Spanish industry spearheads growth

The Spanish economy is continuing to outperform expectations in 2025, with strong, balanced growth driven by investment and private consumption. This buoyancy is also evident in its sectors of activity: of the 22 sectors analysed in this report, 16 are undergoing an expansionary phase in 2025, compared to only 2 in 2023. The greatest momentum can be seen in industry, where growth is being led by the extractive, chemical, pharmaceutical and refining industries, thanks to high investment, productivity gains and adaptation to the energy transition. Construction and real estate activities are also performing strongly, boosted by residential demand. Although some sectors, such as the textile and wood industries, are facing structural challenges, the economy as a whole is moving towards a more sustainable and diversified growth phase. This climate, marked by a healthy labour market, lower interest rates and stimulus from EU funds, is strengthening the resilience of the Spanish economy in a global environment that is fraught with challenges.

An economy that is continuing to outperform expectations

Once again, the strength of the Spanish economy exceeded expectations in 2025. GDP has grown by 3.0% year-on-year up to Q3 2025, surpassing initial forecasts. This growth has been driven by both investment and private consumption, and has taken place in a challenging international climate marked by trade tensions and subdued foreign demand.

Improving indicators (e.g. the composite PMI), strongly performing tourism and job creation (2.5% year-on-year growth in Q3) reinforce the impression of an economy that is gaining solid momentum. Factors such as population growth (the population has increased by 1% per year for three consecutive years), improving productivity (GDP per hour worked has risen by 1% every year since 2022, double the rate in 2015-2019) and an upturn in investment, especially after the shift in monetary policy in 2024, are helping to anchor the expansion.

The outlook remains positive for the short and medium terms: in fact, CaixaBank Research recently revised our GDP growth forecast upwards for 2025, from 2.4% to 2.9%, and we anticipate 2.1% growth in 2026. This trend will be underpinned by the recovery of household purchasing power, lower interest rates, significant job creation and the boost in investment stemming from European NGEU funds. All indications are that growth will increasingly be driven by domestic demand, especially private consumption and investment.

In this context, the CaixaBank Research Sectoral Indicator, a synthetic indicator that combines information from 17 variables on activity, the labour market and the foreign sector,1 shows that growth in the Spanish economy remains buoyant towards the end of 2025, although it also indicates that growth peaked in Q1 2025 and is now slowing to a more modest pace.

- 1

This indicator is calculated on a monthly basis for 24 sectors of activity, including the four main sectors: the primary sector, manufacturing industry, construction and services, with figures compiled since January 2011. It should be noted that the indicator does not include activity in the energy, financial, general government and health sectors.

The expansionary cycle is spreading to an increasing number of sectors

The momentum of the Spanish economy is continuing to gradually spread to a growing number of sectors. In 2025, around three out of four sectors that were analysed have grown in line with or above their long-term trend, according to our Sectoral Indicator. This multi-sector boom is reminiscent of the pre-pandemic period (2015-2018), when 80-95% of sectors experienced strong growth. We are yet to achieve such broad-based growth, but the trend is moving in that direction. In fact, against a backdrop of monetary policy normalisation and the consolidation of EU funds, in 2026-2027 we can expect most of Spain’s production sector to operate close to its long-term trend, repeating a pattern similar to that seen in the second half of the last decade.

Many sectors are growing above their long-term average rates

Momentum is chiefly being driven by the Spanish industrial sector, most notably the extractive industry. Among non-industrial sectors, construction and real estate activities stand out

Broadly speaking, the industrial sectors are driving the current momentum, as can be seen in the chart on the previous page: 7 of the 10 manufacturing sectors included in our analysis are currently growing above their long-term trend, after several years of more muted performance. These are joined by the extractive industry, which is experiencing the highest relative growth of all sectors, thanks to favourable conditions, as it has become a key sector for the energy transition, electric mobility and digitisation. Spain has the potential to be a major European player in this sector, given its reserves of critical minerals.2

Among the remaining non-industrial sectors, the strong performance of the construction sector is particularly noteworthy. This is currently one of the most buoyant sectors, doubtless benefiting from the clear need to expand the housing supply in our country. Real estate activities are also performing well, supported not only by the buoyant residential sector, but also by other segments such as logistics, trade and even the hotel sector, driven by the Spanish market attracting domestic and international investment, thanks to its attractive yields and the strength of the Spanish economy.

However, among the sectors that are currently growing at below historical average rates, we can identify several groups with differing characteristics. Firstly, we would highlight transportation and logistics, and ICTs. Although their growth rates are very strong, they are below their potential capacities. Their medium- and long-term outlooks are very positive, as they are benefiting from major structural trends, such as the boom in e-commerce, the digitisation of production processes and the transformation of business services.

