Spain’s catering sector kicks off the year on a good footing, despite the blackout

The catering sector is continuing its good streak in 2025, with solid growth in spending thanks to the boost from both national and international tourism. Although the pace of growth has moderated compared to previous years, the data show a clear resilience, even after the power blackout on 28 April, which dealt a temporary blow to the sector’s turnover.

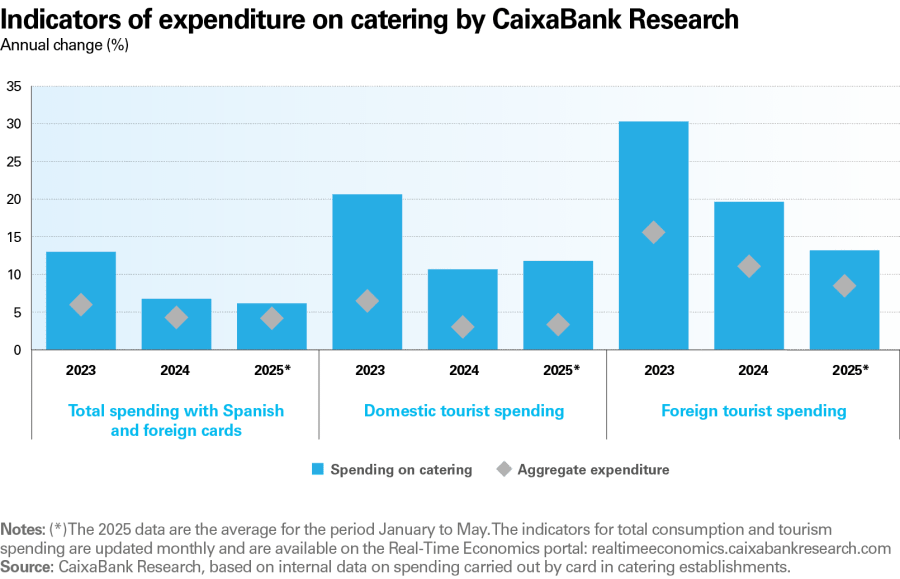

Spain’s catering sector has kicked off 2025 on a good footing, prolonging the upward trend of previous years.6 However, the pace of growth has moderated: according to data from the National Statistics Institute (INE), turnover was up 2.6% year-on-year on average in Q1 2025, compared to 6.5% in 2024 and 9.7% in 2023. The pattern shown by the CaixaBank Research catering spending indicator7 is similar: total expenditure on catering, which includes both in-person and electronic payments with Spanish and foreign cards, grew by 6.4% year-on-year on average between January and May 2025. This falls short of the growth recorded in 2024 and 2023 (6.7% and 12.9%, respectively), although it is more than 2 pps above the growth of total consumption, which encompasses all items of expenditure.

The granularity offered by our internal data allows us to confirm that the buoyancy of the tourism sector explains the strength of catering spending. On the one hand, domestic tourist spending on catering grew by 12.8% year-on-year between January and May 2025, surpassing the figure of 2024 (10.6%). On the other hand, spending on catering by international tourists who visited Spain during the same period recorded rapid growth of 12.6%. Despite registering a slight slowdown compared to 2024 (19.5%), it is once again evident that the boost from international tourism is key for the catering sector. So much so that, according to our estimates, around 30% of Spain's catering establishments are highly dependent on spending by tourists, with 10% of them being dependent on international tourists.8

- 6

See «The catering sector in Spain in 2024: what the data from millions of card payment transactions reveal» published in the Tourism Sector Report of S1 2025 and «Snapshot of the catering sector in Spain: from bars to Michelin stars» published in the Tourism Sector Report of S2 2024.

- 7

The CaixaBank Research consumption indicators track consumption trends in Spain, based on duly anonymised internal data from payments made with cards issued by CaixaBank, as well as from spending recorded on CaixaBank POS terminals and withdrawals from CaixaBank ATMs. The can be found at: https://realtimeeconomics.caixabankresearch.com/

- 8

An establishment is considered to be dependent on tourism if the spending of domestic or foreign tourists represents at least 33% of its total annual turnover. For an analysis of the pattern of spending on catering using internal data, see the article «An exceptional year for the catering sector in Spain», published in the Monthly Report of April 2024.

Impact of the blackout on catering spending

The blackout on 28 April 2025 left the entirety of mainland Spain without electricity during a time of day which had a direct impact on the turnover of catering establishments.9 The power cut started at around 12:30pm, just before lunch time, and did not end in many cases until after dinner time. Based on card payment data, we estimate that spending on catering fell by 57% that day due to the blackout, a bigger drop than that registered by the aggregate consumption of all Spanish households on the same day (34%).10 Similarly, the days following the blackout show a rapid recovery in aggregate consumption, which was less pronounced in the case of catering due to the nature of expenditure in this sector (the food and drink not served that Monday were unlikely to have been postponed to the Tuesday). From 29 April onwards, there are no longer any substantial differences between the spending on catering recorded in mainland Spain and in the rest of the country.

If we compare spending by the hour on the mainland and on the islands and in Ceuta and Melilla before the blackout, we can see that before 12:30pm the level of spending is practically the same in both geographical areas. However, from 12:30pm onwards, there was a sharp fall in in-person catering consumption paid for by card on the mainland, whereas the other areas followed the usual pattern of spending for this type of establishment.

- 9

It should be noted that a limitation of this analysis is that we do not observe cash spending in catering establishments, so the figures should be interpreted as the maximum estimated impact.

- 10

To obtain this estimate, we compared the pattern of card spending on the day of the blackout with the usual spending pattern on Mondays, and with the spending observed in areas where there were no power cuts. See: «Valoración del impacto económico del apagón del día 28 de abril | CaixaBank Research» (content available in Spanish).