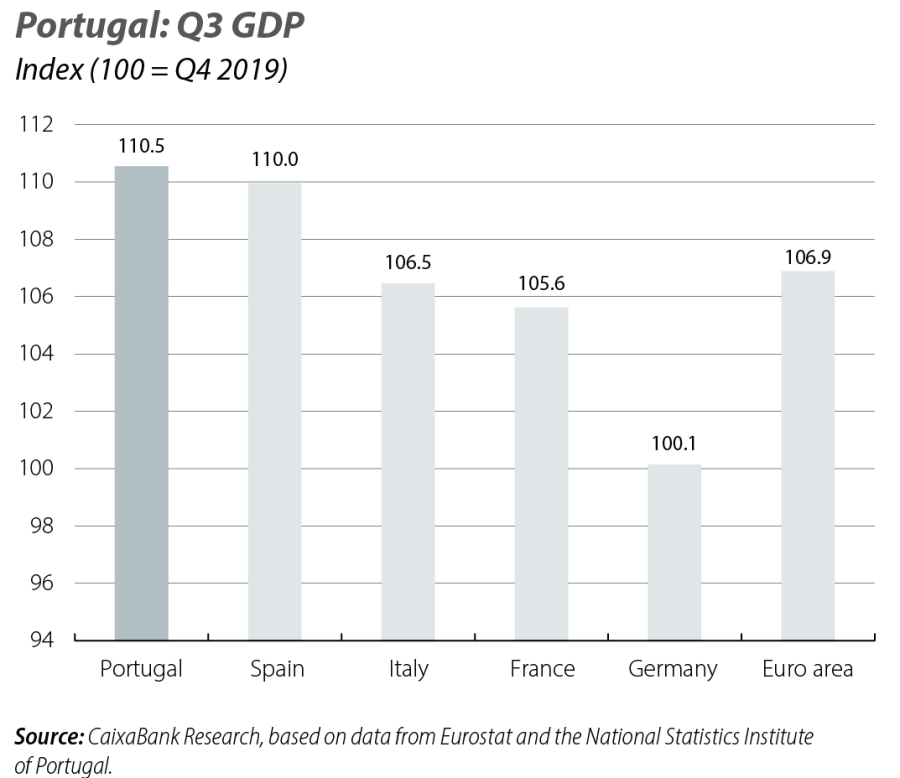

The Portuguese economy stands out in the European context

Q3 GDP grew by 2.4% year-on-year and by 0.8% quarter- on-quarter

The acceleration in quarterly growth reflects a stronger contribution from domestic demand, driven by robust private consumption following the fiscal measures implemented during the quarter, which boosted household disposable income. Foreign demand had a negative contribution to growth, in particular due to imports of goods associated with investment and services. This good performance keeps Portugal in a prominent position among euro area economies since the post-pandemic recovery. While still scarce, the available Q4 data suggest a moderation in growth towards the end of the year. The European Commission’s economic sentiment indicator has fallen from 105.0 to 104.4 points, its lowest level since April, although the strength of the labour market, the acceleration of the deployment of European funds and the reduced trade uncertainty are expected to continue to support the Portuguese economy. In this context, the risks to our current growth forecast (1.8% in 2025 and 2.0% in 2026) are balanced.

