The global economy advances, one truce after another

In the run-up to the Asia-Pacific Economic Cooperation summit, Donald Trump’s Asian tour has led to a certain thaw in US-China trade relations, in a quarter marked by contrasts among advanced economies and dynamism among emerging markets.

US-China relations: truce or trick?

In the run-up to the Asia-Pacific Economic Cooperation (APEC) summit, Donald Trump’s Asian tour has contributed to a thaw in US-China trade ties. The meeting between the US president and Xi Jinping in South Korea concluded with an agreement that includes a one-year delay on the export controls announced by China in October on rare earths and related products, the resumption of purchases of US soybean and a general reduction of 10 pps in the tariffs imposed on imports from China, in exchange for increased cooperation in combating fentanyl trafficking. These measures could reduce the average effective tariff applied by the US on imports from China from around 40% to 30%, and the total US tariff from 16% to 14.5%. The possibility of an easing of US restrictions on the export of advanced chips has also been opened, and additional restrictions on the operation of Chinese companies included in the list of sanctioned entities have been suspended. In addition, the US has reached trade agreements with several ASEAN countries and new agreements have been announced with Malaysia, Thailand and Japan to strengthen cooperation on rare earths, marking an acceleration of the US’ efforts to «shield» its supply chains of critical minerals amid an uncertain geo-economic environment.

