Polarisation: the legacy of the financial crisis and other contextual forces

• The 2008 financial crisis and the recent waves of migration are two of the factors that have contributed to an increase in political polarisation in Europe.

• The impact of the financial crisis on the phenomenon of polarisation is considered greater than that of immigration.

• Social cohesion policies could explain why immigration has had a lower impact on polarisation.

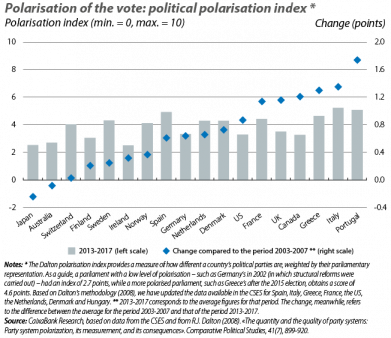

Political polarisation is a phenomenon on the rise, especially in Western economies. Various structural trends are proving to be catalysts for this phenomenon: globalisation, technological change and demographic change are some of them. But beyond these structural elements, certain contextual developments have favoured the rapid increase in polarisation which, as can be seen in the first chart, has increased sharply and become more widespread over the last decade. In particular, there seems to be a clear consensus that the global financial crisis of 2008 and the waves of migration seen in recent years in many European countries are two of the factors that have increased political polarisation in the Old Continent.

From financial crises to political polarisation

Various empirical analyses show that the increase in polarisation is a very common phenomenon after a financial crisis. As an example, one of the benchmark articles on this topic, written by Atif Mian, Amir Sufi and Francesco Trebbi, shows that the increase in polarisation in the US Congress is a process that has been ongoing and uninterrupted for more than 70 years, but it also points out that financial crises have increased polarisation substantially.1 Contextual factors, therefore, appear to play an important role in the phenomenon in question.

Besides the case of the US, these same authors show that, based on a sample of a quarter of a million individuals from a total of 60 countries, financial crises tend to radicalise the political position of voters. In particular, following a financial crisis, the percentage of centrist and moderate voters decreases, while the percentage of more radical left or right-wing voters increases. Similarly, two researchers from the German think tank the Kiel Institute draw a connection between the 2008 financial crisis and the rise in right-wing populist parties in the European political arena.2 Finally, in a very interesting piece of ongoing research on Germany in the 1930s, it is shown that the financial crisis that hit the country at the beginning of the decade made a decisive contribution to the rise of the National Socialist Party in the inter-war period.3

The causal relationship between financial crises and polarisation is empirically well founded, and all the indicators suggest that this relationship operates through three channels: the loss of trust in institutions and the established political class, the debt-conflicts that emerge and the increase in inequality.

In particular, in the stated order, financial crises tend to be perceived as a failure of regulation and/or public policies. As a consequence, they tend to result in a loss of trust in the ruling class and, ultimately, an increase in votes in favour of more extreme political options.

Secondly, numerous studies point out that the resolution of situations of excessive debt also ends up leading to an increase in political polarisation. In particular, debt restructuring processes that affect people with fewer resources tend to provoke a rejection of the political status quo.

Finally, the increase in social inequality, which tends to be particularly intense during financial crises, also leads to an increase in electoral polarisation.4

Migration and polarisation

The second cyclical factor that is causing polarisation to rise is immigration. In the case of Europe, for instance, the increase in immigration (and in the number of refugees arriving) in the 2000s coincided with a considerable rise in support for political parties that oppose this phenomenon. In fact, in some countries this relationship had already been observed for some years.

For example, in an exhaustive study for the city of Hamburg, Otto and Steinhardt5 documented a causal relationship between the increase in immigration and the rise of the far right. Specifically, between 1987 and 1998, the city received a significant number of immigrants, mainly refugees and asylum seekers. With the information on the electoral results in 103 districts of the city for a total of seven elections, and taking into account the characteristics of the different areas of the city, the researchers demonstrate a relationship between the rise of extreme right-wing parties in different districts and the level of immigration.

As in the case of financial crises, the causal relationship between migratory flows and political polarisation seems to be proven, but there is not always consensus among experts on the channels through which this link operates. In general, the economic literature identifies four relevant channels: labour, social benefits, the non-economic channel and politics.6

The labour channel refers to the fact that domestic workers may perceive immigrants as competitors. In order to eliminate part of this competition, voters support anti-immigration political parties.7

The channel of social benefits highlights both the competition for the use of public services that immigrants pose for pre-established population groups and the new redistribution of benefits that is required when faced with the arrival of new citizens with needs that may be very different.8 Again, the desire to expel the competition encourages support for anti-immigration forces.

The non-economic channel emphasises that the arrival of immigrants awakens a greater awareness of ethnic or cultural identity and a hostility towards those who are perceived as different. This greater awareness and hostility is exploited by political parties with clearly anti-immigration discourses.

The last channel, the political one, refers to the fact that the arrival of immigrants can generate greater polarisation to the extent that the political orientation of those arriving substantially differs from that of the pre-established population. This occurs either more or less rapidly depending on how quickly new citizens are given the right to vote. In any case, this is a very different channel from the previous ones, as it does not generate a direct increase in anti-immigration forces.

