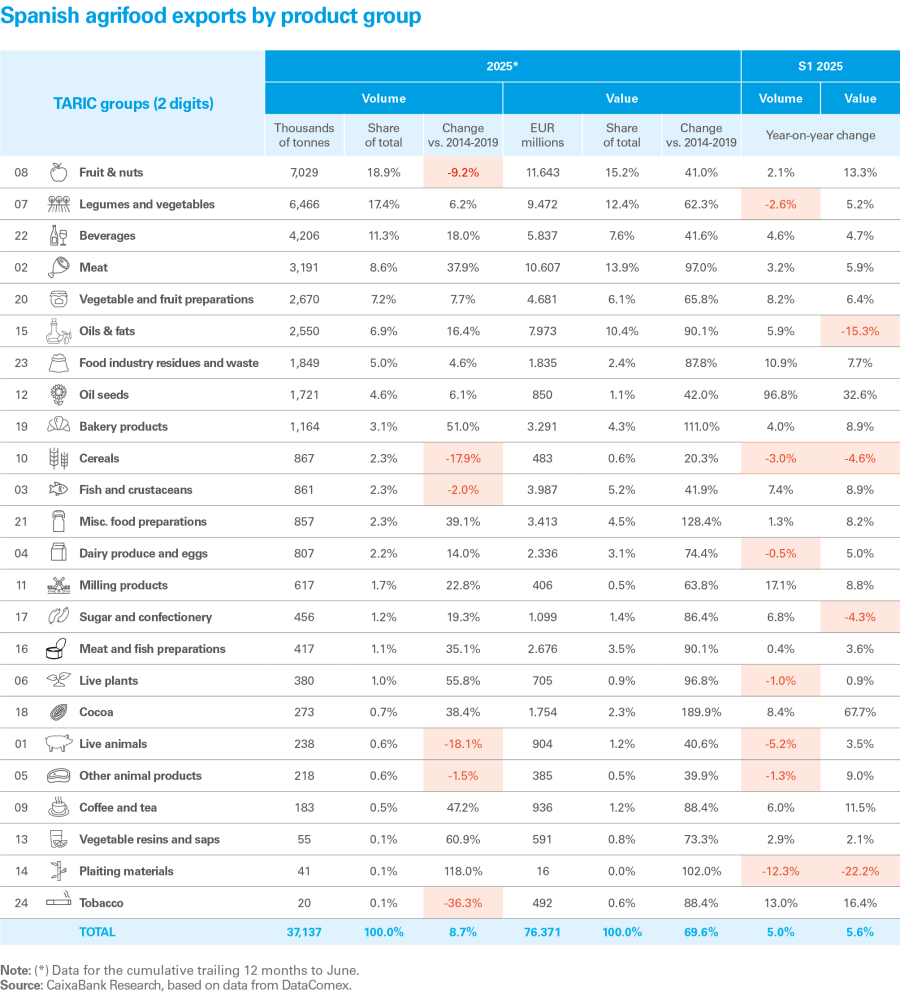

In view of the latest data, Spain’s agrifood exports have continued the growth path initiated last year. In the first half (S1) of 2025, they grew by 5.0% year-on-year in volume and by 5.6% in value, reaching 37.1 million tonnes and almost 76.4 billion euros in total for the trailing 12 months to June, respectively. In both cases, these growth rates far exceed those recorded by the total exports of all goods in the same period (–2.5% in volume and 1.0% in value). Thus, agrifood exports now exceed pre-pandemic levels (i.e. the 2014-2019 average), both in volume (+8.7%) and, above all, in value (+69.6%).

The importance of agrifood for Spain’s foreign sector is reflected in the high surplus in the balance of trade in these products

This good performance reflects the recovery of production after several years of drought and has the merit of doing so in a complex international context, marked by uncertainty linked to geopolitical tensions and the threat of US tariffs, which have prompted an increase in global protectionism and a return to bilateralism, to the detriment of the central role which the WTO has played in international trade relations in recent decades. As we shall see in the article «Agrifood exports in 2025: resisting the protectionist tsunami» in this same report, Spain’s agrifood sector must address the current situation by seeking alternative markets, including through bilateral agreements within the framework of the EU.

