The global economy, from resilience to settlement

The disruptions experienced in 2025 have given way to a new international environment marked by greater barriers to entry into the US market, a certain reconfiguration of trade flows and traditional alliances and, moreover, an acceleration in the race for artificial intelligence. All this is taking place amid persistent sources of uncertainty, while the debate between the promises and fears surrounding AI continues, with its financial offshoot. Moreover, we must not forget the uncertainty surrounding fiscal pressures, with the public accounts of major economies like the US and France deteriorating, but also opening a window of opportunity for economic revitalisation in countries such as Germany.

The international economy, resilient to tariffs and uncertainty

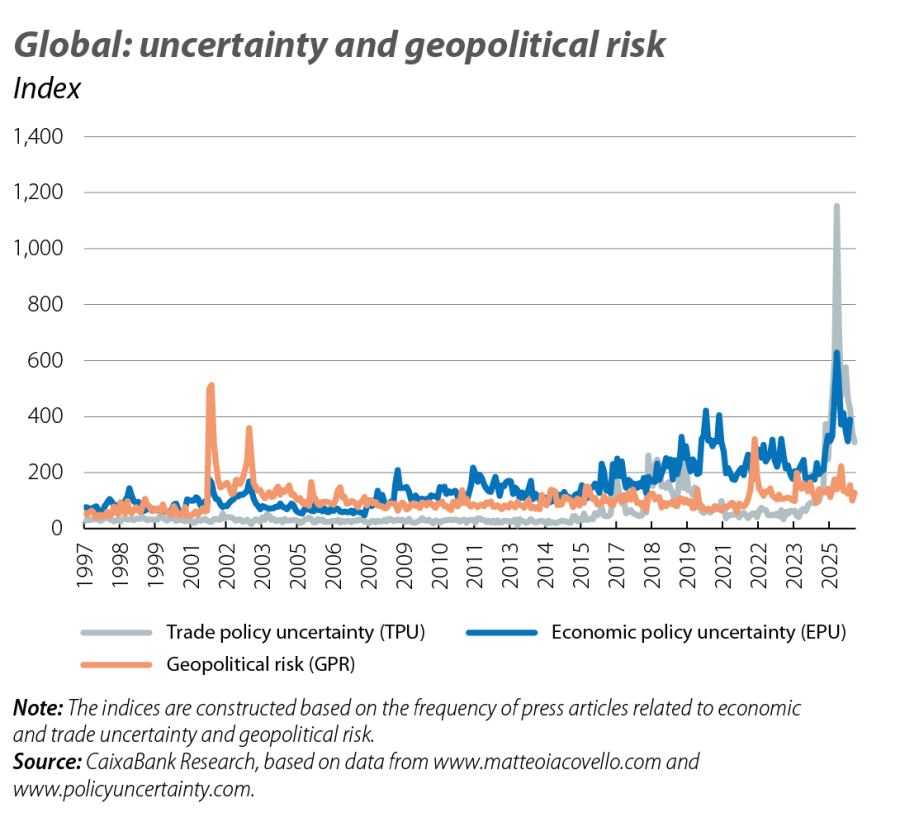

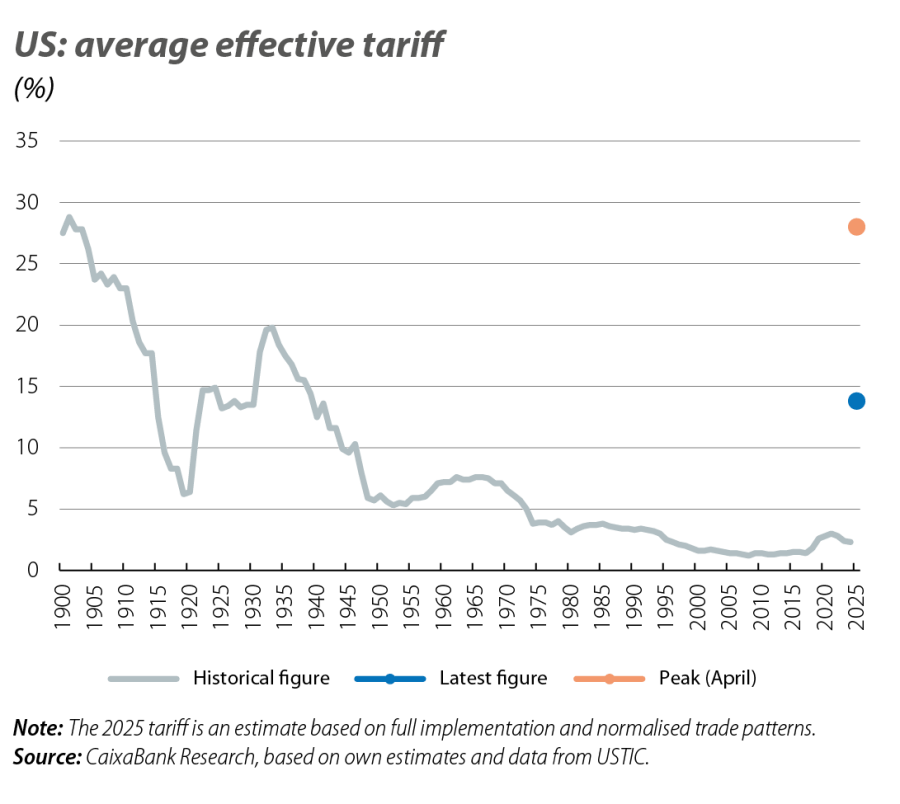

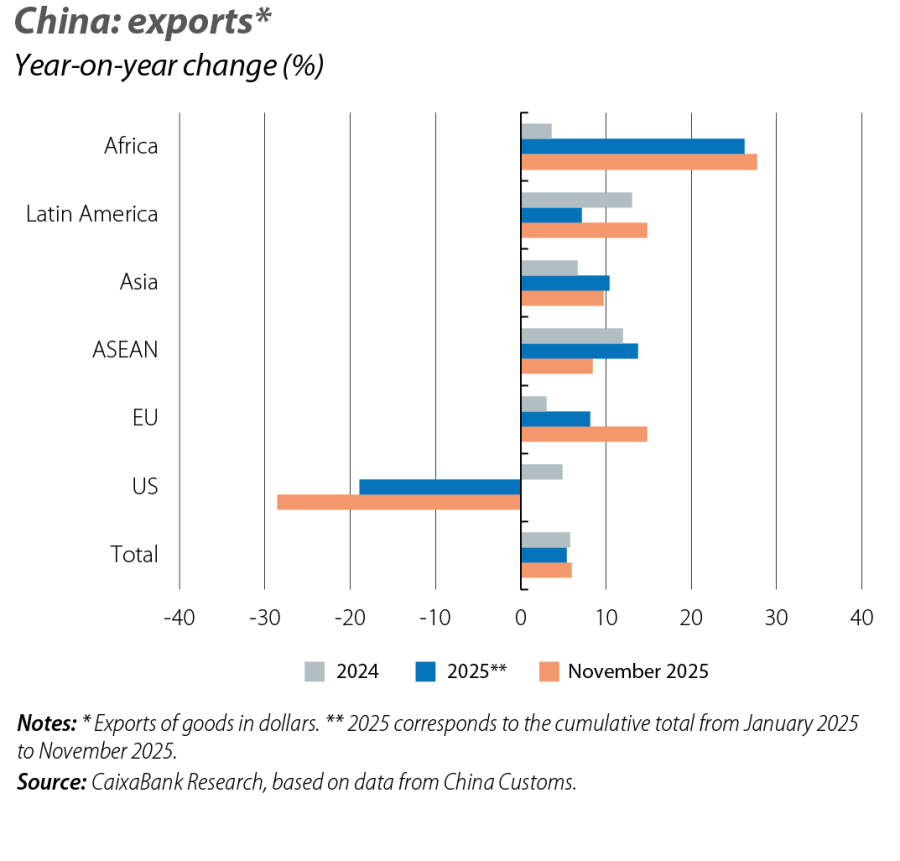

The year 2025 was marked by geopolitical and economic uncertainty, with the US administration’s tariff hikes being the main trigger (with general levies on countries and sector-specific tariffs on products such as steel and motor vehicles). Uncertainty remained high due to the prevalence of military and geopolitical conflicts, such as those in the Middle East and Ukraine, and due to the reconfiguration of international relations, spurred by the transactional diplomacy of the Trump administration. Despite this context and the strong volatility in financial markets during the first part of 2025, the international economy proved more resilient than initially expected. The supporting factors have been diverse: the adaptability of private agents, the reaching of agreements that avoided extreme scenarios, the gradual transmission of tariffs without triggering sudden impacts on inflation, the reorientation of China's trade flows in favour of other markets, monetary easing in various economies and the boost from a weaker dollar for most emerging economies, in addition to relatively contained energy prices.

