The Spanish economy weathers the tariff storm

The strong performance of the Spanish economy in 2025 is mainly explained by the vigour of domestic demand, driven by a dynamic labour market, the decline in interest rates, migration flows and European funds. These factors have more than offset the negative impact of the tariff hikes imposed on our goods exports to the US.

The Spanish economy successfully navigates a year fraught with challenges

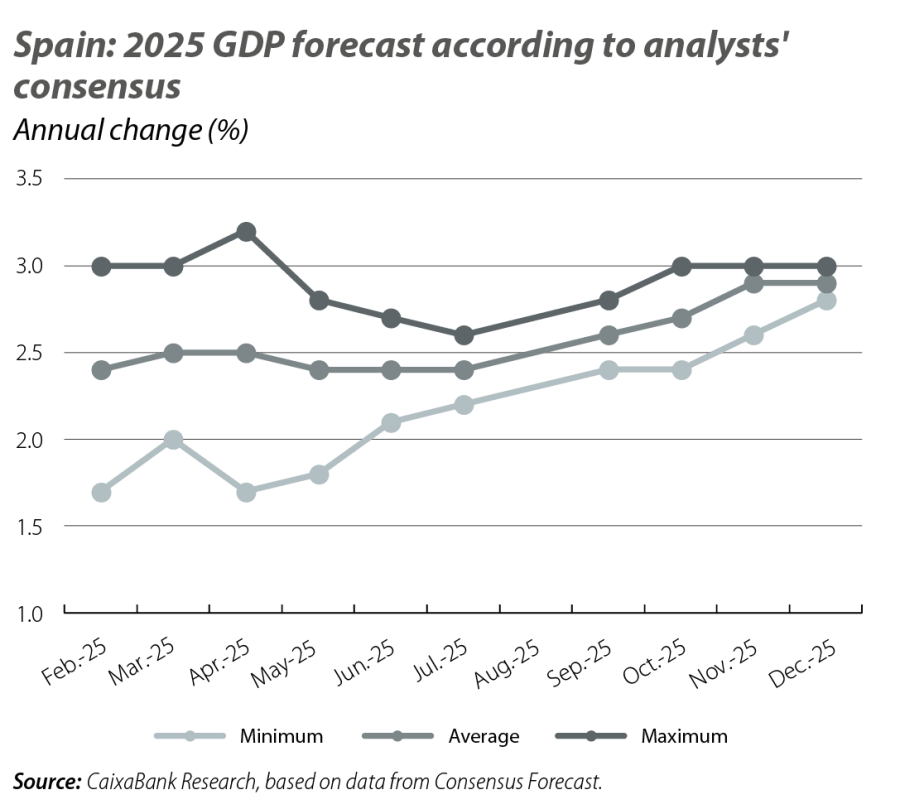

The year 2025 has been a good year for the Spanish economy despite the challenging international context, largely due to the US’ tariff conflict with the rest of the world. At the start of the year, the consensus forecast among analysts placed GDP growth at 2.4%, but projections were revised upwards as the year progressed, reaching 2.9% in December, in line with our own current estimate. If this forecast is confirmed, then the Spanish economy will have grown in 2025 at more than double the rate of the euro area, for which analysts forecast growth of 1.4%. This strong performance is mainly explained by the vigour of domestic demand, driven by a dynamic labour market, the decline in interest rates, migration flows and European funds. These factors have more than offset the negative impact of the tariff hikes imposed on our goods exports to the US.

