Spanish agrifood exports in 2025: resisting the protectionist tsunami

Spain’s agrifood sector is facing a new trade scenario marked by the US tariff hikes, with the rate currently set at 15% for European products pending clarification regarding possible strategic exceptions. In a context of increasing protectionism and weakening multilateralism, the sector is seeking ways to adapt by diversifying its markets and pursuing bilateral agreements through the EU. The agreement with Mercosur opens up opportunities for key products such as olive oil, wine and pork meat, but it also poses risks for competition in sensitive sectors such as beef and rice. Despite this, the competitiveness and diversification of Spain’s agrifood sector places it in a favourable position to tackle this challenging environment.

Tariff tensions with the US and the need to redirect exports towards alternative destinations

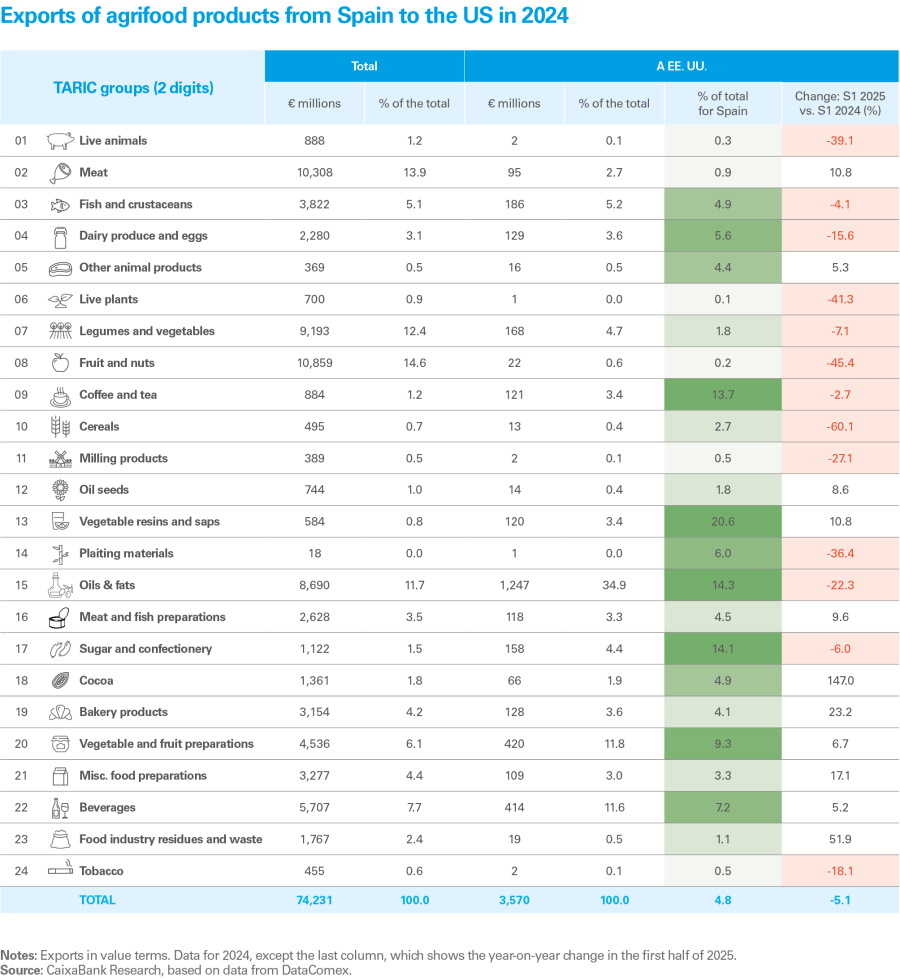

Spain’s agrifood exports to the US grew by 8.8% year-on-year in the second half (S2) of 2024, 3 points more than in the first half of the year. Thus, annual growth stood at 7.2%, the highest since 2021. However, in the first six months of 2025, the growth rate has moderated to 5.1% year-on-year, which could reflect early stockpiling by US importers faced with the threat of new tariffs.

