CaixaBank Research wage indicator: new perspectives by company size and job tenure

The incorporation of these two new dimensions into the indicator allows wage dynamics in Spain to be monitored at a more granular level, based on the aggregated and anonymised analysis of internal data and big data techniques.

The evolution of wages is key for analysing workers’ purchasing power and macroeconomic dynamics. In contexts of high inflation, such as that recorded in 2022, monitoring wage remuneration with precise and high-frequency indicators made it possible to detect the absence of a price-wage spiral. In this context, CaixaBank Research developed a wage indicator from anonymised internal data, integrated into the Real-Time Economics portal, which now includes two important new features: disaggregation by company size and distinction between workers who stay in their company of employment and those who switch employers. These improvements allow wage dynamics in Spain to be monitored at a more granular level and complement the information provided by traditional statistics.

A solid and increasingly comprehensive indicator

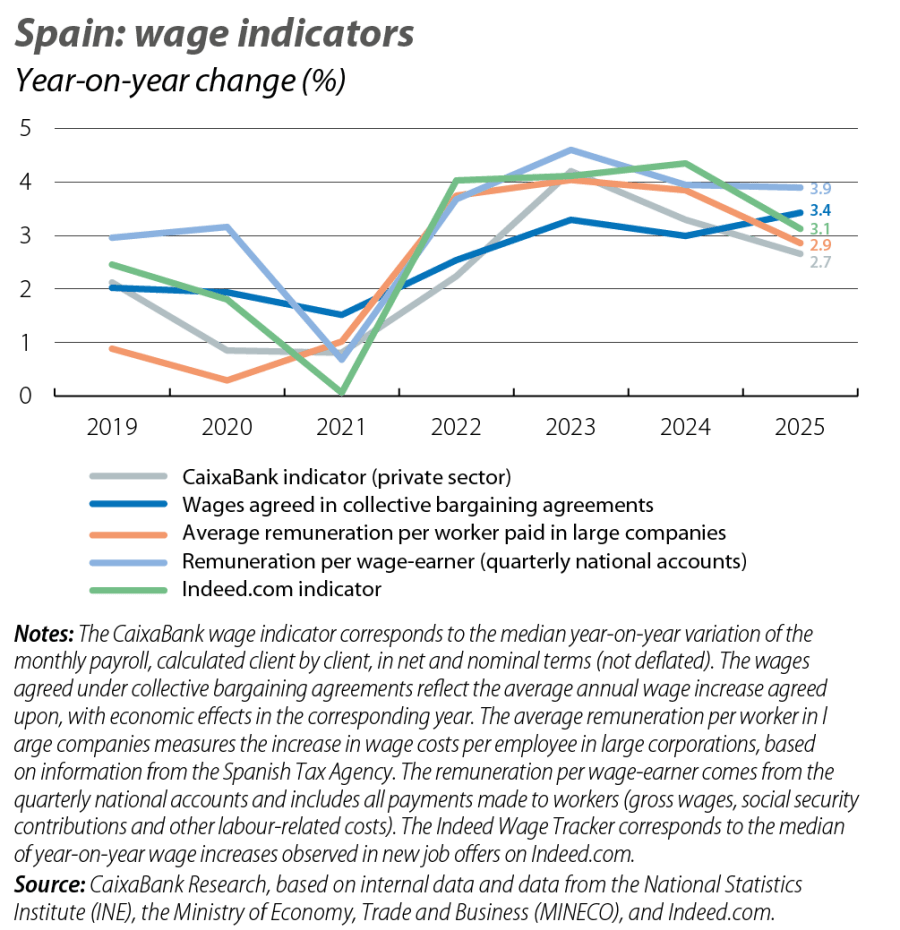

The CaixaBank wage indicator is constructed from duly anonymised account transactions that are identified as payroll.1 Comparing it with other reference indicators (wage rises agreed under collective bargaining agreements, indicators of large firms or offers on job portals, among others) shows that it reflects a similar aggregate pattern in the evolution of wages, while also providing greater granularity and a latency of just a few days. The first chart of this article illustrates these common dynamics, despite the differences between them, such as the wage rebound experienced in 2022 and 2023 and the subsequent moderation in 2024 and 2025. In 2025, wages grew by an average of 2.7% according to the indicator, 0.6 percentage points less than in 2024 and at the same rate as the CPI.

- 1

The indicator corresponds to the median of the year-on-year change in monthly payrolls, calculated customer by customer, in nominal terms (not deflated). The indicator considers payroll transfers received by customers as well as transfers issued by CaixaBank's corporate clients, avoiding duplications when both the sender and the recipient are clients. For further details, see the methodological document available at https://realtimeeconomics.caixabankresearch.com/#/monitor.

