Portugal: 2025 with more employment and robust growth

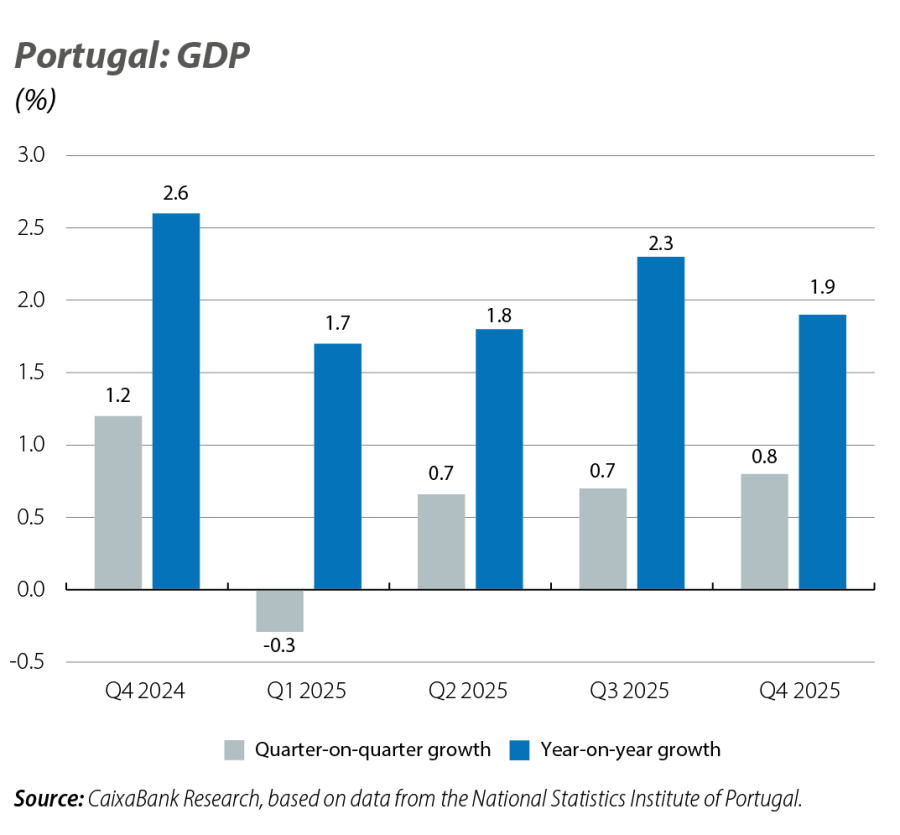

GDP grew by 0.8% quarter-on-quarter in Q4 2025, bringing annual growth for the year to 1.9%

Quarterly performance was weighed down by a negative contribution from domestic demand, driven by a steep drop in investment. The tax reforms announced for 2026 may have led to the postponement of investment decisions, especially in the construction sector. The contribution from foreign demand, meanwhile, was positive due to the reduction of imports. The better-than-expected performance of economic activity and the acceleration observed in the final part of the year suggest that the risks to our GDP growth forecast for 2026 (2.0%) are skewed to the upside. The carry-over effect has been reinforced in a context dominated by a number of factors that should stimulate the economy over the course of the year, such as an acceleration of investment, favoured by the execution of NGEU funds and favourable financing conditions, and the strength of the labour market. Foreign demand will continue to weigh on growth, given the high import intensity of domestic demand and the prevailing global uncertainty. Also, the available data for January point to an economy in expansion. The European Commission’s economic sentiment indicator remains above 100 points, despite the drop to 104.2 points in January (vs. 107.2 in December).

