A snapshot of international luxury tourism in Spain

Luxury tourism has established itself as a strategic segment for the Spanish tourism sector, both for its high contribution to expenditure and for its potential to increase the value added of the sector. According to payment data analysed by CaixaBank Research, although this segment only represents 3% of international cards, it accounts for 20% of in-person spending by foreign tourists. The analysis also highlights the rise of urban luxury tourism, driven largely by Madrid’s dynamism as a high-end destination, despite luxury tourism still maintaining a strong coastal orientation. The United Kingdom, France and Germany are the main sources of tourists travelling to Spain, both in the luxury and conventional segments, although other economies with a very high GDP per capita, great inequality or a combination of both stand out.

Luxury tourism: a key segment

Spain broke a new record international tourist by receiving 85.7 million people in the first 10 months of 2025, according to the INE. As we will explain in this analysis, a key component of this demand is luxury tourism.

To identify which tourists fall into this category, we start with anonymised data from international cards that operate in CaixaBank POS terminals, calculate the average daily spending of all cards, and classify as luxury tourists those whose daily spending is at least 10 times higher than the median spending. Thus, while the average daily expenditure of all foreign cards is €46,6 the luxury tourist spends an average of €731 per day. This card category represents about 3% of the total international cards, but it accounts for no less than around 20% of in-person international tourist spending.

The first thing we observed in the analysis is that the average daily spending per card, both for luxury tourists and other tourists, decreased between 2019 and 2025. However, this is mainly due to the increase in the number of cards used by each visitor, and not to a contraction in spending per person.7

A second characteristic we discovered is that the loyalty of luxury tourists is slightly lower than that of the rest: Among the international cards with payments at CaixaBank POS terminals analysed in 2024, 17.9% of those identified as luxury cards made payments again in 2025, compared to 20.2% of cards associated with non-luxury tourists. Strengthening customer loyalty in this segment is therefore a key lever for increasing the value added of the tourism sector.

The source country of luxury tourists: beyond traditional markets

The main sources of luxury tourism

Regarding the countries, the United Kingdom, France and Germany are the main sources of tourists travelling to Spain, both in the luxury and conventional segments. Even so, although during the first 10 months of 2025 these three countries accounted for 45.8% of total tourist arrivals, according to INE data, their combined weight in luxury tourism, based on internal CaixaBank data, is reduced to 34.7% of cards classified as high spending.

Countries that are overepresented as sources of in luxury tourism tend to be economies with very high incomes, high inequality, or a combination of both. Among the main source countries whose weight in the segment is much greater than their weight in the total number of tourists, the USA stands out, although it only accounts for 4.6% of total arrivals, it concentrates 8.6% of the cards identified as luxury tourist cards. The Netherlands, Belgium and Switzerland also show a greater weight in high-end tourism than in the aggregate – all three are among the countries with the highest per capita income in Europe.

When analysing the proportion of luxury tourists relative to the total number of cards in each country, several Gulf countries, Hong Kong, Israel and Mexico stand out. Malta is a particularly striking case: Luxury cards represent 24.8% of the total number of Maltese cards making payments at CaixaBank POS terminals. However, the observed volume of cards of that nationality seems too high to correspond exclusively to residents of Malta, suggesting that a substantial part of this flow could correspond to tourists from third countries using cards issued by Maltese banks during their visits to Spain.

Preferred destinations: the rise of urban luxury tourism

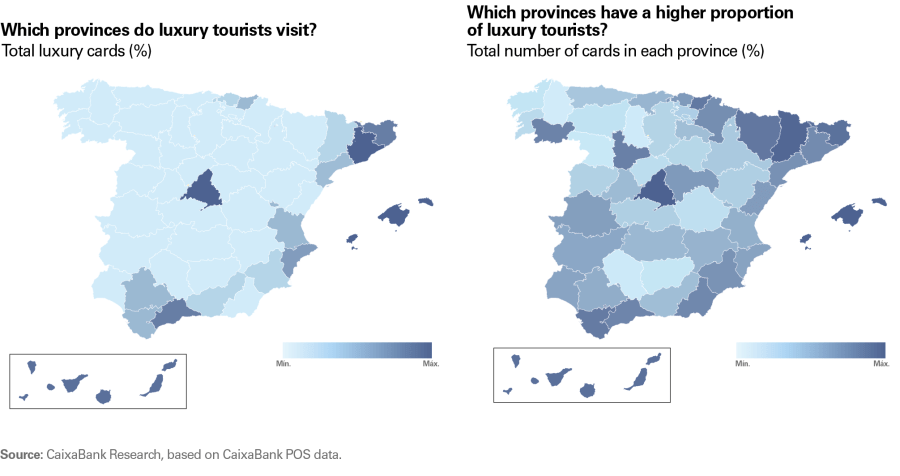

The geographical distribution of luxury tourism shows a high concentration. In the first 10 months of 2025, the three provinces that received the highest number of luxury tourists accounted for 60.6% of visits from this segment: the Balearic Islands (22.5%), Madrid (19.6%) and Barcelona (18.6%). Other important areas include the Canary Islands and several provinces along the Mediterranean coast, such as Malaga, Cadiz, Alicante and Valencia.