2026, the year for settling to the new environment

The disruptions experienced in 2025 have given way to a new environment to which the international economy must adapt in 2026, marked by greater barriers to entry into the US market, a certain reconfiguration of trade flows and traditional alliances and, moreover, an acceleration in the race for artificial intelligence (AI). All this is taking place amid persistent sources of uncertainty, ranging from how the war in Ukraine will pan out, to the robustness or fragility of the US’ trade agreements (among other factors, pending the decision of the Supreme Court). Moreover, the debate between the promises and fears surrounding AI continues, with its financial offshoot in high stock market valuations, bold spending plans, and some doubts in the markets over whether the investments will generate a return in time. We must also not forget the uncertainty surrounding fiscal pressures, with the public accounts of major economies like the US and France deteriorating, but also opening a window of opportunity for economic revitalisation in countries such as Germany.

GDP data resilient to the changes in expectations

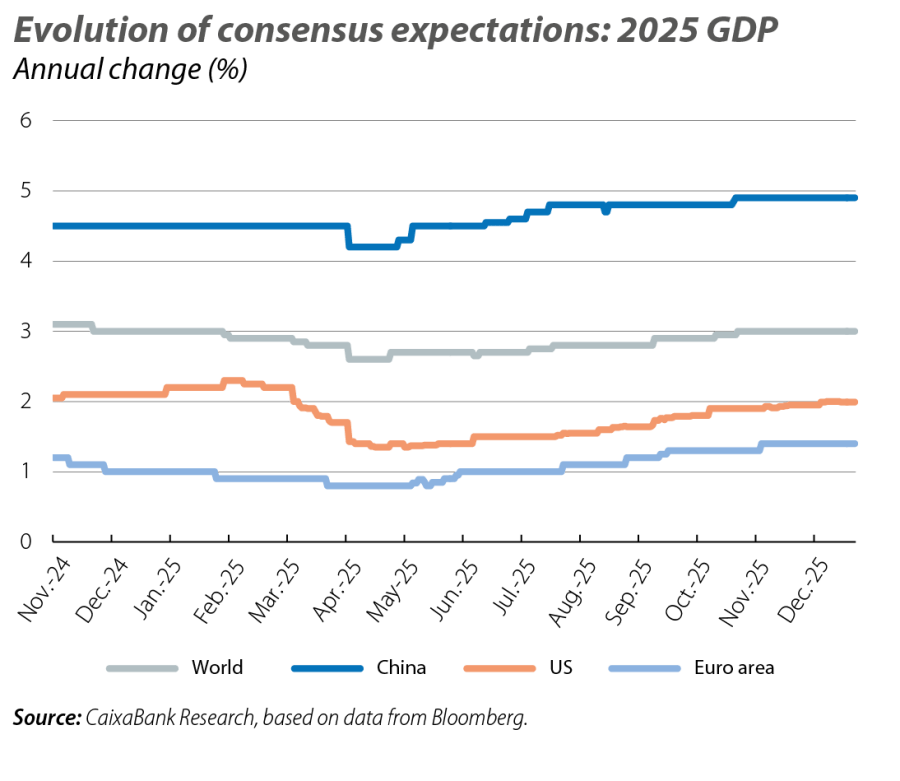

Despite the volatility, the data suggest that global GDP will have managed to achieve growth close to, albeit slightly below, the 3.3% recorded in 2024, with better-than-expected figures in the three major international economies. The digestion of the latest data has led the consensus of analysts to estimate that, in 2025, China's GDP will have grown at almost the same rate as in 2024 (5%), while the euro area will have accelerated to 1.4% (+0.6 pps) and the US will have managed to mitigate the slowdown in GDP and approach a growth rate of 2% for the year as a whole. However, the statistics have not escaped volatility: the stockpiling prior to the introduction of tariffs caused an import boom and a drop in US GDP in Q1, while spurring exports from the rest of the major economies; this effect was reversed in Q2 and Q3, supporting a rebound in US GDP while dampening growth in other regions. Having moved beyond this volatility, the indicators point to generally positive economic activity in the closing stages of 2025.

