Spanish tourism is expected to see more sustainable growth in 2026

In 2025, tourism consolidated its normalisation after the post-pandemic rebound, reaching record levels of activity and profitability. According to our estimates, tourism GDP grew by 2.7%, moderating from 6.0% in 2024, but giving way to a phase of expansion with more sustainable rates and even higher than pre-pandemic levels. International tourism reached new record highs, with 97 million arrivals (+3.5%) and spending of €135 billion (+7.0%), ranking Spain second worldwide in both arrivals (after France) and spending (after the USA). The hotel sector maintained record occupancy rates and improved its profitability, with particular dynamism in rural destinations compared to traditional ones. The outlook remains favourable: Tourism GDP is expected to grow between 2.5% and 2.7% annually in 2026-2027, slightly above the pace of the economy.

Normalisation of the sector after an exceptional post-pandemic cycle

The Spanish economy maintained remarkable dynamism in 2025, with GDP growth of around 3.0% year-on-year, barely moderating from the 3.5% recorded in 2024. This gradual normalisation of growth occurs in a phase of the cycle marked by the strength of domestic demand, which compensates for the moderation of foreign demand, and in which most economic sectors grow above their long-term average.1

In this context, tourism GDP has also slowed down, with year-on-year growth of 2.8% in Q3 compared to 4.8% in Q3 2024, in line with our expectations of gradual normalisation after the extraordinary growth recorded between 2022 and 2024, driven by the very strong post-pandemic recovery. For the whole of 2025 we estimate an increase of 2.7% compared to 6.0% in 2024.

The outlook for the coming years remains positive. High savings levels and increased household disposable income are expected to sustain demand in key source markets. Our estimates point to a growth in tourism GDP of 2.5% in 2026 and 2.7% in 2027, levels comparable to those of 2025 and which represent a return to the levels that the expansion path observed in the 2018-2019 period would have led to, as reflected in the chart on the following page. According to our projections, the sector’s weight will reach in 2026 12.8% of GDP compared to 12.6% in 2019, reaching 12.9% of GDP in 2027.2

- 1

For a more detailed analysis of the current state of the Spanish economy from the perspective of its sectors of activity, please see «The Spanish economy, experiencing broad expansion», Sectoral Observatory S2 2025. According to the report, more than 70% of the sectors analysed are growing above their long-term average.

- 2

The projections regarding the weight of tourism GDP include the adjustments in the historical series of the INE’s tourism satellite account. Prior to these adjustments, the projections stood at 13.1% for 2026 and 13.3% for 2027.

International tourism breaks records in Spain for the third year in a row

International tourism reached historic highs again in 2025. However, as we anticipated, the growth rate of foreign demand indicators has moderated after several years of intense dynamism.

In terms of arrivals, Spain received 91.5 million international tourists between January and November, almost 3 million more than in the same period of the previous year. The summer season was especially successful for the sector and a new record was broken: Between June and September alone, 41.4 million tourists arrived from abroad, some 750,000 more than in 2024, and 3.8 million more than in 2019. However, the increase in arrivals moderated significantly in 2025. For the year as a whole, we estimate that arrivals will grow by 3.5%, reaching 97 million tourists, compared to the 10% increase recorded in 2024.