2025 kicked off with very strong agrifood exports, despite the geopolitical tensions and the protectionist shift in international trade

In terms of value, agrifood exports have shown a positive tone almost across the board during the first half (S1) of 2025: only four product groups have registered reductions, representing 12.5% of the total value. These include oils and fats, exports of which fell by 15.3% year-on-year due to the sharp drop in prices, but they grew by 5.9% in volume terms thanks to the strong recovery in production.6 At the other end of the spectrum, cocoa and oil seeds recorded particularly strong growth in value terms, up 67.7% and 32.6% year-on-year respectively, in line with the upward pressure of international prices.

Fruits also show an upward trend, since in S1 2025 they grew both in value (13.3%) and in volume (2.1%). In any case, fruit is the only one of the main agrifood groups that has not yet recovered the average export volume of 2014-2019 (it is still 9.2% below).

- 6

In the case of olive oil, the 2024-2025 campaign closed with over 1.4 million tonnes, 65.3% more than the previous season and the third highest in the last decade; given that supply is outstripping demand, prices have plummeted: extra virgin oil has fallen by 40% in the last year.

Agrifood exports by product and destination in recent years

Although fruit exports are among the fastest growing in S1 2025, they remain the only category that has not yet recovered pre-pandemic volumes

If we take a broader time perspective7 and calculate the contribution of each product group to the growth of agrifood exports between the pre-pandemic period 2014-2019 and the cumulative 12-month period to June 2025, we see that almost all groups of agrifood exports have enjoyed rapid growth in recent years. As shown in the charts above, exports of meat, beverages, bakery products, legumes and vegetables stand out, which together account for almost 80.0% of the overall export growth (8.7%). To the contrary, cereals and especially fruits have subtracted growth.

- 7

We make this comparison in terms of volume, since the strong inflationary pressures in this period distort the pattern over time in value terms.

In recent years, Morocco has gained prominence as a destination for Spanish agrifood exports, evicting the US from the top 10

Beyond the euro area, Morocco stands out as the second biggest contributor to the growth of Spanish agrifood exports (behind only Portugal), despite ranking only ninth by destination (see chart on the next page) and second among non-European countries, behind China. Thanks to the exceptional growth of exports to the country in recent years, Morocco has gained 1.3 points in its share of the total, now accounting for 2.4%, and it has evicted the US from the top 10 destinations. On the downside, exports to the United Kingdom have collapsed following Brexit (–14.4% on a cumulative basis since 2021), losing 1.4 points in their share of Spain’s agrifood exports since 2014-2019, although the country remains the leading destination outside the euro area and within the top 10.

As already mentioned, the top non-European destination for our agrifood exports is China. After the extraordinary growth rates of sales to that country in 2019 and 2020, mainly driven by the impact of African swine fever on Chinese cattle,8 those rates have now normalised (in S1 2025, these exports grew by 4.7% year-on-year) and the country’s share of the total has risen to 2.5% (0.1 pp more than in the 2014-2019 average).

The next non-European country in the ranking is the US. In this case, the boom in Spanish exports observed in recent years, especially of oils, legumes and vegetables (see the chart below), could be cut short by the Trump administration’s tariff policy.9 However, the impact of the tariff hikes seems to be manageable for the Spanish economy as a whole,10 as well as for the agrifood sector in particular, although there are some products that are potentially more exposed, as we will see below.

- 8

For further information, see the article «The good health of Spanish agrifood exports», in the Agrifood Sector Report 2024.

- 9

After months of negotiations, in July an agreement was reached under which the EU accepts a general tariff of 15% on its exports to the US. This represents an increase from the previous level of 10%, but is less than the 20% announced

in April. The list of tariff-free strategic products is yet to be finalised. - 10

According to the IMF, the Spanish economy is the least affected of the big EU economies by the trade war: for every 10-point increase in US tariffs imposed on the EU, Spain’s GDP growth in the short and medium term could be reduced by 0.1 pp; see IMF (2025), «Spain: 2025 Article IV Consultation». The calculations by the Bank of Spain are similar: it estimates an impact of 0.11% after three years with a tariff of 10%; see the Bank of Spain’s Annual Report (2024).