Pension reform: an unavoidable debate

The latest reform of the Spanish pension system was in 2011. This was the system’s fifth reform in the country’s democratic period and probably one of the most ambitious. The legislation provided for the pension system to be revised after five years so, in November 2016, a parliamentary committee was set up for this very purpose. As pointed out by its chair, Celia Villalobos, «today’s pensions are guaranteed; the reform we want to carry out is to ensure the pensions of the future». We should therefore look at the factors affecting the pension system in the long term. Having established this frame of reference, we can then explore the big decisions that need to be taken for its reform.

One crucial aspect frequently brought up in public discussions is how demographics will affect the pension system. Europe is facing the combination of a longer life expectancy and progressive ageing of its population, the latter due to no small extent to the decline in the birth rate over the past decades, which is set to continue. But these trends are particularly strong in Spain. According to the INE, Spain’s birth rate in 2015 was 9 births for every thousand inhabitants. But this will fall to 6.6 per thousand by 2030 and to 5.6 per thousand by 2060. It is true that the decline in the birth rate intensified due to a cyclical contraction in Spain’s economy (with two recessions in 2008-2009 and 2011-2013). But the underlying trend predicted by the INE is one of fewer births even once the economy begins to grow again. Regarding life expectancy, by 2060 the average lifespan is expected to be eight years longer than at present. This means that, while 16% of Spain’s population is currently over 67, as from the 2040s this figure will be 30%.

The pension system is also feeling the pressure from the trend in labour income. According to available empirical evidence, the labour income share has fallen globally over the past few decades and Spain is no exception. In 1999 this share accounted for 62% of total income while, in 2016, it was 56%.1 As with the birth rate, this trend is due to both structural and cyclical factors. Structural factors include technological advances and globalisation, two phenomena that tend to increase the return on the capital factor compared with the labour factor. But these underlying trends have also become stronger during the aforementioned recessionary cycle, since the labour factor bore the brunt of the adjustment.

Nevertheless, it is all too easy to become simplistic when talking about pensions. For example, one of the recent proposals most widely covered by the media is the need to tax robots, potentially as a source of funding for pensions. First there is the difficulty in defining the «taxable base», so to speak (what is a robot, ultimately? An algorithm plus a machine or merely an algorithm?). But it also seems counterproductive to interfere in the accumulation of capital goods as this would directly hinder innovation and end up blocking a vital source of future prosperity (and therefore future pension funding).

Given such demographic pressures and labour market changes, one key issue is the likely trend in state pension expenditure related to GDP.2 And this largely depends on the demographic trend itself: as a society becomes older, the number of pensioners in relation to the working age population increases (in other words the dependency ratio or demographic factor). If the other parameters remain constant, pension expenditure will therefore be higher. A second factor is the ratio between the pension received and the funds financing it; i.e. between the average pension and the average wage (known as the replacement rate). The larger a pension in relation to wages, the higher the pension expenditure. A third factor is related to the labour market. If the employment rate (the ratio of employed people to the working age population) falls, then pension expenditure (as a percentage of GDP) increases. Although this may seem paradoxical, we should remember that, the smaller the proportion of the working age population that is actually employed, the smaller the GDP and, consequently, the larger the spending on pensions as a percentage of that GDP.

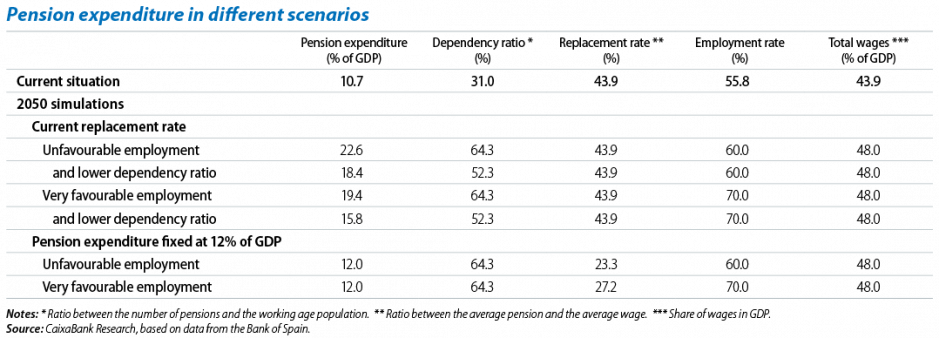

So how much leeway do we actually have to adjust the pension system? Demographics strongly influence the dependency ratio, the labour market, its employment rate and the labour income share. Consequently, in an extreme scenario, the choice is between higher spending on pensions which will result in a higher replacement rate or lower spending on pensions in exchange for a lower replacement rate. And this is precisely the question the Bank of Spain has attempted to answer in a recent exercise.3 Although the institution has produced numerous scenarios (see the enclosed table for a selection), we merely need to look at the most illustrative of these: if pension expenditure as a percentage of GDP increases slightly (12% of GDP in 2050, higher than the current 10.7%), the replacement rate will fluctuate between 23.3% and 27.2% (currently 43.9%) depending on the employment rate achieved. If the current replacement rate remains the same, in 2050 pension expenditure as a percentage of GDP will be between 15.8% and 22.6%.

Society is therefore faced with a very tough choice. And the pension system certainly seems to be heading in this direction. But it is not inevitable. There are two types of measure: for the first there is, in principle, general consensus but the second are more open to discussion. And to provide alternatives that do not suppose any undesirably extreme future scenarios, pension reform will probably have to be based on both types.

The first measures are indirect; i.e. they can have a positive effect on different parameters related to the system’s sustainability. Two actions are particularly key. First, to reduce the shadow economy and thereby improve public revenues. A second action which is widely accepted is a whole package of structural measures aimed at improving growth potential. This would particularly be achieved by creating a more efficient labour market and human capital more in line with future demand. Ultimately, these two aspects should result in a higher employment rate (one of the factors which, as we have seen, are directly linked to pension expenditure).

But there is another package of more direct measures that act on the parameters of the pension system. These are issues which, in one way or another, have been covered by the reforms carried out by the advanced countries since 2007. They include decisions to help delay the effective retirement age and to automatically adjust pensions in order to improve the system’s financial sustainability. Although all these issues are relevant, and will probably be discussed, in our opinion there are others that also need to be considered. Three areas in particular should also be explored and we devote the next articles in the Dossier to these: the need for a more flexible concept of working life after retirement, the discussion of sources of funding for the system and the essential use of private, long-term savings schemes.

As Woody Allen said, we are all concerned about the future because that is where we are going to spend the rest of our lives. And, as is almost always the case, he has hit the nail on the head. The pension debate certainly concerns how we wish to live, work, produce and consume in a future which, although it may seem distant, is nevertheless just around the corner in historical and generational terms. As in this article, those that follow explore those aspects of this future which will affect pensions. We trust that, one way or the other, they help to place an unavoidable discussion on the right track.

Àlex Ruiz

Macroeconomics Unit, Strategic Planning and Research Department, CaixaBank

1. For a more detailed view of this issue, see the Dossier «Labour income share in perspective» published in MR02/2014, and the article «On the distribution of corporate income» in the Dossier published in MR02/2017.

2. The breakdown is as follows: Pension expenditure/GDP = (number of pensions/working age population) x (average pension/average wage) x (working age population/number of workers) x (total wages/GDP).

3. Hernández de Cos, P. et al. (2017), «El sistema público de pensiones en España: situación actual, retos y alternativas de reforma», Documentos Ocasionales, no. 1701, Bank of Spain.