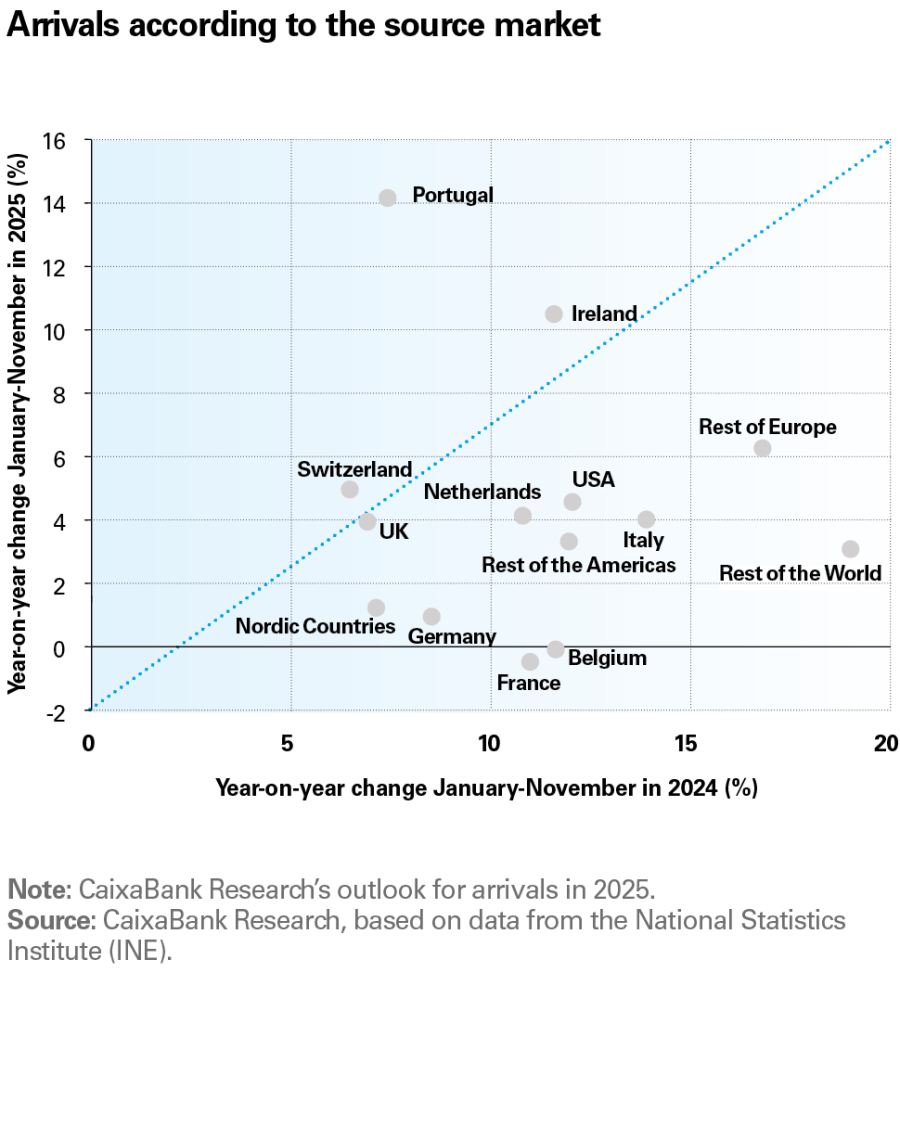

By source markets, the slowdown in arrivals is widespread, with the sole exception of Portuguese tourists (+14% year-on-year between January and November). At the opposite end of the spectrum, Belgian and French tourists are being corrected downwards after the double-digit growth recorded in 2024. Meanwhile, long-distance tourism (categorised as «Rest of the World» and «Rest of the Americas» in the chart below) also shows weak performance, although it consolidates the strong growth of the previous year, when it recorded increases of close to 20% in the case of «Rest of the World», which mainly includes Asian tourists. In any case, it is worth remembering that all markets, except the Nordic ones (and the Russian ones, due to the context of the war in Ukraine), are at record highs in arrivals. The fact that the slowdown is so widespread suggests that it is not due to specific external factors, but rather that the expansion is simply becoming normalised.

Growth in foreign tourist arrivals is slowing generally among source markets

Average spending per international tourist was projected to reach approximately €1,400 in 2025, 3.2% more than in 2024

In terms of spending, the sector took in around €134 billion from foreign tourists in the last 12 months up to November, representing a year-on-year growth of 6.9%, compared to 17.5% in the same period of 2024.

Average spending per person3 was close to €1,400 on average until November, which represents an increase of 3.2%, less than the 5.7% recorded in the same period of 2024, but similar to the behaviour of tourist inflation (see the chart on the following page). This behaviour corresponds to slightly shorter stays (7.1 days on average, 0.1 pp less than in 2024), and with an increase in daily spending per tourist (€195) of 4.6%.

According to CaixaBank Research’s foreign tourist spending indicator, most of the weakness was concentrated in the accommodation category (–3.6% year-on-year in the year to November), while trade and leisure (11.6%) and restaurants (14.5%) continued to grow strongly and compensate for the lower spending on accommodation.

- 3

Average spending per person and trip (calculated by the INE) aims to capture total traveller spending, including trips to Spain.

