Good news in the global economy, but with caution

The global economy sustains the momentum, but pockets of instability persist. The US faces the impact of the longest shutdown in its history; the euro area holds up but lacks momentum, and China’s slowdown is accentuated at the end of the year.

The global economy sustains the momentum, but pockets of instability persist

We are approaching the end of a year marked by multiple challenges (tariffs, geopolitical tensions, technological adaptation) which, while significant, have not derailed the global economy. In addition, a number of factors are converging that allow us to face Q4 with a degree of optimism. The US-China trade agreement eases tensions between the two powers, there are no worrying upward pressures on inflation, the Fed could cut rates in December and the ECB is confident about the evolution of the economy. However, there are elements that advise caution. The US Supreme Court, at the close of this report, was still debating whether it is legal for Trump to invoke a national-emergency statute to impose tariffs, avoiding the need to obtain congressional approval. On the other hand, the US government shutdown will have an impact on short-term growth and has paralysed the release of official data that is key for the Fed’s decision-making. Moreover, in the euro area the divergence between countries has intensified, with France trapped between viability and the need for fiscal adjustment.

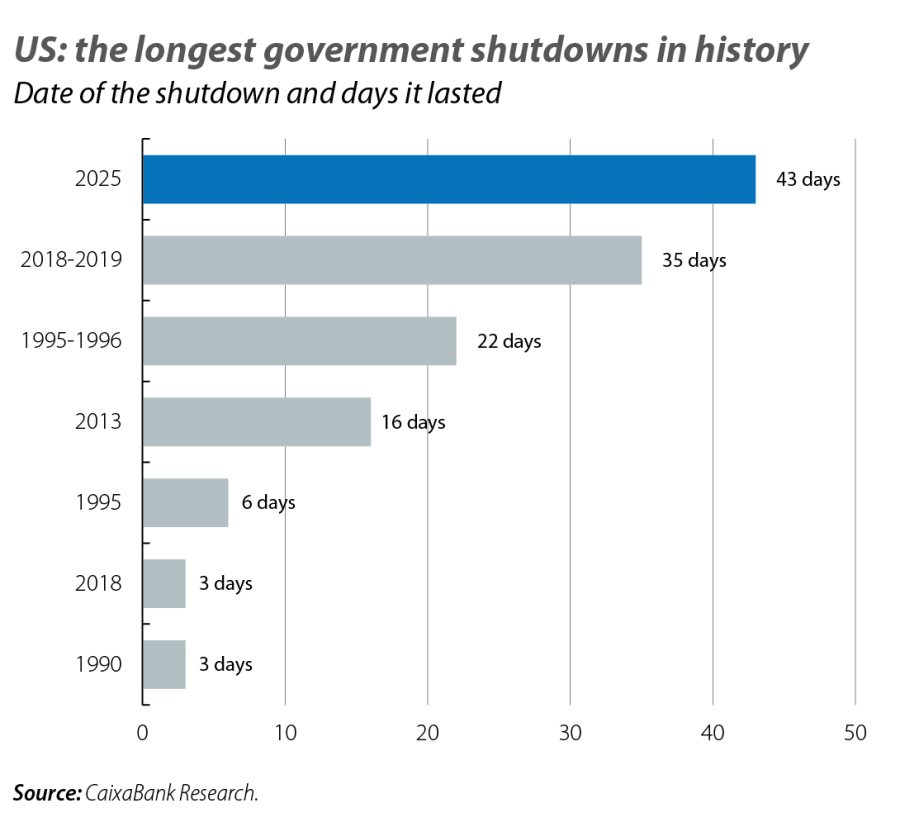

The US faces the impact of the longest shutdown in its history

The federal government has been closed for 43 days and during this time, in addition to the «data blackout», federal employees have not been paid their wages and services and benefits – often critical to the most vulnerable groups of the population – have been paralysed. It is estimated that, for each week of shutdown, the quarterly annualised GDP growth rate is cut by 0.15 pps, although around 75% of those losses are recovered as the normal functioning of the federal government is resumed, so we can expect to see some volatility in the activity data over the coming months.

