Silver tourism in Spain: an opportunity to reduce seasonality and diversify destinations

The population over 65 years of age is consolidating itself as a strategic segment of the Spanish tourism sector, with ample room for expansion. The demographic weight of this group has grown steadily in Spain and its purchasing power now exceeds the national average, reinforcing its strategic importance. Analysis of CaixaBank’s card payment data confirms that this group represents a significant part of tourist spending, particularly for domestic tourism. However, their share remains lower than their weight within the population, which suggests considerable growth potential if the supply is better adapted to their preferences and needs. Furthermore, this group acquires special importance in rural provinces and contributes to deseasonalisation.

Silver tourism: a growing segment

People over 65 have acquired increasing weight in the Spanish demographic pyramid, going from representing around 10% of the population in the early 1970s to 15% in the mid-1990s and 21.1% in 2025. At the same time, their purchasing power has increased significantly in relative terms: while in 2008 their net annual income per person was very similar to that of the population as a whole, in 2024 it was 16.2% higher than the national average.

The demographic weight of this group has grown steadily in Spain

According to CaixaBank card data, duly anonymised and aggregated, the population over 65 years of age accounted for 15.6% of tourist spending9 made by Spaniards. Given the greater propensity of silver tourists to opt for domestic tourism, this group accounts for 16.4% of national tourist spending within Spain. These figures show, on the one hand, that silver tourism is already a significant component of tourist demand in Spain. However, they highlight that the senior population contributes a lower percentage of spending than its demographic weight, despite having a higher average net income. It is reasonable to expect that future cohorts of older people – with more travel-oriented lifestyles and greater familiarity with tourism – will increase their propensity to travel. Consequently, we are facing a strategic segment with great potential: If the offering adapts to their preferences and needs and the new retirees become loyal, silver tourism can become a key driver for the sector.

- 9

Tourist spending in this case means that which is made outside a circular area of 30 kilometres around one’s usual consumption centres. These spending figures include card payments and cash withdrawals made outside these areas.

Tourism spending in Spain, by age

Analysis of per capita tourism spending by age reveals a clear pattern: Tourist spending by Spaniards increases progressively from the age of 18, reaching its peak between the ages of 48 and 54, with figures around €1,500. From that age onwards, spending begins to decrease gradually, reaching around €800 in the case of those over 80 years old. This behaviour underscores the growth potential of the senior segment. A tourism offering tailored to their preferences, and which takes into account diverse health situations, can increase the participation of senior tourism in the sector.

Domestic preference of silver tourists

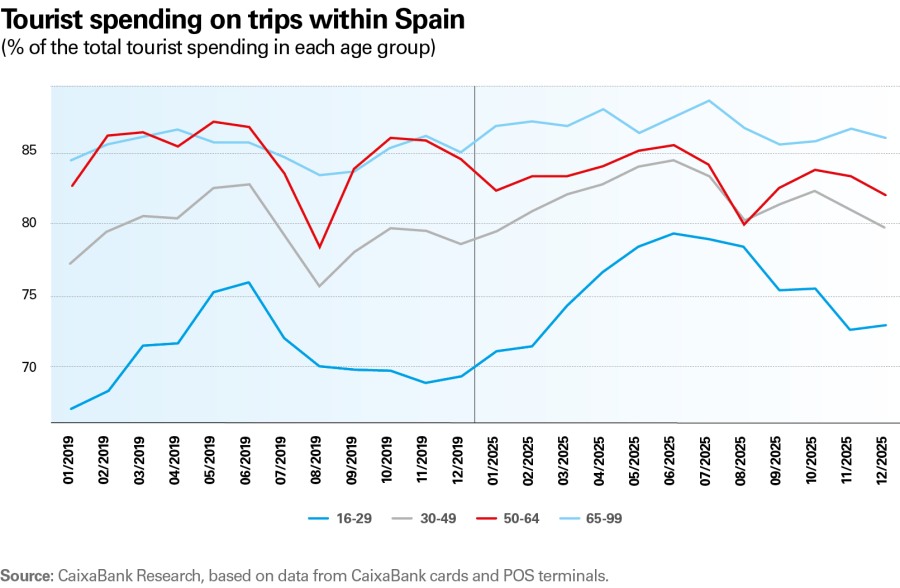

A distinctive feature of silver tourism is their marked inclination towards travel within Spain, in addition to greater stability throughout the year. Unlike younger tourists, who show a greater tendency to travel abroad, those over 65 focus most of their spending on domestic tourism. In 2025, the weight of international tourism in aggregate tourism expenditure for 16 to 29 year olds was 24.2%, for middle-aged tourists spent 17.4%, while for senior tourists, it was only 13.0%.