Growth in tourism spending is slowing in line with the correction of inflation

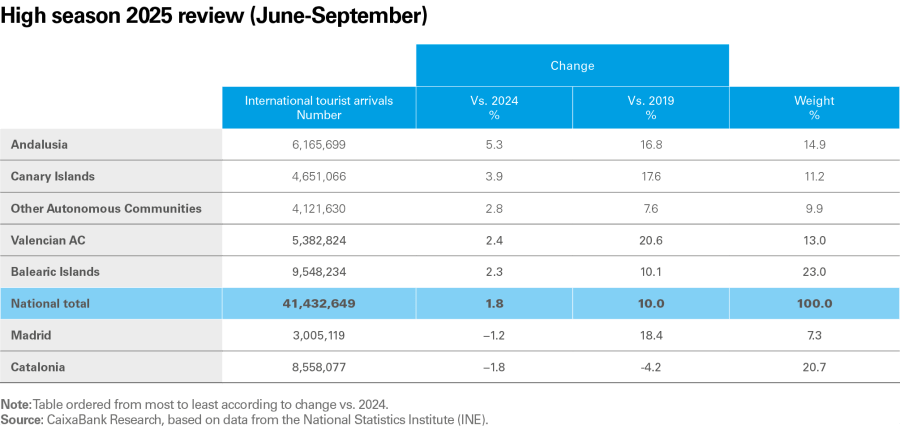

Andalusia led the growth of international tourism in the summer of 2025

Analysing the peak summer season allows us to draw significant conclusions by region. All the areas traditionally most attractive to international tourism surpassed the 2024 figures and reached new all-time highs, although the pace of growth moderated after the double-digit rates recorded the previous year.

Among them, Andalusia stands out as the big winner: It was the region that saw the greatest increase in foreign tourist arrivals in the summer of 2025, with 300,000 additional visitors, reaching a figure of 6.2 million, making it the third-most visited region after the Balearic Islands and Catalonia. Conversely, Catalonia received 8.6 million international tourists in the summer of 2025, down from 8.7 million in 2024 and 8.9 million in 2019. In fact, it has ceased to be the most visited region in the summer season, surrendering the leadership to the Balearic Islands.

Spanish tourists are returning to international destinations

The trends that began to emerge in 2024 consolidated in 2025 with regard to the behaviour of resident tourists and reveal two distinct dynamics. Its presence in domestic destinations is decreasing, falling in terms of the number of trips (–5.8% year-on-year) and overnight stays (–3.9%), the latter even falling below pre-pandemic levels.4 Total spending fell by 0.4% as a result of the decrease in number of travellers, although average spending per person grew by 5.6%. By contrast, trips abroad by Spaniards continue to show an upward trend: Number of trips increases by 4.7% and total spending by 8.5%.

- 4

The overnight stay data from the INE’s resident tourism survey includes all types of accommodation, not just hotel overnight stays.