Domestic demand, the main driver of growth, although foreign demand also offers interesting nuances

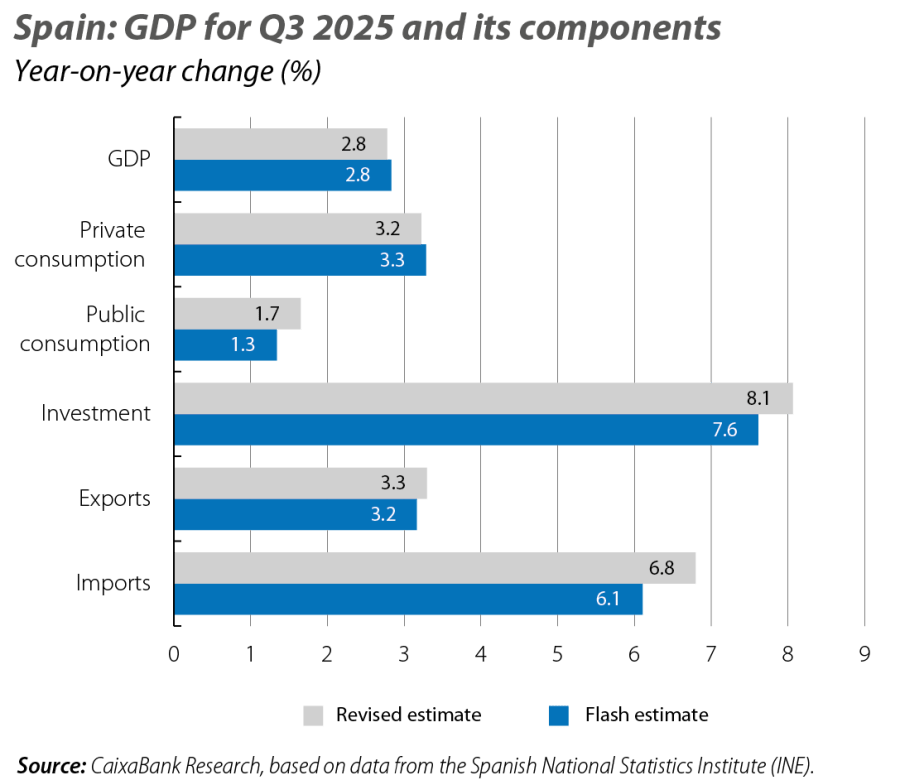

GDP growth in Q3 2025 remained unchanged at 2.8% year-on-year following the National Statistics Institute’s usual revision two months after the publication of the initial estimate. There were slight adjustments in the GDP breakdown, which reinforced the difference between the contribution of domestic and foreign demand. According to the updated figures, domestic demand contributed 3.8 pps to year-on-year GDP growth, 0.1 pp more than in the preliminary estimate, while foreign demand subtracted 1 pp, 0.2 points more than initially forecast.

The GDP breakdown shows an economy with growth that is supported primarily by private consumption and investment, with the latter growing by more than 8% year-on-year and notable growth in all its subcomponents. On the foreign sector side, we observe that exports are growing at a good pace, at 3.3% year-on-year, although behind this figure lie sluggish goods exports – with growth of just 0.5% year-on-year, probably affected by US tariffs – and strong services exports, up 8.7% year-on-year. Despite the overall good performance of exports, imports grew even more, by 6.8%, which explains why foreign demand detracted from GDP growth. This import strength is not necessarily a negative development if it corresponds to purchases aimed at boosting investment and consequently business productivity, as seems to be the case.

