Equilibria that deceive, imbalances that persist

In a context marked by geopolitical tensions, persistent uncertainty and tariff threats, the global economy continues to show remarkable resilience.

Geopolitics and uncertainty shape the global scenario

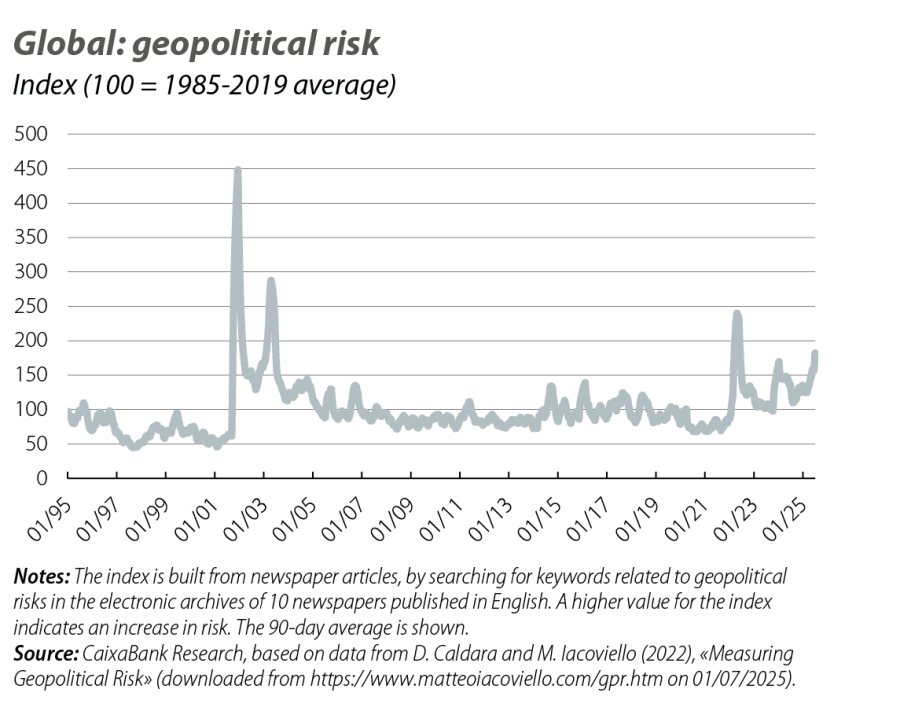

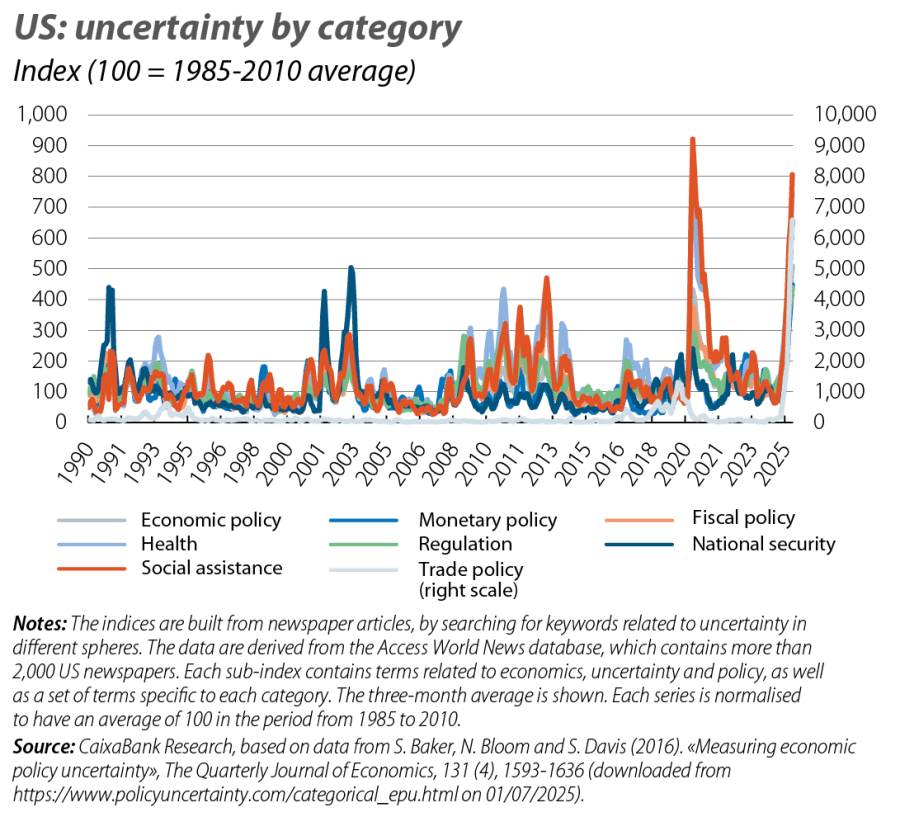

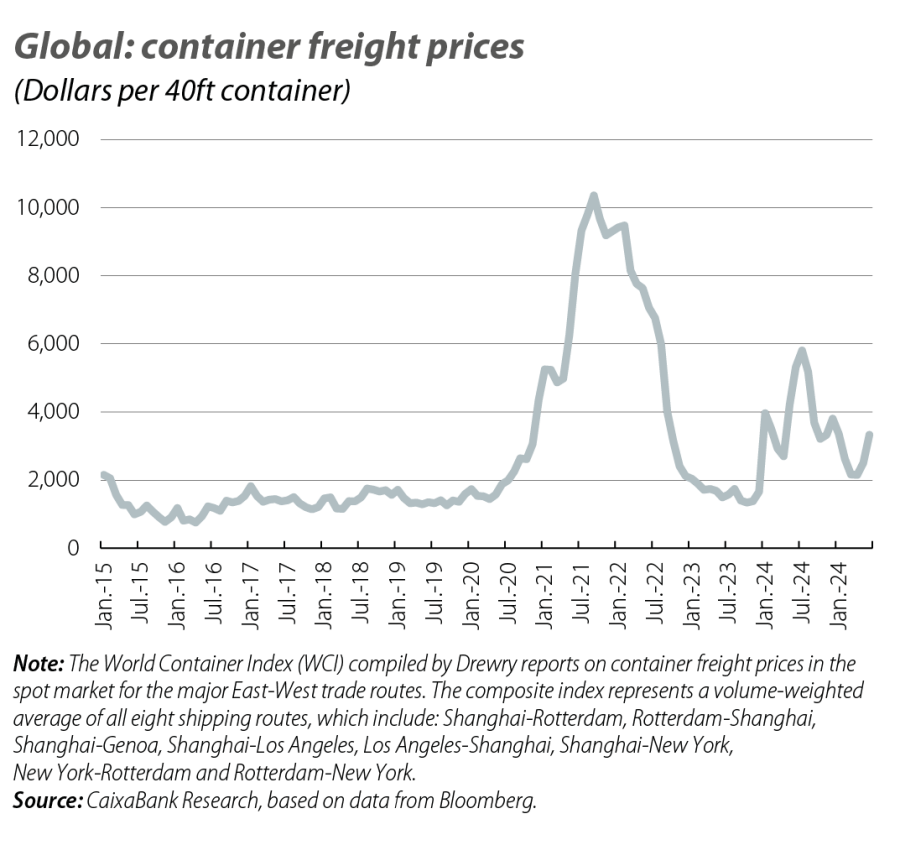

The truce announced between Iran and Israel at the end of June, after days of attacks and a US bombing of three sites linked to Iran’s nuclear programme, was just the latest in a string of episodes of geopolitical tension that have marked recent months and years. While the truce allayed fears of a wider regional conflict and of disruption to the oil supply, this episode reminded us that the economic environment remains subject to the risk of new supply disruptions. Meanwhile, at the summit of NATO country leaders an agreement was reached to increase defence spending to 5% of GDP (3.5% + an additional 1.5% on cybersecurity, infrastructure, etc.). With all the ongoing or frozen conflicts in various regions, the fragmentation of the geopolitical world order will continue to determine the macroeconomic scenario. Another key element of the economic environment is uncertainty. Unlike risk (geopolitical or other), this refers to the difficulty in anticipating events with a certain degree of certainty or probability. This development is particularly visible in the data on uncertainty by category, collected from large databases of US newspapers where, unlike in previous episodes, there is a widespread upturn across all categories. Also, in the US, the main consumer confidence indicators have deteriorated in recent months, while business surveys point to uncertainty, the tariffs and geopolitical risks as being the main challenges.

Tariffs: pauses, agreements, letters and threats

