The Spanish economy remains dynamic in the final stretch of 2025

The November activity indicators point to a very positive Q4 for the Spanish economy, while inflation stabilises at still somewhat high levels and the house price rally shows no sign of easing. The current account surplus is reduced by the strength of imports, as is the public deficit compared to last year.

The November activity indicators point to a very positive Q4

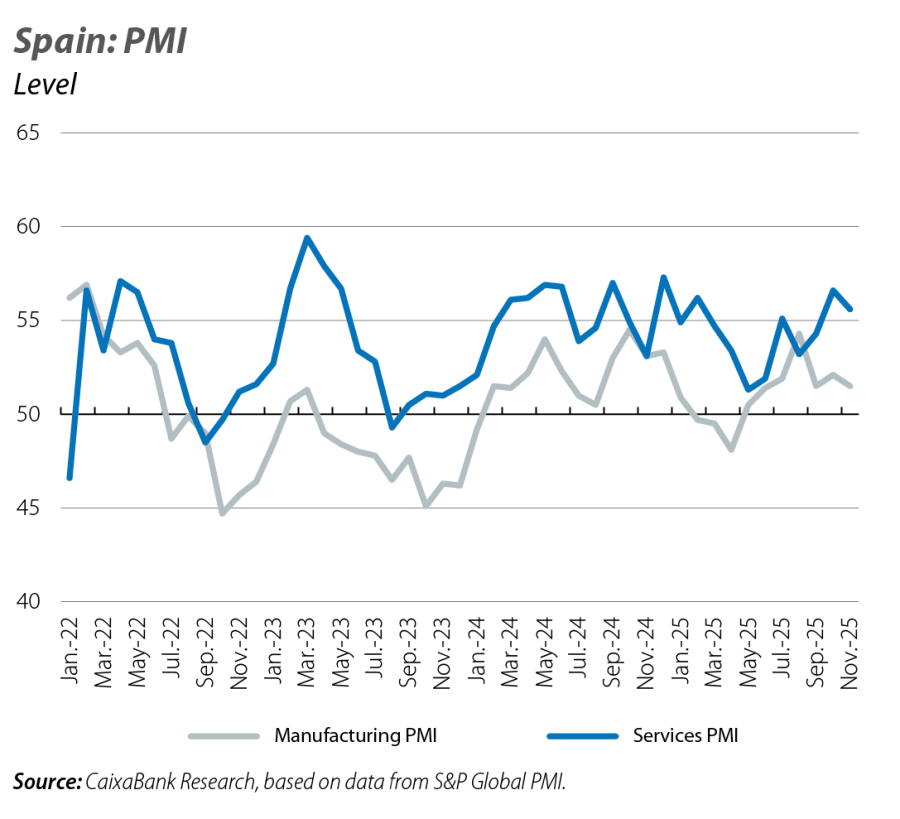

Private consumption remains dynamic, supported by the gradual recovery of household real disposable income and lower interest rates. At the same time, business activity indicators are strong and the labour market continues to create jobs. This context leads us to anticipate a better end of the year than expected. Specifically, the CaixaBank Research consumption indicator shows that spending on Spanish cards in the first three weeks of November increased by 6.9% year-on-year, well above the 3.2% of Q3. Also, the retail trade index, deflated and corrected for seasonality effects, recorded a significant increase of 3.8% year-on-year in October. On the supply side, the PMI for the manufacturing sector stood at 51.5 points in November, slightly below the previous month’s level of 52.1 points and that of Q3 (52.6), but still comfortably above the threshold that denotes growth in the sector (50 points). In addition, the services sector’s PMI reached 55.6 points, a high figure which, although slightly lower than October, is higher than Q3 (54.2).