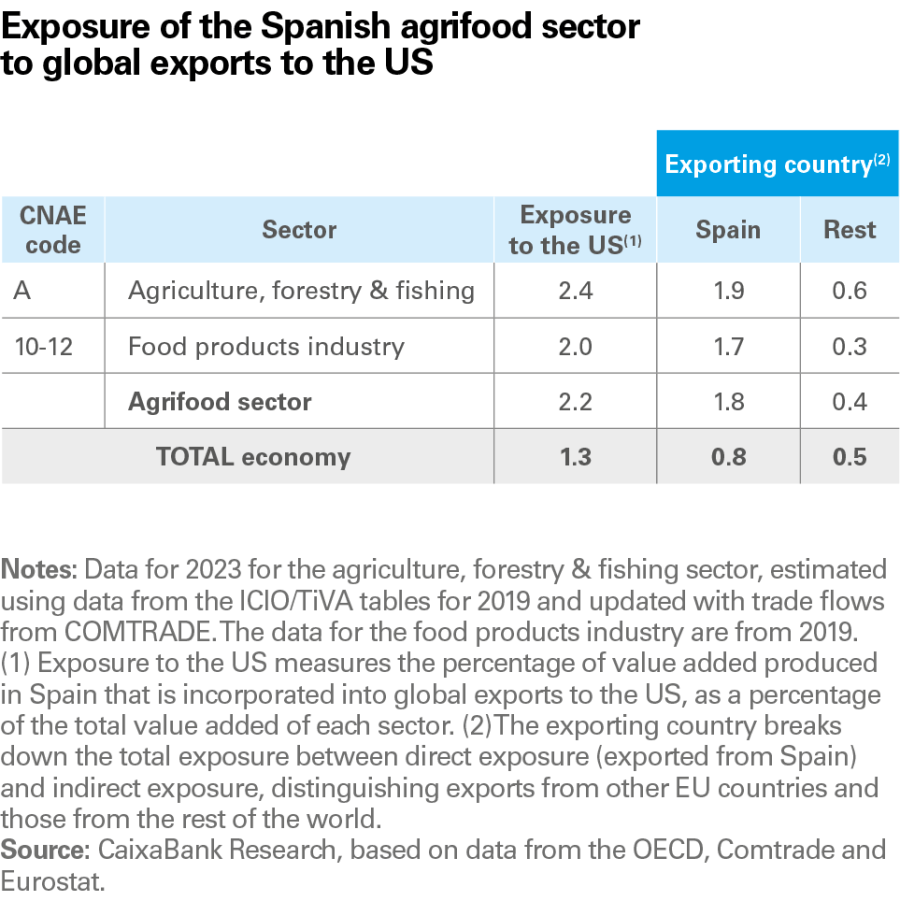

As discussed in the previous article, the US represents 4.6% of the value exported by the agrifood sector (cumulative data for the trailing 12 months to June 2025), although the exposure of some products is much higher, as we will see later. If we include indirect exports (i.e. what Spain exports to other countries and in turn ends up being exported to the US), a total of 2.2% of the value added that is generated by the Spanish agrifood sector ends up being sold in the US (1.8% through direct exports and 0.4% through indirect exports). Therefore, the sector’s exposure is relatively low, albeit higher than that of the Spanish economy as a whole (1.3%).11

On the other hand, the impact of global trade tensions on domestic employment could be significant: 25.3% of employment in Spain depends on final foreign demand, a figure that rises to 39.4% in the agriculture, forestry & fishing sector and to 33.0% in the agrifood industry. However, only 2.4% of the sector’s employment is linked to final US demand, a similar percentage to the exposure in terms of value added.

- 11

For more information, see «Tariff tensions and reconfiguration of trade flows: impact on Spain», in the Sectoral Observatory S1 2025.

When analysing the role of the North American market by exported product, we observe significant differences. For instance, the US accounts for as much as 20.6% of Spain’s exports of vegetable juices, 14.1% of its sugar and confectionery exports and 14.3% in the case of oils and fats. Within this latter group, olive oil stands out, as the US is the second most important destination in value terms, behind only Italy, with 16.5% of the total. This makes it one of the potentially most exposed products to the tariff hikes. However, the impact could be mitigated by the US’ high dependency on imports of this product, in addition to the recent fall in prices, which could partially offset the effect of the tariff increase.

The impact of higher tariffs on olive oil exports will be cushioned by their lower prices and the US’ high import dependency

In any case, Spanish exporters must be ready to cushion the impact of this tariff shock, as well as others that could arise in the future. One strategy is to redirect sales to alternative markets, taking advantage of one of the main strengths of the Spanish agrifood sector: the high diversification of its exports. This characteristic not only bolsters the sector’s resilience in the face of trade tensions, but it also explains the strength of its exports.

