When will the savings rate of Spanish households decrease?

In this article, we analyse the latest data on the savings rate of Spanish households, which remains high, and the structural and economic factors that explain its evolution. This helps us to understand what its trajectory might be in the coming years.

High savings driven by the strength of incomes

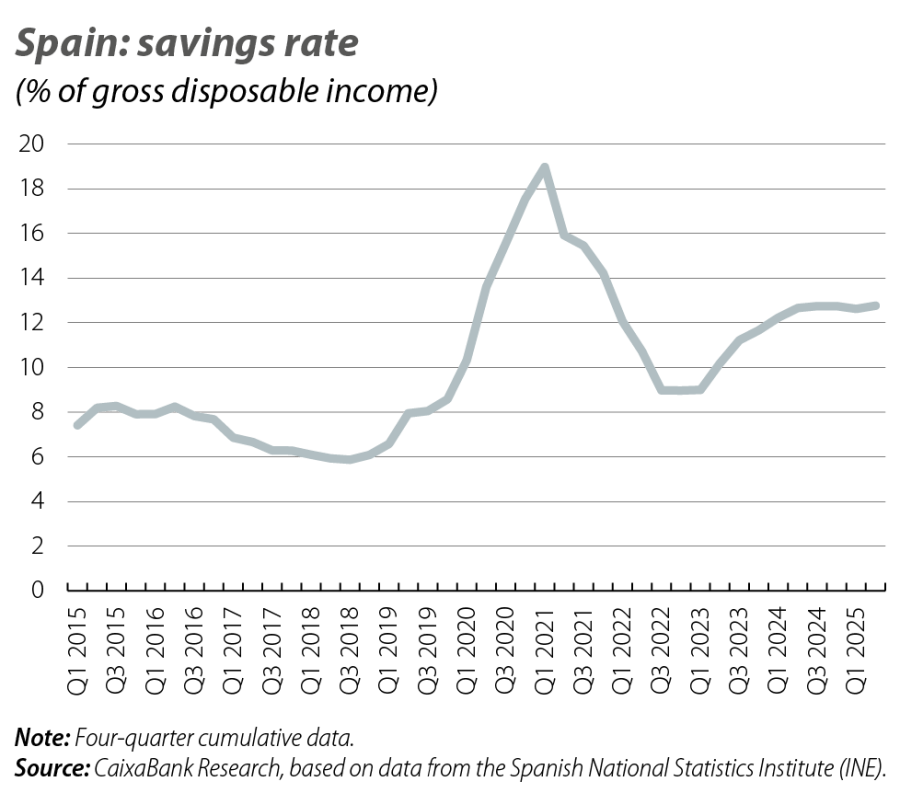

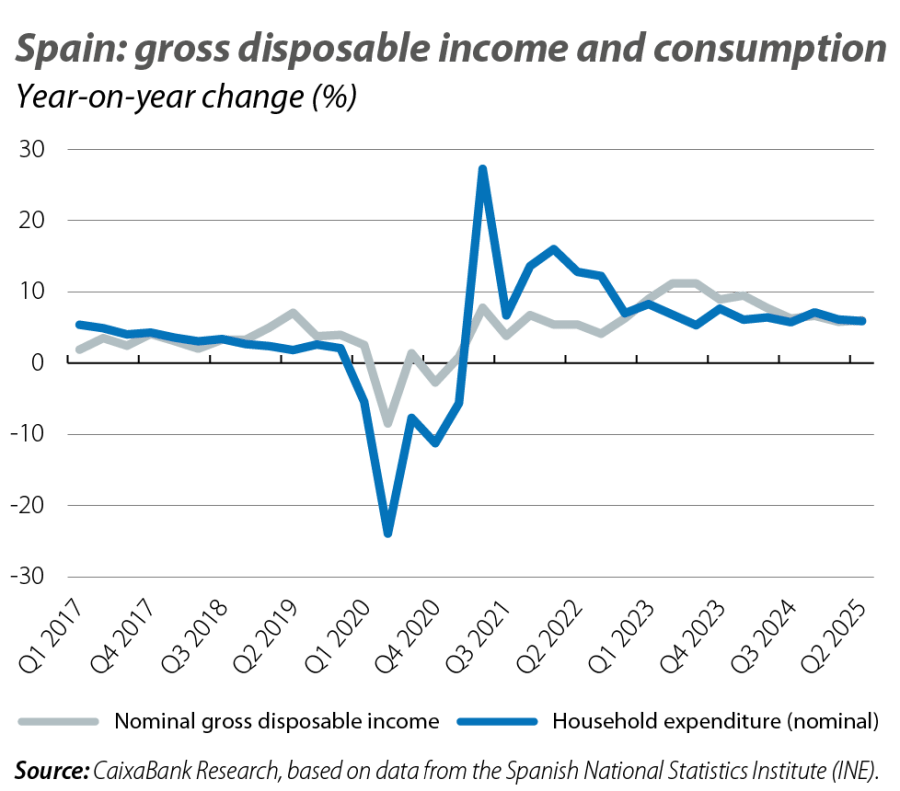

In cumulative terms for the trailing four quarters, the household savings rate in Q2 2025 rose slightly to 12.8% of gross disposable income (GDI), compared to 12.6% in the previous quarter. This level remains well above the average for the period 2015-2019 (7.2%) and prolongs the rebound that began in 2023. The practical stabilisation of the savings rate at high levels has occurred due to a convergence in the growth rate of GDI and household expenditure, which stand at 6.0% and 5.9% year-on-year, respectively.