Autumn leaves: a quarter of contrasts among advanced economies

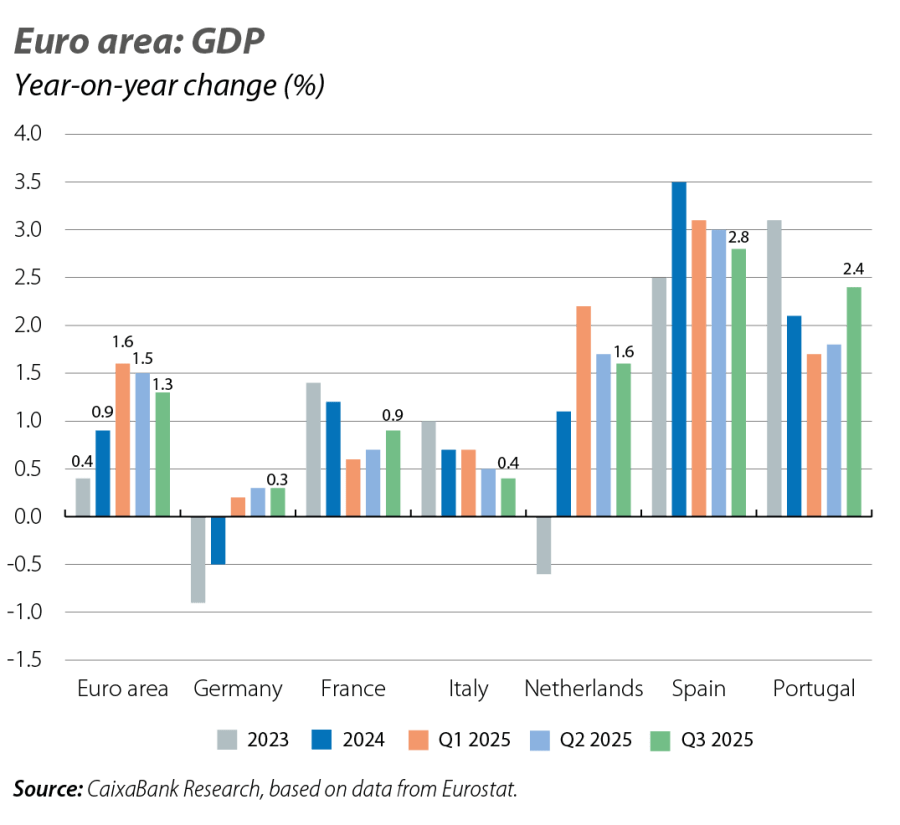

In Q3, euro area GDP grew by 0.2% quarter-on-quarter (vs. 0.1% in Q2). However, the aggregate figure masks significant disparity between countries. Germany and Italy continue to record weak growth, with their economies stagnating in Q3 after experiencing declines in Q2 (–0.2% and –0.1%, respectively), while the French economy accelerated, registering quarter-on-quarter growth of 0.5%, driven by an increase in exports of aircraft equipment. This divergence underlines the fragility of the European economy, where the Spanish economy has been standing out recently, sustaining growth of around 3%. On the other hand, in the US the federal government shutdown since 1 October – now the longest in history, as Republicans and Democrats fail to reach an agreement to pass a bill to fund federal public services beyond 1 October, when the previous federal budget expired – means that the publication of most official statistics, including the data for Q3 GDP, has been postponed.