Good labour market data in Q4

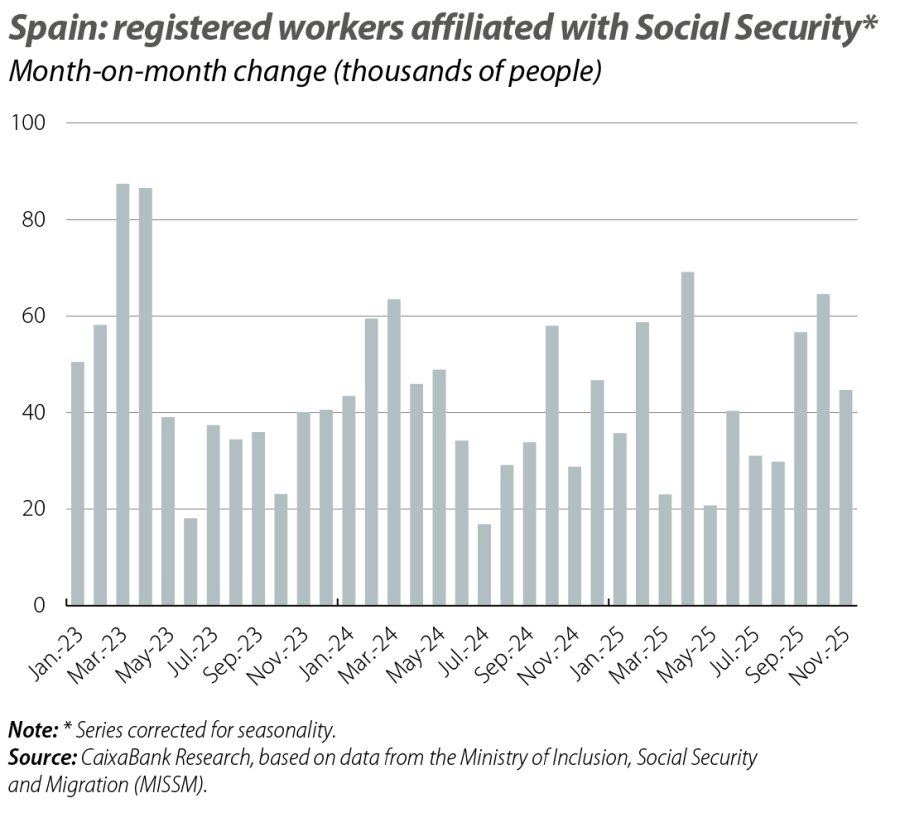

In November, traditionally a month of declines in the number of registered workers due to the fall in employment in the hospitality industry, the labour market showed a good tone: Social Security affiliation fell by 14,358 people compared to October (–0.07%), less than in previous years, and in seasonally adjusted terms it increased by 44,734 people. Thus, affiliation rose in October-November by 0.6% quarter-on-quarter (adjusted for seasonality), 0.1 pp more than in the previous quarter, suggesting an improvement in the pace of job creation. This positive trend indicates that more jobs will have been created in 2025 than in 2024, which is indeed significant: affiliation has increased by 474,846 workers in the first 11 months of the year versus 462,276 in November 2024. Another positive development is that registered unemployment fell by 18,805 people compared to October, to 2.42 million.