Key factors in the evolution of the savings rate: empirical evidence in the case of Spain

According to the economic literature, there are several factors that must be taken into account in explaining the evolution of the savings rate. The key factors include interest rates, since if they increase, they make savings more attractive; inflation, as it influences purchasing power and, therefore, the ability to save; and the unemployment rate, since if this increases, savings increase for precautionary reasons. It is also important to take into account demographics, given the traditional life-cycle effect whereby the savings rate is higher among middle-aged people and lower among young people and retirees. Another important factor is uncertainty, as this stimulates savings for precautionary reasons.

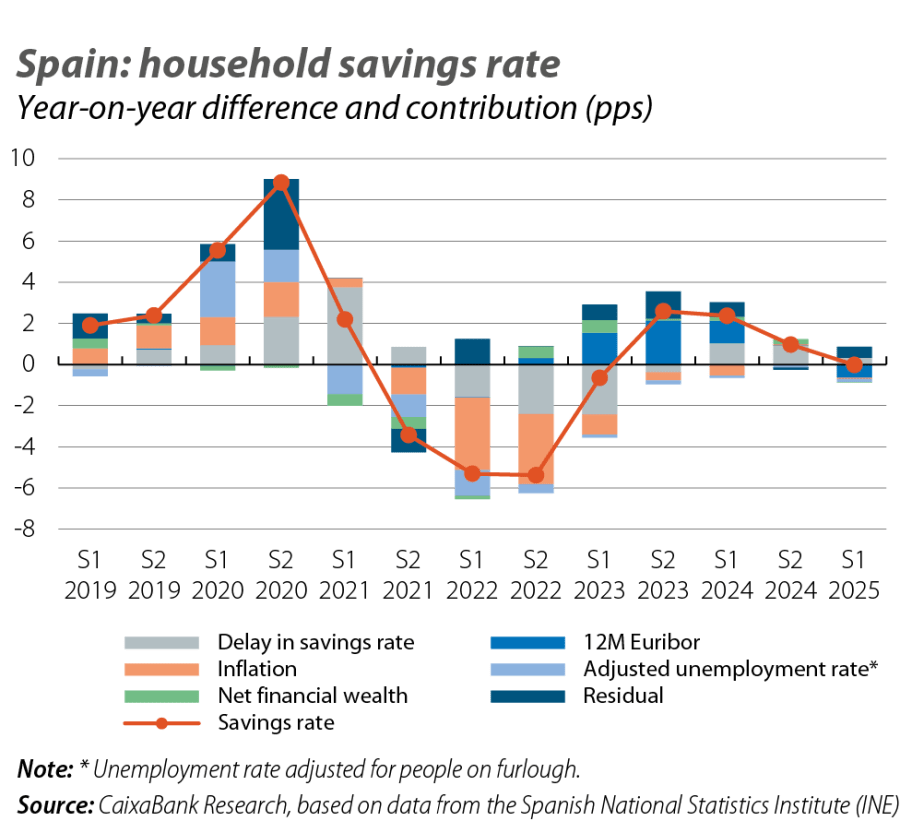

To analyse the impact and the relative importance of these factors, we performed a linear regression analysis between the change in the savings rate and the change in the 12-month Euribor (as a proxy for interest rates), inflation, the change in the unemployment rate (adjusted for the number of people on furlough), the change in the economic policy uncertainty (EPU) index for Spain published by the Bank of Spain, the change in net financial wealth as a percentage of GDP and the change in the weight of a set of age groups relative to the total population.

This analysis confirms a clear relationship between the savings rate and four main factors: interest rates, inflation, unemployment and net financial wealth. The effects are as expected. Higher interest rates encourage savings; high inflation diminishes purchasing power and thus reduces the ability to save; higher unemployment drives precautionary savings; and more financial wealth encourages consumption and reduces saving, although this effect is less pronounced. On the contrary, uncertainty is not significant and demographic variables are generally unstable or not statistically significant, perhaps because they change very gradually and this makes it difficult to capture their short-term effect.