After a 90-day pause, Donald Trump signed an executive order extending the suspension of the tariffs until 1 August. After this date, the reciprocal tariffs announced on 2 April – so-called Liberation Day – which triggered severe turbulence in the financial markets will, in theory, be reapplied. In letters already sent to some of its largest trading partners, the White House highlighted the conditions for the proposed bilateral agreements and updated the tariffs that would be applied in the event of no agreement being reached. Japan, South Korea and Malaysia would be subject to tariffs of 25%, South Africa 30%, Indonesia 32% and Thailand 36% (levels equal to or very close to those announced on 2 April), while Brazil would be subject to a 50% tariff. On the other hand, Trump announced an agreement with Vietnam (without any official details).

A «big, beautiful» fiscal policy on both sides of the Atlantic

The bill recently passed by the US Congress focuses on tax cuts and includes a permanent extension of those introduced in 2017, as well as new deductions for tips and overtime as promised during the election campaign. On the expenditure side, the bill includes both increases in the budget for defence and national security and also cuts to health spending, while eliminating tax incentives linked to the IRA. Early estimates suggest that the total deficit could exceed 7% of GDP in the coming years, while the federal debt is predicted to exceed 125% of GDP, significantly above current levels (around 100% of GDP). The German parliament, for its part, approved a draft budget for 2025-2029, which includes an increase in federal spending of more than 6.0% in 2025 and of more than 3.0% in 2026, driven by increased spending on defence and investment. Also, in the coming years Germany’s budget deficit is expected to exceed the 3% limit set by the EU.