- 2

Spain is the leading European producer of several minerals: the only producer of strontium and sepiolite, the leading producer of fluorspar and gypsum; the second-biggest producer of copper, magnesite and potassium salts; and the world’s top producer of roofing slate.

Transportation and logistics and ICTs are experiencing rapid growth, but below their capacity. The textile and footwear industry and wood and furniture manufacturing industry have the poorest performance and outlook

At the other end of the spectrum, sectors such as textiles and footwear and wood and furniture manufacturing recorded a fall in their respective sectoral indicators. Their medium-term outlook is less encouraging: the textile industry is still being hit by offshoring and competition from manufacturing economies with lower costs, while the wood and furniture manufacturing industries are being hampered by high energy costs and international competition.

Sectors such as the hotels and restaurants industry and transport equipment manufacturing lie somewhere in between. The growth rates of the hotels and restaurants sector are returning to normal after several years of rapid expansion and their more subdued growth rates are not surprising. Meanwhile, transport equipment manufacturing is still being affected by strong global competition in the race for electric vehicles (the European industry is still struggling with competition from Asian brands, which are further ahead in the electrification of their models). However, the transport equipment industry could benefit from increased defence spending in the future, which may result in higher demand for other types of transport equipment.

Shared characteristics of the best-performing sectors in Spain

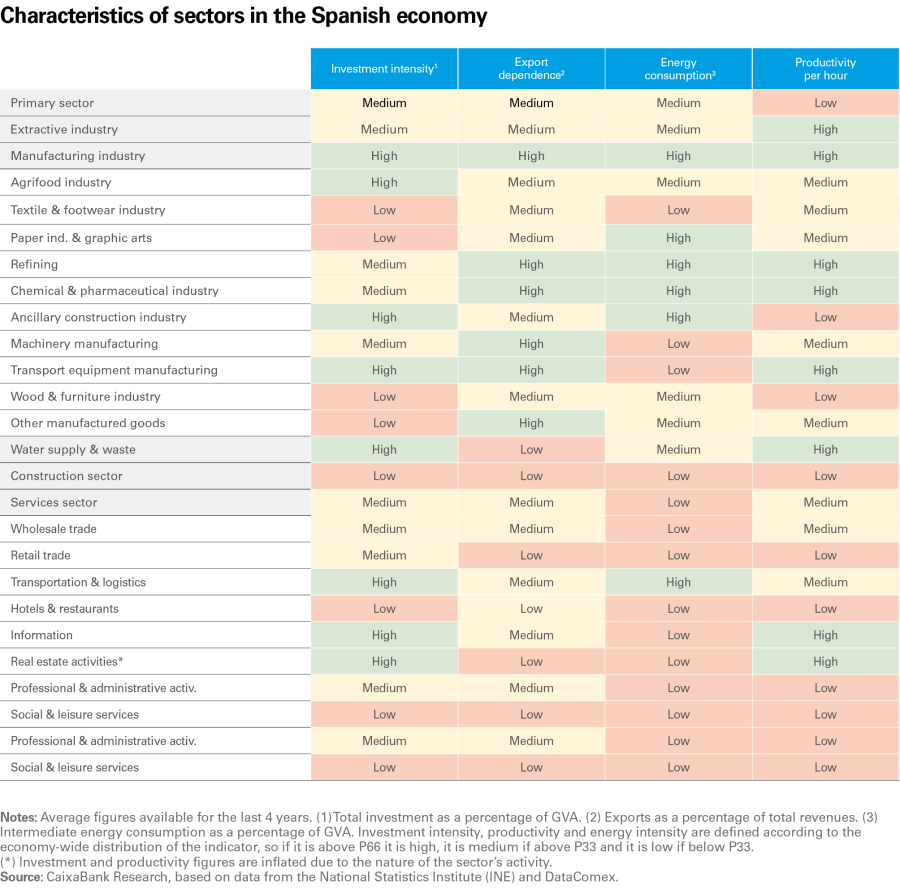

The table on the following page provides an overview of the sectors according to key variables such as investment, export orientation, energy consumption and productivity which, alongside idiosyncratic factors, have shaped the performance of the various sectors.

