Outlook for the Spanish economy from a suply-side perspective 2025-2026

This year and the next, the Spanish economy will enjoy strong expansionary momentum, supported by robust domestic demand and competitive advantages over its main European partners. Despite a challenging global environment, we forecast GDP growth of 2.9% in 2025 and 2.1% in 2026, supported by, among other factors, improved financial conditions supporting continued growth in private consumption and investment, population growth and relatively competitive energy costs. The sectoral analysis also reveals a broad-based expansionary cycle, which ranges from the best-performing sectors such as construction and pharmaceuticals to those that will grow at a more moderate pace, e.g. textiles and motor vehicles.

Broad and dynamic sectoral growth

After 2024, when the Spanish economy grew by a remarkable +3.5% as the pandemic and energy crisis shocks subsided, strong and broad-based growth has continued in 2025, despite a further shock, to global trade. Thus, CaixaBank Research estimates that in 2025 GDP will have grown by 2.9%, a healthy pace and higher than that forecast at the start of the year (+2.4%). This is due to strong domestic demand, with private consumption and investment boosting the economy. This has more than offset the negative impact of the trade shock on exports.

This year and the next, the Spanish economy with enjoy strong expansionary momentum

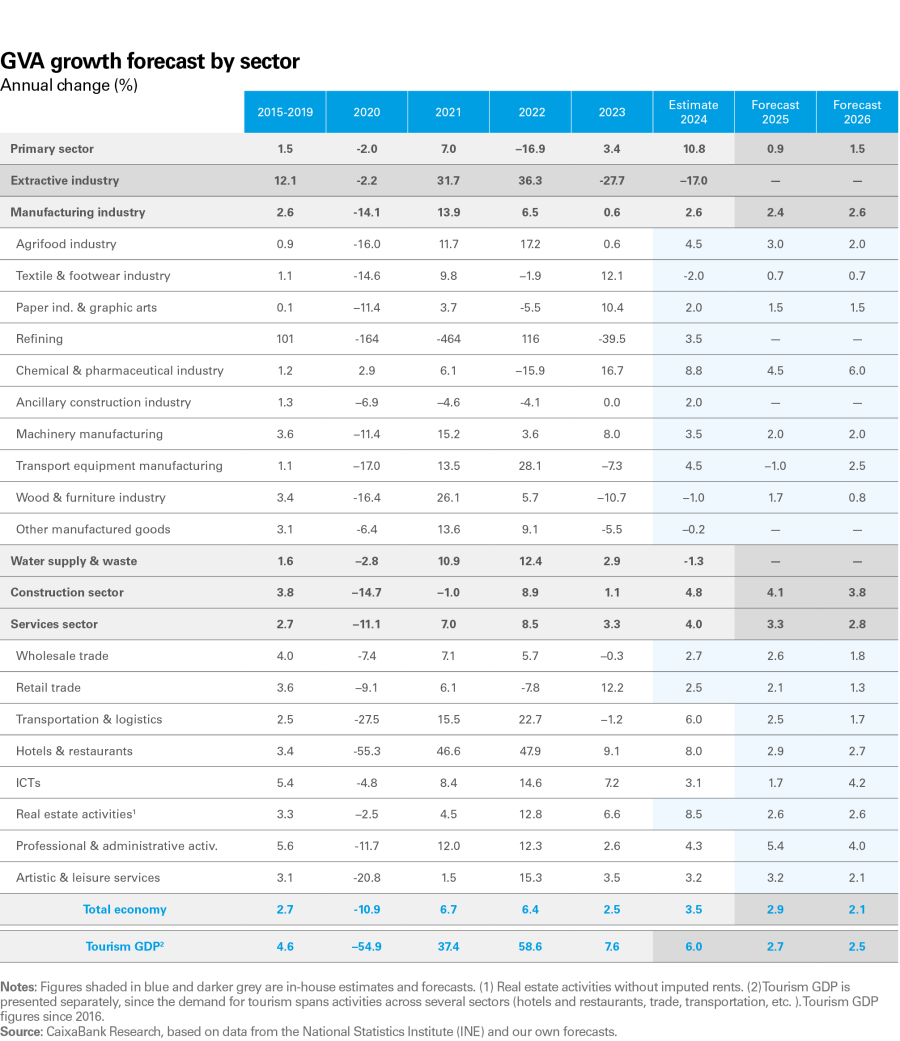

The sector-by-sector breakdown of growth in 2025 underlines the broad-based strength of the economy. While the tariff shock may have dented growth in manufacturing, they have benefited from the lower price of energy inputs for Spanish industry compared to Europe. Thus, growth in industry higher than in the previous expansionary cycle between 2015 and 2019. Meanwhile, services have recorded a slight slowdown, from 4.0% in 2024 to 3.3% in 2025. This is concentrated in tourism, where the growth rate has fallen from 6.0% to 2.7%. As a result, in 2025 tourism will have contributed 0.35 pp to GDP growth, four tenths of a percentage point less than in the previous year. In other words, two thirds of the GDP slowdown in 2025 is due to the lower contribution by the tourism sector. Within services, professional activities have performed outstandingly well, picking up from an already high 4.3% in 2024 to 5.4% in 2025. The construction sector has also benefited from strong domestic demand, supported by population growth. Following the sharp upturn recorded in the sector in 2024, with growth of +4.8%, we estimate that in 2025 it will have grown by 4.1%, significantly ahead of the economy as a whole.