Wage differences by company size

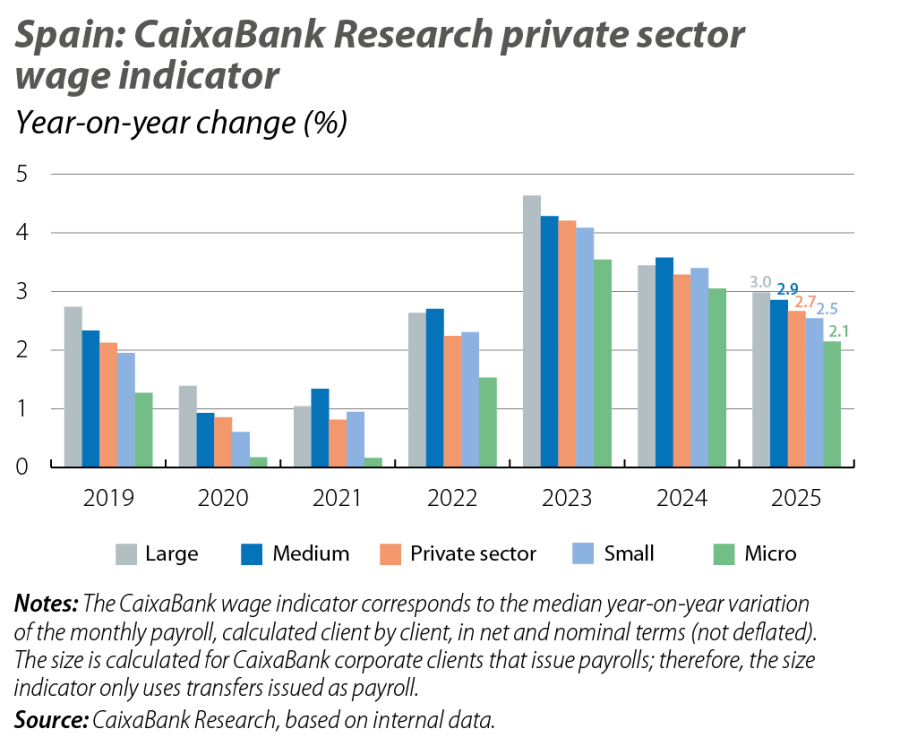

One of the new features added to the portal is the segmentation of wage growth in the private sector according to the size of the payroll-issuing company: micro-enterprises (5-9 employees), small (10-49), medium (50-249) and large (250 or more).2 The data reveal that, on average, large companies record higher wage increases: in 2025, 3.0% compared to 2.9% in medium-sized companies, 2.5% in small companies and 2.1% in micro-enterprises. This spread according to company size is observed recurrently throughout the period analysed, although it is now narrower. Economic literature extensively documents this pattern and attributes it to the higher productivity and income distribution capacity that exists in large companies, as well as their ability to attract and retain higher-skilled profiles (Brown and Medoff, 1989; Bloom et al., 2018).

- 2

The size is calculated for CaixaBank corporate clients that issue payrolls; therefore, the size indicator only uses transfers issued as payroll.

To stay or to switch: the impact of labour mobility on wages

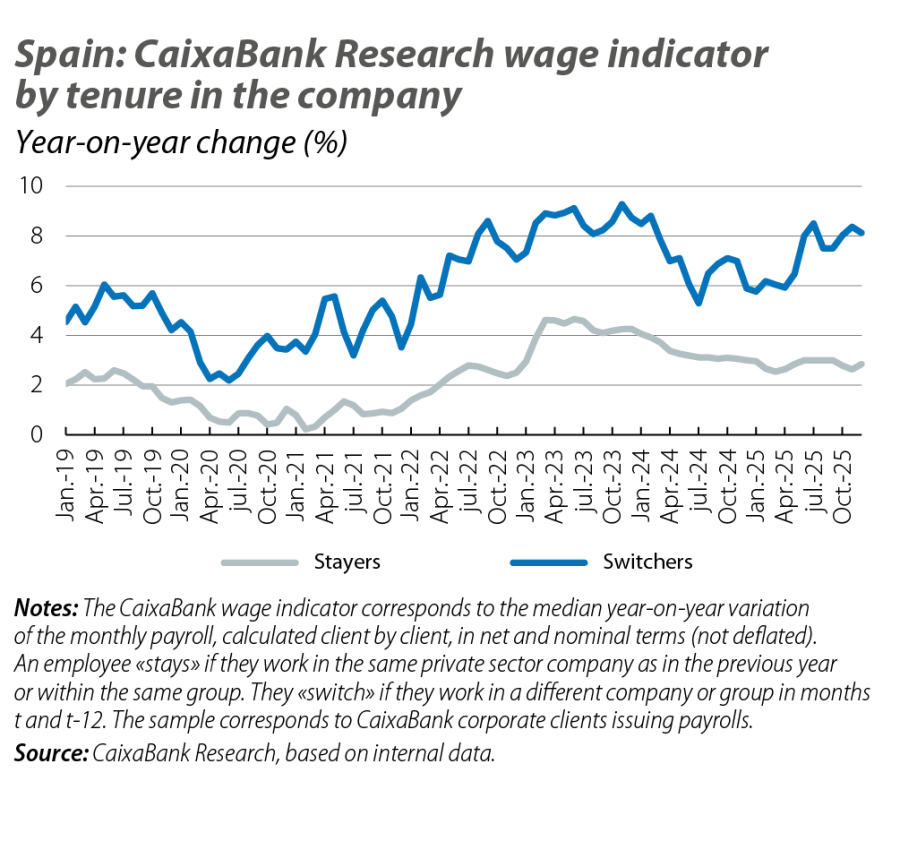

The second axis distinguishes between those who remain in the same company and those who change employers within a 12-month period.3 The results show that workers who switch companies experience significantly higher wage increases than those who stay at the same company. Mobility is a common channel for achieving improvements in remuneration, especially where there is a shortage of certain profiles or intense competition for skilled labour.

The wage gap between those who stay and those who switch companies can help to shed light on the degree of tension in the labour market, among other things: it was low in 2020-2021 during the pandemic and higher from 2022 onwards amid the economic recovery and inflationary pressures. In 2025, wage growth among stayers moderated (+2.8%, compared to 3.3% in 2024), while for switchers it remained high (7.2%). This pattern suggests localised tensions in certain occupations, leading companies to offer higher wage increases in order to attract certain talent profiles.

- 3

An employee «stays» if they work in the same private sector company as in the previous year or within the same group. They «switch» if they work in a different company or group in months t and t-12. The sample corresponds to CaixaBank corporate clients that issue payrolls. The definition is similar to that used to distinguish switchers and stayers in the wage tracker produced by the Federal Reserve Bank of Atlanta (https://www.atlantafed.org/chcs/wage-growth-tracker).