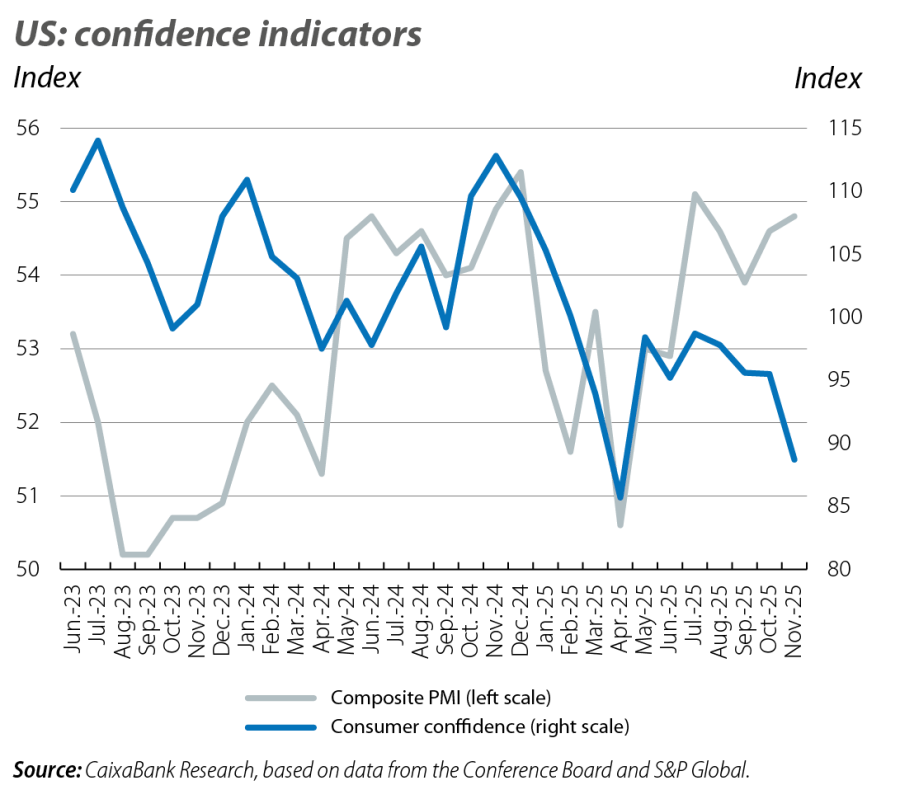

After the reopening of the federal government, the September employment data were published, offering mixed signals: non-agricultural job creation exceeded expectations (119,000), but the August data was revised downwards (–4,000 vs. 22,000 initially); with an unemployment rate rebounding 0.1 pp in September, to 4.4%, the highest level since October 2021. On the other hand, inflation was fairly contained in September (latest available data): the headline index rebounded 0.1 pp, to 3.0%, while the core rate fell 0.1 pp, to 3.0%. Meanwhile, there is a certain divergence in confidence between business leaders and consumers: the PMI, which measures the business climate, stood in November at 54.2 points (50 is the threshold that marks positive growth), but consumer confidence continued to fall in November, reaching a four-year low. In this context, it should be noted that, during the first half of the year, US growth would have been practically zero had it not been for the exceptional boost from the technological investments associated with the expansion of AI, so it will be interesting to see whether this pattern is maintained. On balance, the analyst consensus points to a growth rate of 0.3% quarter-on-quarter in Q4, after a rate of 0.7% expected for Q3 (publication delayed until 23 December due to the shutdown).