In contrast, the primary sector has seen more modest growth in 2025. After the strong uptick in 2024, driven by improved weather conditions following the severe drought and production costs normalising after the initial impact of the war in Ukraine, its pace has slowed in 2025. Although the primary sector’s importance is relatively small (it accounts for 2.8% of the Spanish economy),4 the estimated fall of almost 10 pp in its growth rate in 2025 has implied a contribution of –0.3 pp to GDP growth compared with 2024. Additionally, despite the strong overall performance of manufactured goods, some sub-sectors are reporting weaker growth, most notably the automobile and textile industries, both of which are facing particularly fierce global competition.

In 2026, CaixaBank Research expects GDP growth to slow further to 2.1%. In this climate, still marked by strong domestic demand, we also expect growth to be broad-based across different sectors. The construction sector is expected to perform particularly well, growing by 3.8%, thanks to the momentum of the residential segment. High value added sectors with positive secular trends such as the chemical and pharmaceutical industry (+6.0%), professional activities (+4.0%) and the ICT sector (+4.2%) will also grow strongly. Manufacturing as a whole will maintain robust growth (+2.6%), supported by the competitive advantage provided by lower relative energy input prices. The recovery seen in automobile production in the second half of the year is also expected to gain traction, allowing the sector to return to growth in 2026. The tourism sector will return to a normalised growth rate (+2.5%), and although it will continue to benefit from a high level of specialisation, its growth will be constrained by the economic weakness of its main origin markets.

Although the economy has a broad base of growth, some sectors with a structurally more constrained outlook will record relatively modest increases. This is the case for the primary sector (+1.5%) and certain industrial sectors with lower value added and fierce international competition, such as wood and furniture (+0.8%) and textiles (+0.7%). Nevertheless, no negative rates of change in gross value added (GVA) are expected in any of the sectors under analysis in 2026.

We classify sectors in three main groups, based on their expected growth for the 2025-2026 two-year period: 1) sectors with high growth, 2) sectors with near-average growth and 3) sectors with weaker growth.

- 4

See the article «The Spanish agrifood sector gains momentum in 2025 after overcoming recent challenges», in the Agrifood Sectoral Report 2025.

1) Sectors with high growth

Construction: after 2023, which had been marked by modest growth (+1.1%) due to the impact of rising interest rates, the construction sector picked up strongly in 2024 and grew by 4.8% thanks to pent-up demand, especially in the residential segment. In 2025 and 2026, we expect the high accumulated housing deficit and easing interest rates to drive strong growth in the sector (+4.1% and +3.8%, respectively). Moreover, construction will continue to benefit from the disbursement of Next Generation EU (NGEU) funds, both for infrastructure projects and for housing and urban regeneration. A more rapid deployment of these funds, especially those earmarked for urban regeneration, could entail upside risks to these forecasts.

Professional and administrative activities face a highly positive secular trend, fuelled by a growing demand among businesses for specialised services, such as consultancy and administrative services. Between 2019 and 2024, these activities were a key driver of the momentum behind exports of non-tourism services. In 2025 and 2026, we expect them to continue growing well above the economy's average growth rate, rising by 5.4% in 2025 and 4.0% in 2026.

Information and communication technologies (ICTs): against a backdrop of digital acceleration and the growing integration of AI in business processes, the ICT sector is cementing its position as one of the most dynamic drivers of the Spanish economy. Between Q4 2019 to Q3 2025, it posted cumulative growth of 32.6%, reflecting its pivotal role in the digital transformation. Although in recent quarters the national accounts figures have shown a slight slowdown, the outlook is optimistic: re-acceleration is expected in 2026, with growth of 4.2%, boosted by the expansion of digital services, the increasing adoption of AI-based solutions and the development of next-generation technological infrastructures.

Pharmaceutical industry: the pharmaceutical industry has grown more than any other industrial sector over the last six years, cementing its position as a driver of high value added growth for the Spanish economy. This leading role is maintained through innovation, internationalisation and its ability to create skilled jobs. While its high exposure to the US market has made it vulnerable to the tariffs imposed in recent years, the sector has shown remarkable resilience. Our forecasts indicate that it will remain above the average growth rate of both industry and the economy as a whole, with an upturn in 2026 as international trade rules stabilise and global supply chains grow stronger. This scenario will pave the way for Spain to cement its place as a European hub for biomedical research and advanced pharmaceutical manufacturing.