An autumn free of scares, for the moment

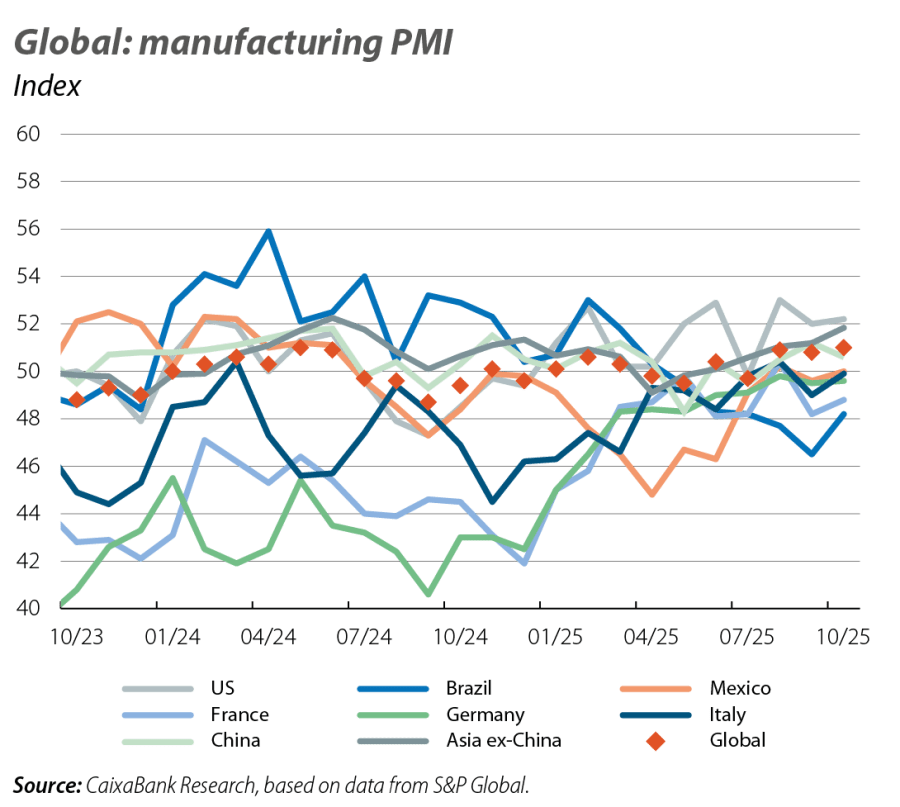

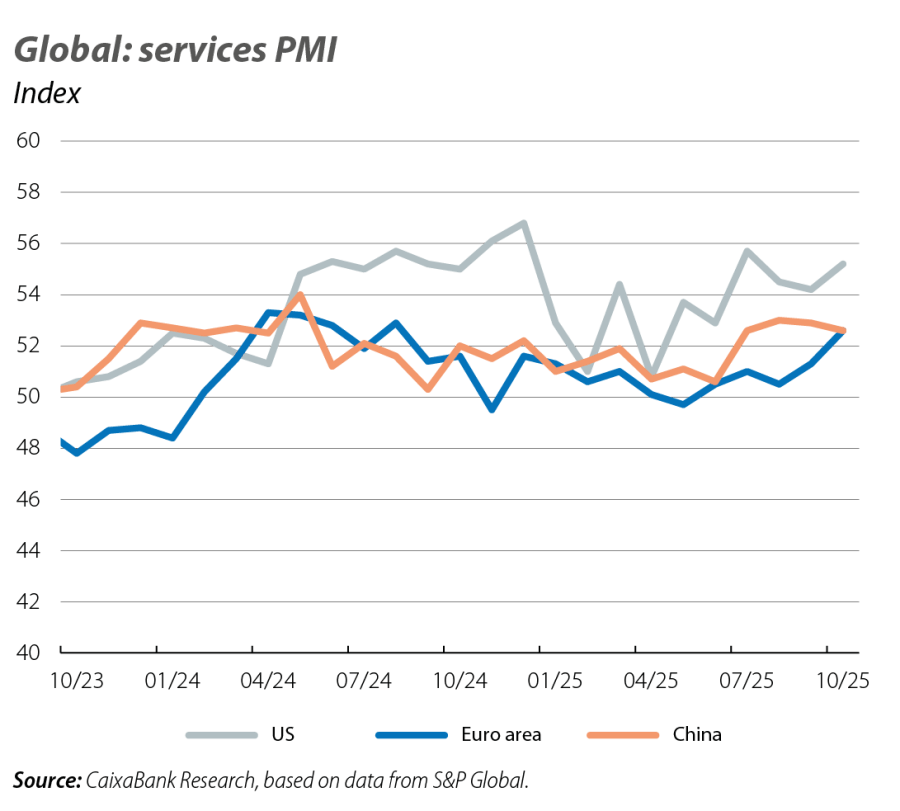

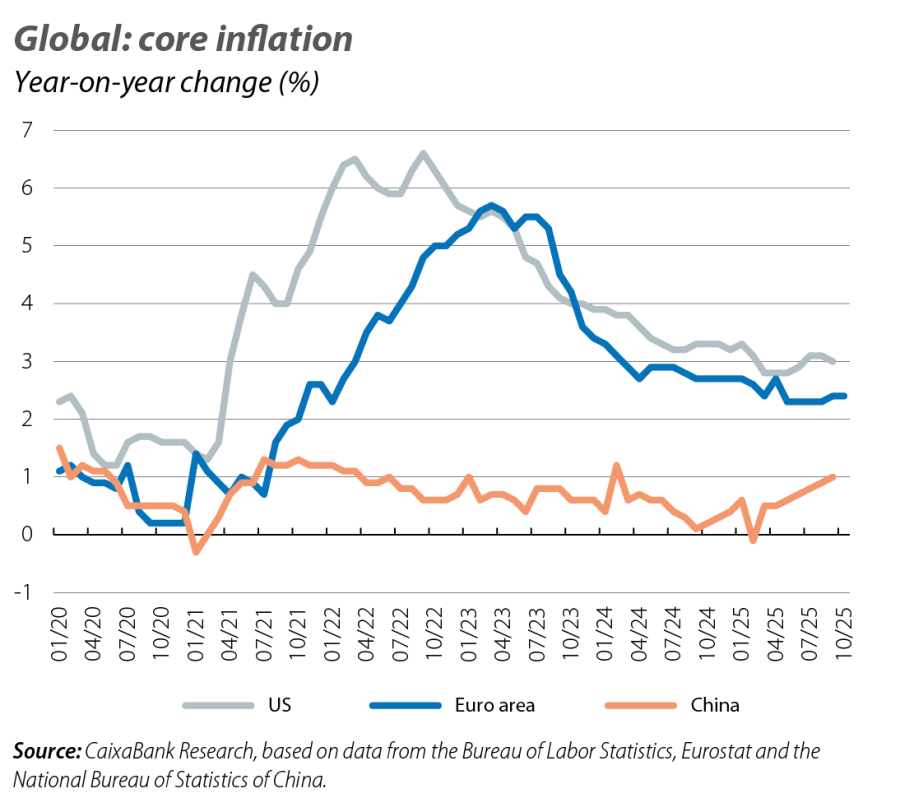

In the euro area, the available activity indicators point to a positive start to Q4. The European Commission’s economic sentiment indicator (ESI) improved in October and reached a peak since March 2023 (96.8 points vs. 95.6 previously), while the manufacturing PMI stood at 50.0 points (vs. 49.8 previously), with improvements in the biggest economies of the bloc. The services PMI has improved to 53.0 points (vs. 51.3 previously), marking a high since August 2024. In this environment, headline inflation fell to 2.1%, while the core index remained at 2.4%. Of particular note was the rebound in services (+0.2 pps, to 3.4%), which offset the moderation in industrial goods and food and the reduction in energy prices. In the US, Q4 began with positive signals, reflected in the rise in the composite PMI to 54.8 points, driven by services (55.2 vs. 54.2 previously) and a slight improvement in manufacturing (52.2 vs. 52.0 previous). However, the pace of job creation continues to moderate, while inflation remains stable, which allowed the Fed to lower rates in October, albeit with a message of caution with respect to the upcoming meetings (see the Financial Markets – Economic Outlook section).

