The Portuguese economy, supported by domestic demand and with balanced public accounts

Year-on-year GDP growth accelerated to 2.4% in Q3 (1.8% in Q2), and the outlook for 2026 remains positive

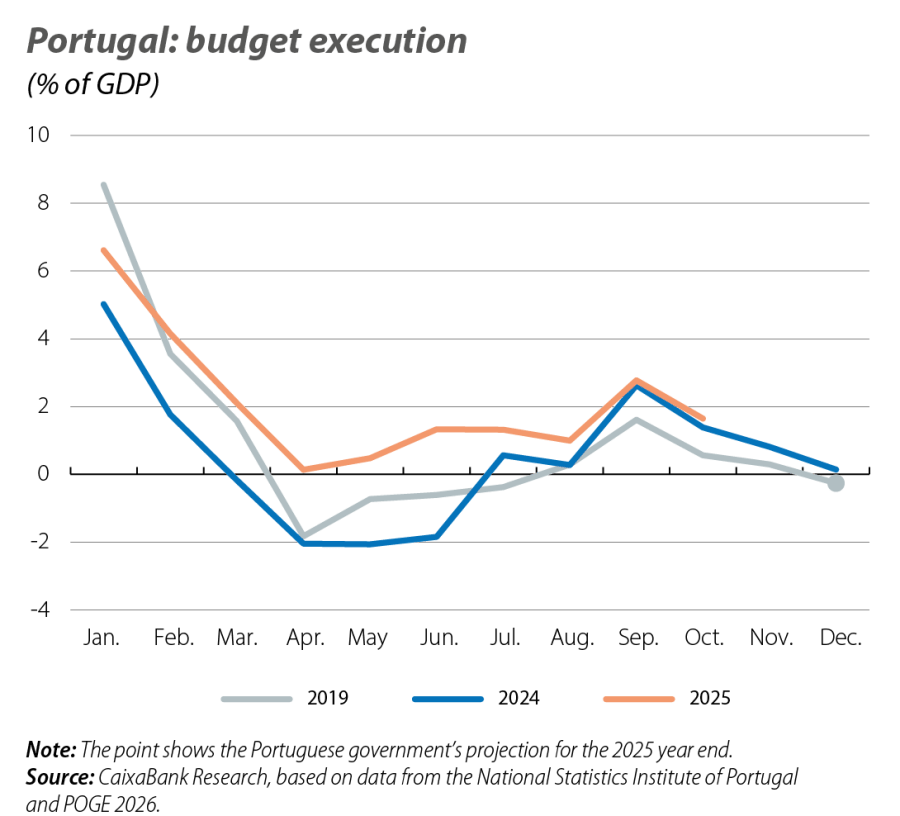

In Q3, domestic demand contributed 3.6 pps, benefiting from the strength of private consumption (+4.0% year-on-year) and investment (+4.0%). Foreign demand continued to contribute negatively to GDP growth (–1.2 pps), albeit to a lesser extent than in Q2. In quarter-on-quarter terms, the growth rate stood at 0.8% driven mostly by the strength of investment (+3.3% quarter-on-quarter, +1 pp) amid significant growth in transport equipment. In this context, we expect the Portuguese economy to grow by around 2% in 2026. The support of investment, driven by the acceleration of NGEU funds and lower financing costs, will be a key factor. Meanwhile, private consumption will continue to support growth, benefiting from a solid labour market, the recovery of incomes and the accumulation of savings in recent years. On the other hand, the negative contribution from foreign demand will persist due to the moderate outlook for export growth and the continued strength of imports. Fiscal policy will continue to be a supporting factor for the economy. In this area, budget execution data reinforce the expectation that the budget balance may end 2025 even above the government’s forecast (0.3% of GDP), offering greater fiscal room for manoeuvre for next year.

Activity data for Q4 remain scarce, but the sentiment indicators point to a stabilisation of confidence levels

The European Commission’s economic sentiment indicator recovered in November to 106.5 points (vs. 104.5 in October, 106.2 in Q3). Similarly, the Portuguese National Statistics Institute’s economic climate indicator accelerated to 3.1% in November, placing the quarter average at 3%, 0.1 pp higher than in Q3, as a result of improved sentiment in the manufacturing sector. Sentiment in the services sector deteriorated, reflecting a slightly more cautious outlook for demand in the coming months. On the other hand, consumer confidence suffered a slight deterioration in November, indicating greater uncertainty about the economic situation in the country.

Inflation continues to moderate, while employment is growing at the fastest pace in the post-pandemic period

In November, headline inflation fell to 2.2% (2.3% in October), placing the average inflation rate for the past 12 months at 2.4%. The core index also declined, reaching 1.9% (2.1% in October). The negative month-on-month change in both indices is consistent with their historical seasonal pattern and paves the way for the year to close with inflation of close to 2%. The population in employment, for its part, reached a new all-time high in Q3. The year-on-year increase of 3.7% is largely explained by the health and social support, hospitality and catering, and information technology sectors. The monthly data also reveal the dynamism of the labour market, with employment growth in excess of 3% year-on-year in October.