The euro area hints at an improvement

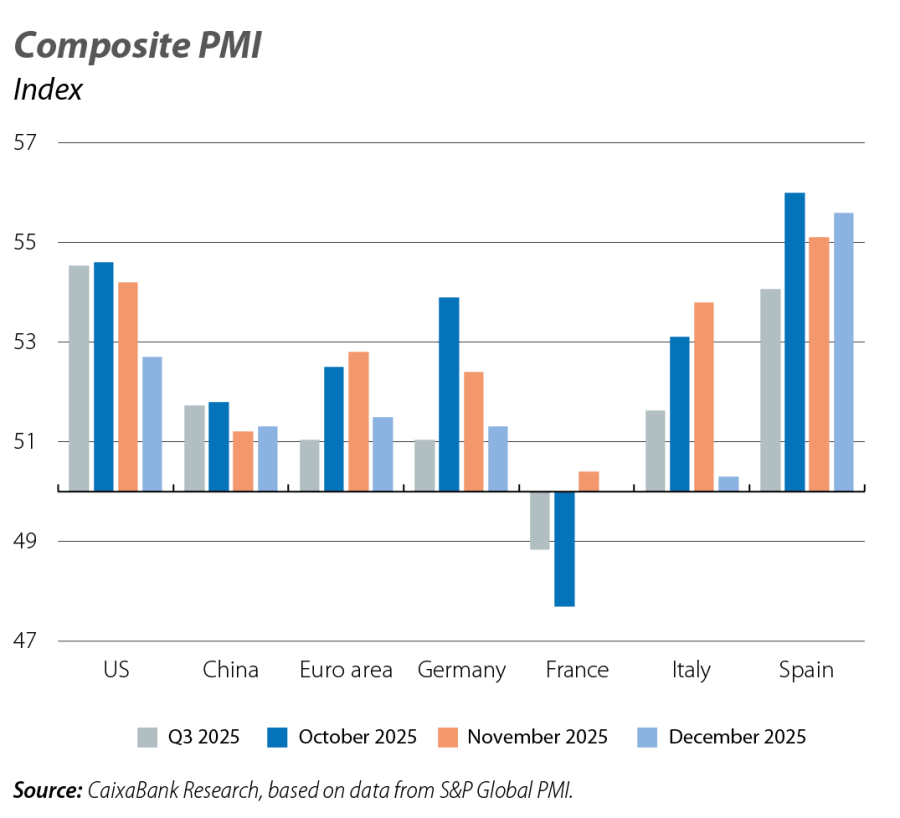

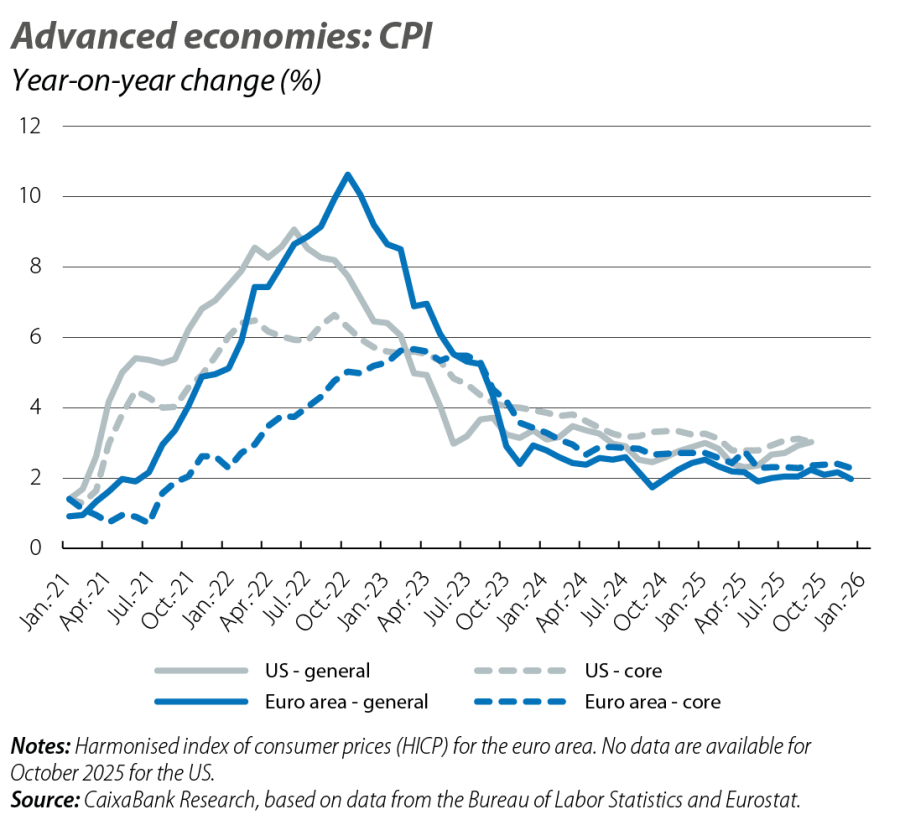

The Purchasing Managers’ Indices (PMIs) improved in the final quarter of the year and, although still modest, reached near-three-year highs. Specifically, the composite PMI reached 52.3 points on average in Q4 2025 (51.5 in December) thanks to the boost from the services sector (53.0 points in Q4, 52.4 in December), while manufacturing remained stagnant (49.5 in Q4, 48.8 in December). By country, significant divergence persists, with France continuing to lag behind (Germany, 52.5 points in Q4; France, 49.4; Italy, 52.4; and Spain, 55.6), although all four economies improved compared to Q3. Consumer confidence also picked up slightly (–14.3 points in Q4), although it remains at a low level and it is contributing to a high household savings rate (15.5% in Q2) and modest consumption growth (retail sales +1.5% year-on-year in October), despite the labour market remaining strong (unemployment stable at 6.4% since mid-2025, very close to the minimum of 6.2% recorded in November 2024). Inflation, for its part, remained close to the ECB's target rate, with the overall HICP advancing by 2.0% in December and core inflation, still pressured by a certain inertia in service prices, standing at 2.3%.

In the US, the end of the government shutdown fails to clear the fog in the data

The GDP figure for Q3 2025 was not published until the end of December, and it depicted robust activity (+1.1% quarter-on-quarter and +2.3% year-on-year), with strong momentum in consumption (+0.9% quarter-on-quarter) and a dual performance in investment (non-residential fixed investment +0.7% quarter-on-quarter, driven by intellectual property and