Low interest rates: for how much longer?

A metric for measuring the stance of monetary policy: the natural rate of interest

The last 30 years have witnessed a sustained decline in real interest rates in the main developed economies (see first chart).1 An initial reading can lead us to the conclusion that this decline could be synonymous with conditions in the financial markets becoming more accommodative in recent decades. However, this is not necessarily the case. Let us take the example of an economy that is entering a recession and whose central bank reacts by lowering interest rates to zero. Let us also suppose, for the sake of simplicity, that in this country inflation drops to zero during the recession. As such, in this economy the real interest rate is zero and, if we are guided by the first chart, it lies below its historical average. Nevertheless, it could be the case that the severity of the recession was such that the most appropriate response from the central bank for stabilising the fluctuations in prices and production would be to generate a drop in the nominal interest rate, causing the real interest rate to become negative. If this were the case, a real interest rate equal to zero, as low as it may seem, may be too high and lead to restrictive financial conditions. Therefore, we need a benchmark that allows us to distinguish between accommodative and restrictive conditions. This benchmark should also serve as a guide for understanding what level interest rates can be expected to converge towards over time. The natural rate of interest is this benchmark, and we dedicate this first section of the Dossier to describing this concept and how it has evolved over the last few decades.

The concept of a natural rate of interest has its origins in the Swedish economist Knut Wicksell (1989), although it has been reformulated and brought back into focus recently.2 Very succinctly, we can define the natural rate of interest as the interest rate that is consistent with activity growing according to its potential and a constant inflation rate. Thus, the natural rate of interest enables us to assess whether a particular real interest rate is accommodative or restrictive. If the real interest rate is above the natural rate, economic growth will lie below its potential and there will be downward pressure on prices, and vice versa. Similarly, the natural rate of interest offers us a point towards which interest rates can be expected to converge. In short, rather than simply looking at the trend in nominal or real interest rates in the economy, we must build a picture of the trend followed by the natural rate of interest. This will give us a more precise idea of whether or not interest rates can be expected to remain low for many years, and whether or not these low interest rates will generate an accommodative macrofinancial environment.

In addition, the natural rate of interest is not an immutable number and it depends, in turn, on other structural aspects of the economy. More specifically, all factors that can affect the supply and demand for savings will also have an impact on the natural rate of interest. So, as we shall see later in this Dossier, structural changes related, for instance, to households’ savings habits (with an impact on the supply side), productivity growth (impact on the demand side by affecting return on investment) or demographic dynamics (impact on the supply side) will all affect the natural rate of interest.

Unfortunately, like many of the variables that are of interest in the economy, the natural rate of interest is not directly observable in the data. Therefore, economists have developed models and statistical techniques which allow us to estimate this variable, although, of course, all such estimates are subject to a notable degree of uncertainty. The second chart shows the estimates made by Holston et al. (2016)3 for the US, the euro area and the United Kingdom, as well as our own estimate for Spain, produced according to the methodology used by Holston et al. (2016).

We can draw various conclusions from the chart. Firstly, the natural rate of interest fluctuates over time. In addition, although the estimate of the natural rate of interest has been produced independently for each country or region, the chart shows that the natural rate follows a similar pattern across these countries and regions. This suggests that there are forces of a global nature that are affecting it. Secondly, the natural rate of interest has followed a slightly downward trend between 1980 and 2008 in all the economies considered (less sharp in the case of the United Kingdom). Also, with the onset of the financial crisis of 2008, the natural rate of interest dropped in all economies and, even today (with data up to Q2 2018), it has still not recovered to pre-crisis levels. What lies behind these trends? The model of Holston et al. (2016) allows us to break the trajectory of the natural rate of interest down into two components: the potential growth of the economy and a residual variable that captures other factors, such as changes in investors’ aversion to risk. According to this breakdown, the fall in the natural rate of interest was largely due to the decline of the economies’ potential growth, although in the case of the euro area and Spain, cyclical factors captured in the residual variable also account for a significant proportion of the fall that took place at the beginning of the recession. Finally, the chart shows that the fall in the natural rate of interest was much more pronounced in Spain than in the euro area as a whole. Without a doubt, this differing behaviour may reflect the fact that the financial crisis was more severe in Spain than in other countries in the region (the financial and sovereign debt crisis coincided with the real estate crisis). However, it could also suggest the presence of differential structural factors that prevented the Spanish economy from adjusting to the economic crisis in a less severe manner. An example of a differential factor is the labour market. A more flexible labour market that generates smaller increases in the rate of unemployment during a recession should help to reduce the incentive for households to increase their savings on a precautionary basis, which in turn should result in a less sudden drop in the natural rate of interest.