Activity indicators perform well in Q4

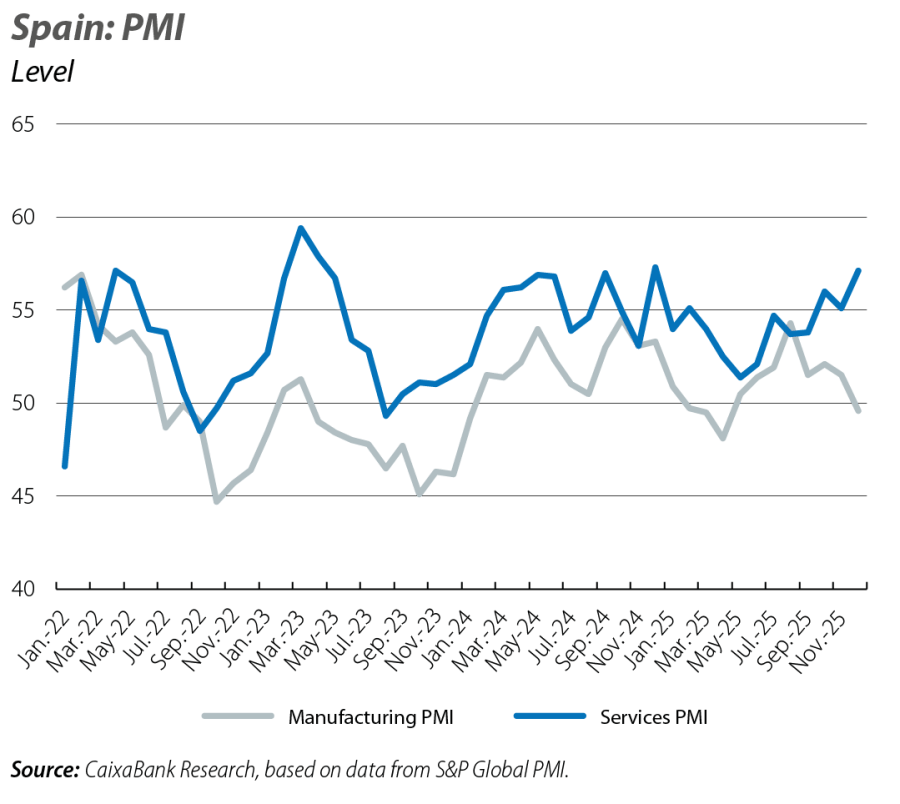

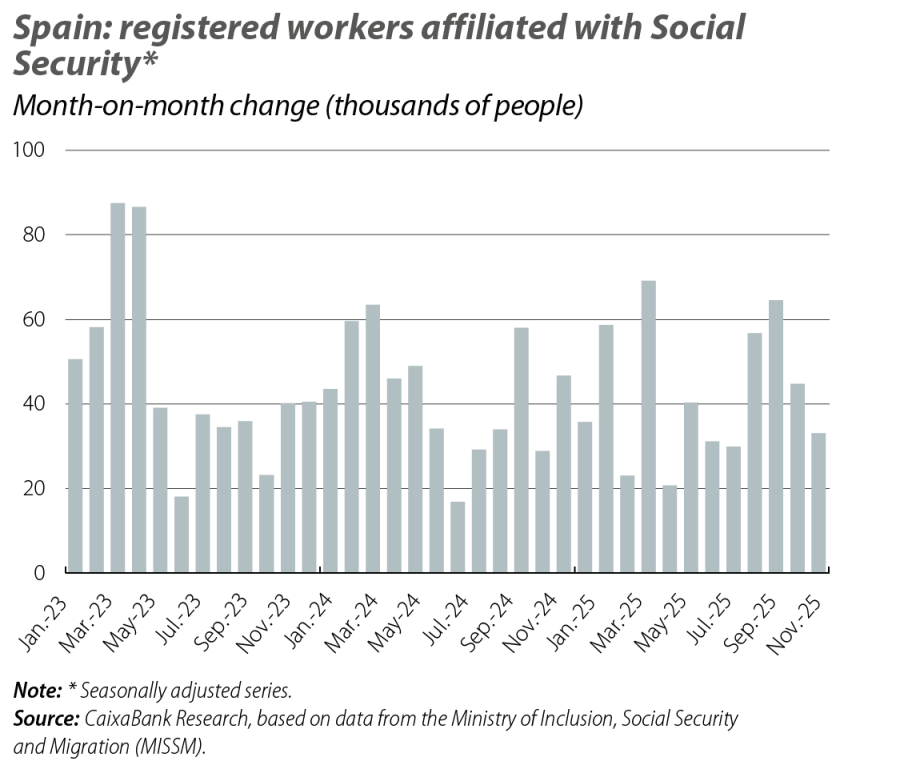

Among sentiment indicators, on average in Q4, the composite PMI stood at 55.6 points, a high figure indicating robust economic growth in the final part of the year and above the previous quarter’s average of 54.1 points. In the case of consumption indicators, retail sales on average in October and November grew by 1.0% compared to the average for Q3, matching the previous quarter’s figure, and the CaixaBank Research Consumption Tracker grew by 3.9% year-on-year on average in Q4, above the previous quarter’s 3.2%. The employment figures, meanwhile, have maintained a positive trend, with a quarter-on-quarter increase in Social Security affiliation averaging 0.7% in Q4. Thus, employment growth has accelerated compared to the previous quarter, when it grew by 0.5%. If we consider all of the available information, our nowcasting model suggests that GDP in Q4 will have grown by 0.8% quarter-on-quarter.

The labour market ends a very good year

Average Social Security affiliation increased by 19,180 workers in December. This is a modest figure, considering that the average increase in 2023-2024 was 32,700 people, but it consolidates the good records of October and November. The labour market’s performance in 2025 as a whole has been very positive, and it ended the year with an increase of 506,451 affiliates, slightly surpassing the previous year’s figure of 502,000. In year-on-year terms, this represents growth of 2.4%, the same figure as in 2024.