The euro area holds up, but lacks momentum

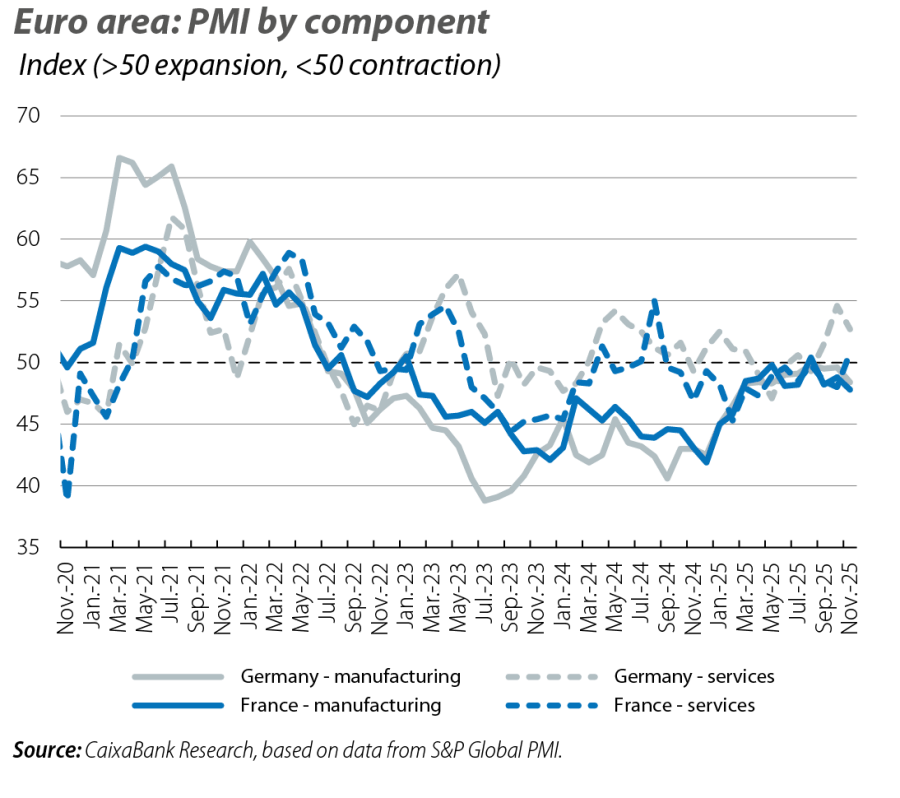

The main business climate and opinion indicators suggest that the euro area economy could maintain growth rates of around 0.2% quarter-on-quarter in Q4, but with divergences by country and sector. In November, the composite PMI stood at 52.8, thanks

to the resilience of the services sector offsetting the renewed weakness in manufacturing. The European Commission’s economic sentiment indicator, meanwhile, consolidated the previous month’s increase and reached 97.0 (also thanks mainly

to services), marking a peak since April 2023, but still below the 100-point threshold which denotes growth around its historical average. One of the reasons for this lack of momentum in the region is the apathy of Germany. While the country could see slightly more dynamic growth rates in Q4, they would still be very modest (around 0.2% quarter-on-quarter vs. 0.0% in Q3), due

to the delay in the implementation of the infrastructure plan resulting from the delayed approval of the 2025 budget (October this year). In fact, the data for Germany’s federal balance reveal that, in the cumulative period from January to October, total spending increased by 9.0% year-on-year, but the expenditure