equipment, vs. residential investment –1.3%). In the final months of 2025, the indicators also point to dynamic economic activity despite the government shutdown. The composite PMI stood at 52.7 points in December, a positive figure, albeit less buoyant than November's 54.2, and the Atlanta and New York Feds’ trackers estimate GDP growth of between 0.5% and 0.7% quarter-on-quarter in Q4. Although 41,000 jobs were lost in the labour market in total in October and November, the decline was heavily influenced by the departure of around 150,000 public sector workers who had accepted the resignation offers made by the Trump administration at the beginning of the year. The unemployment rate rose to 4.6% in November (a four-year high), but the increase reflects growth in labour force participation. The latest inflation figures, meanwhile, show a significant and relatively abrupt moderation (headline inflation of 2.7% year-on-year and core inflation of 2.6% in November, –0.3 pps and –0.4 pps compared to September), which should be interpreted with caution due to data collection issues arising from the government shutdown between 1 October and 12 November.

China experiences a slowdown in the final stretch of 2025

Retail sales slowed to 1.3% year-on-year in November (2.9% in October, 3.4% in Q3), while industrial production advanced by 4.8% (4.9% in October, 5.8% in Q3), its slowest pace since the summer of 2024. The composite PMI, for its part, stood at 51.3 points in December, virtually the same level as in November and slightly below the Q3 average of 51.7. All these figures are set against a backdrop of a persistent real estate crisis, a slowdown in the fiscal boost and weak domestic demand, anticipating a slowdown in the Chinese economy in 2026.