In addition, tourists over 65 years of age show greater consistency throughout the year: in all months of 2025, tourist spending in Spain was of over 85% of the total spending. By contrast, middle-aged tourists increase their international component in August and during the Christmas period, and younger tourists show even greater variability.

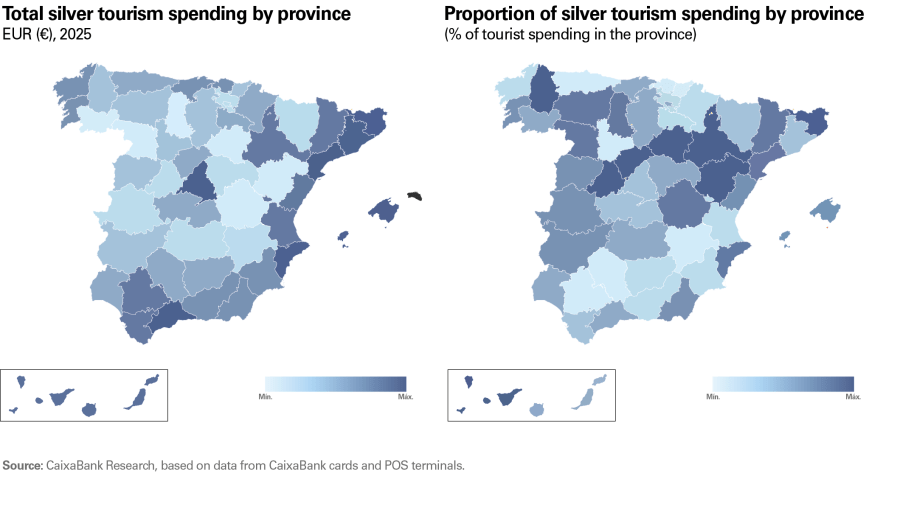

Importance of Spanish silver tourism in rural areas

Silver tourists play a particularly important role in rural areas. Although in absolute terms the tourist spending of senior travellers is concentrated in the most touristic provinces, such as Barcelona, Madrid, the Mediterranean coast and the Canary Islands, its relative weight is higher in the interior of the country. In Soria, Zaragoza, and Teruel, expenditure by seniors is particularly important, accounting for more than 20% of total tourist spending in the province. The weight of senior tourism is also significant in the Canary Islands (20.4% of tourist spending in Tenerife), driven by a mild climate throughout the year. By contrast, its importance is lower in urban destinations such as Barcelona or Madrid, where it represents approximately 15% of tourist spending. Valencia (14.0%) and Seville (12.9%) register an even lower weight of silver tourism.

The good performance of rural provinces may be related to the links that some silver tourists maintain with their hometowns, or those of their families, which encourages travel to these destinations. Furthermore, their preference for less crowded environments suggests that senior tourism can act as a lever for diversification, especially if the public and tourism sectors commit to a coordinated strategy that encourages this segment to continue expanding the range of destinations it visits.

The preference for less crowded environments suggests that senior tourism can act as a lever for diversification

Un patrón de gasto diferenciado

Silver tourists exhibit different consumption patterns compared to the rest of the population. They stand out as having more of a tendency to pay in cash: cash withdrawals represent 37% of their tourist spending, compared to 26.3% for other travellers. In addition, those over 65 spend almost twice as much on travel agencies (6.5% of senior tourism spending, compared to 3.3% for non-seniors) and also allocate a larger proportion to hotel accommodation. By contrast, their spending on restaurants is lower, while their spending in supermarkets remains at levels similar to the rest. Although it's worth noting tourists in the 65-70 age bracket have a high propensity to own a second home, this decreases sharply for older seniors, which explains the need to stay in hotels.9

- 9

Please see «Second homes in Spain: seaside or sierra?», CaixaBank Research, 2020.