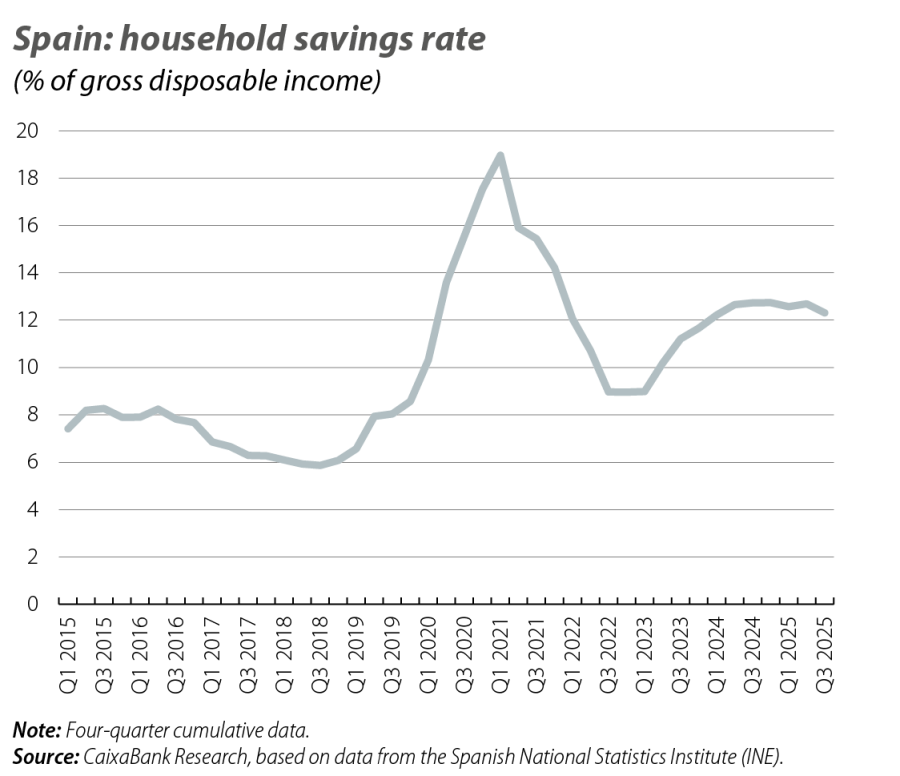

First signs of moderation in the household savings rate

In Q3 2025, and in cumulative terms for the trailing four quarters, the savings rate fell by 0.4 pps to 12.3%. This is the first decline (discounting the negligible one that occurred in Q1 2025) since Q3 2022 and may indicate the beginning of a convergence of the savings rate from its current highs to levels more in line with its historical average, around 8%-9%. The savings rate has fallen because the growth rate of consumption has remained at 6.2% year-on-year (also in four-quarter cumulative terms), whilst gross disposable income (GDI) has decreased by 0.5 pps compared to the previous quarter’s figure, standing at 5.6%. This slowdown in GDI growth is explained by the higher growth in tax payments, with an annual growth rate increasing from 6.9% in Q2 to 9.4% in Q3 (cumulative four-quarter data). In contrast, the strong performance of the labour market has allowed the growth in wage-earners’ remuneration to remain at a buoyant 7.0% year-on-year.

