The Spanish economy closes 2023 with a better rating than expected

The Spanish economy ended 2023 with a better tone than had been anticipated at the beginning of the year

While it is true that there was a slowdown in growth during the second half of the year, this began later than expected and is proving more moderate than had been feared a year ago. Whereas at the beginning of 2023 the analyst consensus placed GDP growth for the year as a whole at 1.3% (FUNCAS Panel), today it places it at around 2.4%, a figure consistent with CaixaBank Research’s own estimate. Moreover, all indicators suggest that in 2024, especially during the second half of the year, the economy could regain some momentum, and this should allow the pace of GDP growth in Q4 2024 to approach 2.0% year-on-year.

The growth rate slowed in Q3 2023, but moderately

In its second estimate of GDP for Q3, the National Statistics Institute confirmed that growth stood at 0.3% quarter-on-quarter, 0.1 pps below the rate recorded in Q2 and 0.2 pps below the average quarterly growth for the last year. Thus, GDP stood 2.1% above the level of Q4 2019. By components, the rate of progress in household consumption and public consumption stand out, both in excess of 1% quarter-on-quarter. In the opposite direction, of particular concern is the poor evolution of investment, which registered a fall of 1.0%, and above all exports of goods and services, which are down 4.1% due to the weakness of our main trading partners.

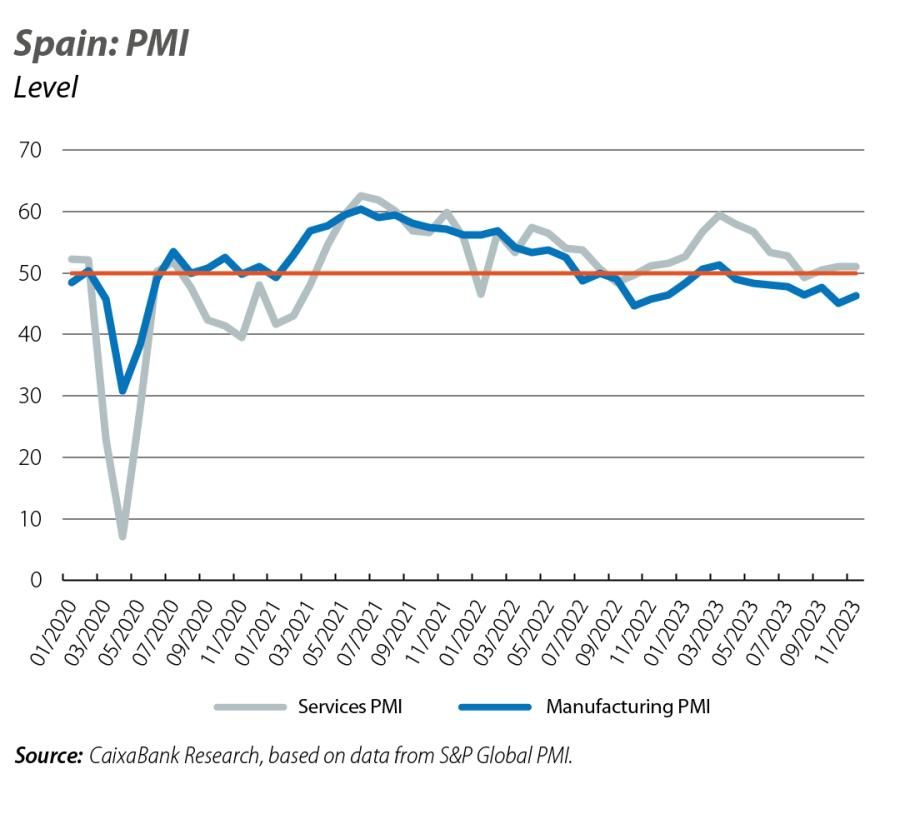

Following the moderation of growth in Q3 2023, the latest indicators suggest that the growth rate has stabilised in the closing stages of the year

In December, the Purchasing Managers’ Index (PMI) for the services sector remained in expansionary territory and stood at 51.5 points (0.5 points above the November figure). Meanwhile, the PMI for the manufacturing sector remains in contractionary territory and was down 0.1 points, at 46.2. Thus, the Composite PMI increased slightly and stood at 50.4 points (49.8 in November), placing the average for the quarter at 50.1, the same level as in the previous quarter. On the other hand, the main driver of growth of the Spanish economy, consumption, is also offering encouraging signals. Specifically, the CaixaBank Research consumption tracker shows that spending conducted with Spanish cards on CaixaBank POS terminals plus cash withdrawals grew by 5.9% year-on-year in Q4 (with data up to the third week of December), representing a 0.4-pp acceleration compared to the figure for Q3.

The labour market holds up well and continues to create jobs, albeit at a more moderate rate

In December, the number of people affiliated with Social Security increased by 29,937, beating last year’s figure of 12,640, although this remains below the average for the period 2014-2019. The increase in affiliated workers, corrected for seasonal effects, amounted to 23,287 people, marking the biggest monthly increase since May. In Q4 as a whole, the increase in registered workers stood at 0.2% quarter-on-quarter, a similar rate of growth to Q3, suggesting that the pace of economic growth has stabilised.

Inflationary pressures continue to moderate

Specifically, the headline inflation rate fell 0.1 pps in December and stood at 3.1%, according to the CPI flash estimate published by the National Statistics Institute. In line with the pattern of moderation of inflation in recent months, the core inflation rate fell by 0.7 pps for the second consecutive month and stood at 3.8% year-on-year. Since July, core inflation has come down significantly, specifically by 2.4 pps.

The government confirms the extension of the anti-inflation measures for 2024

At the end of December, the government set out the measures it would keep in place this year in order to continue tackling inflation. Of particular note in this regard is the rise in VAT on electricity throughout 2024, and until 31 March in the case of gas, to 10%. It should be recalled that this stood at 5% in 2023, while prior to the energy crisis it was 21%. On the other hand, excise duty on electricity and the tax on the value of electricity production will gradually increase throughout the year. With regard to VAT on food, the reduction from 4% to 0% on fresh basic food, and from 10% to 5% on pasta and oil, will remain in force until 30 June. Finally, in terms of transport, the general support measures in place during 2023 will be extended throughout 2024. The extension of many of the measures introduced in 2023 will reduce the impact on inflation that their anticipated withdrawal was expected to have in CaixaBank Research’s forecast scenario, so inflation in 2024 could be slightly lower than forecast.

The buoyancy of household income favours a new rebound in the savings rate

Specifically, gross disposable household income grew by a remarkable 10.6% year-on-year in Q3, while final consumption expenditure increased by 4.5%. As a result, the savings rate climbed to 11.0% (cumulative four-quarter figure), representing a 1.1-pp increase compared to Q2 2023. Moreover, this figure is well above the average recorded between 2015 and 2019 (6.8%). All this suggests that, despite the headwinds that are affecting many families, household consumption, in aggregate, may continue to grow in the coming quarters and will remain an important support factor for the Spanish economy as a whole.