Inflation stabilises at still somewhat high levels

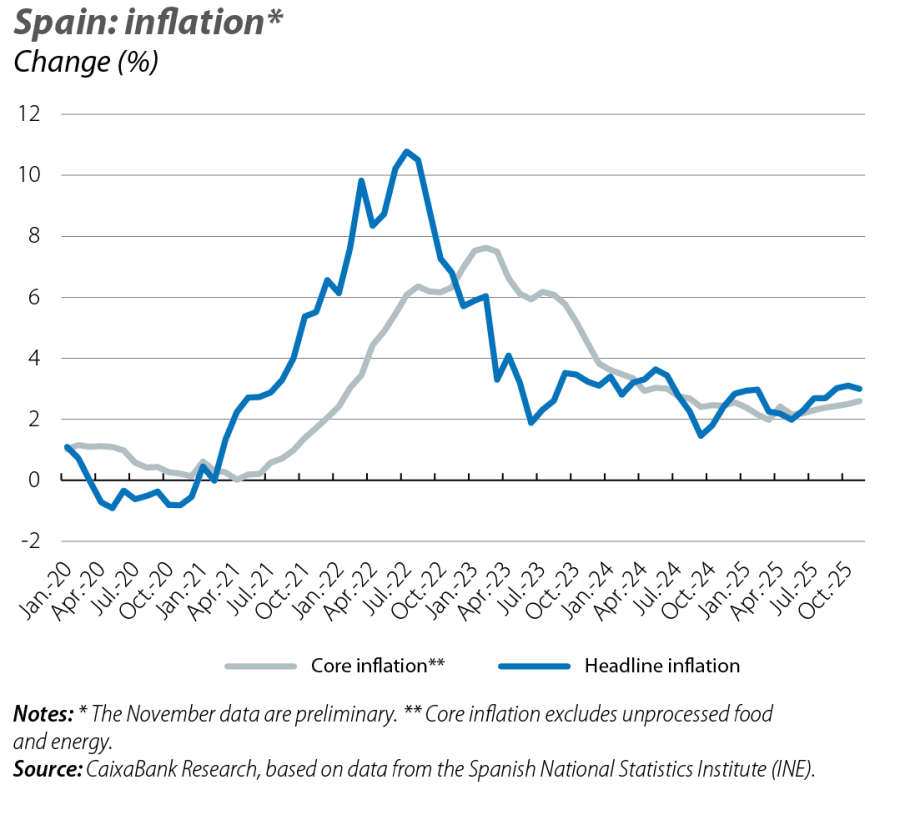

The CPI flash indicator for November stood at 3.0%, 0.1 pp lower than in October, representing a stabilisation after the upward trend observed since May, when inflation was 2.0%. The slight decline was more modest than expected; the price of electricity fell less than expected compared to October, while food and leisure and culture applied upward pressure. Thus, there are upside risks for the inflation forecast due to greater-than-expected inertia in services-related inflation, coupled with the resistance shown by electricity prices to substantially correct.