Armed with the necessary theoretical tools, we can now move on to assess the orientation of common monetary policy over the period in question. In the third chart, we show the gap between the real interest rate and the natural rate. A positive value of the gap indicates that the real interest rate lies above the natural rate and, therefore, that monetary policy is restrictive, and vice versa.

As we can see, prior to the crisis, common monetary policy turned out to be slightly more expansive for Spain than it was for the euro area overall. However, this situation was reversed very sharply during the financial crisis and the subsequent sovereign debt crisis. This is because the accommodative measures implemented by the ECB, while sufficient to make monetary policy neutral for the euro area as a whole, were insufficient to offset the sharp decline in the natural rate interest in Spain. Focusing on the most recent period, estimates suggest that, at present, common monetary policy is practically neutral for Spain and slightly expansive for the whole of the euro area.

It should be noted that although these estimates are subject to a high degree of uncertainty,4 the results shown here are qualitatively similar to those obtained by other authors using different methodologies. As an example, Fries et al. (2016)5 estimated the natural rate of interest for Germany, France, Italy and Spain and also found that the natural rate of interest has fallen over the last 20 years. In addition, they found that common monetary policy was expansionary for Spain during the period leading up to the financial crisis, approximately neutral for Germany, France and Italy between 2009 and 2013, and contractionary for Spain between 2009 and 2013.

What is behind the decline in the natural rate of interest?

The list of factors is long and can be classified into three major groups: those that would have restricted investment, those that would have encouraged saving, and cyclical factors related to the Great Recession (which would explain the most pronounced decline in 2008-2010, shown in the second chart). The pressure of these cyclical elements (such as the high level of private sector debt, which restricts the ability to spend and invest, or the loss of optimism over future growth, which might be understandable after having suffered a long and intense recession in recent years) gradually fades as the expansionary phase sets in. Nevertheless, the evidence suggests that the other factors respond to structural forces, such as long-term growth potential or population ageing, which may continue to influence interest rates over the coming decades (and, therefore, the wider financial environment). Let us see how.

Lower propensity to invest

As discussed previously, the models closely tie the evolution of the natural rate of interest closely to trends in productivity growth. The reason for this is simple: productivity growth is the source of long-term economic growth and, therefore, it determines the extent to which new investment opportunities arise. However, as can be seen in the fourth chart, productivity growth has declined steadily over the past few decades. This trend has not only occurred in parallel with the steady decline in interest rates but, like the latter, it has also had a widespread effect on the major international economies.6 Figures such as the economist from Northwestern University, Robert Gordon, argue that weaker productivity growth is a reflection of underlying trends.7 These trends include, on the one hand, the end of the diffusion of the first two industrial revolutions (the first, led by the steam engine and the railway, and particularly the second which, with inventions such as electricity, the internal combustion engine and running water, facilitated processes such as urbanisation). On the other hand, Gordon also argues that the decline in productivity growth also reflects a lesser economic impact from the Third Industrial Revolution.

In addition to the slowdown in productivity, the boom in information and communication technologies, with computers and the internet at the helm, has shifted the economic structure towards industries that are more intensive in intangible capital and, in general, have lower investment requirements. In fact, the results of Farhi and Gourio (2018)8 suggest that the change in economic structure would indeed have contributed to the decline in the natural rate of interest.

