The American friend: the boom of tourism from the US in Portugal

We analyse the post-pandemic recovery of tourism from one of the Portuguese economy’s star source markets: the US.

While there is no way to erase the dark days that the pandemic brought upon Portuguese tourism, the sector is now back on track and enjoying the good times it had experienced in previous years: between 2013 and 2019, Portugal had almost doubled the number of foreign tourists visiting the country, which reached over 16 million in that final year. In this article, we focus on the post-pandemic recovery of tourism from one of today’s star source markets: the US.

In 2022, non-resident tourism fell short of recovering 2019 levels, as can be seen in the first chart. Overall, overnight stays by foreigners were 5% below the level of 2019 and that gap is even wider when we look at other source markets, excluding countries in Europe. The shortfall is particularly pronounced in the case of Asian tourists: the zero-COVID policy was highly restrictive in China and lasted practically the entire year. Two regions which together account for 60% of bookings by foreigners – the Algarve and the Lisbon metropolitan area – also recorded lower levels of overnight stays than in 2019, specifically –11% and –5%, respectively. However, the US is an outlier in the positive sense: overnight stays of tourists from this country exceeded 2019 levels by 27%. They even surpassed those of German tourists and became the fourth country of origin in terms of tourist arrivals (see second chart).

This positive trend is even accentuating in 2023: the number of guests coming from the US in Q1 2023 stood 79% above the level for the same period of 2019, reaching more than 116,000 tourists. This figure accounts for more than a third of the total change in the number of non-resident tourists between these two periods (342,000). It is also worth noting the signs of diversification in the sector, reflecting the significant growth in the number of tourists from Canada and Poland. The volume of bank card transactions1 offer further proof of this new wave of American tourism. In Q1 2023, spending on US cards was the third highest (behind France and the United Kingdom). In particular, spending on these cards in the «Accommodation» category accelerated by a startling +93.5% compared to the same period in 2022.