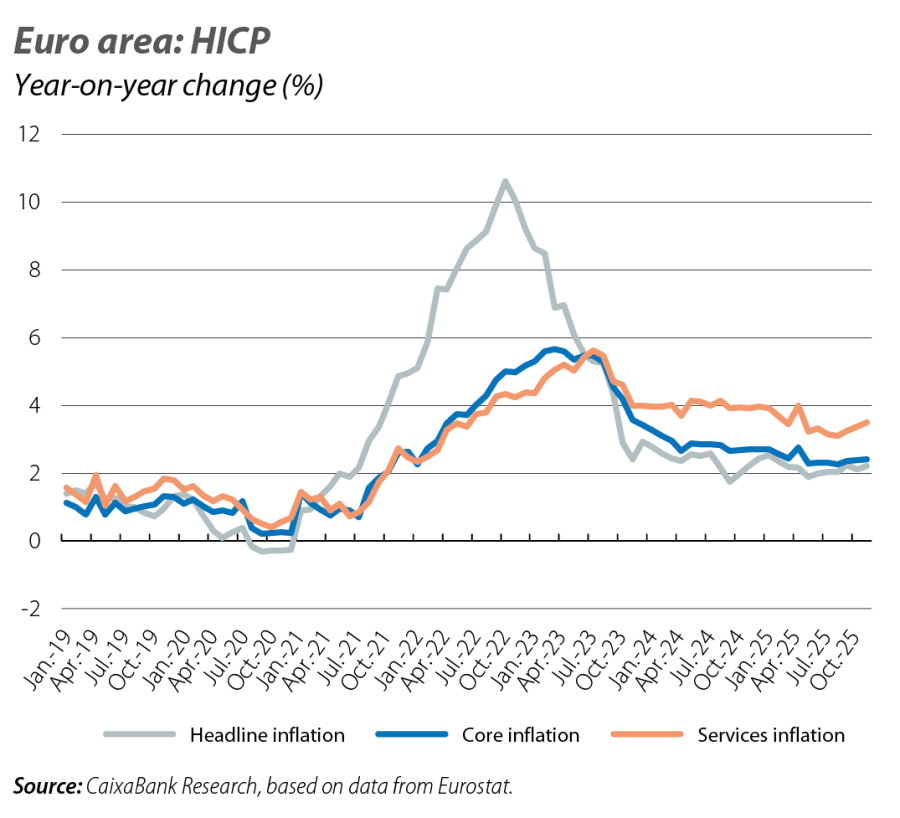

on fixed capital investment is almost 1.8% lower than in the same period of 2024. Moreover, with just two months to go until the end of the year, this category of expenditure has not even reached half of the target level set for 2025 as a whole. On the other hand, the delicate political situation in France is making it difficult to approve the 2026 budget, with the challenge of reducing the fiscal deficit from the level of 5.4% of GDP expected for this year. This climate of uncertainty could weigh down growth in Q4, after temporary factors boosted GDP in Q3. In this context of sustained but weak growth, euro area inflation is in line with the ECB’s target: in November, the headline rate rose 0.1 pp to 2.2%, while the core index remained at 2.4% for the third consecutive month, despite a new upturn in services inflation.