Another factor that could be behind the slowdown in productivity is population ageing.9 In fact, demography is the strongest force highlighted by studies that examine the decline in interest rates. This is illustrated by the estimates of Eggertsson et al. (2017),10 who analysed a –4,02 pp decline in the natural rate of interest in the US between 1970 and 2015. These authors estimate that lower productivity growth would have contributed –1.9 pps to its decline. However, they assign an additional –3.66 pp decline to demographic trends,11 which indicates that demography acts on rates through other channels, besides through its impact on productivity.

Greater propensity to save

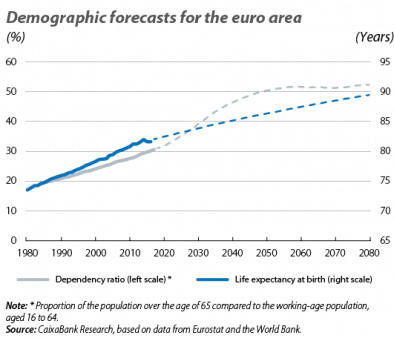

As we explained in a recent report,12 population ageing has significant consequences for savings and is key to understanding the trend in interest rates over the medium and long term. This force acts through three different channels. Firstly, the increase in life expectancy encourages people to save more while they are of working age in order to provide for a longer retirement. Secondly, the reduction in fertility reduces the supply of labour, thus increasing the relative abundance of capital in the productive process and applying downward pressure on its rate of return. Finally, the increase in the fraction of the population in retirement has an ambiguous effect on savings. On the one hand, this group has lower savings rates since they draw down on much of the wealth they have accumulated during their working lives (known as the «flow effect»). On the other hand, this group possesses a greater volume of savings which they have accumulated throughout their working lives (the «stock effect»). Virtually all studies document that population ageing has had a negative impact on interest rates in recent decades. What is more, many estimates (such as Carvalho et al., 201713 or Gagnon et al., 201614 ) suggest that it has been the main driving force behind the decline in the natural rate of interest. Nevertheless, there is no consensus on what its dominant mechanism is: some, such as Carvalho et al. (2017), emphasise the role of longer life expectancy, while others, such as Gagnon et al. (2016), highlight the role of the lower fertility rate and the resulting increase in the ratio of capital per worker. Looking ahead to the future, ageing is a process which is set to continue, as shown by the fifth chart. In this regard, the majority of studies conclude that it will continue to apply downward pressure on interest rates. However, as Goodhart and Pradhan (2017)15 argue, this need not necessarily be the case. Faced with the great uncertainty that always surrounds forecasts, we cannot rule out the possibility that, in the future, the «flow effect» may be greater than the «stock effect», nor that households may not be sufficiently insightful to anticipate that, with a longer life expectancy, they should save more during their working lives.

Savings have also been affected by another important force: a preference for safe-haven assets. In fact, the decline in interest rates is not observed to the same extent across all asset classes. As Del Negro et al. (2017)16 point out, it is more pronounced in assets that are considered relatively safer, such as US sovereign debt, and less so in others that entail more risk, such as corporate debt with a low credit rating. The observation of this growing differential between the returns on assets with lower and higher risk suggests that, since the late 1990s (coinciding with the Asian crises), there has been an increase in risk aversion (which would have been accentuated by the Great Recession) and in the demand for relatively safe assets (which has been accentuated, in turn, by the emergence of China and the resulting increase in savings at the global level). In this regard, Del Negro et al. (2017) decompose the interest rate on US government debt into a safety premium (a price paid for its low risk of default) and a liquidity premium (which captures the value of owning an asset for which there are many buyers and sellers). In this context, an increase in the risk or liquidity premiums implies that investors value an asset’s safety and liquidity more, so they are willing to accept a lower return. In fact, the authors document that, in parallel to the decline in the natural rate of interest, there has been an increase in both premiums. In other words, given that the natural rate is associated with a safe and liquid asset (specifically, central bank reserves), these dynamics suggest that part of the decline in the interest rate is the result of an increase in risk aversion and a preference for relatively safe assets.

