The threat of protectionism in the global economy

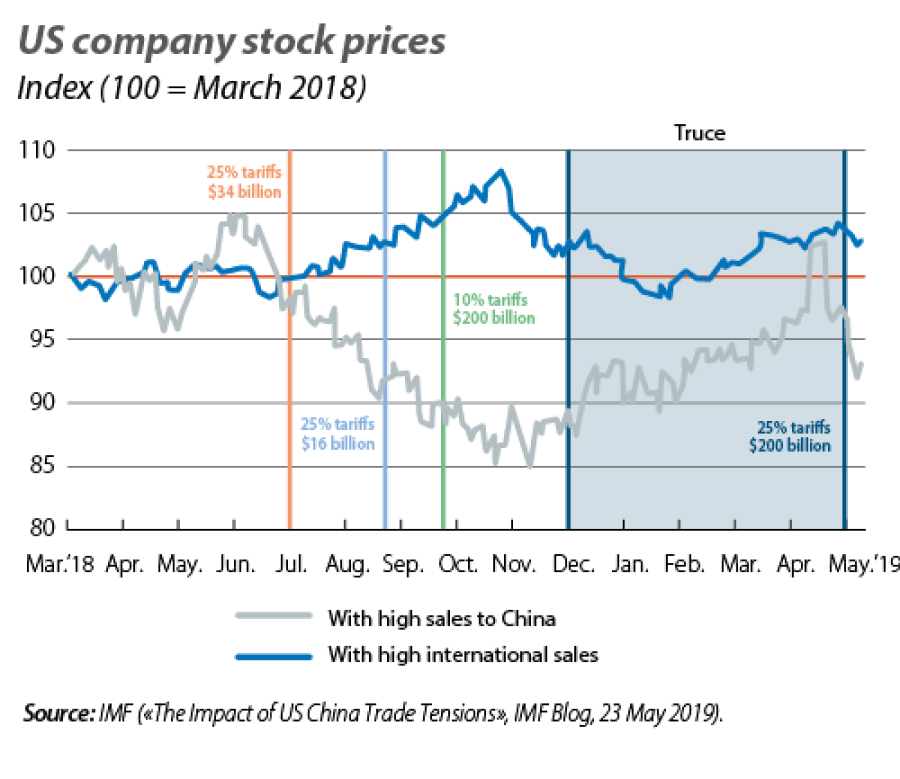

Since the beginning of 2018, the Trump Administration has adopted a more belligerent tone in trade policy: for example, it has increased tariffs on Chinese imports worth 250 billion dollars, it has added Huawei to the list of companies that require government approval to purchase US technology, and it is studying tariffs on auto imports. This can be seen in the following chart.

- Trade tensions between the US and China pose a risk to growth, both for the US and China themselves and for the rest of the world.

- Under a moderate tariff stress scenario, we estimate that average annual global growth over the next three years could be 3 decimal points lower than anticipated (3.1% versus 3.4%), largely due to greater uncertainty.

- Under a high tariff stress scenario, growth could be 8 decimal points lower than forecast (2.6%), due to trade and uncertainty in equal measure.

Since the beginning of 2018, the Trump Administration has adopted a more belligerent tone in trade policy: for example, it has increased tariffs on Chinese imports worth 250 billion dollars, it has added Huawei to the list of companies that require government approval to purchase US technology, and it is studying tariffs on auto imports (see following chart).This can be seen in the following chart:

So far, the tariffs adopted represent a small percentage of global trade (less than 3%).1 However, their economic consequences go much further than what it might seem, since effects are transmitted through uncertainty and disruption to global supply chains. Below, we analyse and quantify the economic impact of the trade tensions between the US and China.

- 1. This refers to the total exports of goods affected by the tariffs since 2018, relative to the overall total exports of goods at the global level. Based on IMF and US Foreign Trade data.

The rise of protectionism in the US is affecting the economic activity of the country itself and that of the world through different channels:

1.Trade channel (or direct). A tariff hike raises the price of imports (from China in the case of the current escalation of protectionism) and leads to an increase in the prices paid by consumers and companies. These higher prices have a detrimental impact on consumption and investment and, therefore, on the economic activity of the «protectionist» country.

Certain factors, however, can either exacerbate or alleviate this direct impact on the US, as well as producing a knock-on effect on other economies:

- The boost to tax revenues generated by the new tariffs can partially offset the detrimental economic impact, although the increase is usually limited.

- Chinese exporters could cut their prices (squeezing their profit margin), which would reduce the detrimental impact on consumers and businesses. However, this has not occurred in the current tariff escalation, in which most of the detrimental impact has been borne by US consumers. According to a recent study, the current measures will cost US households an average of 620 dollars a year.2

- If the consumption of imported goods is replaced by goods produced domestically, there is a boost to the country’s economic activity (to the detriment of the original exporting country, in this case China).3 However, this comes with a cost at the global level, since the original exporters are being replaced by less efficient producers.

- In net terms, estimates suggest that the positive effect on US economic activity is less than the direct negative impact. One of the reasons for this is that, as has occurred in the current situation, the foreign countries that have been the subject of the tariff rise tend to respond by imposing similar measures on the US.

- Some countries may temporarily benefit since, faced with rising prices of some Chinese imports, US consumers and businesses can replace a portion of these purchases with imports from other countries (which are cheaper, after factoring in the tariffs). This is known as a «trade diversion» effect, although it is becoming less and less important in a world dominated by global supply chains.

