High business churn, the unfinished business of the Spanish catering sector

Desde 2022, la restauración en España vive una fuerte reactivación gracias al auge turístico y a la recuperación pospandemia. Sin embargo, aunque los ingresos prácticamente duplican los niveles previos a la crisis sanitaria y el empleo en el sector ha alcanzado cifras récord, persiste un reto estructural: cada año, 1 de cada 10 empresas del sector entra o sale del mercado. El análisis regional y la comparación con la UE confirman que la elevada rotación empresarial responde, entre otros factores, a la alta densidad de locales, al reducido tamaño de las empresas y a un menor grado de profesionalización, lo que se traduce en ingresos por empleado significativamente inferiores.

A very dynamic sector, but with a high business churn

The positive trend in the Spanish catering sector since 2022, supported by historical records in the tourism sector, has resulted in a significant increase in its revenue: turnover shows a growth of close to 100% since 2021, exceeding the cumulative inflation of 24%. Furthermore, employment has reached record highs, with more than 1.5 million registered workers, some 200,000 more than before the pandemic.11

Despite the positive overall performance of the Spanish catering sector, the business churn remains high and is one of the major structural challenges for the sector. The gross entry and exit rates of companies in the sector are usually between 10% and 12% of the total active companies (compared to 9% and 7% for the economy as a whole), which means that 1 in 10 companies changes status each year (either enters or closes).12

In the decade 2010-2019, entries and exits were very balanced, around 12% of the companies active in the sector, so that the net entry rate13 was practically neutral. The pandemic led to a significant contraction of the business fabric (-2.9%) and, from 2023 onwards, entries began to exceed exits, with rates very close to 11% (entries) and around 10% (exits), leading to a moderate net expansion of the number of companies operating in the sector.

- 11

For a more detailed analysis of the catering sector’s strong performance in the years following the pandemic, see the articles «Spain’s catering sector kicks off the year on a good footing, despite the blackout».

- 12

The gross entry rate is defined as the number of new business entries as a percentage of the total number of active businesses, for each time period and for each sector. The gross exit rate is defined as the number of business exits as a percentage of the total number of active businesses, also for each time period and for each sector.

- 13

The net entry rate is defined as the difference between new entries and exits as a percentage of the total number of active companies for each period.

High business mobility is one of the main challenges facing the Spanish catering sector

The catering sector has one of the highest business churn in the Spanish economy, second only to ICTs. Furthermore, it concentrates more young companies than the economy as a whole

Business churn in the catering sector is one of the highest in the Spanish economy,14 with rates around 21% in 2023-2024, second only to the information and telecommunications sector, and clearly above the national average (16.9%). This behaviour reflects the very nature of a sector characterised by low barriers to entry and particularly intense competition.

However, recent developments show some improvement: after reaching highs of around 24% between 2012 and 2016, business churn has gradually decreased, hitting lows during the pandemic and stabilising at somewhat lower levels in recent years.

- 14

The business churn is defined as the percentage of companies that have been established or closed in a given period with respect to the total number of active companies (i.e., it is the sum of the gross entry and exit rates). It reflects the degree of renewal or replacement of the business fabric.

The catering sector, one of the sectors with the highest business churn of the Spanish economy

As a result of the high business churn, the sector is characterised by having a particularly young business fabric, where companies with one year or less of age predominate, representing 1 in 4 active companies. Conversely, the proportion of companies that are 20 years or older is much lower than the average. However, so far this decade, the proportion of more mature companies has increased, representing 26% of the total compared to 24% in the 2013-2019 period. We will have to wait for the next few years (more than 16 years) to see if we are facing a change in trend or if, simply, the good moment that the catering sector has gone through in the last two or three years has allowed the companies in the sector to reach greater maturity.

The catering sector has companies with less time open than the average for the economy

What is the reason for the high churn in the Spanish catering sector?

After analysing business movements in the sector, we set out to understand the factors that explain this handicap. To do this, we analysed other additional characteristics of the Spanish catering business fabric.