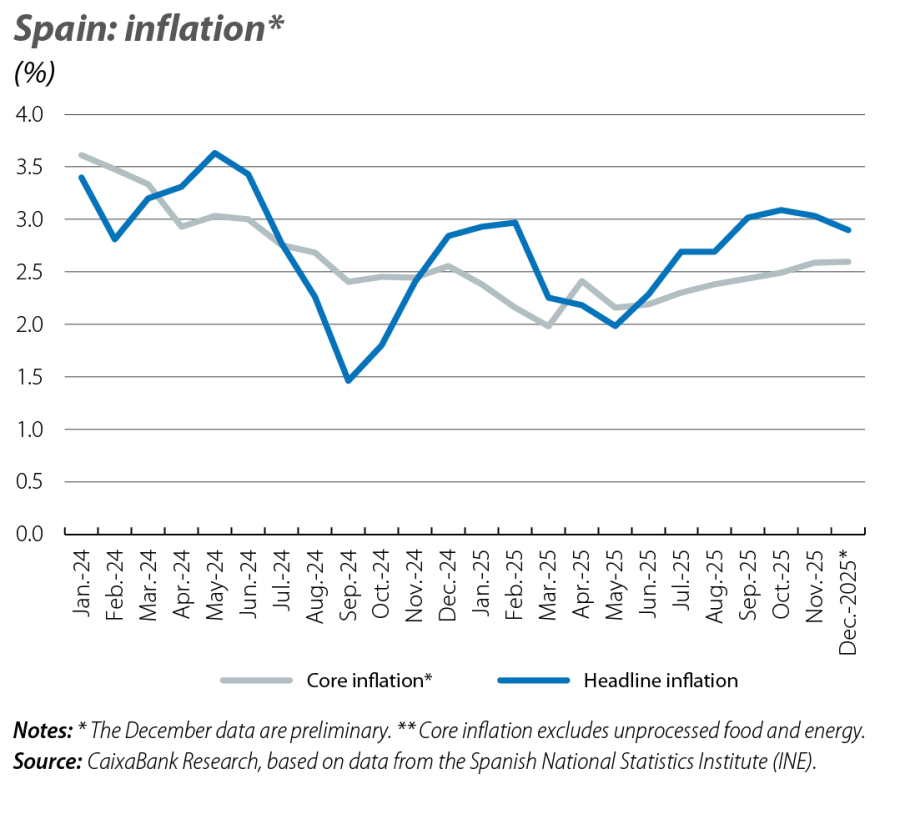

Inflation eases slightly in December

Specifically, in the final month of the year, inflation fell by 0.1 pp to reach 2.9%. According to the flash estimate for the CPI, this decrease is due to the reduction in fuel prices compared to the increase in December 2024, and, to a lesser extent, to a smaller price rise in leisure and culture compared to the increases in the same month of the previous year. Core inflation, meanwhile, has remained stable at 2.6%. In 2025, inflation stood at 2.7%, following the 2.8% recorded in 2024, and core inflation at 2.3%, after 2.9% in the previous year. In January, we anticipate that inflation will moderate due to the fading impact of the normalisation of VAT on electricity bills that took place in January 2025.