In this regard, the best-performing industrial sectors (extractive, chemical and pharmaceutical, and refining industries, among others) are broadly characterised by high investment intensity, high energy consumption (they may be benefiting from a more favourable relative performance of energy prices compared with the euro area) and higher productivity, which has enabled them to better absorb cost increases without passing them on in prices, thereby maintaining their competitiveness. The latter two factors are vitally important in the current climate, which is why we have devoted one article to each of them in this same Sectoral Observatory to examine them in greater depth: «The keys to the good performance of Spanish manufacturing» and «The transformation of the Spanish labour market: an industry-based perspective».

It is also worth noting that these industrial sectors have performed relatively well in recent months despite their high dependence on exports, which have been hampered by the weakness of some of our main trading partners and hit by the protectionist shift in the US economy. Nevertheless, there is no doubt that the ’foreign sector’ component of our Sectoral Indicator has had a negative impact on the overall growth of the economy in the last few quarters.

Most sectors are currently in an expansionary phase

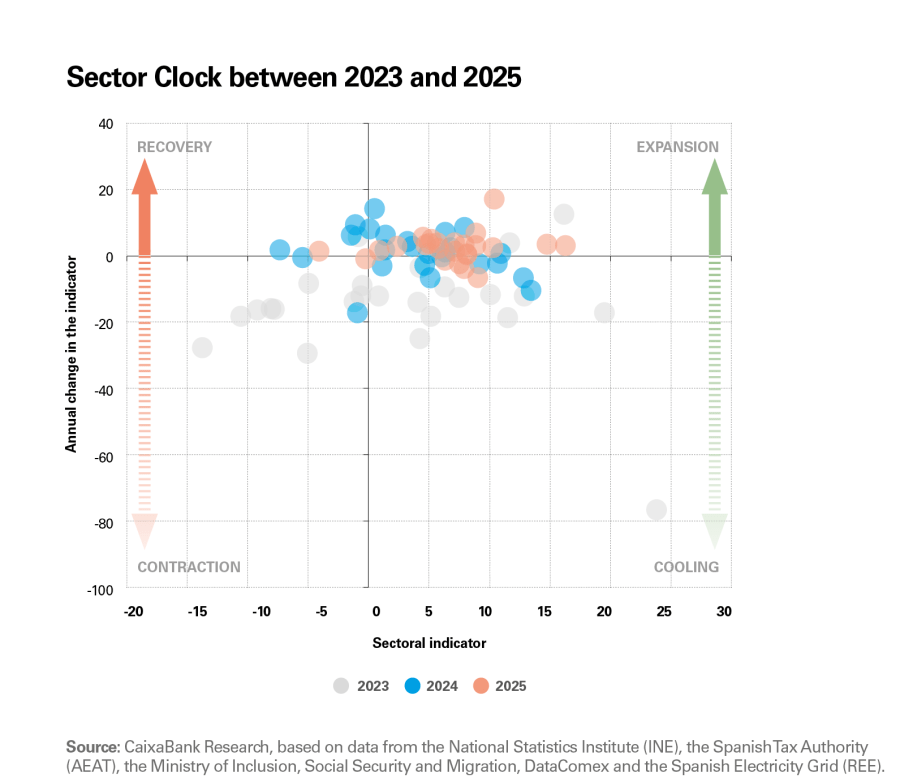

Lastly, a final analysis shows where the different sectors of activity currently stand in the business cycle. For this purpose, we use CaixaBank Research’s Sector Clock3 which reveals that the Spanish economy’s current expansionary phase has been broadened significantly in 2025.

The chart below compares each sector’s current point in the cycle in 2025 (orange circles) with its position in 2023 –a year marked by the tightening of financial conditions– and in 2024, when an upturn started to be observed following the shift in monetary policy. In 2025, 16 of the 22 sectors analysed are expanding, significantly more than the 10 sectors that were expanding in 2024 and the mere 2 in 2023. This suggests that the upsurge that began last year has become consolidated and spread to an increasingly broad spectrum of the production sector.

In overall terms, the Spanish economy is in a phase of cycle normalisation, marked by more balanced and sustainable growth. After the strong post-pandemic upswing (2021-2022) and the subsequent cooling caused by external shocks –such as geopolitical conflicts and rising interest rates–, the current climate combines stronger domestic demand, gradually improving financial conditions and greater price stability. This environment supports more uniform growth across sectors, making it more resilient and reducing reliance on specific drivers of activity.

- 3

CaixaBank Research’s Sector Clock considers the indicator value (horizontal axis) and the change with respect to the previous year (vertical axis). The resulting quadrants reveal the sector’s current position and its recent trend: expansion (positive indicator and growth in the last year); cooling (positive indicator, but declining over the last year); contraction (negative indicator and declining over the last year); and recovery (negative indicator, but increasing over the last year).