From barter to cryptocurrency: a brief history of exchange

Money. What do you think of when you read this word: «money»? Perhaps you have thoughts of a pleasant situation, such as an evening in an elegant restaurant or a holiday on a beach paradise. But not only that. Quite possibly, you will also have visualised the image of a banknote, some coins or a credit card. Money is not a car, or a tasty meal, or even an exotic holiday for that matter. Money is a metal coin, a paper banknote, a plastic card, that is, an object with no intrinsic value whatsoever. Imagine if the richest person in the world were to travel back in time and encountered the men and women of the Stone Age, loaded with bags full of bundles and bundles of banknotes: where today we see wealth, they would see little more than paper to make fire with. What for them would be making the best use of the banknotes, for us would be the destruction of a fortune. What has happened to cause people to see such different things in a piece of paper? We will find the answer in key moments in the history of money.

We begin this story a long time ago when there was no money; a time when it was not possible to sell a product, such as a sack of wheat, and obtain an object (called money) whose only use would be to exchange it again to buy the desired product, such as a set of leather boots. At that time, trade was carried out through barter: if the owner of the sack of wheat wished to obtain some leather boots, they had to find someone who possessed some boots and wanted to buy wheat. For barter to work, each party had to want exactly what the other party was offering, and in the quantity and at the moment in time they were offering it (the so-called «double coincidence of wants»). As you can imagine, this state of affairs imposed severe restrictions on economic activity, specialisation and technological development. In an extreme example, someone devoted themselves exclusively to studying the laws of the universe might have had a challenging life as it could not have been easy to find many ranchers and farmers willing to exchange meat and vegetables for long and complex discussions on theoretical physics.

The diversity and complexity of the economy accentuated the problems of barter to find a mutual coincidence of wants, and long lists of exchange prices were drawn up (if Charlie exchanged carrots for peas with Hailey, who in turn exchanged some carrots for wood with Amelie, how many peas should Charlie offer for a piece of wood?). At this juncture, money offered a technology to facilitate exchanges: it emerged as an object which, as it became accepted by more people, made it possible conduct exchanges between more types of goods. With its appearance, a butcher could buy vegetables, footwear, clothing, and so on, without having to find a farmer, a shoemaker or a tailor who wanted to sell their goods in exchange for meat. In this way, the butcher no longer had to devote time to producing his own footwear and clothing and could specialise even more in the production of meat. In other words, money not only acted as a catalyst for the economy, enabling all kinds of transactions to be carried out, but it also enabled workers to become more specialised.

In addition to offering a means of payment, money also fulfils two other important functions: it acts as a unit of account (it fixes the price of all goods and services in the same unit) and as a store of value (which makes it possible to easily move resources between different regions and moments in time). However, the implementation of this technology was not easy and there is a long and curious list of objects which served as money in different regions and eras: whale teeth, grains of rice, cowry shells, livestock and even slaves. In fact, it must have required some courage for someone to agree to the sale of the product of their own work (meat, vegetables, tools, clothing, etc.) in exchange for a whale tooth or a few cowry shells for the first time. This act highlights the importance of trust in one’s neighbour, something which we will discuss later on. In any case, the object which ended up dominating was the metal coin (gold, silver or an alloy of both, such as the Lydia currency of the 6th century B.C.), possibly favoured by its intrinsic value (the precious metal itself) and the fact that it was small, durable, and easy to transport and to divide into smaller units.

From the decline of the coin to the emergence of a new form of money

The strong expansion of trade in the European age of Renaissance meant that the market was flooded by coins from a wide range of territories. In addition, the trade of the time required a broader spectrum of coin denominations that would facilitate both small transactions (with coins of little value) and large transactions (with high-value coins). Despite the high demand for low-denomination coins (which were used to carry out the majority of exchanges), for coin producers it was much more profitable to produce higher denomination coins (since it offset their production cost better). Thus, this often resulted in shortages of small coins and fed the incentives of private agents to produce their own coins.

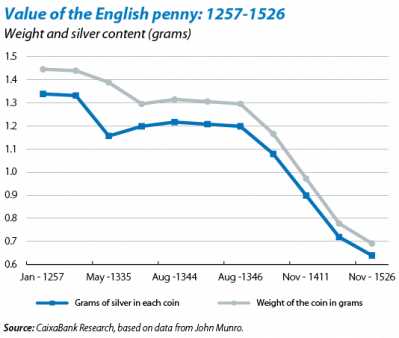

With all of these elements combined, merchants found themselves in an environment in which a wide variety of different coins coexisted. For example, in 1606, a report by the Dutch parliament identified 341 different silver coins and 505 gold coins. In addition, the coin producers showed a systematic tendency to degrade their value by reducing both the precious metal content and the size of the coins themselves (see the case of the English penny in the chart below). The coexistence of so many different coins began to be problematic because it became increasingly difficult and costly to determine each one’s true gold or silver content. Furthermore, this uncertainty was heightened by the fact that it was the low-quality coins that dominated the market: everyone wanted to get rid of the bad coins and hoarded the good ones, which paradoxically led to the low-quality coins being used the most in transactions (this is known as «Gresham’s law»).