Behaviour of resident tourists in 2025

The hotel sector is maintaining occupancy levels and its profitability improves

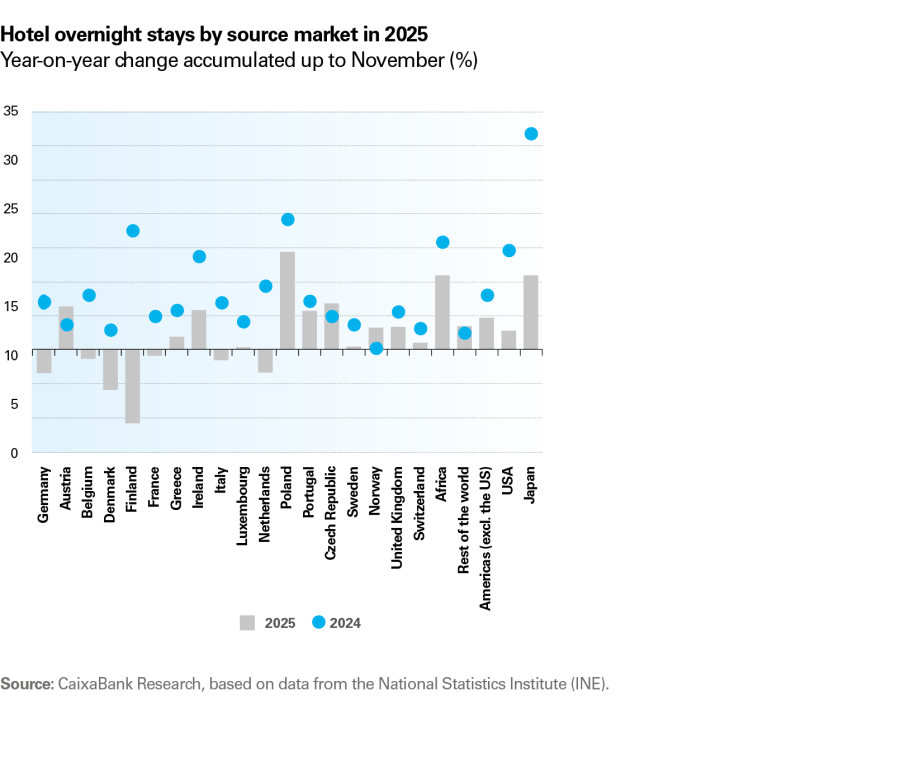

In 2025, hotel overnight stays have remained at record levels, very similar to those of 2024, consolidating its demand, which is 6% higher than the pre-pandemic period. However, the growth rate has slowed down considerably: through November, overnight stays barely increased by 0.9% year-on-year, compared to 5.0% the previous year. This slowdown affects all types of tourists, although it is more pronounced among residents, whose numbers have decreased by 0.2%, while non-resident tourists have increased by 1.5%. Regarding the source of foreign tourists, the decline in stays by some nationalities that are key to the sector stands out, such as French, German and Italian tourists, who account for 20% of total stays.

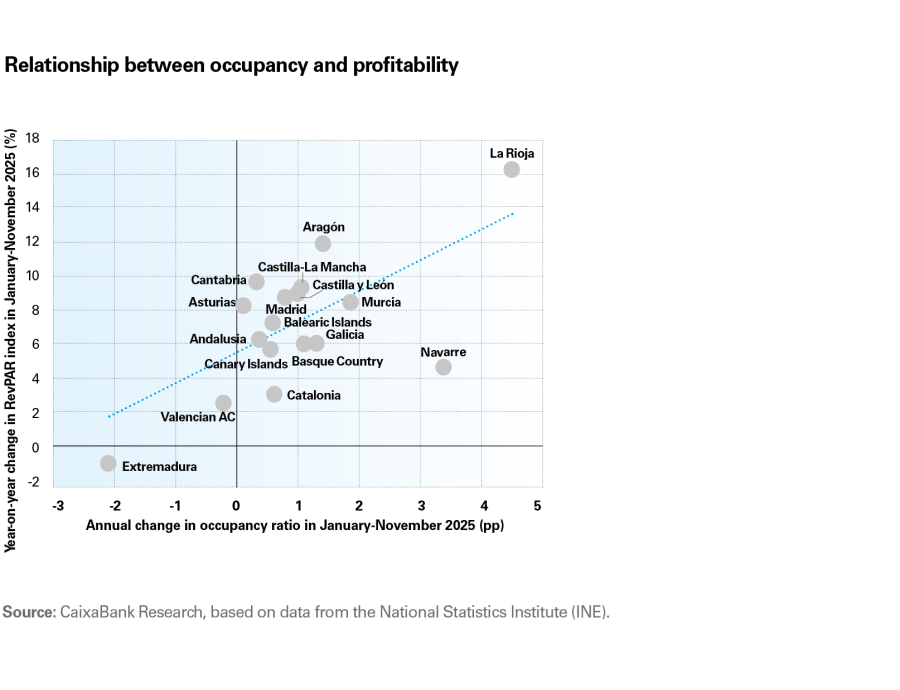

Despite this stabilisation, occupancy remains high and at record highs: around 70% in the year and close to 77% in the summer months, slightly exceeding the excellent figure for 2024. Furthermore, the sector’s profitability continues to rise: the RevPAR index grew by 6.4%, above inflation, although less than in 2024 (9.8%).