China’s slowdown is accentuated at the end of the year

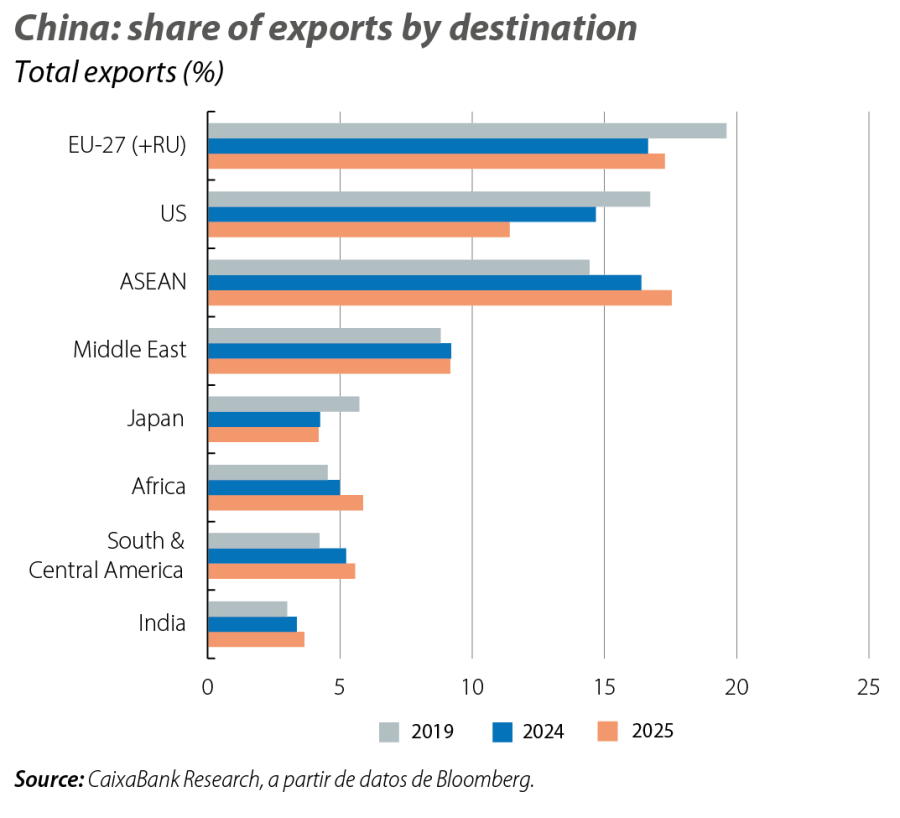

The main activity indicators show a continuation of the slowdown that began in the summer, especially in investment: cumulative fixed capital investment to October fell by 1.7% year-on-year, the worst result since 2020. The only solid growth rates for investment are found in the automotive sector (17.5%) and the rail, maritime and air transportation sector (20.1%). This pattern coincides with that indicated by industrial production, which in October moderated its year-on-year growth rate by 0.6 pps, to 4.9%, although production in the sectors with the highest value added continues to show rapid growth (e.g. cars 17%, rest of transportation 15%, semiconductors 18%), corresponding with the priorities set by the Chinese authorities in their five-year plan. The latest industrial indicators show no signs of improvement, with an official manufacturing PMI in contractionary territory (49.2 points in November). Despite China’s ability to redirect trade in the face of Trump’s tariff policies (the US has become its third biggest market, while the ASEAN bloc now ranks first), the latest export figures have been weaker (1.1% year-on-year in October, after recording +8.3% in September) in a context of appreciation of the yuan (by more than 3.0% against the dollar in the year).

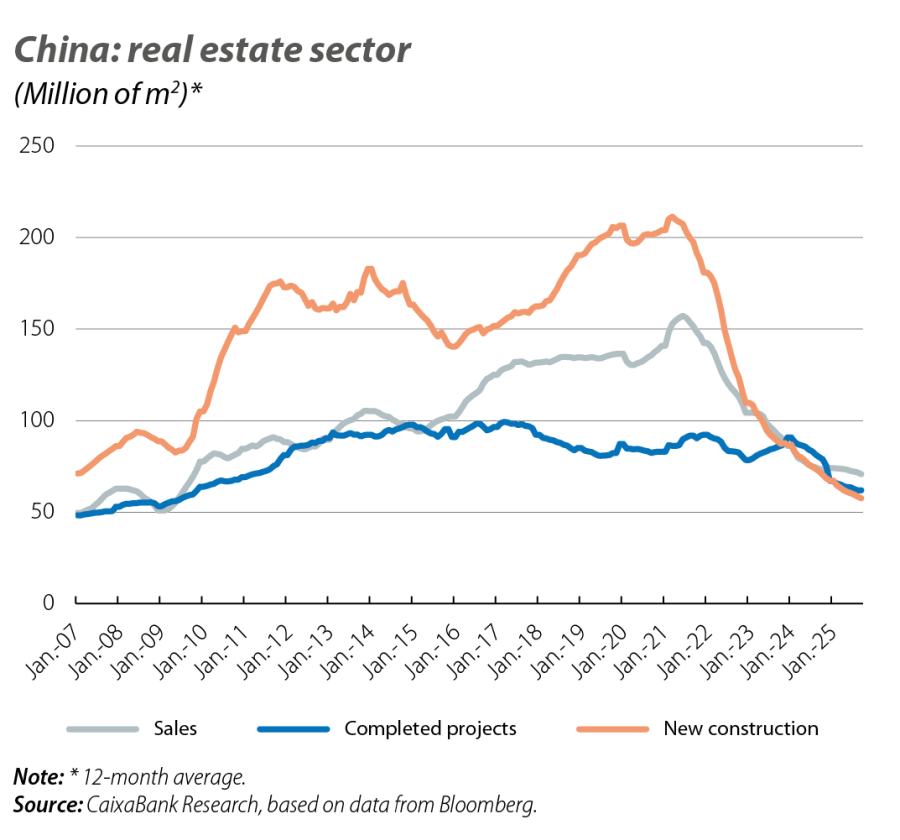

Meanwhile, the residential sector remains a major burden. New and existing house prices recorded the biggest monthly falls in a year in October and, in many cities, prices have already suffered a correction of between 20% and 30% from the peaks, which continues to punish residential investment (–15% year-on-year in the year to October) in a context of weak demand. However, the government's goal of 5.0% growth for this year seems virtually assured.