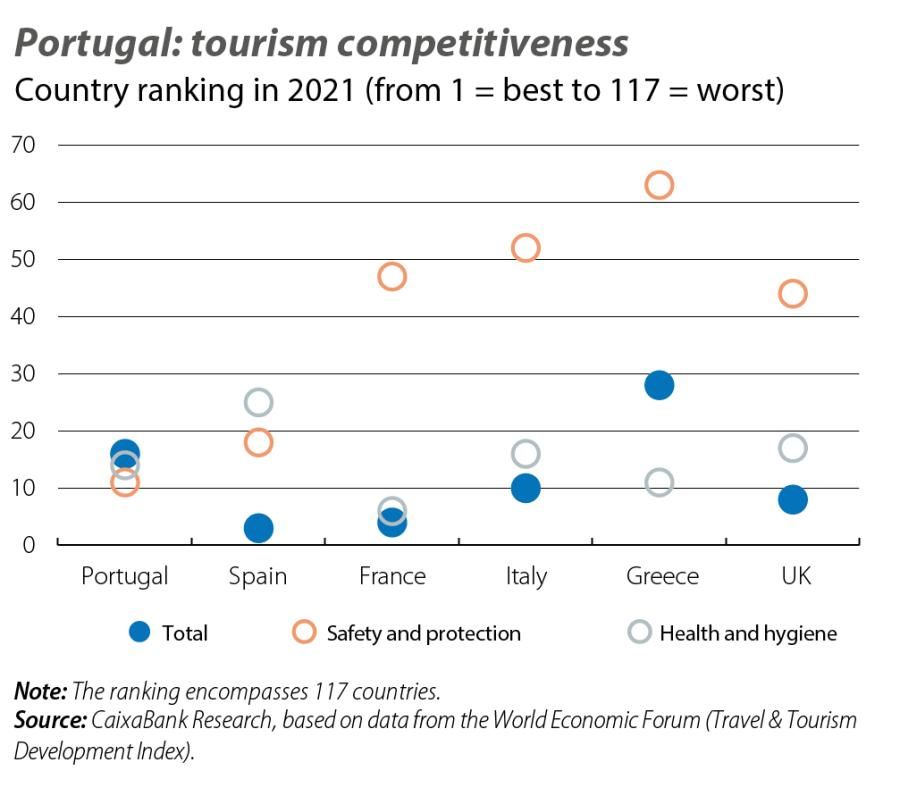

The figures are illuminating, but what are the reasons behind them? The answer has several aspects to it. Firstly, there has been an increase in residency applications from US citizens. In 2021 (the latest available data provided by the National Statistics Institute), residency applications more than doubled, and the number of residents with US nationality rose by 44%. We know that in 2022 Portugal was already the most sought-after EU country among Americans interested in moving abroad, according to Google data.2 The fact that more Americans are living (or interested in living) in the country has a multiplier effect: it means a greater number of visits from family and friends, but also more tourist visits with the aim of getting to know the country before making the decision to move. On the other hand, there has been a significant increase in air capacity on flights between Portugal and the US: in the summer of 2019, there were 8 US cities with an air connection with Portugal through 4 airlines and with a weekly frequency of 79 flights. For the summer of 2023, 5 airlines, more routes and 121 weekly flights are planned.3 Also of importance was the Close to US campaign conducted by the national tourism authority Turismo de Portugal, focused on the US market. This campaign began with the «take over» of all the big digital screens in New York’s iconic Times Square and was conducted in partnership with the launch event for the Cristiano Ronaldo wax figure at Madame Tussauds in New York. But in addition to these emblematic actions, a broader plan has been launched that includes the presence of the Destination Portugal campaign on business platforms, such as at trade fairs and workshops; the implementation of a public relations strategy aimed at some of the country’s main influencers, and a strong digital marketing campaign. Moreover, Portugal is benefiting from other competitiveness factors unrelated to price difference which have been gaining importance in the current context, especially in the spheres of health and safety (see fourth chart). Finally, there are additional factors (internal to the US) which support US tourism in general: historically low unemployment rates and resilient private consumption, surplus savings accumulated during the pandemic and aircraft fuel prices falling back down to the levels of prior to the war in Ukraine.

- 1Data from SIBS analytics.

- 2More than 41,200 monthly searches in 2022, a figure that exceeds Spain (the second most searched country, with 38,900). See https://www.dnoticias.pt/2022/12/2/338723-portugal-destrona-a-espanha-como-o-destino-europeu-numero-1-para-norte-americanos-se-mudarem-para-o-exterior-em-2022/#

- 3Data from TravelBI (Turismo de Portugal): https://travelbi.turismodeportugal.pt/movimentos-aereos/capacidade-aerea-estimada/

However, the importance of the US market is not only derived from quantitative factors, which we have already covered, but also from qualitative ones: of all the main source markets, American tourists are the ones with the highest percentage of overnight stays in 5-star hotels (38%). If we check the data on travel and tourism export income from the balance of payments4 alongside the data on guests and overnight stays, we find that American tourists also generate the third highest level of income per day. Tourism from the US has helped to restore pre-pandemic tourism levels in the Lisbon region (given that over 50% of their bookings are in this region) and it is also the main reason for the higher rate of tourism growth in Portugal compared to other competing markets, and thus the increase in market share.

- 4Corresponding to the revenues obtained when a person resident in another country travels to Portugal in the context of a temporary trip or stay (recorded as a credit in the balance of services).

To try to translate what US tourism could contribute in 2023 in terms of figures, we have carried out a simple exercise considering two scenarios. In the first scenario, we assume that the growth rate of American guests registered up until April (compared to 2019) will continue through to the end of the year. In the second, we assume that tourism from the US will return to pre-pandemic levels and that Portugal will maintain the market share which it had in 2022.5 The first scenario would result in an increase in the number of guests compared to 2022 of 730,000 people and an additional 906 million euros in exports. The second scenario would result in an increase in the number of guests compared to 2022 of 345,000 people and an additional 429 million euros in exports. Regardless of whether either of these scenarios end up materialising, all the conditions are in place for American tourism to help make 2023 a record year for tourism in Portugal.

- 5The outflow of US tourists abroad was 99.2 million in 2019, 33.1 million in 2020, 18.7 million in 2021, and 80.7 million in 2022 (data from the US Department of Trade, International Trade Administration, National Travel and Tourism Office [NTTO]). The market share of Portugal was 1.2% (2019), 0.4% (2020), 0.7% (2021) and 1.9% (2022).