Despite geopolitics, uncertainty and the tariffs, the global economy holds steady

The global manufacturing PMI stood at 50.3 in June and regained its level of March, after two readings below 50 points in April and May. By country, in the US the PMI stood at 52.9 points (a peak since the beginning of 2022). The analysis by component reveals an increase in production in the US last month, but also in purchases of inputs and in prices growth, symptoms of a partial and temporary tariff truce. In the euro area, the manufacturing PMI stood at 49.5 points (a peak since the summer of 2022), while in China it recovered to 50.4 points, after a brief fall in May, placing it at the same level as that of all emerging economies as a whole, where increases were also observed in June. The broad-based improvement in the manufacturing PMI in June, along with the stability of the global PMI at around 50 points so far this year, paints a picture of a global economy that continues to withstand multiple shocks and is growing at a moderate pace. Among other witnesses of the timid outlook for the global economy, we find the economies of Canada and the ASEAN countries, whose PMIs (45.7 and 48.8 points in Q2 vs. 49.9 and 51.0 in 2024, respectively) point to a clear contraction in manufacturing activity in Q2.

Mixed data for Q2, after a Q1 that brought more bad news than good

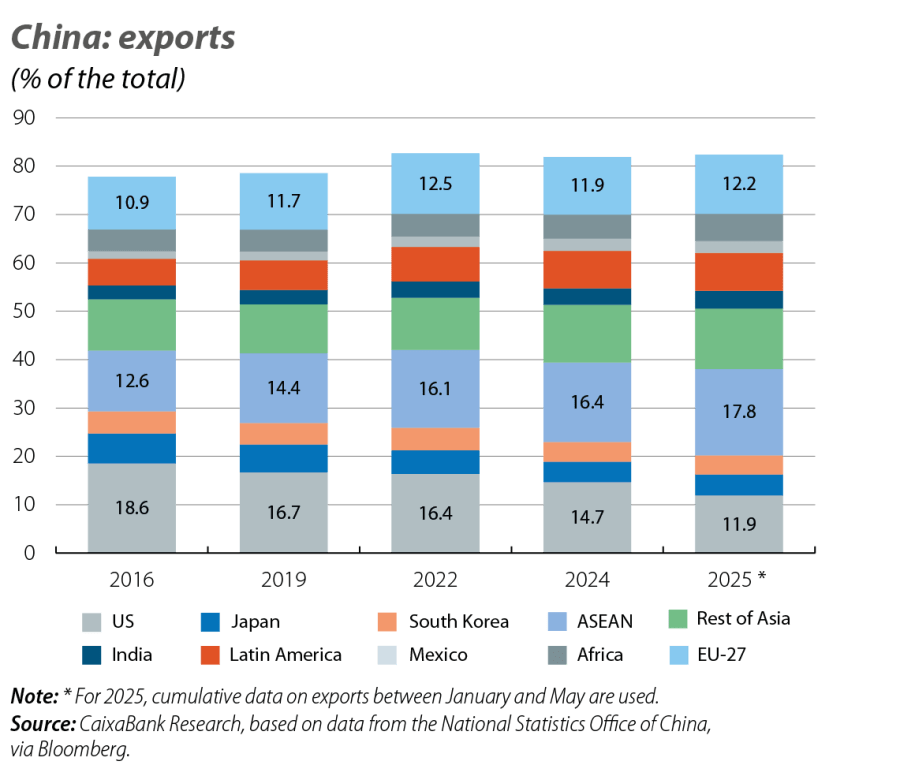

The latest estimate for US GDP in Q1 showed domestic demand slowed more than expected. Despite the fact that GDP growth remained unchanged (–0.1% quarter-on-quarter), the substantial slowdown in private consumption is particularly concerning – a key driver of the US economy in recent years – with quarter-on-quarter growth falling by 0.3 pps, to 0.1%. Economic data available for Q2 point to a quarter characterised by moderation. In the US, retail sales fell 0.9% on a month-on-month basis in May. On the other hand, the «control group» (which excludes components such as vehicles, petrol and restaurants, and is considered more stable for the purpose of measuring trends in economic activity) grew by 0.4%, indicating that consumption remains robust. In this environment, the US labour market remains strong. In Q2, an average of 150,000 jobs were created each month, compared to 111,000 in Q1, while the unemployment rate fell from 4.3% to 4.1% in June. In the euro area, retail sales grew by 1.8% year-on-year in May (vs. 2.7% in April, 2.0% in Q1) and the unemployment rate rose slightly (6.3% in May vs. 6.2% in April), while the economic sentiment indicator continued to fall in June (94 points vs. 94.8 previously). In China, retail sales grew by 6.4% in May (vs. 5.1% in April), an acceleration that can be attributed to the programmes aimed at stimulating the consumption of durable goods, which grew at double-digit rates. Industrial production was up 5.8% year-on-year (vs. 6.1% in April), in a month in which exports of goods slowed (+4.8% vs. 8.1% previously). Between domestic and foreign headwinds, the Asian giant is growing at a moderate rate, supported by fiscal policy and an export sector quickly adapting to a tricky environment.