At this juncture, there were two major innovations. On the one hand, the emergence of the cylinder press allowed the production of coins to be mechanised and standardised, leading them to become much more similar to each other and, therefore, more difficult to counterfeit. Also, governments took advantage of this innovation to increase the production of their own currency, at the expense of other rivals on the market. This reduced the diversity of coins in circulation and began to lay the foundations for the monopoly that central governments would eventually impose.

On the other hand, in 1609, the Bank of Amsterdam was established in the Netherlands. In this important trade city of the time, the bank opened accounts (backed by deposits of cash), allowing its customers to channel their exchanges and transactions. This saved them from having to exchange cash because the transactions were settled with entries in the bank’s accounting books: for buyers, a reduction in their deposits was recorded, and for sellers, an increase. A crucial feature of this system was that the Bank of Amsterdam was responsible for analysing the metal content of the coins and for certifying that the accounts only contained good-quality coins. In doing so, the Bank reduced the uncertainty and gave its clients a sense of security and trust. Not only that, however: by processing the transactions through the accounting books, it implemented a new form of money that was no longer directly embodied in a physical object.

The Government takes control: the creation of central banks

Other cities such as Rotterdam followed the example of the Bank of Amsterdam and, later, central governments joined the initiative by creating the first central banks. Little by little, these central banks would gain a monopoly over the issuing of money and would eliminate the great diversity of coins in circulation. The first of these was the Riksbank, the central bank of Sweden, which was created in 1668 tasked with providing credit to the government and a system of payments to merchants. It was followed by the Bank of England in 1694, which was also born with the aim of providing credit lines to the government in order to finance the war against France. In addition, although it was created as a private entity, the Bank of England received government authorisation to issue banknotes backed by gold, which it held in reserves (a privilege that no other bank had). Similarly, in 1716, John Law got the support of the French monarchy to found the General Bank in Paris. This was a private bank which he used to grant credit to the government and to issue banknotes which, in addition to being backed by gold deposits, were attractive because the French government accepted them as a means for paying taxes.

Although the banknotes of the Bank of England were not the first (in fact, historians pinpoint the birth of paper money in China some time before the 10th century B.C. and, in the western world, in the US colonies in the late 17th century A.D.), its good reputation was key for the consolidation of paper currency. In fact, the Bank of England, which was governed by a gold standard system (it held gold reserves, which could be exchanged for banknotes at a fixed rate), gained a monopoly over the issuing of money in England. It achieved this thanks to the support of the government, which amended the legislation to prevent other agents from issuing money, as well as thanks to its good reputation for satisfying requests to convert banknotes into gold and the fact that the paper currency issued by the central bank could be used to pay taxes.

The central role which the Bank of England carved out for itself in the international financial system of the 19th century gave way to the domination of the Fed in the 20th century. Through their actions, both made it clear that the central banks had taken control of the supply of money. The emergence of the central banks not only reduced uncertainty regarding the quality of the money in circulation, but also imposed a mechanism for stabilising prices, since the convertible nature of the banknotes tied the supply of money to the reserves of gold. In this sense, the steady supply of gold prevented an explosion in the supply of money, which would result in runaway inflation. In addition, by having a monopoly over the issuing of money, the central banks became the banks that served the banks, since they supplied them with liquidity. This put them in the ideal position to manage monetary policy (by influencing interest rates with the liquidity provided to retail banks) and to play the role of lender of last resort in the event of a bank run. All in all, in little more than 200 years, central banks went from being a source of funding for governments to being independent entities that were key in order to establish an environment of greater macroeconomic and financial stability.

With the end of the Bretton Woods system in 1971, under which the Fed undertook to convert dollar bills into gold, the world moved on to a monetary system purely based on fiat money: today, if you were to go to the counter at the Fed to convert a dollar bill, you would only receive an identical dollar bill in exchange. In other words, fiat money is backed by itself. Its only value lies in the fact that we all trust that everyone else will accept that piece of paper as a means for conducting exchanges. This has led some economists to say that fiat money requires faith in eternity: faith in the concept that tomorrow, the day after tomorrow, the next day and the next, and so on, citizens will accept the banknotes we possess today as a means of payment. In fact, there is no clearer illustration of this faith than the very inscription that appears on the US dollar bill: In God We Trust, which also shows that the good reputation of the central banks was key to generating a climate of trust that made it possible to abandon the gold-based collateral of money.

We end this story by returning to the question with which we began: why, when we think about money, do we immediately conjure up concepts such as wealth and happiness, instead of thinking of a piece of paper, metal or plastic? The answer can be found in the (almost) infinite liquidity of these objects in which money is embodied. They are so easy to convert into any kind of goods or services, that we see them directly as what they can become, not as what they are: objects with no intrinsic value whatsoever. This leap is the result of technological and institutional improvements that have led us to evolve from an economy based on barter to the current payment systems based on fiat money and, increasingly, on digital money (such as credit cards or payment systems through mobile phones), as well as from hand-written entries in the accounting books of the Bank of Amsterdam to the electronic records of today’s bank accounts. What will be the next step in this history of money? Will Bitcoin or other cryptocurrencies be the next revolution? We invite you to continue your journey into the future in the next articles of this Dossier.

Cristina Farràs and Adrià Morron Salmeron

CaixaBank Research