2) Sectors with near-average growth

Tourism and hotels and restaurants: the Spanish tourism industry remains one of the cornerstones of the economy, thanks to its high level of competitiveness and specialisation. During the 2015-2019 period, it grew above the national average and, after the pandemic, it made a faster and more vigorous recovery than expected, outperforming its main European competitors and cementing Spain's position as a leading destination. This success demonstrates the resilience of tourism and its ability to adapt to structural and cyclical changes in the market.

Looking ahead, growth rates are expected to return to normal, standing at 2.5% in 2026, reflecting the shift to a more sustainable pace after the post-pandemic recovery.

The weaker momentum than in recent years is due to the subdued growth expected in the economies of the main source countries. Despite this, global tourism demand will continue to grow faster than gross disposable income in these countries, since international tourism is a luxury good (i.e. as household income rises in the source countries, an increasing proportion of it is spent on tourism in Spain). Furthermore, high savings rates in most of these countries will help to bolster demand in the sector.

Manufacturing industry: manufacturing will continue to perform strongly, with projected growth of 2.4% in 2025 and 2.6% in 2026. These figures are higher than its historical average and the figures recorded by its main European competitors. This growth is supported by a key competitive advantage: the lower cost of energy inputs compared to other countries on the continent thanks to lower exposure to Russian gas, and greater use of renewables in electricity production in Spain, which cost less than traditional energy sources.5 Although the industry is more exposed to tariffs imposed by the US –both directly due to its export intensity and indirectly due to the impact of uncertainty on investment–, the sector has shown remarkable resilience in the face of external tensions. The strength of domestic demand is an additional supportive factor.

The sectors that are growing at a near-average rate include machinery manufacturing. This sector was hit hard during the pandemic and by disruptions in global supply chains, but has experienced strong growth in recent years (+8.0% in 2023 and +3.5% in 2024), which we expect to be maintained (+2.0% in 2025 and 2026), boosted by healthy levels of investment in this two-year period.

Wholesale and retail trade: strong growth is expected in both segments, thanks to the momentum in private consumption. While maintaining positive growth, the retail trade is facing major challenges such as growing competition from e-commerce, the digital transformation and changes in consumer habits that require it to adapt quickly. Nevertheless, we expect average growth to be above 1.5% for both sectors in 2025 and 2026.

- 5

For further details, see the article «The keys to the strong performance of Spanish manufacturing» in this report.

3) Sectors with relatively weak growth

Although in our central scenario we do not foresee a decline in any sector, some sectors are expected to perform below average. In manufacturing, the weakest sectors include the textile industry, the wood industry, and furniture manufacturing. These sectors are facing strong global competition and, in the case of the textile industry in particular, a negative secular trend. Although somewhat stronger, the paper industry will also be slightly below average for the manufacturing sector.

Having weathered the impacts of the pandemic and the energy shock, the car industry is now facing new strategic challenges. The shift towards electric vehicles and global competition –especially from China– are putting pressure on a sector that, nevertheless, has factors in its favour: an ageing stock of vehicles in Spain, expanding private demand and a highly automated car industry (second only to Germany in Europe). While growth is still expected to be weak in 2025, forecasts point to an upturn in 2026, provided that the sector manages to adapt to electrification and focuses on high value added models. To achieve this, it must accelerate the deployment of charging infrastructures and use the Strategic Project for Economic Recovery and Transformation of the Electric and Connected Vehicle (PERTE VEC) to consolidate the entire value chain across the country.

The primary sector will also see somewhat more muted growth. It should be recalled that after seeing strong expansion in 2024, due to lower production costs and improved weather conditions, the sector is facing major structural challenges, such as ageing populations in rural areas and the progression of climate change, major factors that will impact on its competitiveness and sustainability.

A broad-based expansionary cycle

Despite facing recent shocks such as the pandemic and the energy crisis, the Spanish economy currently features a: dispersion in growth rates across sectors at an historic low. This phenomenon reflects a remarkably balanced expansionary cycle, where growth is not reliant on a single driver, but is spread across multiple sectors.

An analysis of variations in annual growth –excluding particularly volatile sectors such as refining and the primary sector– confirms that the dispersion is countercyclical: it tends to decrease during expansionary phases and to increase during contractionary periods. However, even compared with other expansionary cycles, this one is notably broad-based and homogeneous.

Unlike the 2004-2007 cycle, which was dominated by the real estate boom, current growth comes from a far more diversified base. This cross-sector growth gives us confidence in the robustness of the cycle, as the economy is not dependent on a single sector to sustain its momentum. Consequently, any macroeconomic downturn would have to affect multiple industries simultaneously to dampen growth, strengthening overall resilience to specific shocks.