The positive trend in the Portuguese economy continues at the end of the year

Activity indicators point to a dynamic economy at the end of the year, while consumption continues to show resilience

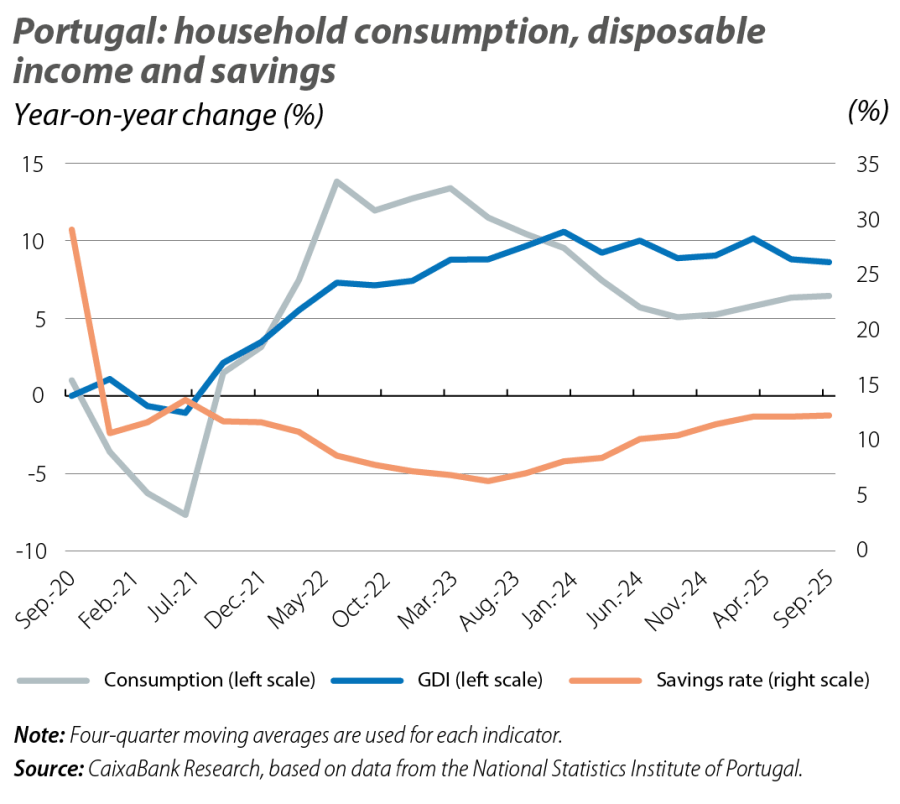

In the first three quarters of the year (Q1 2025-Q3 2025), GDP grew by 1.9% (–0.1 pps compared to the same period of the previous year). On the other hand, private consumption continued to contribute to the strength of activity, accelerating to 3.8% (+1.2 pps compared to the same period of the previous year), driven by a strong labour market and tax withholding reductions in August and September (with retroactive effects). From an income perspective, household incomes continue to grow steadily, although they are showing some signs of deceleration. On average, gross disposable income (GDI) grew by 7.6% year-on-year in the year up to Q3 2025 (–1.3 pps versus the previous year). Consumption, meanwhile, shows a moderate acceleration, driven by the strength of employment and wage growth, and the average savings rate remains stable (12.3%). Also, in November the employed population accelerated once again. The provisional estimate by INE points to an annual increase of 3.8%, which would place the average growth rate for those 11 months of the year at 3.2% (compared to 1.4% in the same period of 2024). In this context, the total number of people employed in Portugal once again reached a new all-time high (of 5,306,100 people). At the same time, the unemployment rate reached 5.7%, a reduction of 0.1 pp compared to October and of 0.9 pps compared to November 2024.

House prices continue to rise sharply

In Q3 2025, the house price index climbed 17.7% year-on-year, placing the average house price growth over the last year at 15.7%. The latest data reflects a continuation of the rally seen in recent quarters, with quarter-on-quarter growth rates exceeding 4%. Q3 is also the fourth consecutive quarter in which the number of sales transactions has exceeded 40,000 (42,400, +3.8% compared to Q3 2024, –1.0% compared to the previous quarter). According to bank appraisal data, the above-average increases in value (in terms of value/m²) correspond to homes in the Setúbal Peninsula, Médio Tejo, and Lezíria do Tejo, which reflect upward pressures extending to an increasingly wider ring around the Lisbon Metropolitan Area.

Average inflation in 2025 was 2.3%

With the headline CPI standing at 2.2% in December (the same as in November), 2025 ended with an average inflation rate of 2.3%. The core index, for its part, stood at 2.1% year-on-year in December (vs. 2.0% in November). Although the slowdown in inflation in 2025 has been confirmed, it was less than we had initially expected, mainly due to the persistence of services inflation and the higher-than-expected increase in the price of unprocessed food products. The current forecast for 2026 places the headline CPI at 2.1%, very close to the ECB’s 2% benchmark rate for the euro area as a whole, maintaining the disinflationary trend observed in 2025. On the energy front, we foresee support for the disinflationary process based on an average Brent price lower than that recorded in 2025, while in the food sector, high output and cereal reserves should also favour some relief in processed food prices.