The ECB and risk premia in the periphery

We assess the situation of risk premia in the euro area periphery and the tools available to the ECB (flexible reinvestments under the PEPP and TPI) to curb their rise.

The ECB manages the monetary policy of a union made up of different European economies, each with its own economic, fiscal, social and political structure. This means that a change in its monetary policy can be transmitted differently between euro area countries. As an example, if there are doubts about a particular country’s capacity to service its debt payments as a result of low long-term economic growth or a high debt-to-GDP ratio, then a rise in official interest rates (like the one the ECB is currently implementing to fight high inflation) is likely to raise sovereign interest rates in the euro area unevenly.

The first chart shows the increase in interest rates that occurred around the dates when the ECB made public its intention to abandon negative interest rates during Q3 2022. We can see how the yield on 10-year sovereign debt rose in Germany by around 80 bps, while in Italy it increased by almost 130 bps. The ECB’s response to this asymmetric reaction in the financial markets was not far behind, as just six days after the 9 June meeting at which it had set out how the official interest rate hikes would occur during Q3 2022, it held an urgent meeting to announce two decisions aimed at containing the rise in risk premia,1 as described below.

- 1. The risk premium is the cost which a debt-issuing country pays in excess of the German 10-year bond to reward investors for investing in a riskier asset.

Although net purchases under the PEPP (pandemic emergency purchase programme) ended in March, the ECB remains active in the sovereign debt market with this programme as it is reinvesting the assets at maturity. The total public debt held by the ECB under the PEPP amounts to around 1,650 billion euros, of which around 20 billion reach maturity each month. With this limited capacity, in June the ECB began skewing the reinvestments of debt away from the core euro area countries in favour of those of the periphery in order to contain their risk premia (see second chart).

However, the focus has been on the ECB’s new mechanism, the TPI (transmission protection instrument), the main details of which were published at the 21 July meeting. The TPI will allow the ECB to purchase debt from those countries where it believes the rise in their risk premia jeopardises the transmission of its monetary policy, without this being justified by macroeconomic fundamentals. For starters, the volume of assets that could be acquired under this programme is unlimited, and the possibility of acquiring corporate debt has not been ruled out. The ECB has explained that these purchases will not interfere with the orientation of its monetary policy, so they ought not to have a persistent impact on the central bank’s balance sheet or the liquidity of the economy, although it has not yet specified details about how it would sterilise such purchases.

On the other hand, the ECB Governing Council will judge which countries are eligible to benefit from this instrument on the basis of certain macroeconomic criteria (see table). On the whole, these criteria do not appear to be overly demanding, so all euro area countries could most likely be eligible as of today. With regards to the first condition specified, the rules of the excessive deficit procedure (EDP)2 are currently suspended and are not expected to be reintroduced until 2024, meaning that during 2022 and 2023 all countries could be eligible under this criterion. Furthermore, if any country were to enter an EDP or an excessive imbalance procedure (EIP) under the second condition, it could still be eligible for the TPI if it is judged that the EU Council’s recommendations to correct these imbalances are being followed. Similarly, the third condition is also subject to a great deal of subjectivity, as there is no single definition of debt sustainability and the Governing Council has given itself sufficient discretion to make its own judgements on this matter. Finally, in terms of meeting the commitments of the Resilience and Recovery Plan and the European Commission’s six-monthly recommendations, it seems logical to assume that no EU country is flagrantly in breach of its commitments.

- 2. Specifically, (i) not having a fiscal deficit above 3% and (ii) not having a debt-to-GDP ratio of more than 60% or, if it is above this threshold, having a declining trend (reduction of 1/20th per year on average over the last three years).