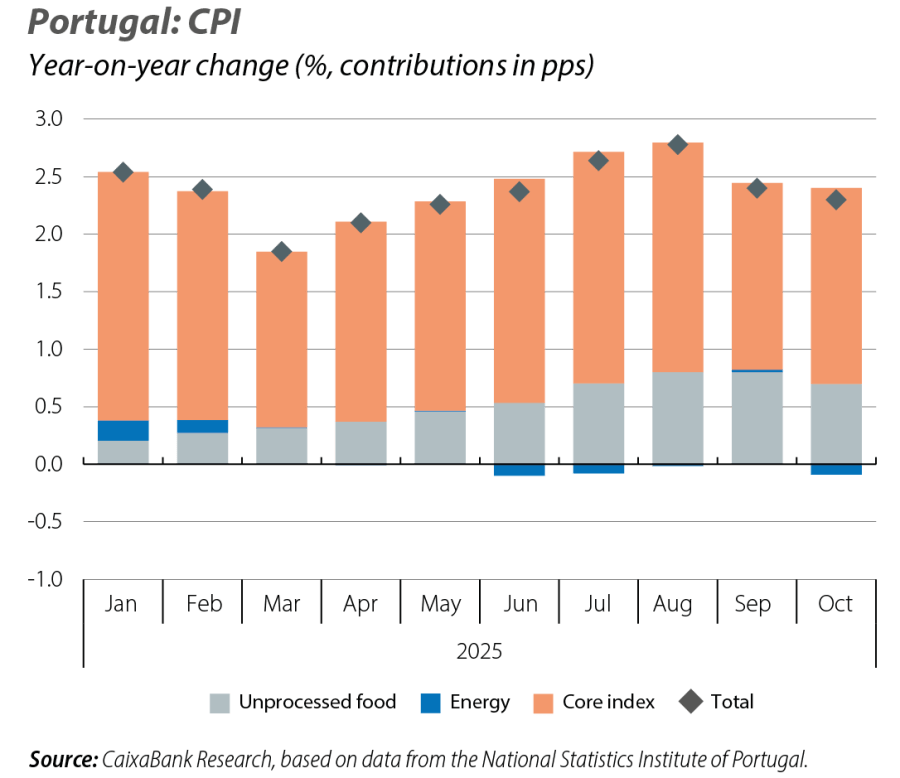

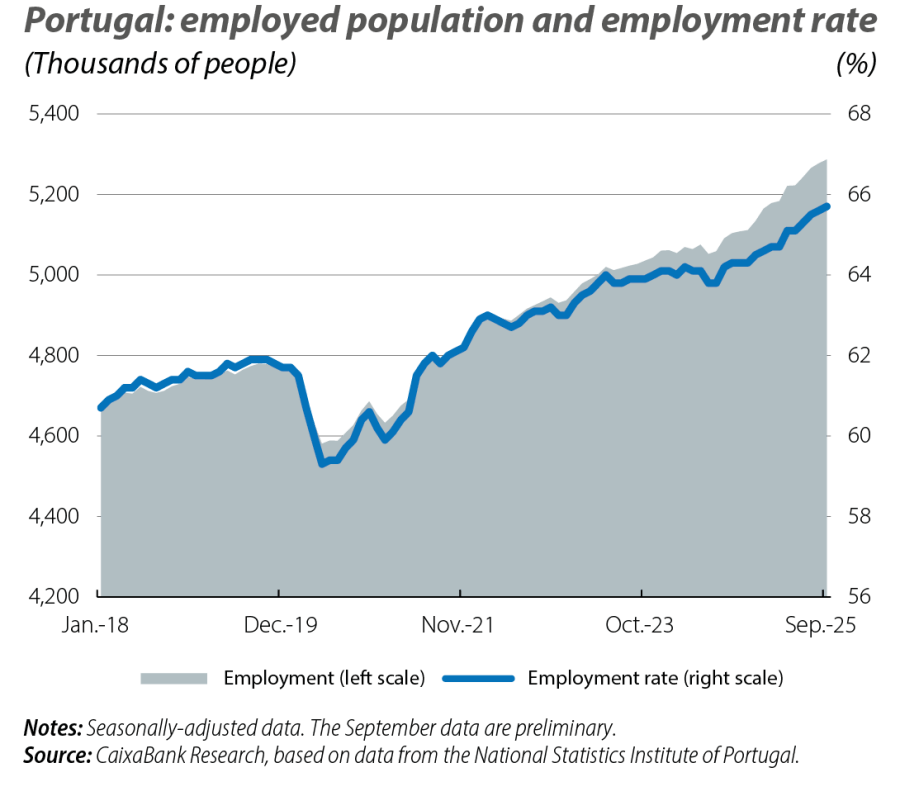

Inflation eases in October, as employment figures continue to defy expectations

Headline inflation fell 0.1 pp to 2.3%, while core inflation rose to 2.1% (+0.1 pp). The fall is explained by the more volatile components of the index, such as energy and unprocessed food. It should also be noted that the monthly dynamics of both the headline CPI (0.0% change) and the core index (+0.1%) were weaker compared to the historical trends, suggesting more contained inflation dynamics, in line with our current forecast (2.3% in 2025). The labour market, for its part, remains highly dynamic. Employment rose by 3.6% year-on-year, lifting average annual growth above 3% (a marked increase compared to the 1.2% recorded in 2024). This performance brings the employment rate to 66% of the labour force, an all-time high.

The 2026 budget points to an almost balanced fiscal position, albeit with risks

The budget balance is expected to decline in 2026, converging towards balance (0.1%, compared to 0.3% expected in 2025). Fiscal policy will be expansionary, with a notable increase in primary current spending (+4%), driven by wages and social benefits, thus maintaining the growth trend observed in the post-pandemic period. The government expects the public debt ratio to continue to decline to 87.8% of GDP in 2026, a fall of 2.4 pps versus the previous year (−3.4 pps in 2025), and has revised slightly upwards the growth of primary spending in 2025-2028 compared to the budget plan submitted to the European Commission, although it remains within the range permitted under the fiscal rules. In this regard, some institutions estimate fiscal deviations greater than those envisaged by the government, although the clauses associated with defence spending could offer sufficient flexibility to ensure compliance with the European rules. Yet, a risky environment persists, both domestically, amid announced spending measures not yet included in the 2026 budget and the possibility of weaker-than-expected growth in tax revenues, as well as externally, with geopolitical and macrofinancial risks that could drive up financing costs.