The current account surplus is reduced by the strength of imports

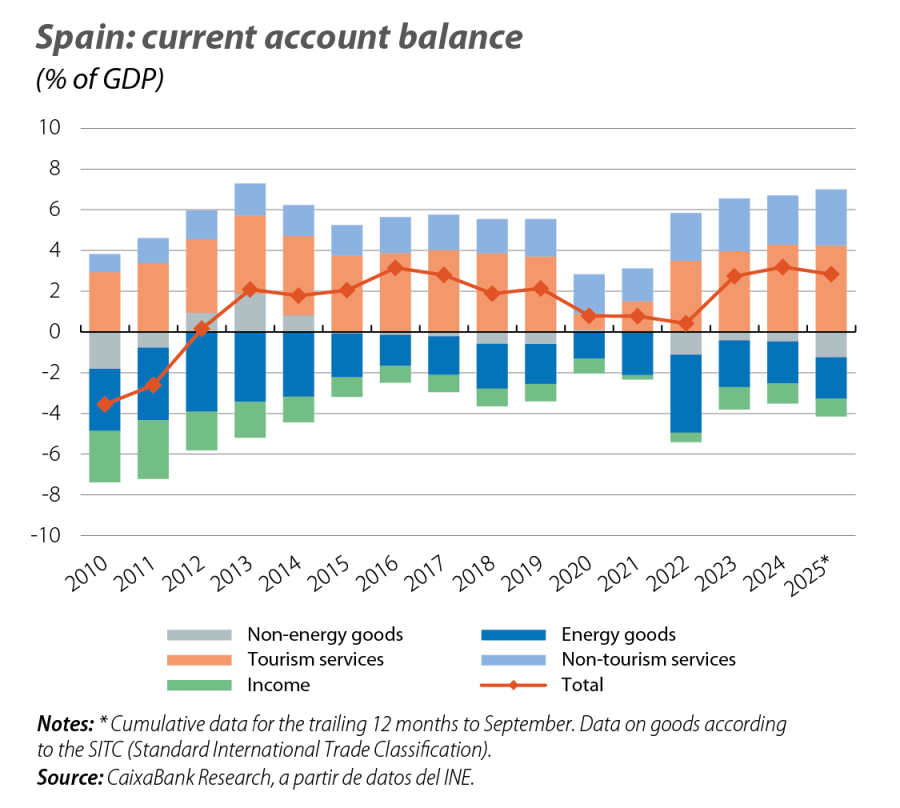

The current account balance up until September, in cumulative terms for the trailing 12 months, showed a surplus of 2.8% of GDP, 0.3 points less than in 2024 as a whole. The setback was primarily due to the significant dynamism of imports of non-energy goods, which supplied strong domestic demand and was much greater than that of exports. This left a deficit in the balance of non-energy goods of 1.2% of GDP, 0.7 points more than at the end of 2024. The energy deficit, for its part, recorded a slight improvement, standing at 2.0% of GDP compared to 2.1% in 2024, with prices continuing to fall (–15% year-on-year in 2025). On the services side, the growth of non-tourism services stands out, with a surplus of 2.7% of GDP compared to 2.4% in 2024, amid a 10% year-on-year increase in exports. Tourism continued to perform well, with a surplus of 4.2% of GDP, following its record of 4.3% last year. By geographical area, between January and September, of particular note was the 7.4% year-on-year fall in exports of goods to the US, which left a trade deficit of almost 10.8 billion with the North American country (10,785.6 million, to be precise).