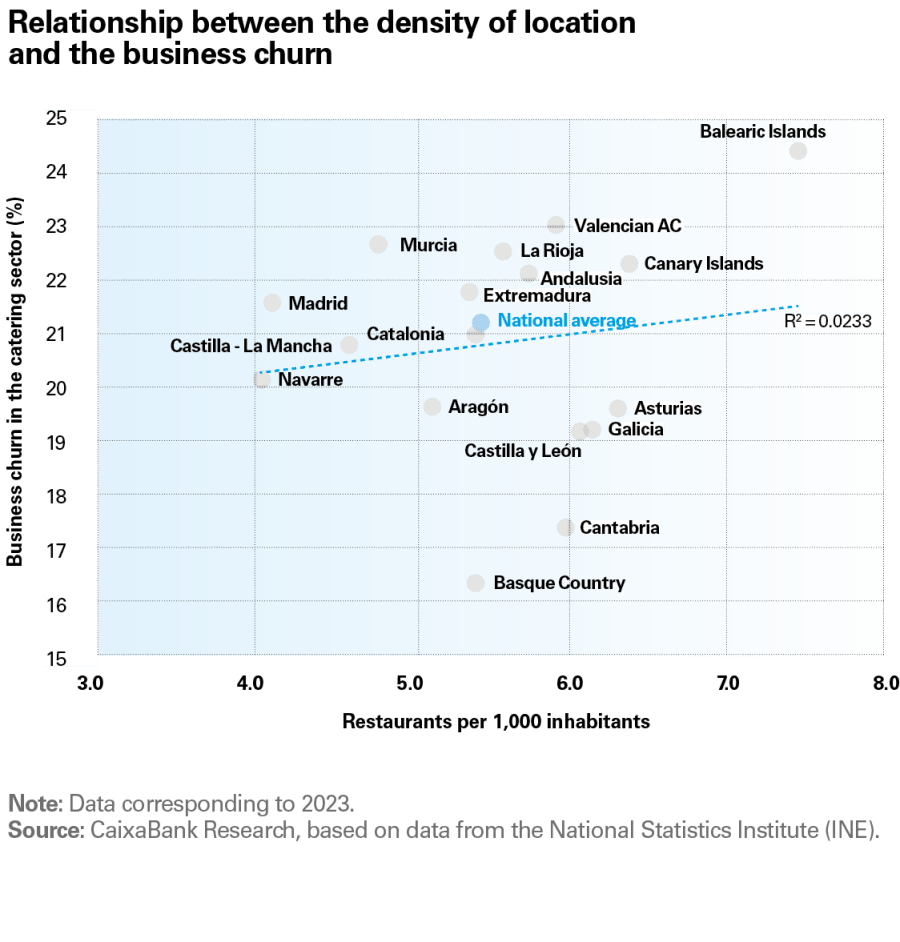

First, we examined how the density of companies in the sector influences the region, analysing the relationship between the number of establishment o location per 1,000 inhabitants and the business churn. Although the direct relationship is moderate, it is observed that those regions with a higher density of premises tend to suffer a higher business churn. This pattern is observed in the Balearic Islands, the Canary Islands, the Valencian Community and Andalusia, among others. However, there are exceptions, such as the Basque Country, Cantabria, Galicia or Asturias, which show greater stability in their business fabric despite having a relatively high density.

It should be noted that areas with higher business density and, therefore, a higher level of competition, tend to coincide with tourist destinations that usually have a more volatile and seasonal demand, which would explain a higher business turnover.

Tourist regions and those with a higher density of businesses tend to have a higher business churn

Another business characteristic that may explain the business mobility of the sector is the size of the companies. The relationship is clear: companies without wage-earners have the highest business churn, well above the sector average; As size increases, the business churn decreases significantly, and companies with 10 or more workers show much lower levels, below the economy average. Therefore, it seems clear, that size brings stability, probably due to greater financial capacity, organisational structure and resilience to shocks.

Considering the legal status of the company, it can be seen that corporations (public or private limited companies) register a lower average business churn, similar to that of the economy as a whole (around 17%). Conversely, companies owned by individuals show a significantly higher business turnover, highlighting their greater vulnerability.

Companies without wage-earners are the ones that present the highest business turnover

The European catering sector exhibits a lower business churn

A comparison between the Spanish catering sector and that of other European economies allows us to identify some characteristics specific to the national market. In terms of sector size, the Spanish catering sector ranks among the top in Europe, well above the European average both in the number of active companies (7.6% of the total economy) and in annual revenue (representing 2.4% of the total turnover of the economy), significantly exceeding the EU average (4.7%).

However, the Spanish sector has two distinguishing features: a smaller proportion of companies with 10 or more employees, reflecting a business fabric dominated by micro-enterprises, and by modest professionalisation in management, with a percentage of companies owned by individuals much higher than the euro area average and that of economies such as France, Italy or Belgium.

The Spanish catering sector has a significant presence in Europe, both in active companies and in revenue, but it is less professionalised and more dominated by micro-enterprises

The European catering sector: larger companies and those owned by corporations

As regards business turnover, the Spanish sector shows one of the highest in Europe, above that of other major economies, such as France, Germany or Italy, and others where the catering sector has a significant presence, such as Greece or Portugal.

A greater capacity to generate income is also observed on the part of the European catering sector. Countries such as Belgium, Finland, Luxembourg, France and Sweden, among others, have a smaller sector than Spain, but with a lower business turnover and significantly higher productivity.

Higher churn and lower revenue per employee

Improving the business churn requires larger and better managed companies

The high business churn in the catering sector is due to several structural and cyclical factors, which manifest themselves in:

(i) Very low barriers to entry: a small initial investment is required compared to other sectors, which facilitates the entry of new projects.

(ii) High competition and market saturation: Spain has a high density of restaurants per capita, which puts pressure on profit margins and makes survival difficult.

(iii) Sensitivity to demand and high seasonality: the sector depends on tourism and domestic consumption, which makes it vulnerable to crises and changes in habits.

(iv) High operating costs, with little possibility of passing them on to prices without losing customers.

(v) High employee turnover and lack of qualified personnel.

Although the recent trend points to some stabilisation of the business churn, improving the survival rate of companies requires progress in professional management, scalability, and efficiency. Only in this way will vulnerability be reduced and profitability improved. It is crucial to foster the growth of stronger and larger companies, with professional and efficient management, capable of improving their productivity and resilience to market fluctuations. Similarly, it is a priority to improve training and talent retention, reducing the high job turnover that also weakens the sector. Likewise, it is necessary to adapt the supply and business models to mitigate seasonality. All in all, only with stronger, better-managed companies that are aligned with their environment will the Spanish catering sector be able to consolidate recent growth in revenue and employment, reduce its exposure to future crises, and ensure long-term sustainable growth.