Luxury tourism is concentrated on the coast and in Madrid

Taking into account the weight of luxury tourism on total international tourist spending in each province, the map becomes more nuanced. Madrid and the Balearic Islands continue to stand out: 30.3% of international tourist spending in Madrid and 24.8% of international spending in the Balearic Islands comes from luxury tourism.

However, other provinces also show a notable dependence on this segment. Among them are Lleida (18.4%) and Huesca (16.9%), where ski tourism has a significant presence; as well as Orense (19.4%) and Vizcaya (18.4%). In Barcelona, luxury tourism represents 16.8% of the province’s international tourist spending, a figure slightly lower than the national average (19.9%).

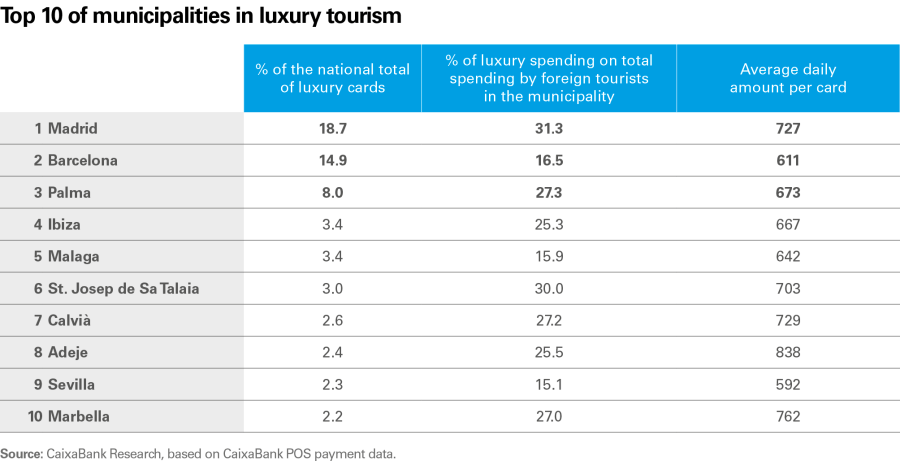

The top 10 municipalities with the highest luxury tourism spending reveal a clear pattern: a combination of urban destinations and coastal enclaves with a marked specialisation in this segment. Madrid tops the list, both in terms of the number of luxury tourists and the weight of this segment in the municipality’s total tourist spending. In recent years, the capital has experienced a luxury tourism boom, driven by the opening of numerous «ultra-luxury» category hotels and a clear commitment from the tourism sector to this niche.

Barcelona, which continues to be the municipality with the highest total international tourist spending, ranks second in luxury spending. However, the proportion of luxury tourism in the city's tourist spending (16.5%) is significantly lower than that observed in Madrid (31.3%). Furthermore, luxury tourists register a slightly higher average daily expenditure in Madrid than in Barcelona, which reinforces the capital’s stronger position in the premium segment.

Coastal destinations maintain their prominence, especially in the Balearic Islands: Palma, Ibiza, Sant Josep de Sa Talaia or Calvià have a very high percentage of luxury spending on the total tourist spending of the municipality. In the province of Malaga, Marbella is consolidating itself as a highly specialised destination in that segment, while in the Canary Islands, Adeje stands out, a city with a notable concentration of five-star hotels.

Madrid’s strong dynamism has meant that, between 2019 and 2025, the proportion of luxury spending in non-coastal urban destinations has increased from 16.4% to 24.4%. These destinations have also become the most dependent on luxury tourism, which accounts for 23.0% of international tourist spending in these locations. By contrast, in coastal destinations, the relative weight of luxury tourism has decreased slightly.

What do luxury tourists spend their money on?

Finally, the analysis of card transactions at CaixaBank POS terminals allows for a breakdown of in-person payments8 by luxury tourists by spending categories. The most significant item corresponds to hotel accommodation, which accounts for 38.6% of the total. Other prominent categories include restaurants, fashion and jewellery.

Particularly noteworthy is spending in jewellery stores, where luxury tourists account for 64.5% of total spending by foreign tourists, as well as casinos (73.1%) and exclusive services such as aircraft parking (84.3%). Conversely, its weight in the supermarket category is marginal (4.5%).

This consumption pattern – high concentration in high-end accommodation, restaurants, luxury shopping and very exclusive services – reinforces the idea that luxury tourism constitutes a differentiated vector to increase the added value and quality of the Spanish tourism model.

- 8

Therefore, in-person payments exclude expenses incurred from the source country at the time of booking the trip.