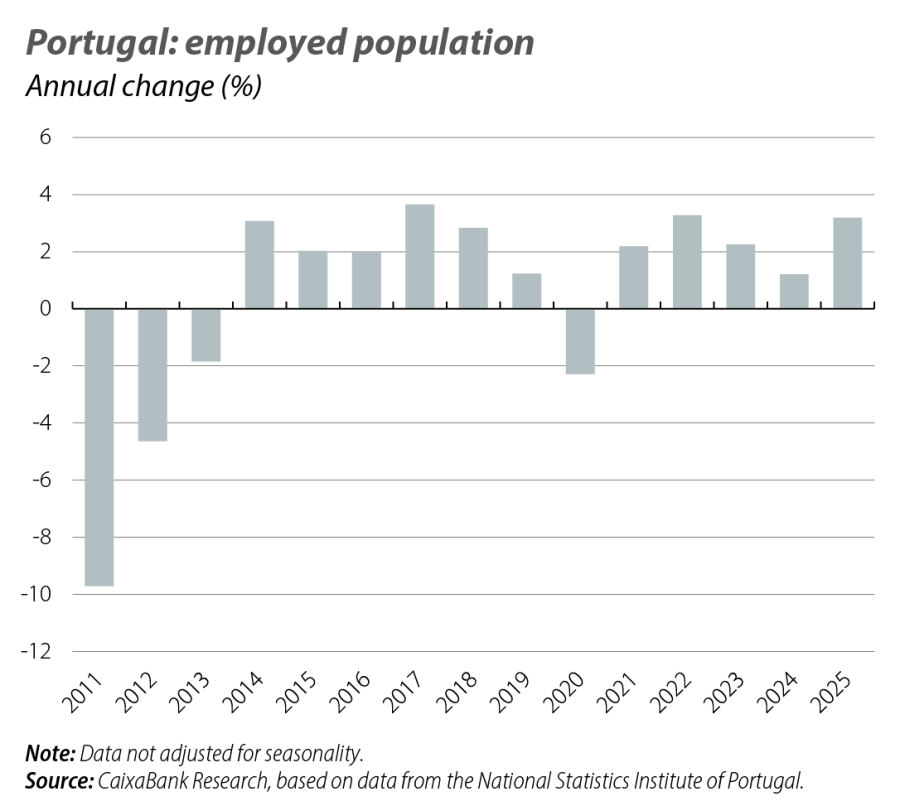

As the year draws to a close, the labour market stands out as a bright spot

Employment grew by 3.7% year-on-year in Q4, placing the annual growth rate at 3.2%, similar to that recorded in 2022. The tertiary sector was the main driver of this growth, with notable contributions from human healthcare and social support activities, as well as accommodation and food services. Also of note was the creation of more stable employment, with the increase in permanent contracts exceeding that of other types of contracts. The unemployment rate remained unchanged in Q4 (at 5.8%) and placed the annual average for 2025 at 6.0%.

Inflation enters 2026 below 2%

The year-on-year rate of change in the CPI stood at 1.9% in January (vs. 2.2% in December) while core inflation fell to 1.8% (vs. 2.1% in December). A stronger euro and stable energy prices are expected to aid the ongoing gradual disinflation, even as escalating trade tensions and geopolitical risks could still generate upward pressure.

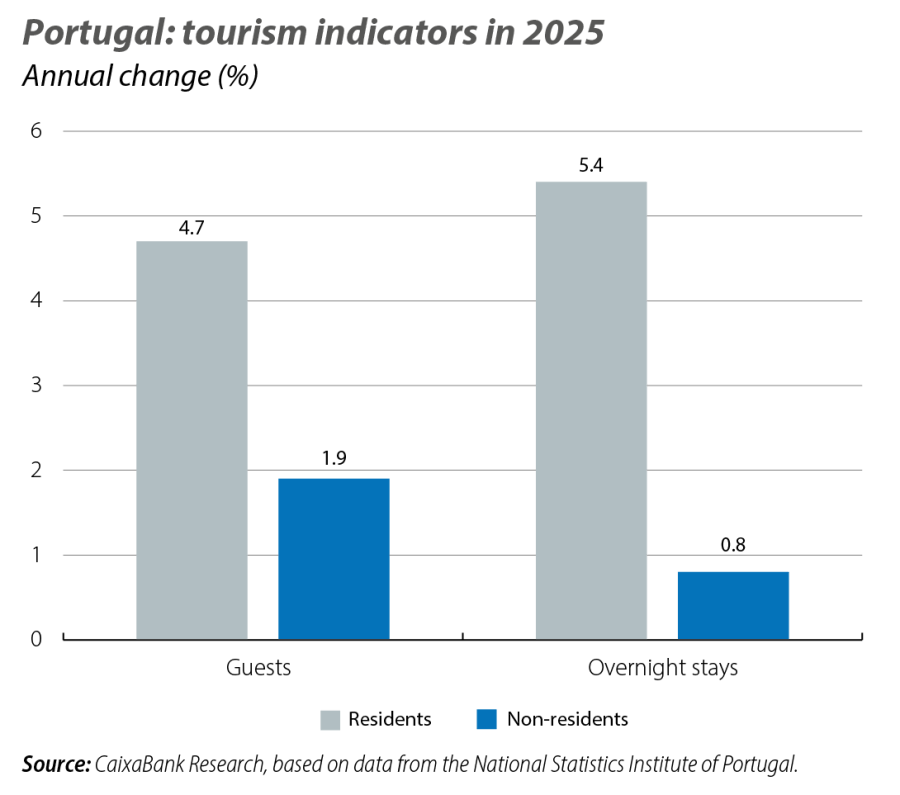

Public finances and the tourism sector close the year on a notably strong footing

The budget execution up to December revealed a surplus of 0.4% of GDP in the public-sector accounts (compared to 0.1% in 2024), surpassing the government’s estimate of –0.3%. The increase in revenues (+7.6%) exceeded the growth in expenditure (+6.9%). In particular, expenditure was almost 2.3 billion euros below expectations, with public investment being notably lower (–1.75 billion euros). In the tourism sector, 2025 saw new record figures for guests, overnight stays and turnover. The growth in guests and overnight stay metrics was mainly supported by resident tourism (4.7% and 5.4%, respectively), while it was more moderate among non-residents.