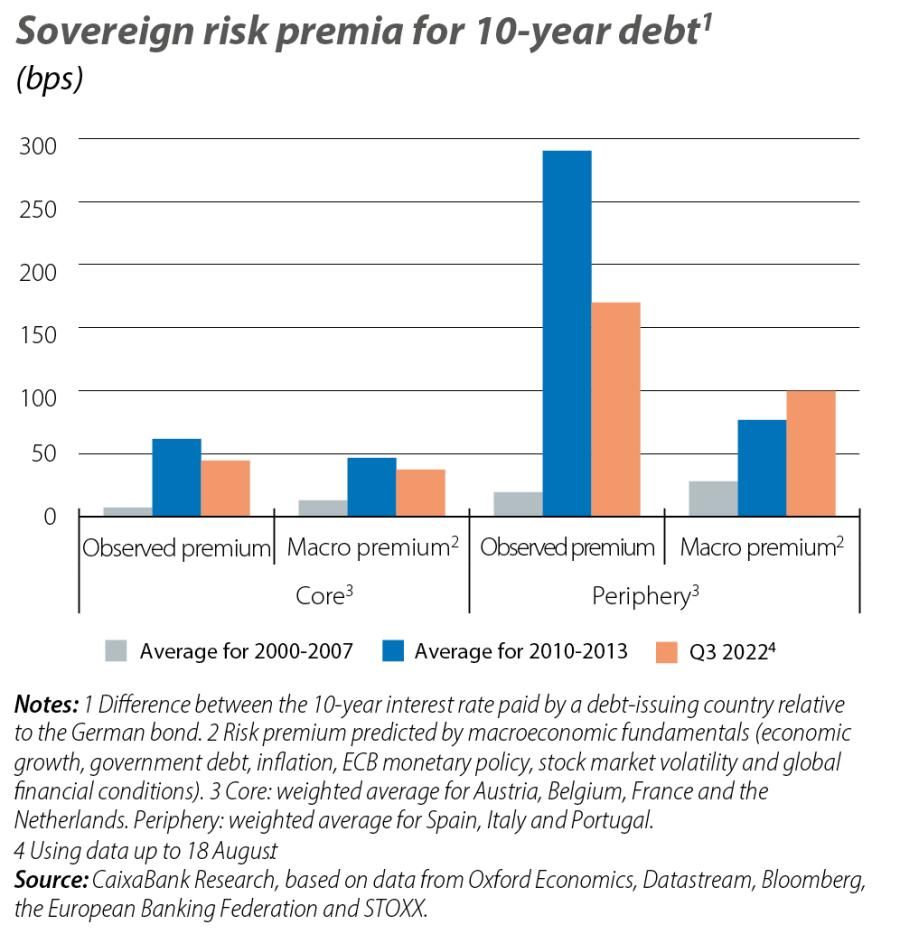

As mentioned, the ECB will choose to use the TPI tool if it considers that a particular Member State’s risk premium is significantly above that which would be consistent with the macroeconomic fundamentals (the so-called macro risk premium). The question that occurs to us is: what are the current macro risk premia and how do they compare with those observed in the sovereign debt market?

Although a country’s macro risk premium is not an observable variable, it can be estimated based on a set of variables. On the one hand, economic growth and the debt-to-GDP ratio are variables which determine a country’s debt-repayment capacity. From a monetary point of view, the inflation rate and the reference interest rates set by the ECB also influence the macro rate. On the other hand, we must consider the debt yield of non-euro area countries, since they represent alternative investment opportunities, as well as the degree of uncertainty prevailing in the financial markets. Combining all these elements, we estimated the macro interest rate of the euro area’s core and periphery countries using a simple model.3

- 3. We used a regression (ordinary least squares) with panel data between Q1 1999 and Q4 2009 for Germany, Austria, Belgium, Spain, France, Italy, Ireland, the Netherlands and Portugal. The period from Q1 2010 onwards is not considered, as the sovereign debt crisis, the unconventional implementation of the ECB’s monetary policy and the COVID-19 crisis would significantly alter the model’s estimates. As explanatory variables for the macro rate, the model includes real GDP growth, the debt-to-GDP ratio, the inflation rate, the three-month Euribor, an indicator of stock market volatility (VSTOXX), the US 10-year sovereign rate and country fixed effects. The R² of the regression is 77% and the estimated coefficients are in line with related articles. For instance, see Pamies et al. (2021). «Do Fundamentals Explain Differences between Euro Area Sovereign Interest Rates?». European Commission, European Economy Discussion Papers.

The results for Q3 2022 to date show that, unlike in the core euro area countries, the risk premia observed in the periphery are higher than what the macroeconomic fundamentals would suggest. However, the difference between the observed premium and the macro premium is much smaller than that noted during the 2010-2013 sovereign debt crisis (see third chart). With the Italian risk premium at around 220 bps and those of Spain and Portugal at slightly over 100 bps, the ECB does not currently consider it necessary to activate the TPI. Nevertheless, the Italian risk premium’s rally to around 250 bps in June served as a wake up call for the Governing Council to begin designing the TPI. Thus, should the risk premium of the transalpine country return to or exceed those levels, the ECB may consider the possibility of purchasing Italian government debt through the TPI. Interestingly, this does not mean it would actually have to do so, as the mere warning that it is willing to buy government debt at around these levels might be enough to keep the risk premium in check.