China, with beacons of light in a stormy horizon

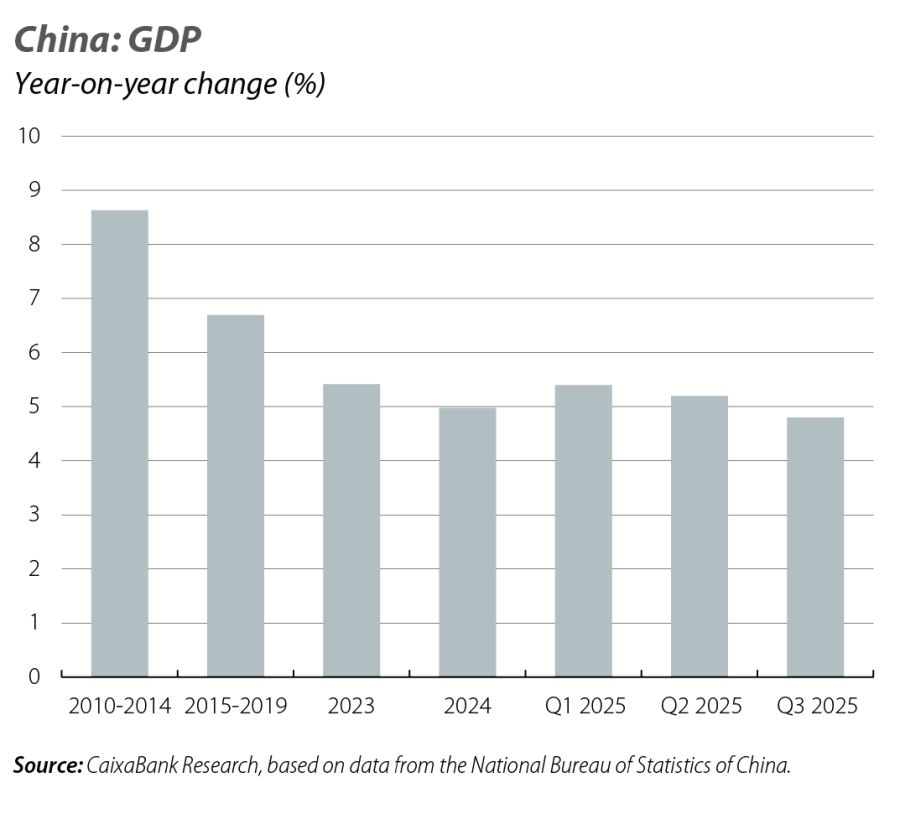

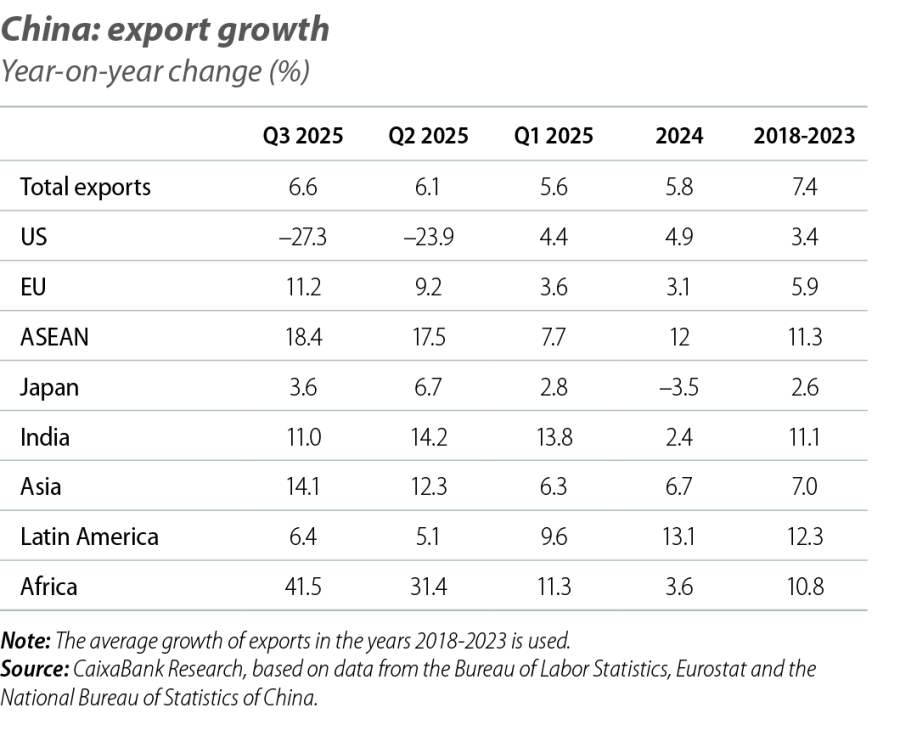

The Chinese economy grew by 1.1% quarter-on-quarter in Q3, a slight acceleration versus Q2, although year-on-year growth has slowed from 5.2% to 4.8%, and the monthly indicators show a slowdown in private consumption and investment. The pace of growth in retail sales fell (6.2% in Q2, 5.8% in Q3) and investment in urban areas contracted 0.5% year-on-year to September, its first decline since 2020. On the other hand, industrial production and exports accelerated in September (6.5% vs. 5.2% previously and +8.3% vs. 4.4% previously, respectively). Despite sharp falls in exports to the US, exports as a whole continue to offer a growth lever for the Asian giant and trade flows with the so-called Global South have provided an important buffer. Of particular note this year is the increase in exports to Africa and the rest of Asia, marking an acceleration of a trend observable in recent years. Still, the October figures point to a slowdown, with the official manufacturing PMI falling to 49.0 points (49.8 in September), marking its lowest level since May – a trend also observed in the PMI RatingDog (50.6 vs. 51.2 previously).

Emerging markets, a «sweet spot» in a challenging environment

Amid all the commotion in geopolitics, emerging economies continue to show significant dynamism. Although the manufacturing PMI fell slightly in October to 51.1 points, the index remains in expansionary territory and close to its highest level of the year. Also, the falls in China and Korea have been offset by improvements in India (59.2 points, also close to this year’s highs) and several countries in the ASEAN region, such as Thailand (56.6 points, a high since May 2023) and Vietnam (54.7, a high since July 2024), as well as by Brazil’s recovery (48.2 points vs. 46.5 previously). Nevertheless, export orders remain below the levels of the beginning of the year in most countries. Mexico’s economy, for its part, continues to be affected by the US’ trade policies. GDP contracted 0.2% in Q3, the first annual decline since Q1 2021. The brake on activity was mainly concentrated in industry, while a slowdown was observed in consumption and investment. At its last meeting, Banxico lowered interest rates by 25 bps, to 7.5%, and highlighted its concerns regarding the country’s economic weakness amid the trade uncertainty. In addition, in its latest autumn update, the IMF has kept its forecasts for emerging economies virtually unchanged with respect to its July scenario (4.2% in 2025 and 4.0% in 2026), highlighting the difficult environment for the global economy in which global trade will grow more slowly, while the specter of fragmentation, migration restrictions, and fiscal vulnerabilities will come to the fore.