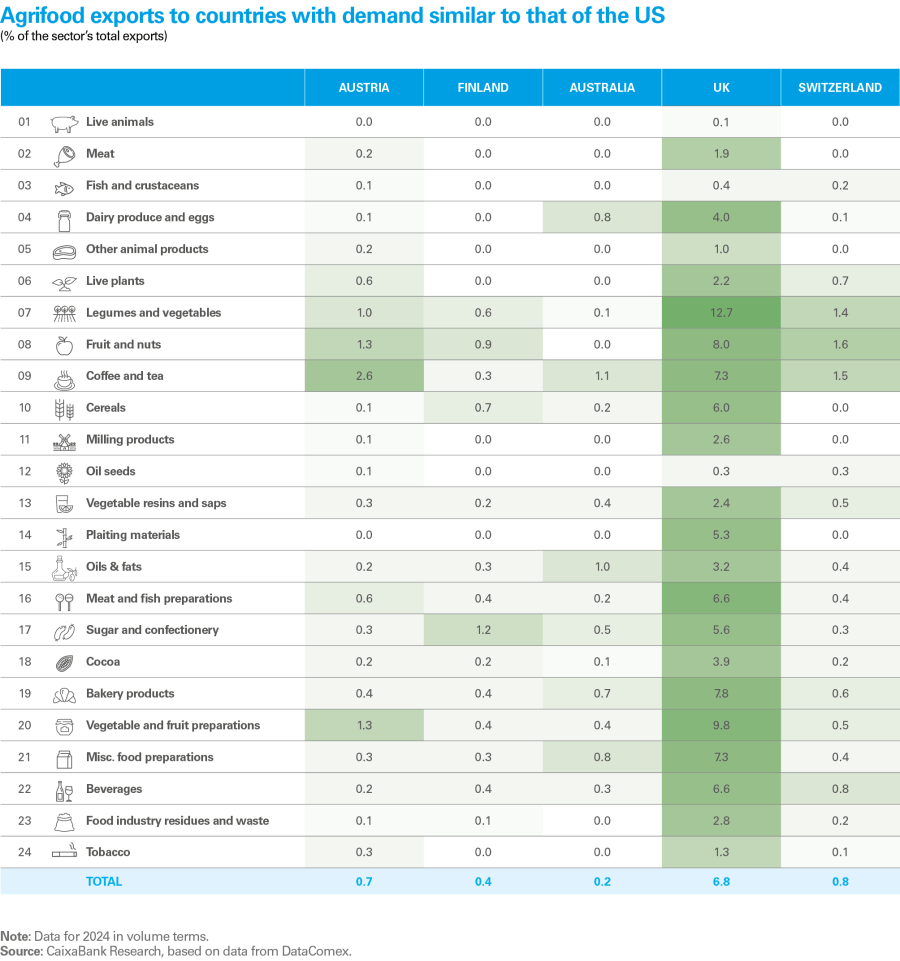

In line with the need to diversify destinations in order to mitigate the impact of trade shocks such as that of tariffs, it is also worthwhile identifying markets that have similar demand patterns to the US. Countries such as Austria, Finland, Australia, the United Kingdom and Switzerland are the most similar to the North American market, so they stand out as potentially attractive options for redirecting Spanish exports.12 As shown in the table above, with the exception of the United Kingdom – a destination that is already consolidated and offers little margin for growth – other countries account for a relatively small share of Spain’s agrifood exports. This suggests that there is significant scope for improvement in terms of the penetration of trade, especially in particular products.

- 12

However, in addition to the similarity of patterns in demand, other factors have to be taken into account, such as the competition of companies from other countries in a similar situation to those in Spain, the volume of the destination market and the degree of the country’s commercial accessibility; for example, Switzerland has a very high tariff of over 18% for agrifood products.