Silver tourism contributes to deseasonalisation

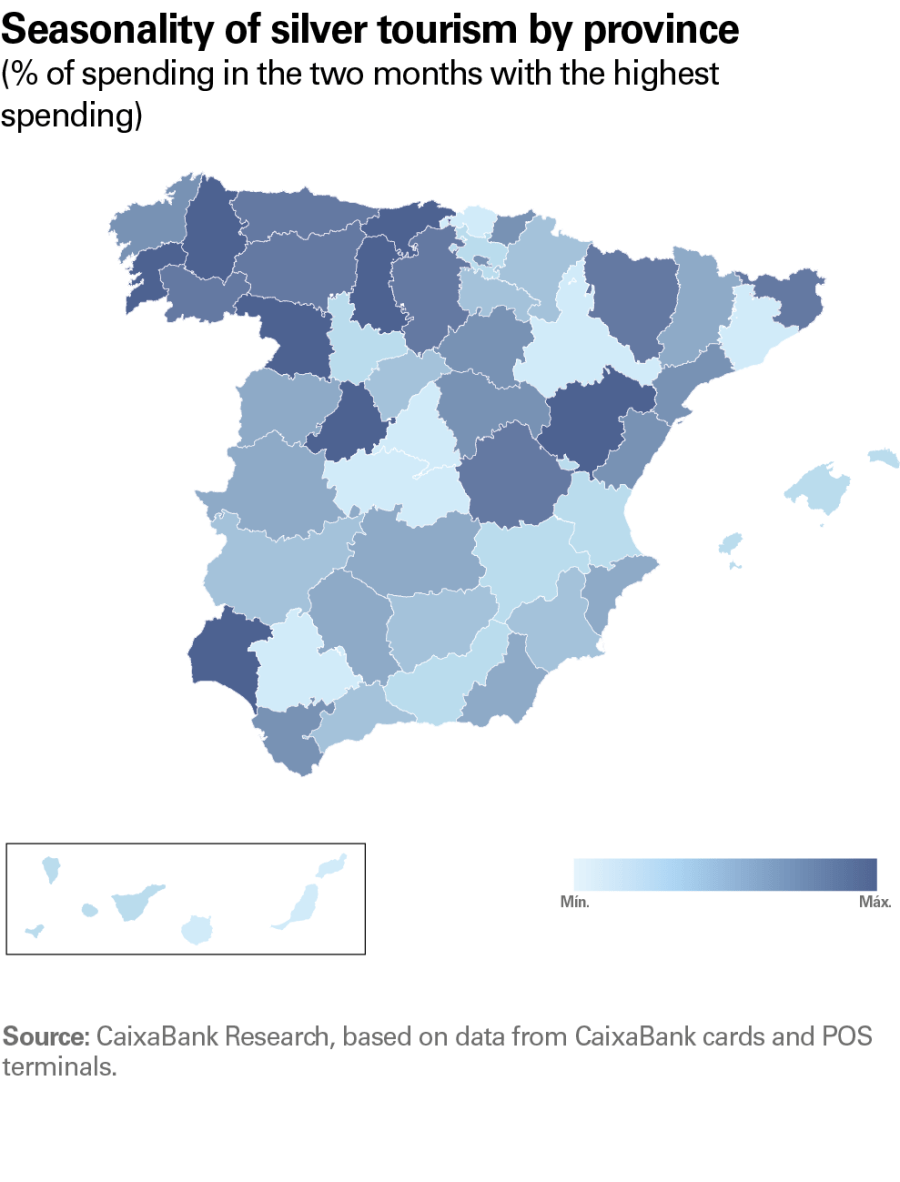

Silver tourists exhibit a less seasonal spending pattern than the rest of Spanish travellers and travel more frequently outside of peak season, making them a vector for promoting a more balanced distribution of tourist demand throughout the year.

Specifically, those over 65 years of age accounted for only 22.1% of their tourist spending in the two peak months, compared to 24.6% for the rest of the tourists. This lower seasonality is largely explained by factors associated with their greater availability of leisure time: since they are mostly out of the labour market and do not have school-age children, the senior segment enjoys higher flexibility to travel at any time of the year.

However, the provincial analysis reveals a more heterogeneous reality. Although in aggregate terms they are less seasonal, in some regions they show marked peaks, some of which are even higher than those of the rest of the tourists. This would be the case of the coast of Cantabria, where the senior segment shows a more pronounced seasonality, a pattern consistent with a greater sensitivity to cold in advanced ages.

This result underscores the importance of incorporating the preferences of this segment to maximise its contribution to deseasonalisation, which can result in improved sector efficiency and promote steady value generation throughout the year.

Looking ahead, INE projections indicate that by 2055, 30.5% of the Spanish population will be over 65 years old, and globally this group is estimated to reach 2 billion people. This is a large population, which also reaches this stage with greater purchasing power and better health than previous generations, all of which opens up an opportunity for tourist destinations that adapt to their specific needs. Aspects such as accessibility, safety and personalised experiences will be key to attracting this segment and boosting its contribution to the sector.