Before bringing the topic of immigration to a close, it is worth mentioning the specific case of refugees and their effects on polarisation. The reason for this is that some recent studies point towards a weak relationship between these two elements if policies that strengthen social cohesion are implemented. For example, between 2014 and 2015, some regions of Austria that received significant flows of refugees did not suffer the marked increase in votes for the far right that occurred in other regions of the country. University of Munich researcher Andreas Steinmayr attributes this result to the efforts carried out by local authorities to explain the refugees’ situation to the resident population affected and to encourage contact between the two groups. This led to what some have come to call the «contact effect». In contrast, regions that did not receive refugees only learned of the situation through the media and through political groups that were more opposed to immigration.9

Quantitative exercise

At this juncture, and to illustrate in a simple manner the role of the 2008 financial crisis and the recent waves of migration on the increase in polarisation in advanced economies, we use the country-level polarisation index developed by Russell J. Dalton10 and plot it against the unemployment rate, the Gini index and the number of immigrants.

Intuitively, we tend to identify the countries that suffered the most from the effects of the last financial crisis as those that registered the highest increases in their unemployment rate. If we analyse the changes in these two indicators (polarisation and unemployment) from before the crisis up to the present day by country, we indeed note that there is a positive correlation between them (see the first panel of the second chart). Secondly, as a measure of inequality, we refer to the Gini coefficient (which reflects how equal or unequal income distribution is among a country’s inhabitants)11 in order to precisely show inequality at the outset. The correlation is also positive for changes in these two measures: countries with greater increases in inequality are also the ones that have shown greater increases in the polarisation index (see the second panel of the second chart). Similarly, greater flows of immigration also appear to be associated with bigger increases in the level of polarisation (see the third panel of the second chart).

Lastly, we perform a simple exercise to estimate the sensitivity of the polarisation index to changes in the contextual factors we have just defined as a whole.12 The results of our exercise suggest that the effect of the economic crisis, measured through the increase in the levels of unemployment and inequality, explained around 35% of the surge in polarisation observed since the crisis began in 2007. Increases in migratory flows, meanwhile, often have an insignificant effect. This would be in line with the weaker relationship between refugees and polarisation suggested by some of the research mentioned above.

In short, the increase in polarisation in the European political arena should not come as a surprise in an environment of considerable migratory flows and, in particular, after a financial crisis without precedent in recent memory. Nevertheless, this lack of surprise should not lead to conformity.

Clàudia Canals and Javier Ibáñez de Aldecoa

1. See A. Mian, A. Sufi and F. Trebbi (2014). «Resolving debt overhang: political constraints in the aftermath of financial crises». American Economic Journal: Macroeconomics, 6(2), 1-28.

2. See M. Funke and C. Trebesch (2017). «Financial Crises and the Populist Right». Ifo DICE Report, 15(4), 6-9.

3. See S. Doerr, S. Gissler, J. Peydro and H.-J. Voth (2019). «From Finance to Fascism: The Real Effect of Germany’s 1931 Banking Crisis». CEPR Discussion Paper n° 12806.

4. The increase in inequality has been observed for several decades in most advanced countries, but it was accentuated a priori temporarily with the arrival of the financial crisis (see the article «Political polarisation: the phenomenon that should be on everyone’s lips» in this same Dossier and the article «Inequality and populism: myths and truths» in the Dossier of the MR01/17).

5. See A.H. Otto and M.F. Steinhardt (2014). «Immigration and election outcomes-Evidence from city districts in Hamburg». Regional Science and Urban Economics, 45, 67-79.

6. Among the articles that analyse this topic for the European case, particularly noteworthy is the study by D. Card, C. Dustmann and I. Preston (2012). «Immigration, wages, and compositional amenities». Journal of the European Economic Association, 10(1), 78-119.

7. The economic impact of immigration is much more complex than the simplified version of a supply shock, since it depends on the country’s productive structure, among other elements (see article «The economic impact of immigration» in the Dossier of the MR10/16). However, this simplification is what usually lies behind many citizens’ voting decision.

8. In both cases, this can be a simple perception. In the case of the United Kingdom, the total effect of immigration on the public finances is positive, since their contribution through taxes is greater than what they receive in social benefits (see C. Dustmann and T. Frattini (2014). «The fiscal effects of immigration to the UK». The economic journal, 124(580), F593-F643).

9. See A. Steinmayr (2018). «Contact matters: Exposure to refugees and voting for the far-right». Working Paper. For an example relating to France, see P. Vertier and M. Viskanic (2018). «Dismantling the “Jungle”: Migrant Relocation and Extreme Voting in France». Working Paper.

10. The polarisation index used provides a measure of how different a country’s political parties are, weighted by their parliamentary representation. The data is obtained from the Comparative Study of Electoral Systems, and for Spain, Italy, Greece, France, the US, the Netherlands, Denmark and Hungary we complete the last wave using the methodology explained in R.J. Dalton (2008) «The quantity and the quality of party systems: Party system polarization, its measurement, and its consequences». Comparative Political Studies, 41(7), 899-920.

11. High values reflect a high level of inequality in terms of income.

12. We estimate the following regression in differences: ΔPolarisation indexi,t = α + ∆ Xi,t β + ξi,t, where the matrix Xi,t contains the unemployment rate, the Gini coefficient and the number of immigrants for the country i in the period t. The constant α reflects the growing linear trend in polarisation (the non-contextual factor), thereby taking into account possible spurious correlations caused by the trend in the variables. To test the robustness of our results, we have estimated different specifications, including specific temporal trends by region.