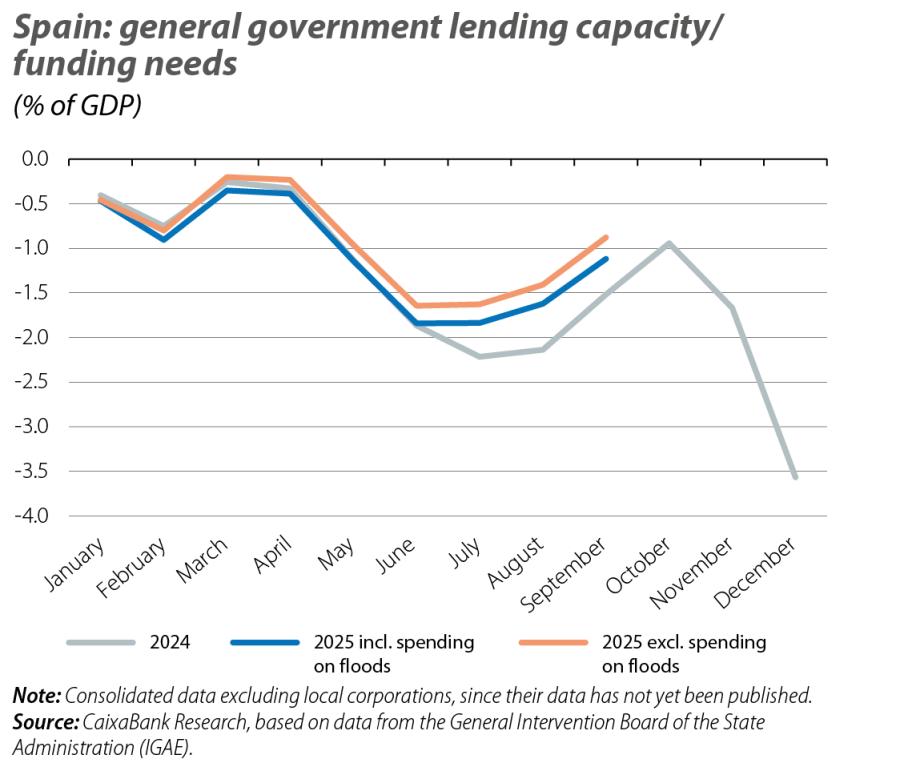

Reduction of the budget deficit up until Q3 compared to last year

Up to September, the consolidated general government deficit (excluding local government corporations) fell to 1.1% of GDP, compared to 1.5% in the same period of 2024, thanks to the strength of public revenues (+7.2% year-on-year) versus more contained expenditure (+5.7%). In nominal terms, the deficit is 23% lower than a year ago. Tax collection revenues grew by 7.8%, driven by both direct taxes (+9.9%) and indirect taxes (+7.3%), while social security contributions rose by 6.5%. On the expenditure side, of particular note is the increase in social benefits (+6.3%), while that of wage earners’ remuneration remained moderate (+3.1%), pending the retroactive application of the 2.5% wage rise agreed in December. With these trends, all the indicators suggest a deficit of around 2.5% of GDP in 2025 (vs. 3.2% in 2024), which is better than our current forecast of 2.7% prepared with data from the first half of the year.

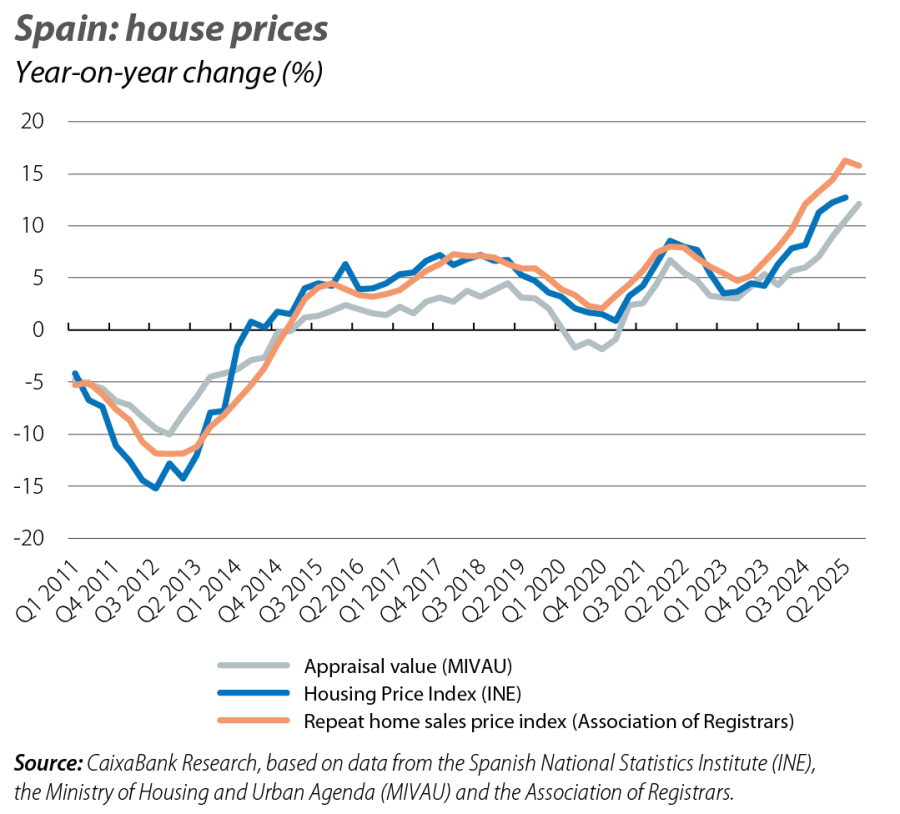

The house price rally shows no sign of easing

The appraisal value of unsubsidised housing grew in Q3 by 3.0% quarter-on-quarter and by 12.1% year-on-year, an acceleration from the 10.4% recorded in Q2 and the biggest increase since 2005. This rebound reflects the imbalance between supply and demand, although in real terms the price remains 27% below the 2007 peak. In this context, sales are showing some volatility: after several quarters with increases in excess of 10%, August saw a fall in sales of 3.4% and in September there was a slight rebound of 3.8%. Nevertheless, the volume remains high, with 707,800 sales transactions closed in the past 12 months, the highest figure since 2007.