The model we estimate has a high explanatory power and clearly describes the evolution of the savings rate in recent years. This can be seen in the third chart, where we show, with a semi-annual frequency, the year-on-year differences in the savings rate and the contributions of each explanatory factor to these movements. As can be seen, according to the model, the increase in the unemployment rate was the main factor behind the increase in savings that we saw during the pandemic (beyond the impact of mobility restrictions, which is no doubt what is reflected in the residual). From 2021 onwards, the savings rate began to moderate due to the revival of the labour market and, in 2022, it began to fall due to the rise in inflation. Finally, the new rebound in the savings rate that we saw in 2023 is explained by the combination of the moderation of inflation rates and the impact of the interest rate hikes, which incentivise savings. In the last two semesters we have seen the savings rate stabilise due to the fading impact of interest rates – in fact, with the rate cuts implemented during 2024 and early 2025, in the most recent semester they have applied downward pressure on savings.

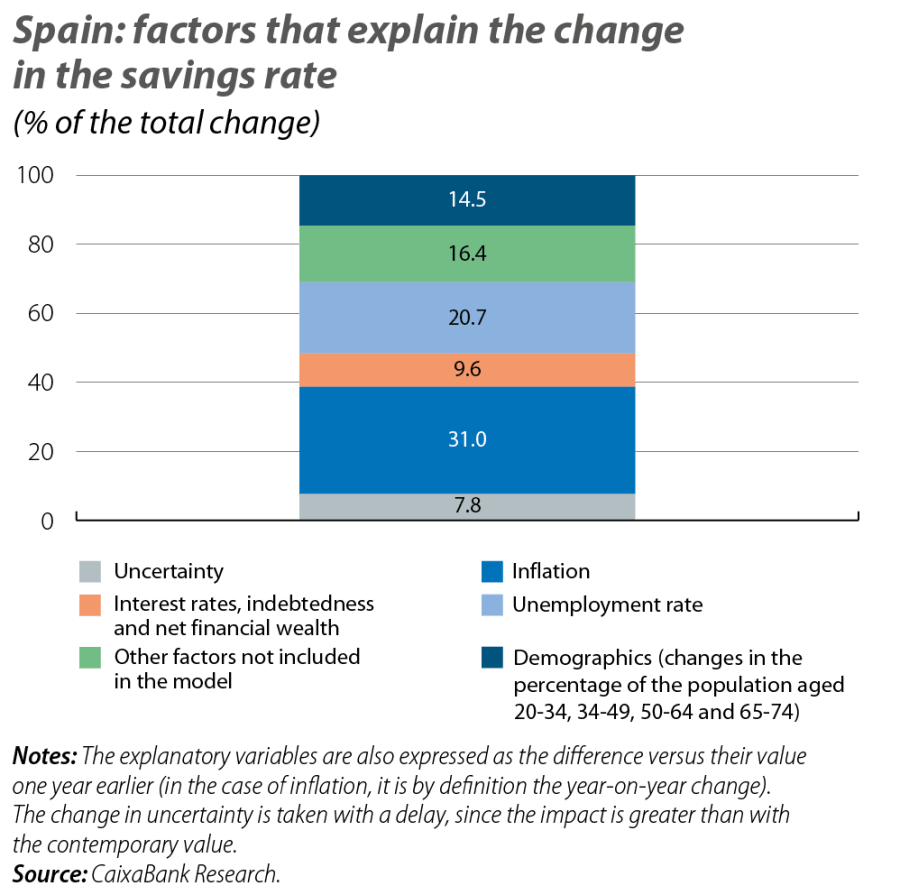

Finally, we carried out a decomposition exercise on the variance in order to quantify the relative importance of each factor in explaining the evolution of the change in the savings rate of households in Spain in the last 25 years. The results (see fourth chart) show that inflation and unemployment are the most determining factors and explain more than half of the total variance. Demographics have a more limited impact (14.5%), while macrofinancial factors (interest rates, financial wealth and indebtedness) and uncertainty contribute less, explaining between 10% and 8% of the change, respectively.

Outlook for the savings rate: reduction in the coming years, but mild

In 2025, we expect GDI to grow at around 5.5%, supported by a strong labour market and increased pension spending, which, combined with a similar increase in nominal consumption, would keep the savings rate at around 13%. In 2026, we anticipate that the growth of GDI will moderate to 4.0%-4.5%, while consumption will grow slightly faster than GDI, thus initiating a reduction of the savings rate. This decline will be driven by unemployment falling below 10%, lower uncertainty following the stabilisation of tariffs and the gradual effect of lower rates on financial decisions. The unknown is the speed at which this adjustment will take place.

To shed some light, the model estimated above can provide some guidance. If we assume that inflation will converge on the 2% mark in 2026, that the Euribor will stabilise around its current level of 2.2%, that the unemployment rate will gradually decrease to a range of between 8% and 9%, and that net financial wealth will grow at its historical average rate, we find that the savings rate should converge towards 10% in the next five years. This is substantially lower than the current rate of around 13%, but somewhat higher than its historical average.

In short, the savings rate remains high, which strengthens households’ future spending capacity. After stabilising in 2025, we expect to see a steady decline in the coming years. Each point less in the savings rate raises GDP by approximately 0.45 pps. Thus, the estimated cumulative fall of 3 pps between 2026 and 2030 would contribute around 0.3 pps per year to GDP growth.