Question marks

Before concluding, we must add one more element to all the forces described above. Given that the natural rate is not observable and must be estimated using economic models, the estimate depends on which variables are included in the model and what relationships are assumed to exist between them. If important variables are omitted, or if the «Neo-Keynesian» relationships between interest rates, economic activity and inflation that are typically used are incorrect, even the very existence of a decline in the natural rate could be called into question. For example, in the years leading up to the Great Recession, the buoyancy of economic activity could have been due to a significant expansion in lending (and not necessarily due to the differential between the natural rate and the interest rate set by monetary policy). Nevertheless, when Juselius et al. (2016)17 incorporate a variable that captures the status of the business cycle and estimate the natural rate again, we still observe a sustained decline in the interest rate, albeit of a somewhat lower magnitude.

What will come next?

As we have seen, there is a wide range of factors behind the natural rate of interest. The most important of them, demography, follows relatively predetermined trends and, according to the majority of studies, will continue to weigh down on interest rates over the coming decades. As such, beyond the rate hikes and cuts performed by the central banks for cyclical reasons, monetary policy and the financial environment of the future are likely to be determined by a context of relatively low interest rates. Nevertheless, there are many other factors that are difficult to predict. They include the financial cycle, cyclical constraints and risk aversion. Yet the key factor for reversing the pressures exerted by population ageing is the future of productivity. That said, this will be no easy task: there would need to be a strong push to counteract the demographic headwinds (Eggertsson et al. (2017) estimate that, in the US, sustained productivity growth at around 2.5% would be needed – a figure well above the 0.5% average for 2014-2017 and even the 1.3% average for 1992-2007). Only then could the natural rate of interest be hoisted up to levels at which the 0% threshold would no longer be a concern for the central banks.

Oriol Carreras and Adrià Morron Salmeron

CaixaBank Research

1. The real interest rate is defined as the nominal interest rate less inflation.

2. See, for example, M. Woodford (2003), «Interest and Prices: Foundations of a Theory of Monetary Policy», Princeton University Press: Princeton.

3. K. Holston, T. Laubach and J. Williams (2016), «Measuring the Natural Rate of Interest: International Trends and Determinants», Federal Reserve Bank of San Francisco, Working Paper 2016-11.

4. See footnote 3.

5. See S. Fries, J.S. Mésonnier, S. Mouabbi and J.P. Renne (2017), «National natural rates of interest and the single monetary policy in the Euro Area», Bank of France, Working Paper 611.

6. See the Dossier «Technological change and productivity» in the MR02/2018.

7. See R. Gordon (2012), «Is US economic growth over? Faltering innovation confronts six headwinds», NBER Working Paper n° 18315.

8. See E. Farhi and F. Gourio (2018), «Accounting for Macro-Finance Trends: Market Power, Intangibles, and Risk Premia» NBER Working Paper n° 25282.

9. The article «Population ageing and its macroeconomic impact», in the Dossier of the MR11/2018, analyses how ageing directly affects economic growth.

10. Eggertsson, G. et al. (2017), «A Model of Secular Stagnation: Theory and Quantitative Evaluation», NBER Working Paper n.º 23093.

11. They estimate that the increase in public debt in this period would have mitigated the downward pressure on rates.

12. See the article «The demographic cycle of savings and interest rates» in the Dossier of the MR11/2018.

13. Carvalho, C. et al. (2017), «Demographic Transition and Low U.S. Interest Rates», Federal Reserve Bank of San Francisco Economic Letter, 11.

14. Gagnon, E. et al. (2016), «Understanding the New Normal: the Role of Demographics», Finance and Economics Discussion Series, Board of Governors of the Federal Reserve System.

15. Goodhart, C. and Pradhan. M. (2017), «Demographics will reverse three multi-decade global trends», BIS Working Papers n.º 656.

16. Del Negro, M. et al. (2017), «Safety, Liquidity, and the Natural Rate of Interest», Staff Report n.º 812, Federal Reserve of New York.

17. Juselius, M. et al. (2016), «Monetary policy, the financial cycle and ultra-low interest rates», BIS Working Papers nº 569.