The EU’s response: the agreement with Mercosur as a strategic opportunity

In the current geopolitical landscape, marked by uncertainty, successive crises, the rise of protectionism and the weakening of multilateralism, the EU has strengthened its trade strategy through bilateral agreements that guarantee preferential and barrier-free access to enter key markets. It is within the framework of this strategy that agreements have been reached with Canada (CETA), Japan (JEFTA)13 and, more recently, Mercosur.14

The agreement with Mercosur, signed in December 2024, is yet to be ratified by the EU Council – it requires the support of at least 15 of the 27 Member States, representing 65% of the population – and by the European Parliament. This process is not free of obstacles, including the possibility of rejection by some countries,15 as well as concerns regarding environmental sustainability, the impact on European agricultural SMEs and the differences in labour and regulatory costs, which are significantly lower in Mercosur.16

The treaty envisages the gradual elimination of tariff barriers within 10 years for more than 90% of the products traded – according to the European Commission, this will mean a saving of 4 billion euros per year in tariffs for European exports.17 It also provides for the removal of non-tariff barriers, such as those imposed on medical and plant-protection products, and technical regulations to ensure product standards. According to the Bank of Spain, the agreement could boost trade between the EU and Mercosur by more than a third in the long term. The impact would be particularly significant in Spain, as it could double the increase in total trade that is expected for the EU, estimated at between +0.3% and +0.7%.

The opening up of a market of more than 270 million consumers represents a strategic opportunity for Spain, especially in the agrifood sector. Mercosur will eliminate the tariffs on 93% of EU exports,18 and this could benefit Spanish exports, as the obstacles that have held back their growth will disappear.

Spain has a large trade deficit with Mercosur, and it has increased in recent years to reach almost 3.7 billion euros in 2025 (cumulative data for the 12 months to June), 43.4% above the 2014-2019 average (see chart below).

- 13

CETA provisionally entered into force in September 2017, but is awaiting ratification by all EU national parliaments, while JEFTA entered into force in February 2019.

- 14

The founding and signatory countries of the Treaty of Asunción in 1991 are Argentina, Brazil, Paraguay and Uruguay; Venezuela joined in 2012, but has been suspended since 2019 due to democratic breaches, while Bolivia ratified its accession in 2024, but there is a transition period of up to four years to incorporate the bloc’s regulatory acquis.

- 15

This is the case for France, due to the import of soybean and corn from Brazil and Argentina, which could displace European producers and affect France in particular, given its key role in the biofuel market.

- 16

For more information on the agreement and its potential impacts, see Bank of Spain (2025): The EU-Mercosur agreement, in the «Report on the Latin American economy, second half of 2024», box 1; and FEDEA (2025): «Tiempo para los buenos aliados comerciales: el impacto económico del Acuerdo UE-Mercosur», Notes Collection issue 2025-24.

- 17

Among others, tariffs on exports of olive oil (currently 10%), malt (14%), wine and other beverages (as high as 35%) and chocolates (20%) will be eliminated.

- 18

The EU, for its part, will liberalise 82% of agrifood imports from Mercosur and will impose tariff quotas for the most sensitive products. See Ministry of Agriculture, Fisheries and Food (2025): «Informe anual de comercio exterior agroalimentario y pesquero 2024».

This imbalance is largely explained by the low volume of exports: 401 million euros, which is only 0.4% of the volume and 0.5% of the value of aggregate exports (annualised data to June 2025). The main items are beverages, oil seeds and especially fruits, as shown in the chart on the next page.

In addition to their limited scale, agrifood exports to Mercosur have shown a decreasing trend, as shown in the same chart. In 2025, the volume exported fell by 11.9% compared to the pre-pandemic average (2014-2019), weighed down by a decline almost across the board, especially in fruits, legumes and vegetables, with the exception of the rebound in oil seeds.

Conclusion

Spain’s agrifood exports continue to consolidate their role as a strategic pillar of foreign trade and they have a promising growth outlook. However, the sector faces significant risks stemming from geopolitical tensions, the rise of protectionism, climate change – with increasingly intense and recurring periods of drought, and the proliferation of diseases.19 In this scenario, adaptation is essential in order to maintain the sector’s high competitiveness, reduce its exposure to external risks and take advantage of the new opportunities offered by trade agreements and global consumer trends in favour of high-quality products. To this end, it is essential to focus on market diversification and the integration of innovation, sustainability and digitalisation throughout the value chain.

- 19

For example, the recent outbreaks of bird flu in several regions across the country have led to China banning the import of poultry products from Spain since 7 August, including both fresh and processed products, after the loss of its status as a country free of bird flu according to the World Organisation for Animal Health (WOAH). China’s veto pours cold water over the sector’s growth perspectives, since it has come just as Spanish poultry had begun to enter one of the markets with the highest demand for this meat worldwide, thanks to the bilateral agreement signed in May.