2. Uncertainty channel (or indirect). Faced with a more uncertain outlook, households tend to postpone their spending decisions, and companies, their investment decisions: a «wait and see» approach that depresses economic activity at the global level. Furthermore, a climate of heightened uncertainty tends to drive up the costs of financing for both households and companies. This, again, affects spending and investment decisions and, ultimately, has a detrimental impact on economic activity.

- 2. See M. Amiti, S.J. Redding and D. Weinstein (2019). «The Impact of the 2018 Trade War on US Prices and Welfare» National Bureau of Economic Research n° w25672; and the most recent numerical update in the Blog of the Federal Reserve Bank of New York («New China Tariffs Increase Costs to U. S. Households», Liberty Street Economics, 23 May 2019).

- 3. The exchange rate is another factor to consider. If the yuan depreciates (as has happened, by 9.5% against the dollar since April 2018), the effect of the tariffs on US consumers is lower. On the contrary, an appreciation of the dollar (like the one that has occurred, amounting to 7.4% against a whole series of currencies) depresses foreign demand for US exports.

Given the multiplicity of mechanisms discussed, in order to estimate the economic impact of an escalation of protectionism like the one that might occur between the US and China, we need to use general equilibrium models, i.e. models that seek to capture all the relationships of supply and demand that occur in the different markets at both the country level and between different countries. In the summary table, we present the results reached by the IMF, the Bank of England (BoE) and the European Central Bank (ECB) with this type of exercise.4 In all three cases, the results take into account both the direct impact through trade and the indirect impact of a climate of greater uncertainty.

This latter channel, uncertainty, is no doubt the most relevant in a situation like the current one (with protectionist measures that are still relatively moderate in global terms, but with many threats). That said, it is also the most difficult one to determine. For this reason, we use the simulations performed by the above institutions, together with an analysis of our own. In particular, our estimates suggest that a spike in uncertainty similar to that seen in 2018 would cause global GDP growth rates to fall by 2 decimal points compared to those forecast under a scenario in which the two powers reach an agreement in the coming months.5 In the event of shocks considerably greater than those that occurred in 2018, annual growth rates would be some 4 decimal points lower than forecast (as a result of the indirect channel).6

Following this analysis of uncertainty and of the results of the aforementioned simulations by the IMF, the BoE and the ECB, we built two adverse scenarios relating to how the trade conflict between the US and its various trading partners could develop over the period 2019-2021, i.e. three years (see the last chart):

- Scenario of moderate tariffs. This scenario assumes a slightly higher level of protectionism than we have seen to date. In this context, the average annual growth of global GDP in the period 2019-2021 would be 3.1%, compared to the 3.4% forecast by CaixaBank Research. This would be mainly as a result of the uncertainty channel (accounting for 2 decimal points of the reduction). By country, the impact in the US and China would be substantially greater than the impact in the euro area. In Europe, on the other hand, while the uncertainty channel would clearly have a detrimental impact, the trade channel could be favoured by what we referred to as «trade diversion». However, as the trade tensions grew in 2018, Europe suffered a major slowdown in growth (from 0.7% quarter-on-quarter in Q4 2017 to 0.2% in Q4 2018). As such, this «trade diversion» effect does not appear to have made an impact so far.

- Scenario of high tariffs. This scenario assumes a much greater escalation of protectionism than that witnessed at present, with measures imposed on all US imports and a response of the same calibre imposed against the US by the countries affected. In this case, the average annual growth of global GDP in the period 2019-2021 could fall to 2.6% (8 decimal points below the expected scenario). In this case, trade and uncertainty would contribute equally to lower growth. Again, the US and China would be the most adversely affected economies, although the US economy more so, since it would suffer all the replicas of the tariffs imposed by its various trade partners.

- 4. See the IMF (WEO, October 2018), the ECB - Economic Bulletin Issue 3/2019, «The economic implications of raising protectionism: a euro area and global perspective» and the Bank of England (speech given by Mark Carney on 5 July 2018).

- 5. In our scenario, we are assuming that the two powers reach an agreement during the second half of 2019 or in early 2020. The agreement would possibly contain very specific measures on products, making it possible to ensure that it is complied with (it will be a highly technical document). In addition, we envision certain elements in the field of technology transfer and intellectual property. However, the agreement will not entail an immediate withdrawal of the tariffs imposed to date, but rather a gradual removal.

- 6. We take the global economic policy uncertainty index developed by Steven J. Davis («An Index of Global Economic Policy Uncertainty», Macroeconomic Review, 2016) based on the analysis performed by Baker, Bloom and Davis. A vector autoregression (VAR) of order three is estimated using quarterly data on global GDP growth, global CPI, the short-term (3-month) global interest rate and the global economic policy uncertainty (GEPU) index. The GEPU index reflects global uncertainty, as measured by the relative frequency of news and newspaper articles containing terms related to the economy, uncertainty, politics and public policy in a set of countries that represent two-thirds of the world’s GDP.

However, the risk posed by this potential escalation of tariffs goes beyond the negative short and medium-term effects. The major fear is that this escalation could lead to non-tariff protectionist measures that affect international trade and investment more directly, such as restrictions on foreign technology companies, with potentially far greater impacts both at the economic and the institutional level. Furthermore, in the long term, all these economic obstacles represent a toll on productivity, since they impose barriers for the spread of knowledge and the establishment of network economies, trends that are key in an increasingly digital world.