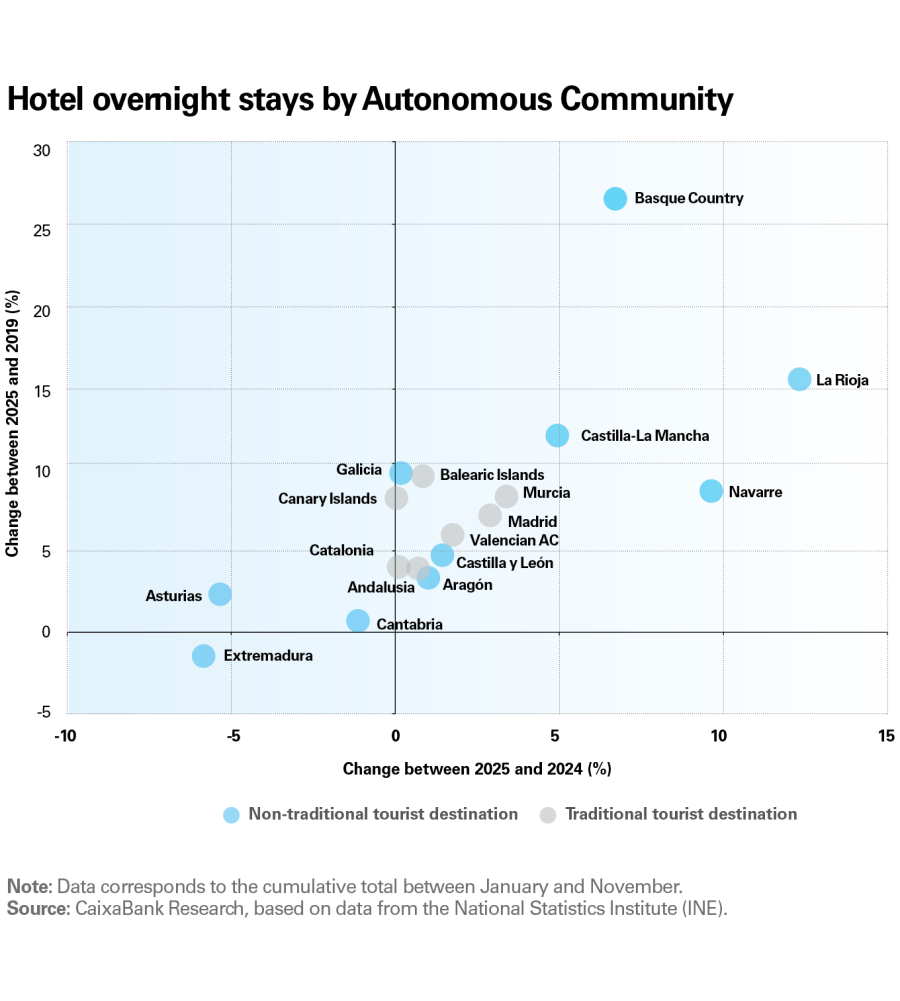

By region, hotel occupancy increased across the board, except in Extremadura and the Valencian Community. The strong increases in destinations less common for foreign tourism, such as La Rioja, Navarra or Galicia, stand out. However, to what extent does this increased occupancy translate into improved hotel profitability? The combined analysis of occupancy and profitability shown in the charts on the following page demonstrates the expected positive relationship: where occupancy increases, profitability improves. However, there are cases that deserve attention. On a positive note, La Rioja shows the greatest growth in both occupancy and RevPAR. At the opposite end, Extremadura and the Valencian Community register declines in occupancy and hardly any improvements in profitability (in Extremadura, it even falls). Navarra, with a strong increase in occupancy (the second-highest), presents a relatively moderate increase in RevPAR.

Hotel sector: non-resident demand continues to increase, as well as occupancy and profitability

What post-pandemic tourism trends will endure in Spain five years later?

After observing the normalisation of the tourism sector after the pandemic, one of the natural questions to ask is whether the trends that have been observed in the first years after the COVID-19 shock have been reversed or whether, on the contrary, they have been consolidated.

Firstly, the tourism sector has shown a growing deseasonalisation in its activity throughout the year after the outbreak of the pandemic.5 The following charts compare tourist arrivals and occupancy rates for each month of the year in 2024 and 2025 against the pre-pandemic period. As usual, the months of June to September concentrate the highest volume, but it is observed that activity outside of peak season is gaining importance. Although this trend continued in 2025, it cannot be said that it accelerated compared to 2024; rather, the sector's deseasonalisation remains very gradual.

- 5

The reduction of seasonality in the sector is a gradual process that has been observed for decades, but which seems to have accelerated in recent years. For an in-depth analysis of this process and its causes, see the article «What factors have contributed to the reduced seasonality of tourist spending in Spain?» in the Tourism Sector Report S1 2025.

The trend towards the deseasonalisation of tourism in Spain continues

One of the most notable trends after the pandemic has been the growing interest in non-traditional destinations, linked to so-called green or rural tourism, as opposed to the classic sun and beach destinations, which are usually more crowded and concentrate most of the tourist offering in Spain.

The trends towards a gradual deseasonalisation in tourism activity and towards diversification of destinations remain in place

Finally, another major post-pandemic trend has been the rise of luxury tourism in our country, making it a strategic segment due to its high contribution to spending and its ability to boost the added value of the sector. In this regard, this report contains the article «Snapshot of international luxury tourism in Spain», where we delve into the characteristics, source and behaviour of this type of tourist based on aggregated and anonymised data of payments with foreign cards at CaixaBank POS terminals.